Among 5 analysts covering SL Green Realty (NYSE:SLG), 3 have Buy rating, 0 Sell and 2 Hold. Therefore 60% are positive. SL Green Realty had 10 analyst reports since October 24, 2018 according to SRatingsIntel. As per Tuesday, January 15, the company rating was upgraded by SunTrust. The firm has “Underweight” rating given on Wednesday, December 19 by JP Morgan. Deutsche Bank upgraded SL Green Realty Corp. (NYSE:SLG) rating on Monday, December 10. Deutsche Bank has “Buy” rating and $118 target. Barclays Capital upgraded SL Green Realty Corp. (NYSE:SLG) on Monday, February 4 to “Overweight” rating. Goldman Sachs downgraded SL Green Realty Corp. (NYSE:SLG) rating on Tuesday, January 15. Goldman Sachs has “Neutral” rating and $92 target. The rating was downgraded by Robert W. Baird to “Neutral” on Wednesday, October 24. JP Morgan maintained SL Green Realty Corp. (NYSE:SLG) rating on Wednesday, October 24. JP Morgan has “Neutral” rating and $106 target. See SL Green Realty Corp. (NYSE:SLG) latest ratings:

13/03/2019 Broker: J.P. Morgan Rating: Sell Downgrade

13/03/2019 Broker: JP Morgan Old Rating: Equal-Weight New Rating: Underweight Downgrade

28/02/2019 Broker: BidaskScore Rating: Sell Downgrade

04/02/2019 Broker: Barclays Capital Old Rating: Equal-Weight New Rating: Overweight Old Target: $97 New Target: $100 Upgrade

15/01/2019 Broker: SunTrust Old Rating: Hold New Rating: Buy Upgrade

15/01/2019 Broker: Goldman Sachs Old Rating: Buy New Rating: Neutral Old Target: $115 New Target: $92 Downgrade

19/12/2018 Broker: JP Morgan Old Rating: Neutral New Rating: Underweight Downgrade

10/12/2018 Broker: Deutsche Bank Old Rating: Hold New Rating: Buy Old Target: $114 New Target: $118 Upgrade

24/10/2018 Broker: JP Morgan Old Rating: Neutral New Rating: Neutral Old Target: $107 New Target: $106 Maintain

24/10/2018 Broker: Robert W. Baird Old Rating: Outperform New Rating: Neutral Old Target: $109 New Target: $103 Downgrade

In a an analyst report made public on Monday morning, Canaccord Genuity has decreased Spirit AeroSystems Hldgs (NYSE:SPR) stock to a Hold and has set a 12-month price target at $92. SPR’s old rating was Buy.

The stock decreased 1.26% or $1.14 during the last trading session, reaching $89.64. About 1.25M shares traded or 10.98% up from the average. Spirit AeroSystems Holdings, Inc. (NYSE:SPR) has risen 10.88% since April 8, 2018 and is uptrending. It has outperformed by 6.51% the S&P500. Some Historical SPR News: 27/04/2018 – Spirit AeroSystems Stockholders Vote in Favor of Shareholder Proposal to Lower Special Meeting Threshold to 10%; 14/03/2018 – SPIRIT AERO SEES DEFENSE SALES GROWING TO 10-15% FROM 5% TODAY; 22/05/2018 – Moody’s Affirms Baa3 Spirit Aerosystems Senior Unsecured Debt; Outlook Is Stable; 25/04/2018 – SPIRIT AEROSYSTEMS ANNOUNCES 20% INCREASE TO QUARTERLY CASH DIVIDEND; 02/05/2018 – Spirit Aerosystems Backs FY18 Rev $7.1B-$7.2B; 02/05/2018 – SPIRIT AEROSYSTEMS CONCLUDES QUARTERLY EARNINGS WEBCAST; 14/03/2018 – SPIRIT AEROSYSTEMS CEO CONCLUDES REMARKS AT J.P. MORGAN EVENT; 02/05/2018 – SPR WAS AS MANY AS 15 SHIPMENTS FOR 737 BEHIND SCHEDULE: CEO; 02/05/2018 – Spirit Aerosystems Close to Buying Asco Industries for $650M; 02/05/2018 – Spirit Aerosystems 1Q EPS $1.10

More notable recent Spirit AeroSystems Holdings, Inc. (NYSE:SPR) news were published by: which released: “Barron’s Picks And Pans: Conoco (NYSE:COP), Foot Locker (NYSE:FL), Open Text (NASDAQ:OTEX), Tilray (NASDAQ:TLRY) And More – Benzinga” on April 06, 2019, also Fool.com with their article: “Why Care.com, AngloGold Ashanti, and Spirit AeroSystems Holdings Slumped Today – The Motley Fool” published on March 11, 2019, published: “4 Other Stocks to Sell As Boeing Tumbles – Yahoo Finance” on March 11, 2019. More interesting news about Spirit AeroSystems Holdings, Inc. (NYSE:SPR) were released by: Streetinsider.com and their article: “Put Buying Activity in Spirit AeroSystems (SPR) Targets 14.5% Downside in Shares, as Major Parts Supplier for Boeing (BA) 737 MAX Planes -Susquehanna – StreetInsider.com” published on March 28, 2019 as well as Bizjournals.com‘s news article titled: “FAA says Boeing needs more time on 737 MAX software fix – Wichita Business Journal” with publication date: April 01, 2019.

Among 4 analysts covering Spirit AeroSystems (NYSE:SPR), 4 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Spirit AeroSystems has $105 highest and $103 lowest target. $104.33’s average target is 16.39% above currents $89.64 stock price. Spirit AeroSystems had 7 analyst reports since October 12, 2018 according to SRatingsIntel. The stock of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) earned “Outperform” rating by Credit Suisse on Thursday, November 1. Standpoint Research upgraded the stock to “Buy” rating in Friday, October 12 report. On Thursday, November 8 the stock rating was upgraded by Bank of America to “Buy”. The stock of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) earned “Outperform” rating by Wells Fargo on Thursday, November 1.

Spirit AeroSystems Holdings, Inc., through its subsidiaries, designs, makes, and supplies commercial aero structures worldwide. The company has market cap of $9.47 billion. Spirit AeroSystems Holdings, Inc., through its subsidiaries, operates as a commercial aerospace original equipment maker worldwide. It has a 15.85 P/E ratio. The firm operates through three divisions: Fuselage Systems, Propulsion Systems, and Wing Systems.

Investors sentiment decreased to 0.8 in 2018 Q4. Its down 0.13, from 0.93 in 2018Q3. It worsened, as 43 investors sold Spirit AeroSystems Holdings, Inc. shares while 115 reduced holdings. 45 funds opened positions while 82 raised stakes. 98.11 million shares or 0.70% less from 98.80 million shares in 2018Q3 were reported. Massmutual Tru Fsb Adv reported 0% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Charles Schwab Investment Mgmt holds 0.03% or 462,029 shares. Utah Retirement System reported 19,700 shares. Meeder Asset Mgmt has invested 0.05% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Clearbridge Investments Ltd Liability holds 2,590 shares. Daiwa Securities Group Incorporated reported 0% stake. First Trust Advisors Ltd Partnership reported 102,137 shares stake. Atwood & Palmer owns 0% invested in Spirit AeroSystems Holdings, Inc. (NYSE:SPR) for 350 shares. First Manhattan has invested 0.18% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). 5,820 were accumulated by Sumitomo Mitsui Asset. California State Teachers Retirement Systems owns 178,383 shares. Cannell Peter B & Inc invested in 289,550 shares. Aperio Grp Limited Liability Company accumulated 53,022 shares or 0.02% of the stock. Pitcairn Co reported 0.03% stake. Northern Mngmt Ltd Co has 25,505 shares for 0.49% of their portfolio.

Analysts await Spirit AeroSystems Holdings, Inc. (NYSE:SPR) to report earnings on May, 1. They expect $1.69 EPS, up 53.64% or $0.59 from last year’s $1.1 per share. SPR’s profit will be $178.58 million for 13.26 P/E if the $1.69 EPS becomes a reality. After $1.85 actual EPS reported by Spirit AeroSystems Holdings, Inc. for the previous quarter, Wall Street now forecasts -8.65% negative EPS growth.

The stock increased 0.88% or $0.81 during the last trading session, reaching $92.6. About 381,175 shares traded. SL Green Realty Corp. (NYSE:SLG) has declined 5.41% since April 8, 2018 and is downtrending. It has underperformed by 9.78% the S&P500. Some Historical SLG News: 11/04/2018 – SL GREEN REALTY CORP – TWO TRANSACTIONS ARE EXPECTED TO GENERATE COMBINED NET PROCEEDS TO SL GREEN OF APPROXIMATELY $190 MLN; 19/04/2018 – SL GREEN FIRST QUARTER EARNINGS CONFERENCE CALL BEGINS; 25/04/2018 – SL Green Realty Signs McDermott Will & Emery at One Vanderbilt Avenue; 19/04/2018 – SL GREEN CEO HOLLIDAY SAYS ITS LOAN AT 245 PARK IS DOING WELL; 18/04/2018 – SL GREEN REALTY CORP SLG.N – QTRLY TOTAL REVENUES $301.7 MLN VS $377.4 MLN; 17/05/2018 – SL Green Signs PUMA to Global Retail Flagship at 609 Fifth Avenue; 19/04/2018 – SL GREEN VP OF LEASING STEVE DURELS SPEAKS ON CONFERENCE CALL; 11/04/2018 – SL GREEN REPORTS SALE OF 1745 BROADWAY OFFICE CONDOMINIUM & TWO; 04/05/2018 – SL GREEN REALTY CORP – COTY IS EXPECTED TO TAKE POSSESSION OF PROPERTY IN JULY 2018; 08/03/2018 SL GREEN REALTY CORP SLG.N : BARCLAYS RAISES TARGET PRICE TO $103 FROM $102

SL Green Realty Corp. is a real estate investment trust . The company has market cap of $8.19 billion. The firm engages in the property management, acquisitions, financing, development, construction, and leasing. It has a 34.67 P/E ratio. It also provides tenant services to its clients.

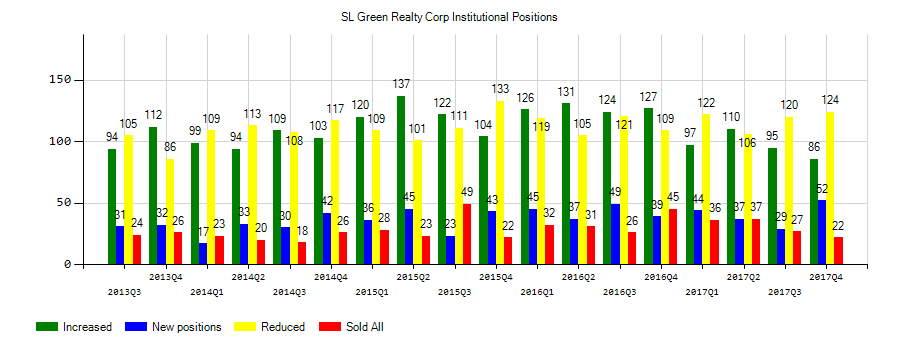

Investors sentiment decreased to 0.83 in Q4 2018. Its down 0.09, from 0.92 in 2018Q3. It worsened, as 31 investors sold SL Green Realty Corp. shares while 126 reduced holdings. 50 funds opened positions while 80 raised stakes. 79.72 million shares or 2.54% less from 81.80 million shares in 2018Q3 were reported. Boston Prns accumulated 6.32 million shares or 0.72% of the stock. Public Employees Retirement Of Ohio holds 128,972 shares or 0.06% of its portfolio. Canada Pension Plan Inv Board reported 253,211 shares or 0.04% of all its holdings. Ls Lc owns 14,648 shares. Michigan-based Asset Mngmt has invested 0.03% in SL Green Realty Corp. (NYSE:SLG). Fjarde Ap stated it has 0.03% of its portfolio in SL Green Realty Corp. (NYSE:SLG). D E Shaw & has 104,111 shares for 0.01% of their portfolio. Credit Suisse Ag holds 229,730 shares. Jane Street Limited Liability Corporation holds 0% or 19,624 shares in its portfolio. 7,300 are held by Fort Washington Invest Advisors Oh. Etrade Cap Ltd Liability Corp accumulated 5,386 shares. Walleye Trading Limited has 0.01% invested in SL Green Realty Corp. (NYSE:SLG) for 13,188 shares. Livforsakringsbolaget Skandia Omsesidigt has 0.01% invested in SL Green Realty Corp. (NYSE:SLG). Louisiana State Employees Retirement accumulated 4,500 shares or 0.02% of the stock. Commerzbank Aktiengesellschaft Fi holds 0% or 2,815 shares.

More notable recent SL Green Realty Corp. (NYSE:SLG) news were published by: which released: “Benzinga’s Top Upgrades, Downgrades For March 13, 2019 – Benzinga” on March 13, 2019, also Businesswire.com with their article: “SL Green Announces Sale of 521 Fifth Avenue for $381 Million – Business Wire” published on March 28, 2019, Seekingalpha.com published: “SL Green Realty Is Quality At A Value Price – Seeking Alpha” on February 22, 2019. More interesting news about SL Green Realty Corp. (NYSE:SLG) were released by: Seekingalpha.com and their article: “SL Green Realty declares $0.85 dividend – Seeking Alpha” published on November 29, 2018 as well as Seekingalpha.com‘s news article titled: “SL Green Realty (SLG) To Present At Citi’s Global Property CEO Conference – Slideshow – Seeking Alpha” with publication date: March 04, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.