Calamos Advisors Llc increased its stake in Cia De Minas Buenaventur (BVN) by 62.75% based on its latest 2018Q4 regulatory filing with the SEC. Calamos Advisors Llc bought 99,400 shares as the company’s stock rose 17.96% with the market. The institutional investor held 257,800 shares of the precious metals company at the end of 2018Q4, valued at $4.18 million, up from 158,400 at the end of the previous reported quarter. Calamos Advisors Llc who had been investing in Cia De Minas Buenaventur for a number of months, seems to be bullish on the $4.19B market cap company. The stock increased 0.12% or $0.02 during the last trading session, reaching $16.49. About 721,205 shares traded. CompañÃa de Minas Buenaventura S.A.A. (NYSE:BVN) has risen 4.28% since April 16, 2018 and is uptrending. It has underperformed by 0.09% the S&P500. Some Historical BVN News: 26/04/2018 – Peru’s Buenaventura says first-quarter net profit slid 60 pct; 26/04/2018 – BUENAVENTURA 1Q REV. $316.9M; 14/05/2018 – Buenaventura files Form 20-F with the U.S. Securities and Exchange Commission; 26/04/2018 – BUENAVENTURA 1Q ADJ EBITDA $173.7M; 23/04/2018 – Buenaventura Announces the Appointment of Juan Carlos Ortiz as Vice Pres of Ops; 23/04/2018 – Buenaventura: Gonzalo Eyzaguirre Resigns Effective April 30; 26/04/2018 – BUENAVENTURA 1Q ALL-IN SUSTAINING COST $758 PER GOLD OUNCE

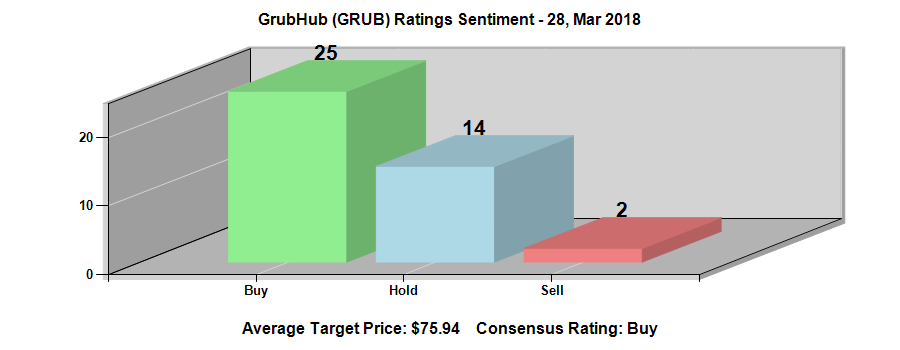

1492 Capital Management Llc increased its stake in Grubhub Inc (GRUB) by 81.77% based on its latest 2018Q4 regulatory filing with the SEC. 1492 Capital Management Llc bought 5,191 shares as the company’s stock declined 2.59% while stock markets rallied. The institutional investor held 11,539 shares of the business services company at the end of 2018Q4, valued at $886,000, up from 6,348 at the end of the previous reported quarter. 1492 Capital Management Llc who had been investing in Grubhub Inc for a number of months, seems to be bullish on the $5.95 billion market cap company. The stock decreased 0.11% or $0.07 during the last trading session, reaching $65.33. About 2.48M shares traded. Grubhub Inc. (NYSE:GRUB) has declined 20.05% since April 16, 2018 and is downtrending. It has underperformed by 24.42% the S&P500. Some Historical GRUB News: 01/05/2018 – GRUBHUB 1Q ADJ EPS 52C, EST. 38C; 23/04/2018 – RAN SEES 60% UPSIDE FOR GRUBHUB AT SOHN CONFERENCE; 22/04/2018 – Uber Eats is the fastest-growing meal delivery service in the U.S., bringing in nearly as much new customer revenue as GrubHub:; 23/04/2018 – Grubhub: A Good Company at the Wrong Price — Barrons.com; 01/05/2018 – GrubHub 1Q Rev $232.6M; 01/05/2018 – GrubHub 1Q Net $30.8M; 10/05/2018 – GRUBHUB INC – PARTNERING WITH JACK IN BOX TO PROVIDE DELIVERY FOR HUNDREDS OF LOCATIONS ACROSS THE COUNTRY; 23/04/2018 – GrubHub Touted by Half Sky Capital’s Li Ran at Sohn Conference; 01/05/2018 – GrubHub 1Q EBITDA $64.1M; 08/05/2018 – Chicagoans Can Now Order from Grubhub Through Groupon

More notable recent CompañÃa de Minas Buenaventura S.A.A. (NYSE:BVN) news were published by: Businesswire.com which released: “Buenaventura Announces Third Quarter and Nine Month 2018 Results – Business Wire” on October 25, 2018, also Seekingalpha.com with their article: “CompañÃa de Minas Buenaventura goes ex-dividend tomorrow – Seeking Alpha” published on April 11, 2019, Businesswire.com published: “Buenaventura Announces a Temporary Suspension of Production at Orcopampa Mine – Business Wire” on December 12, 2018. More interesting news about CompañÃa de Minas Buenaventura S.A.A. (NYSE:BVN) were released by: Businesswire.com and their article: “Buenaventura Announces Resumption of Operations at the Uchucchacua Mine – Business Wire” published on January 30, 2019 as well as Seekingalpha.com‘s news article titled: “CompañÃa de Minas Buenaventura S.A.A. (BVN) CEO Victor Gobitz on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” with publication date: February 22, 2019.

Calamos Advisors Llc, which manages about $26.54B and $15.15B US Long portfolio, decreased its stake in Baxter International Inc (NYSE:BAX) by 188,799 shares to 1.17 million shares, valued at $76.81 million in 2018Q4, according to the filing. It also reduced its holding in Lumentum Holdings Inc (Prn) by 1.14 million shares in the quarter, leaving it with 47.30M shares, and cut its stake in Mastercard Inc (NYSE:MA).

More notable recent Grubhub Inc. (NYSE:GRUB) news were published by: which released: “48 Stocks Moving In Friday’s Mid-Day Session – Benzinga” on April 12, 2019, also Schaeffersresearch.com with their article: “Enormous Put Trade Crosses on GrubHub – Schaeffers Research” published on April 09, 2019, Fool.com published: “Grubhub Investors Shouldn’t Ignore DoorDash – Motley Fool” on March 26, 2019. More interesting news about Grubhub Inc. (NYSE:GRUB) were released by: Seekingalpha.com and their article: “GrubHub -6% on KeyBanc user trend warning – Seeking Alpha” published on March 19, 2019 as well as ‘s news article titled: “48 Biggest Movers From Friday – Benzinga” with publication date: April 15, 2019.

1492 Capital Management Llc, which manages about $188.45M and $111.53M US Long portfolio, decreased its stake in Biotelemetry Inc (NASDAQ:BEAT) by 36,697 shares to 81,151 shares, valued at $4.85 million in 2018Q4, according to the filing. It also reduced its holding in Neogenomics Inc (NASDAQ:NEO) by 63,329 shares in the quarter, leaving it with 295,966 shares, and cut its stake in Direxion Shs Etf Tr.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.