Herzfeld Caribbean Basin Fund Inc (CUBA) investors sentiment increased to 1.33 in Q4 2018. It’s up 0.04, from 1.29 in 2018Q3. The ratio has increased, as 12 investment managers opened new or increased holdings, while 9 decreased and sold positions in Herzfeld Caribbean Basin Fund Inc. The investment managers in our database now have: 2.10 million shares, down from 2.11 million shares in 2018Q3. Also, the number of investment managers holding Herzfeld Caribbean Basin Fund Inc in top ten holdings decreased from 1 to 0 for a decrease of 1. Sold All: 3 Reduced: 6 Increased: 8 New Position: 4.

Toth Financial Advisory Corp decreased Kennametal Inc (KMT) stake by 91.44% reported in 2018Q4 SEC filing. Toth Financial Advisory Corp sold 11,750 shares as Kennametal Inc (KMT)’s stock declined 9.93%. The Toth Financial Advisory Corp holds 1,100 shares with $37,000 value, down from 12,850 last quarter. Kennametal Inc now has $3.30B valuation. The stock decreased 0.37% or $0.15 during the last trading session, reaching $40.17. About 337,135 shares traded. Kennametal Inc. (NYSE:KMT) has declined 9.03% since April 16, 2018 and is downtrending. It has underperformed by 13.40% the S&P500. Some Historical KMT News: 10/05/2018 – KENNAMETAL INDIA LTD KENI.BO – DECLARED INTERIM DIVIDEND OF 2 RUPEES PER SHARE; 02/05/2018 – Kennametal 3Q Net $50.9M; 02/05/2018 – KENNAMETAL SEES FY ADJ EPS $2.55 TO $2.65, SAW $2.40 TO $2.70; 08/05/2018 – Kennametal at Wells Fargo Industrials Conference Tomorrow; 02/05/2018 – KENNAMETAL SEES FY ADJ EPS $2.55 TO $2.65; 13/03/2018 – Kennametal to Attend Bank of America Merrill Lynch Global Industrials Conference on March 21st – 22nd, 2018; 22/05/2018 – Kennametal Presenting at KeyCorp Conference May 31; 01/04/2018 – Mumbai Bourse: Press Release From Kennametal India Ltd; 17/04/2018 – DEEP ECO: Kennametal May Face Pressure, Industry Production Down; 26/04/2018 – Kennametal to Attend Wells Fargo Industrials Conference on May 9, 2018

Among 2 analysts covering Kennametal (NYSE:KMT), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Kennametal had 4 analyst reports since January 7, 2019 according to SRatingsIntel. BMO Capital Markets maintained the stock with “Hold” rating in Tuesday, February 19 report. The firm has “Overweight” rating by Barclays Capital given on Wednesday, April 3. Barclays Capital maintained it with “Equal-Weight” rating and $38 target in Monday, January 7 report.

Analysts await Kennametal Inc. (NYSE:KMT) to report earnings on May, 1. They expect $0.80 earnings per share, up 14.29% or $0.10 from last year’s $0.7 per share. KMT’s profit will be $65.78M for 12.55 P/E if the $0.80 EPS becomes a reality. After $0.71 actual earnings per share reported by Kennametal Inc. for the previous quarter, Wall Street now forecasts 12.68% EPS growth.

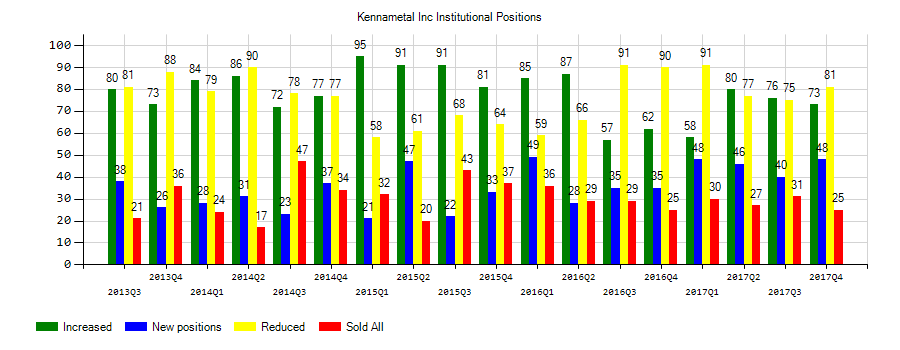

Investors sentiment decreased to 1.14 in Q4 2018. Its down 0.22, from 1.36 in 2018Q3. It is negative, as 24 investors sold KMT shares while 69 reduced holdings. 40 funds opened positions while 66 raised stakes. 80.36 million shares or 3.15% more from 77.91 million shares in 2018Q3 were reported. 13,995 are owned by Employees Retirement Association Of Colorado. Martingale Asset Mgmt LP reported 17,330 shares. 23,500 are held by Tocqueville Asset Limited Partnership. 147,911 were reported by California Public Employees Retirement System. Smith Asset Management Limited Partnership has invested 0% in Kennametal Inc. (NYSE:KMT). Foundry Prtn Ltd Company stated it has 44,302 shares or 0.07% of all its holdings. 5,080 were reported by Meeder Asset. Trust Company Of Vermont has 0% invested in Kennametal Inc. (NYSE:KMT) for 533 shares. Barclays Public Ltd Liability Corporation reported 362 shares. Panagora Asset Mngmt Inc holds 7,309 shares or 0% of its portfolio. Bancorporation Of Ny Mellon has 1.91 million shares. Skylands Lc owns 34,400 shares. Arrowmark Colorado Holding Ltd Limited Liability Company invested in 3.42 million shares or 1.19% of the stock. Jag Mgmt Ltd Com stated it has 0.09% in Kennametal Inc. (NYSE:KMT). Wells Fargo & Mn invested in 0% or 259,485 shares.

Toth Financial Advisory Corp increased Proshares Tr stake by 6,783 shares to 107,120 valued at $5.54M in 2018Q4. It also upped Spdr S&P 500 Etf Tr (SPY) stake by 3,691 shares and now owns 7,826 shares. Walgreens Boots Alliance Inc was raised too.

More recent Kennametal Inc. (NYSE:KMT) news were published by: Globenewswire.com which released: “Factors of Influence in 2019, Key Indicators and Opportunity within Monster Beverage, Kennametal, Waddell & Reed Financial, GlycoMimetics, WW Grainger, and Immersion — New Research Emphasizes Economic Growth – GlobeNewswire” on April 11, 2019. Also published the news titled: “10 Biggest Price Target Changes For Wednesday – Benzinga” on April 03, 2019. ‘s news article titled: “Benzinga’s Top Upgrades, Downgrades For April 3, 2019 – Benzinga” with publication date: April 03, 2019 was also an interesting one.

Since December 3, 2018, it had 0 insider purchases, and 2 sales for $284,419 activity. 5,000 shares valued at $213,520 were sold by Bacchus Judith L on Monday, December 3. On Wednesday, February 6 Keating Michelle R sold $70,899 worth of Kennametal Inc. (NYSE:KMT) or 1,890 shares.

Thomas J. Herzfeld Advisors Inc. holds 2.28% of its portfolio in The Herzfeld Caribbean Basin Fund Inc. for 1.17 million shares. Shaker Financial Services Llc owns 120,906 shares or 0.33% of their US portfolio. Moreover, Blue Bell Private Wealth Management Llc has 0.17% invested in the company for 66,243 shares. The United Kingdom-based City Of London Investment Management Co Ltd has invested 0.17% in the stock. Cornerstone Advisors Inc, a Alabama-based fund reported 81,372 shares.

More notable recent The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) news were published by: Nasdaq.com which released: “Oil tankers leave Venezuela for Cuba despite sanctions -document, data – Nasdaq” on April 11, 2019, also Nasdaq.com with their article: “Ostrich, rodent on the menu as Cuba seeks food miracle – Nasdaq” published on April 11, 2019, Nasdaq.com published: “Venezuela pledges to honor oil commitments to Cuba despite sanctions – Nasdaq” on April 08, 2019. More interesting news about The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) were released by: Nasdaq.com and their article: “Google Strengthens Presence in Cuba With ETECSA Team Up – Nasdaq” published on April 01, 2019 as well as Nasdaq.com‘s news article titled: “Castro says Cuba will not abandon Venezuela despite U.S. ‘blackmail’ – Nasdaq” with publication date: April 10, 2019.

The stock decreased 0.67% or $0.04 during the last trading session, reaching $5.94. About 2,257 shares traded. The Herzfeld Caribbean Basin Fund Inc. (CUBA) has declined 13.08% since April 16, 2018 and is downtrending. It has underperformed by 17.45% the S&P500.

The Herzfeld Caribbean Basin Fund Inc. is a closed-ended equity mutual fund launched by Thomas J. The company has market cap of $36.43 million. Herzfeld Advisors, Inc. It currently has negative earnings. The fund is managed by Herzfeld/Cuba.

Since January 1, 0001, it had 3 buys, and 0 insider sales for $390,352 activity.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.