Regions Financial Corp increased Novartis Ag (NVS) stake by 8.71% reported in 2018Q4 SEC filing. Regions Financial Corp acquired 3,828 shares as Novartis Ag (NVS)’s stock declined 0.59%. The Regions Financial Corp holds 47,761 shares with $4.10 million value, up from 43,933 last quarter. Novartis Ag now has $181.75B valuation. The stock decreased 2.23% or $1.77 during the last trading session, reaching $77.57. About 3.13 million shares traded or 25.20% up from the average. Novartis AG (NYSE:NVS) has risen 8.33% since April 17, 2018 and is uptrending. It has outperformed by 3.96% the S&P500. Some Historical NVS News: 31/05/2018 – Novartis loses a head honcho, with US oncology head Bill Hinshaw exiting for new gig at Axcella @BrittanyMeiling; 10/05/2018 – Cohen was originally contracted to consult with Novartis on health-care policy issues, including ones related to Obamacare; 10/05/2018 – LISTEN: Novartis’ bad day, Spark’s Amish entanglement, and a biotech history lesson; 19/04/2018 – NOVARTIS AG NOVN.S – SAYS 2018 GROUP AND DIVISION OUTLOOKS CONFIRMED; 10/04/2018 – Tuberous Sclerosis Alliance salutes FDA approval of Afinitor® DISPERZ (everolimus) as the first adjunctive treatment approved in US for patients aged 2 years and older with tuberous sclerosis complex (TSC)-associated partial-onset seizures; 16/05/2018 – Novartis: Shannon Thyme Klinger Will Be Appointed Group General Counsel; 09/04/2018 – REG-Novartis enters agreement to acquire AveXis Inc. for USD 8.7 bn to transform care in SMA and expand position as a gene therapy and Neuroscience leader; 10/05/2018 – ADRs End Slightly Higher; BT Group, Randgold and Novartis Trade Actively; 09/04/2018 – Novartis said on Monday it plans to buy gene therapy company AveXis in a cash deal totaling $8.7 billion; 19/03/2018 – NOVARTIS NOVN.S FILES PATENT INFRINGEMENT LAWSUIT AGAINST REGENERON REGN.O OVER LATTER’S MANUFACTURING OF EYLEA, ZALTRAP — COURT FILING

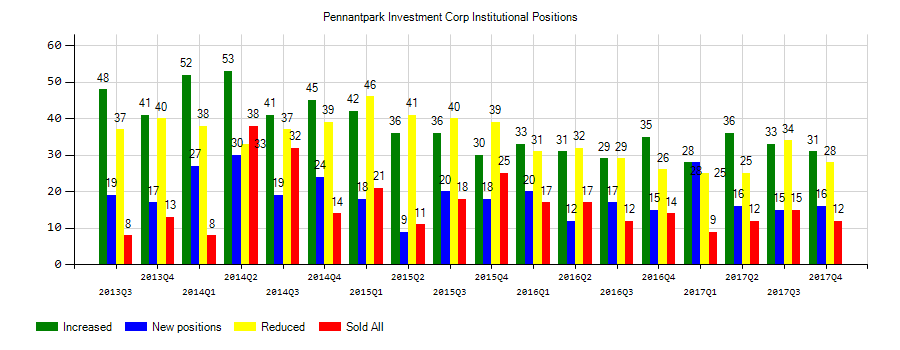

Pennantpark Investment Corp (PNNT) investors sentiment increased to 1.22 in 2018 Q4. It’s up 0.36, from 0.86 in 2018Q3. The ratio has improved, as 44 funds increased and opened new stock positions, while 36 decreased and sold equity positions in Pennantpark Investment Corp. The funds in our database now hold: 27.28 million shares, up from 26.20 million shares in 2018Q3. Also, the number of funds holding Pennantpark Investment Corp in top ten stock positions decreased from 2 to 1 for a decrease of 1. Sold All: 10 Reduced: 26 Increased: 25 New Position: 19.

More notable recent PennantPark Investment Corporation (NASDAQ:PNNT) news were published by: Nasdaq.com which released: “PennantPark Investment Corporation Schedules Earnings Release of Second Fiscal Quarter 2019 Results – Nasdaq” on April 08, 2019, also Seekingalpha.com with their article: “PennantPark Investment declares $0.18 dividend – Seeking Alpha” published on December 05, 2018, Nasdaq.com published: “PennantPark Investment Corporation (PNNT) Ex-Dividend Date Scheduled for March 19, 2019 – Nasdaq” on March 18, 2019. More interesting news about PennantPark Investment Corporation (NASDAQ:PNNT) were released by: Globenewswire.com and their article: “PennantPark Investment Corporation to Redeem Notes Due 2019 – GlobeNewswire” published on January 31, 2019 as well as Globenewswire.com‘s news article titled: “PennantPark Investment Corporation Announces Quarterly Distribution of $0.18 per Share – GlobeNewswire” with publication date: March 06, 2019.

PennantPark Investment Corporation specializes in direct and mezzanine investments in middle market companies. The company has market cap of $483.00 million. It invests in the form of mezzanine debt, senior secured loans, and equity investments. It has a 11.79 P/E ratio. The fund typically invests in building and real estate, hotels and gaming, electronics, healthcare, education and childcare, financial services, printing and publishing, consumer products, business services, energy and utilities, distribution, gas and oil, media, environmental services, aerospace and defense, manufacturing industries and retail.

Analysts await PennantPark Investment Corporation (NASDAQ:PNNT) to report earnings on May, 8. They expect $0.17 earnings per share, down 10.53% or $0.02 from last year’s $0.19 per share. PNNT’s profit will be $11.56M for 10.44 P/E if the $0.17 EPS becomes a reality. After $0.18 actual earnings per share reported by PennantPark Investment Corporation for the previous quarter, Wall Street now forecasts -5.56% negative EPS growth.

Signia Capital Management Llc holds 4.84% of its portfolio in PennantPark Investment Corporation for 655,719 shares. Greenwich Investment Management Inc. owns 524,169 shares or 4.11% of their US portfolio. Moreover, Muzinich & Co. Inc. has 2.58% invested in the company for 1.43 million shares. The Illinois-based West Family Investments Inc. has invested 1.7% in the stock. Ares Management Llc, a California-based fund reported 2.18 million shares.

The stock decreased 0.70% or $0.05 during the last trading session, reaching $7.1. About 47,543 shares traded. PennantPark Investment Corporation (PNNT) has risen 0.14% since April 17, 2018 and is uptrending. It has underperformed by 4.23% the S&P500. Some Historical PNNT News: 09/05/2018 – PENNANTPARK INVESTMENT CORP QTRLY NET INVESTMENT INCOME PER SHARE $ 0.19; 09/05/2018 – PennantPark Investment 2Q Net Asset Value $9/Share; 09/05/2018 – PENNANTPARK INVESTMENT CORP – EXPECTS REPURCHASE PROGRAM TO REMAIN IN PLACE UNTIL EARLIER OF MAY 8, 2019; 05/03/2018 Fitch Affirms PennantPark at ‘BBB-‘; Outlook Remains Negative; 05/03/2018 – PennantPark Investment Corporation Announces Quarterly Distribution of $0.18 per Share; 09/05/2018 – PENNANTPARK INVESTMENT 2Q INVESTMENT EPS 19C, EST. 18C; 03/04/2018 – PennantPark Investment Access Event Set By Janney for Apr. 5; 05/04/2018 – PennantPark Investment at Company Marketing Hosted By Janney; 09/05/2018 – PENNANTPARK INVESTMENT CORP QTRLY NET ASSET VALUE PER SHARE $ 9.00; 09/05/2018 – PENNANTPARK INVESTMENT 2Q INVESTMENT EPS 19C

Among 3 analysts covering Novartis (NYSE:NVS), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Novartis had 6 analyst reports since November 19, 2018 according to SRatingsIntel. On Monday, November 26 the stock rating was upgraded by Cowen & Co to “Outperform”. Goldman Sachs upgraded Novartis AG (NYSE:NVS) on Monday, November 19 to “Conviction Buy” rating. As per Tuesday, December 11, the company rating was reinitiated by Jefferies.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.