Peak Asset Management Llc increased its stake in Apple Inc (AAPL) by 4.23% based on its latest 2018Q4 regulatory filing with the SEC. Peak Asset Management Llc bought 2,474 shares as the company’s stock declined 2.81% while stock markets rallied. The hedge fund held 60,990 shares of the computer manufacturing company at the end of 2018Q4, valued at $9.62M, up from 58,516 at the end of the previous reported quarter. Peak Asset Management Llc who had been investing in Apple Inc for a number of months, seems to be bullish on the $940.82B market cap company. The stock increased 0.01% or $0.03 during the last trading session, reaching $199.53. About 8.70 million shares traded. Apple Inc. (NASDAQ:AAPL) has risen 0.49% since April 10, 2018 and is uptrending. It has underperformed by 3.88% the S&P500. Some Historical AAPL News: 27/04/2018 – Tesla’s head of Autopilot leaves; ex-Apple exec to succeed him; 16/05/2018 – San Jose Bus Jrn: Sources: North Carolina site tops Apple’s shortlist for second big corporate campus; 10/05/2018 – ♫ Reuters Insider – U.S. Morning Call: Oil set for biggest weekly rise in a month; Apple scraps $1 bln Irish data centre; 14/03/2018 – Google, Apple face EU law on business practices; 27/03/2018 – Apple Announces iPad Update at Chicago School Event; 20/03/2018 – Apple Rumors Feed: Apple IBM combine Watson and Core ML for the smartest ever mobile apps (Ben Lovejoy/9 to 5 Mac); 12/03/2018 – The magazine service with access to 200 publications is now under the Apple umbrella; 11/05/2018 – Apple is vastly more profitable than Amazon; 03/04/2018 – Apple discloses gender pay gap at UK operations; 23/04/2018 – European Commission annouces ‘in-depth investigation’ into Apple’s Shazam deal

Rice Hall James & Associates Llc decreased its stake in Biotelemetry Inc. (BEAT) by 27.86% based on its latest 2018Q4 regulatory filing with the SEC. Rice Hall James & Associates Llc sold 125,615 shares as the company’s stock declined 1.40% while stock markets rallied. The institutional investor held 325,259 shares of the health care company at the end of 2018Q4, valued at $19.42M, down from 450,874 at the end of the previous reported quarter. Rice Hall James & Associates Llc who had been investing in Biotelemetry Inc. for a number of months, seems to be less bullish one the $2.11B market cap company. The stock increased 2.26% or $1.38 during the last trading session, reaching $62.55. About 143,377 shares traded. BioTelemetry, Inc. (NASDAQ:BEAT) has risen 116.89% since April 10, 2018 and is uptrending. It has outperformed by 112.52% the S&P500. Some Historical BEAT News: 25/04/2018 – BioTelemetry 1Q Rev $94.5M; 24/04/2018 – BioTelemetry Short-Interest Ratio Rises 34% to 12 Days; 19/04/2018 – DJ BioTelemetry Inc, Inst Holders, 1Q 2018 (BEAT); 25/04/2018 – BioTelemetry 1Q EPS 17c; 26/04/2018 – BIOTELEMETRY INC BEAT.O : BENCHMARK RAISES TARGET PRICE TO $46 FROM $44; 25/04/2018 – BioTelemetry 1Q Adj EPS 39c; 10/04/2018 BioTelemetry Closes Above 200-Day Moving Average: Technicals; 15/05/2018 – Arrowmark Partners Buys New 1.2% Position in BioTelemetry; 14/05/2018 – Renaissance Technologies LLC Exits Position in BioTelemetry

Investors sentiment increased to 0.97 in Q4 2018. Its up 0.30, from 0.67 in 2018Q3. It improved, as 82 investors sold AAPL shares while 860 reduced holdings. 159 funds opened positions while 756 raised stakes. 2.83 billion shares or 5.50% more from 2.68 billion shares in 2018Q3 were reported. Forbes J M Com Ltd Liability Partnership has invested 1.79% in Apple Inc. (NASDAQ:AAPL). Independent Investors reported 26.24% of its portfolio in Apple Inc. (NASDAQ:AAPL). Herald Inv Mngmt Ltd invested 0.81% of its portfolio in Apple Inc. (NASDAQ:AAPL). Rosenbaum Jay D holds 9,468 shares. The United Kingdom-based Origin Asset Mgmt Ltd Liability Partnership has invested 2.99% in Apple Inc. (NASDAQ:AAPL). State Of New Jersey Common Pension Fund D reported 3.99 million shares or 2.69% of all its holdings. Texas-based Linscomb Williams Inc has invested 0.63% in Apple Inc. (NASDAQ:AAPL). Lederer Assocs Inv Counsel Ca holds 5.34% or 31,661 shares in its portfolio. New York-based F&V Capital Mngmt Lc has invested 0.69% in Apple Inc. (NASDAQ:AAPL). Putnam Fl Mgmt Company holds 3.65% or 212,742 shares in its portfolio. Strategy Asset Managers Ltd Llc owns 4,934 shares. Reilly Herbert Faulkner Iii holds 2.91% or 33,972 shares in its portfolio. Benedict Financial Advisors has invested 2.96% in Apple Inc. (NASDAQ:AAPL). Park National Oh owns 258,823 shares or 2.53% of their US portfolio. Cortland Assoc Inc Mo, Missouri-based fund reported 9,912 shares.

Peak Asset Management Llc, which manages about $326.42M and $266.55 million US Long portfolio, decreased its stake in Ishares Tr (Call) (EEM) by 16,730 shares to 200 shares, valued at $8,000 in 2018Q4, according to the filing.

Since November 19, 2018, it had 0 buys, and 2 sales for $902,607 activity. LEVINSON ARTHUR D had sold 1,521 shares worth $255,087 on Friday, February 1.

More notable recent Apple Inc. (NASDAQ:AAPL) news were published by: Seekingalpha.com which released: “Apple: Dividend Hardly Counts – Seeking Alpha” on April 09, 2019, also Nasdaq.com with their article: “Apple Stock Is Still Ripe for the Picking – Nasdaq” published on April 04, 2019, Nasdaq.com published: “Better Buy Amid Tech Diversification: Apple (AAPL) vs. Amazon (AMZN) Stock – Nasdaq” on March 26, 2019. More interesting news about Apple Inc. (NASDAQ:AAPL) were released by: Seekingalpha.com and their article: “What Does The New Services Mean For Apple? – Seeking Alpha” published on March 29, 2019 as well as Seekingalpha.com‘s news article titled: “Apple: Easy Money – Seeking Alpha” with publication date: March 29, 2019.

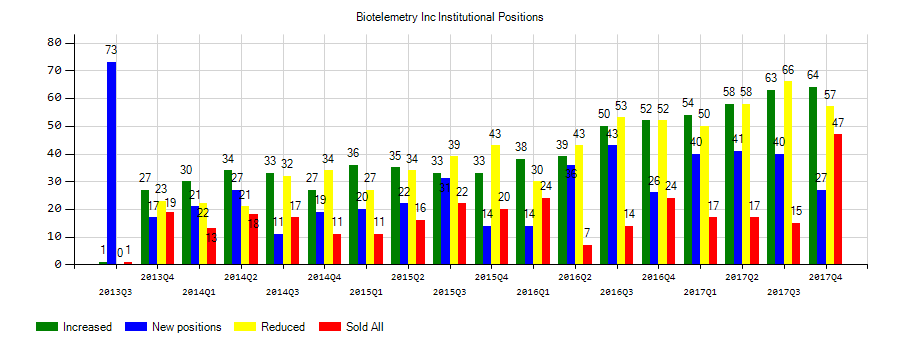

Investors sentiment increased to 1.39 in 2018 Q4. Its up 0.35, from 1.04 in 2018Q3. It is positive, as 21 investors sold BEAT shares while 75 reduced holdings. 58 funds opened positions while 75 raised stakes. 29.71 million shares or 4.55% more from 28.42 million shares in 2018Q3 were reported. Next Finance Group reported 0% in BioTelemetry, Inc. (NASDAQ:BEAT). Sector Pension Inv Board holds 28,719 shares or 0.01% of its portfolio. Moreover, Voloridge Invest Mgmt Llc has 0.04% invested in BioTelemetry, Inc. (NASDAQ:BEAT). Moreover, Great West Life Assurance Can has 0.01% invested in BioTelemetry, Inc. (NASDAQ:BEAT) for 43,802 shares. Moreover, Ameriprise Inc has 0.01% invested in BioTelemetry, Inc. (NASDAQ:BEAT) for 218,483 shares. Fiera Cap reported 0.03% of its portfolio in BioTelemetry, Inc. (NASDAQ:BEAT). Amundi Pioneer Asset, Massachusetts-based fund reported 34,000 shares. Stifel Financial Corp reported 0.06% of its portfolio in BioTelemetry, Inc. (NASDAQ:BEAT). 5,142 were accumulated by Amalgamated Comml Bank. Sterling Mgmt Limited Liability Company reported 446,788 shares. The Illinois-based Oberweis Asset Mgmt has invested 2.34% in BioTelemetry, Inc. (NASDAQ:BEAT). Cubist Systematic Strategies Ltd Liability Corporation has invested 0.09% in BioTelemetry, Inc. (NASDAQ:BEAT). 1492 Capital Mngmt Ltd Liability Corporation reported 4.34% stake. Perkins Cap has 0.69% invested in BioTelemetry, Inc. (NASDAQ:BEAT). Citigroup Inc invested in 0% or 53,238 shares.

Rice Hall James & Associates Llc, which manages about $1.51B and $2.74B US Long portfolio, upped its stake in J2 Global Inc. (NASDAQ:JCOM) by 158,102 shares to 563,397 shares, valued at $39.09M in 2018Q4, according to the filing. It also increased its holding in Points International Ltd. (NASDAQ:PCOM) by 173,511 shares in the quarter, for a total of 520,487 shares, and has risen its stake in Lkq Corp. (NASDAQ:LKQ).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.