Bourgeon Capital Management Llc increased its stake in Prologis Inc. Reit (PLD) by 33.3% based on its latest 2018Q4 regulatory filing with the SEC. Bourgeon Capital Management Llc bought 17,850 shares as the company’s stock rose 4.44% with the market. The hedge fund held 71,455 shares of the consumer services company at the end of 2018Q4, valued at $4.20 million, up from 53,605 at the end of the previous reported quarter. Bourgeon Capital Management Llc who had been investing in Prologis Inc. Reit for a number of months, seems to be bullish on the $46.52 billion market cap company. The stock decreased 0.58% or $0.42 during the last trading session, reaching $72.47. About 734,799 shares traded. Prologis, Inc. (NYSE:PLD) has risen 15.84% since April 9, 2018 and is uptrending. It has outperformed by 11.47% the S&P500. Some Historical PLD News: 17/04/2018 – PROLOGIS SEES FY CORE FFO/SHR $2.95 TO $3.01, EST. $2.91; 30/04/2018 – PROLOGIS CEO HAMID MOGHADAM SPEAKS ON DCT ACQUISITION CALL; 05/03/2018 – Prologis Will Retain 15% Ownership in Nippon Prologis REIT; 19/04/2018 – ProLogis Property Mexico 1Q FFO 4.58c/Shr; 05/03/2018 – PROLOGIS INC – PROLOGIS WILL RETAIN ITS 15 PERCENT OWNERSHIP INTEREST IN NPR; 17/04/2018 – Prologis 1Q Rev $693.7M; 30/04/2018 – PROLOGIS CEO: EXPECT TO TRIM $550M OF DCT PORTFOLIO IN 2 YEARS; 17/04/2018 – PROLOGIS BOOSTS FORECAST; 17/04/2018 – PROLOGIS INC – QTRLY TOTAL REVENUES $694 MLN VS $629 MLN REPORTED LAST YEAR; 29/04/2018 – Prologis: Annual Stabilized Core Funds From Operations Expected to Increase 6c-8c Per Shr

Renaissance Group Llc decreased its stake in Centene Corp (CNC) by 84.77% based on its latest 2018Q4 regulatory filing with the SEC. Renaissance Group Llc sold 11,739 shares as the company’s stock declined 16.85% while stock markets rallied. The institutional investor held 2,109 shares of the medical specialities company at the end of 2018Q4, valued at $243,000, down from 13,848 at the end of the previous reported quarter. Renaissance Group Llc who had been investing in Centene Corp for a number of months, seems to be less bullish one the $23.77B market cap company. The stock increased 1.57% or $0.89 during the last trading session, reaching $57.53. About 4.96M shares traded or 31.20% up from the average. Centene Corporation (NYSE:CNC) has risen 17.34% since April 9, 2018 and is uptrending. It has outperformed by 12.97% the S&P500. Some Historical CNC News: 24/04/2018 – CENTENE CORP SEES FY 2018 TOTAL REVENUES $58.2 BLN TO $59.0 BLN; 24/04/2018 – Correct: Centene Sees 2018 Adj EPS $6.75-Adj EPS $7.15; 24/04/2018 – Centene 1Q Net $338M; 09/05/2018 – Moody’s Rates Centene Escrow I Corporation Senior Notes Ba1; Outlook Stable; 24/04/2018 – Centene 1Q EPS $1.91; 09/05/2018 – llliniCare Health Recognized with Two Platinum Awards from Decision Health for Outstanding Achievement in Healthcare; 02/04/2018 – CENTENE EXPECTED TO ENTER UNDERTAKINGS WITH NY DEPT OF HEALTH; 24/04/2018 – CENTENE TO FINANCE FIDELIS DEAL WITH $2.3B EQUITY, $1.6B DEBT; 02/04/2018 – CENTENE SEES CONTRIBUTING $340M TO NY STATE OVER 5-YR PERIOD; 24/04/2018 – CENTENE SEES FIDELIS DEAL COMPLETED NO LATER THAN JULY 1

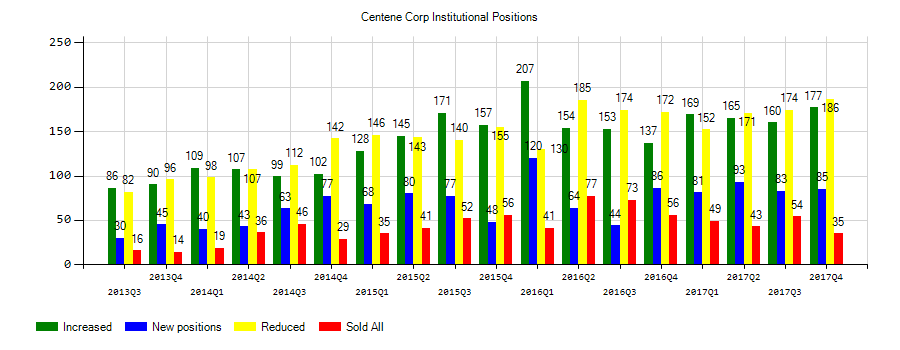

Investors sentiment increased to 1 in Q4 2018. Its up 0.11, from 0.89 in 2018Q3. It is positive, as 55 investors sold CNC shares while 211 reduced holdings. 79 funds opened positions while 187 raised stakes. 186.41 million shares or 6.67% more from 174.76 million shares in 2018Q3 were reported. 2,018 are held by Hollencrest Management. 1.10 million are owned by Legal General Gp Public Limited Liability Corporation. Kbc Grp Nv owns 0.03% invested in Centene Corporation (NYSE:CNC) for 26,077 shares. South State holds 0.14% in Centene Corporation (NYSE:CNC) or 10,559 shares. Toth Fincl Advisory invested in 0.01% or 240 shares. Ibm Retirement Fund reported 3,067 shares. Healthcor Management Lp has invested 1.15% in Centene Corporation (NYSE:CNC). Blair William And Il holds 0% or 4,925 shares in its portfolio. Invesco has invested 0.06% of its portfolio in Centene Corporation (NYSE:CNC). Roberts Glore & Com Inc Il holds 0.71% of its portfolio in Centene Corporation (NYSE:CNC) for 8,725 shares. Ima Wealth holds 0.05% of its portfolio in Centene Corporation (NYSE:CNC) for 1,006 shares. Citadel Ltd Liability Co holds 0.01% or 113,790 shares in its portfolio. Cornerstone Advsrs holds 0.2% of its portfolio in Centene Corporation (NYSE:CNC) for 19,400 shares. Signature Estate And Advisors Ltd invested 0.09% in Centene Corporation (NYSE:CNC). Buckingham Asset Management holds 0.13% or 7,445 shares in its portfolio.

Since October 25, 2018, it had 0 insider purchases, and 4 insider sales for $3.96 million activity. Hunter Jesse N also sold $1.21M worth of Centene Corporation (NYSE:CNC) on Tuesday, December 18. $1.94M worth of Centene Corporation (NYSE:CNC) was sold by DITMORE ROBERT K on Thursday, October 25. The insider Schwaneke Jeffrey A. sold $500,000.

More notable recent Centene Corporation (NYSE:CNC) news were published by: Investorplace.com which released: “CVS Stock Is Not Nearly as Cheap as You Might Think – Investorplace.com” on April 09, 2019, also Seekingalpha.com with their article: “How To Play The Centene-WellCare Deal – Seeking Alpha” published on March 28, 2019, Investorplace.com published: “5 Killer Strong Buy Stocks to Multiply Your Money – Investorplace.com” on March 20, 2019. More interesting news about Centene Corporation (NYSE:CNC) were released by: Seekingalpha.com and their article: “Centene: WellCare Acquisition A Positive – Seeking Alpha” published on April 02, 2019 as well as Seekingalpha.com‘s news article titled: “Centene’s New Hampshire subsidiary wins medicaid contract – Seeking Alpha” with publication date: March 28, 2019.

Analysts await Centene Corporation (NYSE:CNC) to report earnings on April, 23 before the open. They expect $1.32 earnings per share, up 21.10% or $0.23 from last year’s $1.09 per share. CNC’s profit will be $545.41M for 10.90 P/E if the $1.32 EPS becomes a reality. After $0.69 actual earnings per share reported by Centene Corporation for the previous quarter, Wall Street now forecasts 91.30% EPS growth.

Bourgeon Capital Management Llc, which manages about $244.47M and $152.88M US Long portfolio, decreased its stake in Martin Marietta Matr (NYSE:MLM) by 3,250 shares to 1,235 shares, valued at $212,000 in 2018Q4, according to the filing. It also reduced its holding in Bank Of America Corp (NYSE:BAC) by 30,570 shares in the quarter, leaving it with 164,820 shares, and cut its stake in Microsoft Corp (NASDAQ:MSFT).

Investors sentiment decreased to 1.07 in Q4 2018. Its down 1.33, from 2.4 in 2018Q3. It dropped, as 41 investors sold PLD shares while 191 reduced holdings. 75 funds opened positions while 174 raised stakes. 579.83 million shares or 1.83% more from 569.42 million shares in 2018Q3 were reported. 3.22 million are held by Amp Cap Investors Limited. Farmers Merchants Investments accumulated 254 shares. Levin Capital Strategies Lp invested 0.01% of its portfolio in Prologis, Inc. (NYSE:PLD). Blackrock holds 0.2% of its portfolio in Prologis, Inc. (NYSE:PLD) for 66.63 million shares. Rampart Investment Mngmt Com Ltd accumulated 6,614 shares. 15,938 are held by Balasa Dinverno Foltz Limited Co. Comerica Securities invested in 6,659 shares. Mngmt Ltd stated it has 0.03% of its portfolio in Prologis, Inc. (NYSE:PLD). Meiji Yasuda Life holds 0.35% of its portfolio in Prologis, Inc. (NYSE:PLD) for 38,800 shares. Raymond James Fin Services Advisors Incorporated accumulated 21,179 shares. Texas Yale Corp reported 31,610 shares. Investec Asset Mngmt Limited invested 0.08% in Prologis, Inc. (NYSE:PLD). Eaton Vance Mngmt stated it has 0.03% in Prologis, Inc. (NYSE:PLD). Profund Limited Liability, a Maryland-based fund reported 27,567 shares. North Carolina-based Bb&T has invested 0.09% in Prologis, Inc. (NYSE:PLD).

Another recent and important Prologis, Inc. (NYSE:PLD) news was published by Seekingalpha.com which published an article titled: “Prologis: A Low Risk Play On E-Commerce – Seeking Alpha” on March 27, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.