Tygh Capital Management Inc decreased its stake in Patterson Uti Energy Com (PTEN) by 31.16% based on its latest 2018Q4 regulatory filing with the SEC. Tygh Capital Management Inc sold 58,282 shares as the company’s stock declined 7.65% while stock markets rallied. The institutional investor held 128,785 shares of the energy company at the end of 2018Q4, valued at $1.33M, down from 187,067 at the end of the previous reported quarter. Tygh Capital Management Inc who had been investing in Patterson Uti Energy Com for a number of months, seems to be less bullish one the $3.16B market cap company. The stock decreased 0.20% or $0.03 during the last trading session, reaching $15.17. About 380,051 shares traded. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) has declined 25.34% since April 15, 2018 and is downtrending. It has underperformed by 29.71% the S&P500. Some Historical PTEN News: 22/05/2018 – SMG Industries Inc. Retains FieldView Capital Markets to Lead Investor Relations Program; 03/04/2018 – Patterson-UTI Energy Announces Appointment of Janeen S. Judah to Board of Directors; 04/04/2018 – PATTERSON-UTI HAD AVG OF 172 DRILLING RIGS OPERATING IN MARCH; 26/04/2018 – Patterson-UTI 1Q Rev $809.2M; 22/04/2018 – DJ Patterson-UTI Energy Inc, Inst Holders, 1Q 2018 (PTEN); 27/03/2018 PATTERSON-UTI ENERGY SAYS ON MARCH 27, 2018, ENTERED INTO AN AMENDED AND RESTATED CREDIT AGREEMENT – SEC FILING; 03/04/2018 – Patterson-UTI Energy Announces Appointment of Janeen S. Judah to Bd of Directors; 04/04/2018 – PATTERSON-UTI ENERGY INC – FOR MONTH OF MARCH 2018, COMPANY HAD AN AVERAGE OF 172 DRILLING RIGS OPERATING; 27/03/2018 – PATTERSON-UTI ENERGY – CREDIT AGREEMENT IS A COMMITTED SENIOR UNSECURED REVOLVING CREDIT FACILITY THAT PERMITS BORROWINGS OF UP TO $600 MLN; 02/04/2018 – PATTERSON-UTI ENERGY -ENTERED INTO FIVE-YEAR CREDIT AGREEMENT WITH A GROUP OF FINANCIAL INSTITUTIONS LED BY WELLS FARGO BANK, NATIONAL ASSOCIATION

Triangle Securities Wealth Management increased its stake in Diamondback Energy Inc (FANG) by 80.32% based on its latest 2018Q4 regulatory filing with the SEC. Triangle Securities Wealth Management bought 3,550 shares as the company’s stock declined 4.67% while stock markets rallied. The institutional investor held 7,970 shares of the energy company at the end of 2018Q4, valued at $739,000, up from 4,420 at the end of the previous reported quarter. Triangle Securities Wealth Management who had been investing in Diamondback Energy Inc for a number of months, seems to be bullish on the $17.73B market cap company. The stock increased 1.51% or $1.6 during the last trading session, reaching $107.88. About 406,912 shares traded. Diamondback Energy, Inc. (NASDAQ:FANG) has declined 17.20% since April 15, 2018 and is downtrending. It has underperformed by 21.57% the S&P500. Some Historical FANG News: 10/04/2018 – Diamondback Energy 1Q Production Up More Than 10% From 4Q; 10/04/2018 – DIAMONDBACK ENERGY SAYS 1Q PRODUCTION WAS UP 10% Q/Q

Tygh Capital Management Inc, which manages about $521.11M and $477.43M US Long portfolio, upped its stake in Altra Industrial Motion Corp (NASDAQ:AIMC) by 43,595 shares to 280,573 shares, valued at $7.06 million in 2018Q4, according to the filing. It also increased its holding in Modine Manufacturing Co (NYSE:MOD) by 141,980 shares in the quarter, for a total of 559,279 shares, and has risen its stake in Mastec Inc (NYSE:MTZ).

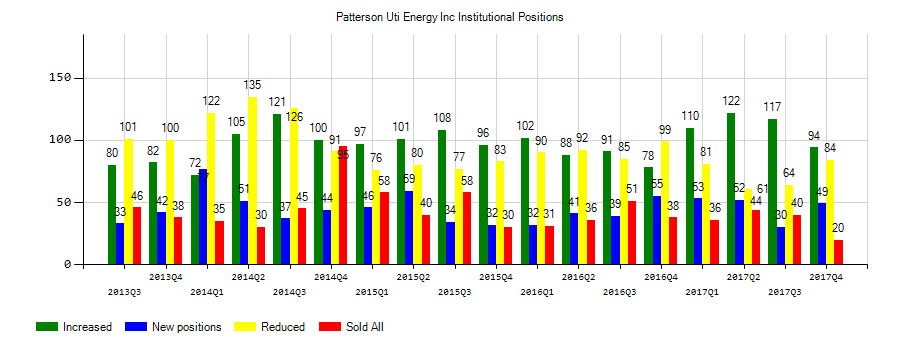

Investors sentiment increased to 0.97 in Q4 2018. Its up 0.04, from 0.93 in 2018Q3. It improved, as 31 investors sold PTEN shares while 94 reduced holdings. 44 funds opened positions while 77 raised stakes. 200.75 million shares or 0.70% more from 199.36 million shares in 2018Q3 were reported. Renaissance Technologies Ltd Limited Liability Company invested in 282,653 shares. Gabelli Funds Ltd Company reported 0.02% of its portfolio in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). Federated Invsts Pa reported 0.02% of its portfolio in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). Loomis Sayles & Com Lp has invested 0% in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). Twin Tree Mngmt LP holds 0% of its portfolio in Patterson-UTI Energy, Inc. (NASDAQ:PTEN) for 3,150 shares. Invesco Ltd holds 0.01% or 2.97M shares in its portfolio. Gemmer Asset Mngmt Lc accumulated 238 shares or 0% of the stock. Sir Capital Limited Partnership, New York-based fund reported 25,100 shares. 23,950 were reported by Oakbrook Invs Lc. Captrust Finance Advsrs reported 2,440 shares. Moreover, Quantbot Tech Lp has 0.03% invested in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). Parametric Llc reported 498,614 shares stake. Tygh Capital Mgmt reported 0.28% of its portfolio in Patterson-UTI Energy, Inc. (NASDAQ:PTEN). California Pub Employees Retirement Systems owns 351,581 shares or 0.01% of their US portfolio. Thrivent For Lutherans owns 3.91 million shares or 0.15% of their US portfolio.

More notable recent Patterson-UTI Energy, Inc. (NASDAQ:PTEN) news were published by: Nasdaq.com which released: “PTEN Stock Crowded With Sellers – Nasdaq” on October 24, 2018, also Nasdaq.com with their article: “Why Is Patterson-UTI (PTEN) Down 0.3% Since Last Earnings Report? – Nasdaq” published on March 09, 2019, 247Wallst.com published: “Jump in Oil Prices Could Be Huge for 3 Top Lagging Stocks – 24/7 Wall St.” on April 08, 2019. More interesting news about Patterson-UTI Energy, Inc. (NASDAQ:PTEN) were released by: Nasdaq.com and their article: “After Hours Most Active for Mar 7, 2019 : LTHM, MSFT, S, GE, F, MRO, PFE, GLPI, PTEN, MNST, EBAY, RMBS – Nasdaq” published on March 07, 2019 as well as Nasdaq.com‘s news article titled: “Patterson-UTI Energy, Inc. (PTEN) Ex-Dividend Date Scheduled for March 06, 2019 – Nasdaq” with publication date: March 05, 2019.

Analysts await Patterson-UTI Energy, Inc. (NASDAQ:PTEN) to report earnings on April, 25. They expect $-0.21 earnings per share, down 31.25% or $0.05 from last year’s $-0.16 per share. After $-0.04 actual earnings per share reported by Patterson-UTI Energy, Inc. for the previous quarter, Wall Street now forecasts 425.00% negative EPS growth.

Since December 20, 2018, it had 1 insider purchase, and 1 sale for $415,439 activity. Van’t Hof Matthew Kaes also sold $89,913 worth of Diamondback Energy, Inc. (NASDAQ:FANG) on Thursday, December 20.

More notable recent Diamondback Energy, Inc. (NASDAQ:FANG) news were published by: Cnbc.com which released: “Stock market winners list this year features odd bedfellows in ‘FANG’ and utility stocks – CNBC” on March 25, 2019, also Globenewswire.com with their article: “Investor Expectations to Drive Momentum within Entercom Communications, PPL, Clean Energy Fuels, Diamondback Energy, Agilent Technologies, and Toro — Discovering Underlying Factors of Influence – GlobeNewswire” published on March 25, 2019, Nasdaq.com published: “Why FANG Stocks Soared on Friday – Nasdaq” on January 04, 2019. More interesting news about Diamondback Energy, Inc. (NASDAQ:FANG) were released by: Nasdaq.com and their article: “Notable Friday Option Activity: MSFT, RCL, FANG – Nasdaq” published on April 12, 2019 as well as 247Wallst.com‘s news article titled: “Why Mega-Cap FANG Tech Leaders May Be Offering Investors Incredible Value – 24/7 Wall St.” with publication date: March 29, 2019.

Triangle Securities Wealth Management, which manages about $617.85 million and $169.35 million US Long portfolio, decreased its stake in Johnson Ctls Intl Plc by 27,931 shares to 7,196 shares, valued at $213,000 in 2018Q4, according to the filing.

Investors sentiment increased to 2.48 in 2018 Q4. Its up 1.23, from 1.25 in 2018Q3. It improved, as 55 investors sold FANG shares while 82 reduced holdings. 139 funds opened positions while 201 raised stakes. 161.29 million shares or 50.75% more from 107.00 million shares in 2018Q3 were reported. Country Tru National Bank & Trust owns 7 shares. Fukoku Mutual Life Ins has invested 0.02% in Diamondback Energy, Inc. (NASDAQ:FANG). Nomura Holdg Incorporated invested in 65,688 shares. Connecticut-based Point72 Asset Mngmt Limited Partnership has invested 0.75% in Diamondback Energy, Inc. (NASDAQ:FANG). New England Investment And Retirement Grp Incorporated holds 0.22% or 4,136 shares in its portfolio. Capital Growth Mngmt Ltd Partnership holds 0.35% or 60,000 shares in its portfolio. First Republic Inv Management invested 0.02% in Diamondback Energy, Inc. (NASDAQ:FANG). Perella Weinberg Prns Cap Management LP holds 2.13% in Diamondback Energy, Inc. (NASDAQ:FANG) or 366,398 shares. Jefferies Financial Gp Inc holds 128,411 shares or 1.4% of its portfolio. Moreover, Bright Rock Cap Management Ltd Com has 0.49% invested in Diamondback Energy, Inc. (NASDAQ:FANG). Westfield Capital LP has 0.26% invested in Diamondback Energy, Inc. (NASDAQ:FANG) for 334,687 shares. 297,597 were reported by Parametric Portfolio Associate Ltd Company. Lombard Odier Asset (Usa) holds 1.17% or 160,000 shares. Mitchell Grp Inc Incorporated holds 4.16% in Diamondback Energy, Inc. (NASDAQ:FANG) or 56,260 shares. Brinker Capital Inc holds 11,806 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.