Cullen Frost Bankers Inc decreased its stake in Exxon Mobil Corp Com (XOM) by 1.06% based on its latest 2018Q4 regulatory filing with the SEC. Cullen Frost Bankers Inc sold 8,379 shares as the company’s stock rose 2.37% with the market. The institutional investor held 779,374 shares of the integrated oil company at the end of 2018Q4, valued at $53.15M, down from 787,753 at the end of the previous reported quarter. Cullen Frost Bankers Inc who had been investing in Exxon Mobil Corp Com for a number of months, seems to be less bullish one the $344.57B market cap company. The stock increased 0.25% or $0.2 during the last trading session, reaching $81.4. About 4.70M shares traded. Exxon Mobil Corporation (NYSE:XOM) has risen 6.80% since April 17, 2018 and is uptrending. It has outperformed by 2.43% the S&P500. Some Historical XOM News: 07/03/2018 – Exxon Mobil Sees 2025 Downstream Margins Increasing by 20%; 18/04/2018 – Eni has no plans to pull out of Rosneft deal after sanctions; 12/04/2018 – EXXONMOBIL XOM.N – PRODUCTION TO INCREASE IN COMING WEEKS; LNG CARGO DELIVERIES TO COMMENCE SOON; 27/04/2018 – Exxon Mobil 1Q Oil-Equivalent Production Down 6%, Adjusted Output Down 3%; 07/03/2018 – Exxon sees earnings doubling by 2025 at current oil prices; 22/05/2018 – Exxon Reports Leak, Emissions at Baytown, Texas, Refinery; 29/03/2018 – ExxonMobil Wins Eight Deepwater Blocks in Latest Brazil Bid Round; 13/04/2018 – MA AG: COURT ORDERS EXXON TO TURN OVER DOCUMENTS IN PROBE; 17/04/2018 – EXXONMOBIL XOM.N : HSBC RAISES TARGET PRICE TO $85 FROM $82.5; 11/04/2018 – EXXONMOBIL – RESULTS SUPPORT DISCUSSIONS WITH JV PARTNERS ON THREE-TRAIN EXPANSION CONCEPT FOR PNG LNG LIQUEFIED NATURAL GAS PLANT NEAR PORT MORESBY

J Goldman & Company Lp increased its stake in Stemline Therapeutics Inc (STML) by 125% based on its latest 2018Q4 regulatory filing with the SEC. J Goldman & Company Lp bought 125,000 shares as the company’s stock rose 8.46% with the market. The hedge fund held 225,000 shares of the health care company at the end of 2018Q4, valued at $2.14M, up from 100,000 at the end of the previous reported quarter. J Goldman & Company Lp who had been investing in Stemline Therapeutics Inc for a number of months, seems to be bullish on the $539.45 million market cap company. The stock decreased 5.50% or $0.77 during the last trading session, reaching $13.23. About 605,719 shares traded. Stemline Therapeutics, Inc. (NASDAQ:STML) has declined 31.88% since April 17, 2018 and is downtrending. It has underperformed by 36.25% the S&P500. Some Historical STML News: 16/03/2018 – Stemline Therapeutics 4Q Loss/Shr 93c; 15/05/2018 – Nexthera Capital Buys 1.7% Position in Stemline Therapeutics; 16/04/2018 – Stemline Therapeutics Expands Board of Directors; Further Enhances Commercial Expertise with Appointment of Darren Cline; 17/05/2018 – Stemline Therapeutics Announces Presentation of SL-801 and SL-701 Clinical Data at the Upcoming ASCO Annual Meeting; 15/03/2018 Stemline Therapeutics Closes Below 50-Day Average: Technicals; 16/04/2018 – Stemline Therapeutics Names Darren Cline to Board; 11/05/2018 – Citadel Advisors Buys 1.9% Position in Stemline Therapeutics; 15/05/2018 – Polar Capital Buys New 1.2% Position in Stemline Therapeutics; 16/04/2018 – Stemline Therapeutics Names Dan Hume and Mark Sard to Bd; 16/03/2018 – Stemline Therapeutics 4Q Rev $0.00

Since November 26, 2018, it had 0 insider purchases, and 3 sales for $823,879 activity. $374,769 worth of Stemline Therapeutics, Inc. (NASDAQ:STML) was sold by Bergstein Ivan on Thursday, February 14.

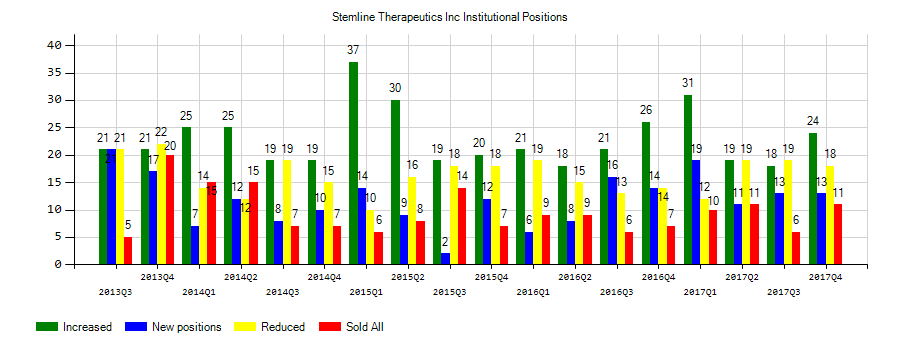

Investors sentiment increased to 1.92 in Q4 2018. Its up 0.61, from 1.31 in 2018Q3. It improved, as 9 investors sold STML shares while 17 reduced holdings. 18 funds opened positions while 32 raised stakes. 18.68 million shares or 1.87% less from 19.04 million shares in 2018Q3 were reported. Credit Suisse Ag owns 14,041 shares. State Of Wisconsin Investment Board holds 0% or 29,300 shares. Wells Fargo & Mn invested in 0% or 15,008 shares. 77,957 were accumulated by Citigroup. Invesco Ltd invested in 0% or 20,968 shares. Ameritas Investment Prtn Inc invested in 0% or 1,930 shares. Metropolitan Life Ins New York owns 0% invested in Stemline Therapeutics, Inc. (NASDAQ:STML) for 8,523 shares. Morgan Stanley reported 49,816 shares. 37,138 are owned by Rhumbline Advisers. Artal Grp Inc accumulated 400,000 shares or 0.14% of the stock. Baldwin Brothers Ma stated it has 3,100 shares or 0% of all its holdings. Ameriprise Financial Incorporated holds 0% of its portfolio in Stemline Therapeutics, Inc. (NASDAQ:STML) for 44,950 shares. Fosun Int Limited has invested 0.03% in Stemline Therapeutics, Inc. (NASDAQ:STML). Alkeon Cap Lc reported 70,000 shares. Charles Schwab has 64,291 shares.

Another recent and important Stemline Therapeutics, Inc. (NASDAQ:STML) news was published by Seekingalpha.com which published an article titled: “Piper boosts Stemline target to 260% upside – Seeking Alpha” on December 26, 2018.

J Goldman & Company Lp, which manages about $1.17B and $1.30B US Long portfolio, decreased its stake in Werner Enterprises Inc (NASDAQ:WERN) by 84,108 shares to 140,747 shares, valued at $4.16 million in 2018Q4, according to the filing. It also reduced its holding in Paypal Hldgs Inc by 59,195 shares in the quarter, leaving it with 36,547 shares, and cut its stake in Canadian Pac Ry Ltd (NYSE:CP).

More notable recent Exxon Mobil Corporation (NYSE:XOM) news were published by: Seekingalpha.com which released: “Exxon makes another gas discovery offshore Cyprus – Seeking Alpha” on February 28, 2019, also Seekingalpha.com with their article: “Exxon Mobil: Lowest Yield This Decade – Seeking Alpha” published on February 13, 2019, Seekingalpha.com published: “Exxon In The Permian: High Costs And Poor Results May Drag The Stock Down – Seeking Alpha” on March 12, 2019. More interesting news about Exxon Mobil Corporation (NYSE:XOM) were released by: Fool.com and their article: “Better Buy: ExxonMobil vs. BP – Motley Fool” published on March 16, 2019 as well as Seekingalpha.com‘s news article titled: “Should New Investors Buy Exxon Mobil? – Seeking Alpha” with publication date: February 04, 2019.

Analysts await Exxon Mobil Corporation (NYSE:XOM) to report earnings on April, 26. They expect $0.88 earnings per share, down 19.27% or $0.21 from last year’s $1.09 per share. XOM’s profit will be $3.73B for 23.13 P/E if the $0.88 EPS becomes a reality. After $1.51 actual earnings per share reported by Exxon Mobil Corporation for the previous quarter, Wall Street now forecasts -41.72% negative EPS growth.

Since November 28, 2018, it had 0 insider purchases, and 7 sales for $5.27 million activity. 7,562 shares were sold by Rosenthal David S, worth $614,337 on Tuesday, December 4. On Wednesday, November 28 the insider Schleckser Robert N sold $619,861. $214,914 worth of Exxon Mobil Corporation (NYSE:XOM) was sold by Hansen Neil A on Friday, December 14. $746,620 worth of stock was sold by Spellings James M Jr on Wednesday, November 28. The insider Verity John R sold $1.22 million. Corson Bradley W sold $1.09 million worth of Exxon Mobil Corporation (NYSE:XOM) on Wednesday, December 19.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.