Levin Capital Strategies Lp decreased its stake in Papa Johns Intl Inc (PZZA) by 51.24% based on its latest 2018Q4 regulatory filing with the SEC. Levin Capital Strategies Lp sold 22,052 shares as the company’s stock declined 9.38% while stock markets rallied. The hedge fund held 20,987 shares of the consumer services company at the end of 2018Q4, valued at $835,000, down from 43,039 at the end of the previous reported quarter. Levin Capital Strategies Lp who had been investing in Papa Johns Intl Inc for a number of months, seems to be less bullish one the $1.64 billion market cap company. The stock increased 0.54% or $0.28 during the last trading session, reaching $51.53. About 162,891 shares traded. Papa John's International, Inc. (NASDAQ:PZZA) has declined 27.73% since April 5, 2018 and is downtrending. It has underperformed by 32.10% the S&P500. Some Historical PZZA News: 08/05/2018 – Consolidated Research: 2018 Summary Expectations for Papa John’s International, Sanderson Farms, SandRidge Energy, SM Energy, U; 10/05/2018 – Papa John’s International Reaches Milestone with 50th Restaurant Opening in Spain; 09/05/2018 – Papa John’s is struggling to find its identity as sales continue to slump and competition in the pizza space stiffens; 03/05/2018 – American Century Companies Inc. Exits Position in Papa John’s; 28/03/2018 – Papa John’s at Company Marketing Hosted By Stephens Inc. Today; 08/05/2018 – Papa John’s 1Q EPS 50c; 16/05/2018 – Papa John’s International Reaches Milestone with 50th Restaurant Opening in Turkey; 26/04/2018 – Papa John’s Announces Joe Smith as Chief Fincl Officer; 08/05/2018 – PAPA JOHN REAFFIRMS ITS PREVIOUSLY ISSUED 2018 OUTLOOK; 08/05/2018 – PAPA JOHN’S INTERNATIONAL INC – QTRLY INTERNATIONAL COMPARABLE SALES INCREASES OF 0.3%

Murphy Pohlad Asset Management Llc increased its stake in Bank Amer Corp (BAC) by 24.03% based on its latest 2018Q4 regulatory filing with the SEC. Murphy Pohlad Asset Management Llc bought 12,925 shares as the company’s stock rose 2.11% with the market. The institutional investor held 66,712 shares of the major banks company at the end of 2018Q4, valued at $1.64 million, up from 53,787 at the end of the previous reported quarter. Murphy Pohlad Asset Management Llc who had been investing in Bank Amer Corp for a number of months, seems to be bullish on the $280.37B market cap company. The stock decreased 0.22% or $0.06 during the last trading session, reaching $29.09. About 16.99 million shares traded. Bank of America Corporation (NYSE:BAC) has declined 7.78% since April 5, 2018 and is downtrending. It has underperformed by 12.15% the S&P500. Some Historical BAC News: 07/05/2018 – Alder Bio Presenting at Bank of America Conference May 15; 14/05/2018 – Owens & Minor Presenting at Bank of America Conference Tomorrow; 18/05/2018 – Bank of America Delivers First Widely Available Al–Driven Virtual Financial Assistant; 15/05/2018 – Merck & Co Presenting at Bank of America Conference Tomorrow; 15/05/2018 – Adamas Pharma Presenting at Bank of America Conference Tomorrow; 23/03/2018 – Markets not panicking yet over trade war threat – BAML; 16/05/2018 – Hedge Funds Buy VICI Properties, Sell BofA in Financials: 13F; 08/05/2018 – Cigna Presenting at Bank of America Conference May 16; 02/05/2018 – Hill-Rom Presenting at Bank of America Conference May 15; 22/03/2018 – BLOCK TRADE – GROWTHPOINT PROPERTIES: BOOKRUNNER SAYS BOFA MERRILL LYNCH, STANDARD BANK OF SOUTH AFRICA, AS JOINT BOOKRUNNERS OF GROWTHPOINT PLACING

More notable recent Bank of America Corporation (NYSE:BAC) news were published by: Investorplace.com which released: “Fed Rate Hike Pause Could Pressure Bank of America Stock – Investorplace.com” on March 27, 2019, also Investorplace.com with their article: “5 Top Stock Trades for Tuesday: BAC, NFLX, ATVI, INTC – Investorplace.com” published on April 01, 2019, Seekingalpha.com published: “Buying panic in bonds sinks banks – Seeking Alpha” on March 22, 2019. More interesting news about Bank of America Corporation (NYSE:BAC) were released by: Seekingalpha.com and their article: “Bank stocks slump amid ECB’s dimmed outlook – Seeking Alpha” published on March 07, 2019 as well as Seekingalpha.com‘s news article titled: “Bank of America details modernization push – Seeking Alpha” with publication date: April 05, 2019.

Investors sentiment decreased to 0.83 in 2018 Q4. Its down 0.01, from 0.84 in 2018Q3. It turned negative, as 107 investors sold BAC shares while 616 reduced holdings. 124 funds opened positions while 475 raised stakes. 6.44 billion shares or 1.20% more from 6.37 billion shares in 2018Q3 were reported. Mercer Capital Advisers stated it has 0.41% in Bank of America Corporation (NYSE:BAC). Polaris Greystone Financial Grp accumulated 105,691 shares or 0.24% of the stock. 14,879 are held by Confluence Invest Mngmt Limited Liability. Bbr Ptnrs Ltd Liability Company owns 115,566 shares. Ruggie Capital Grp Inc reported 0.03% in Bank of America Corporation (NYSE:BAC). Pacific Invest Management stated it has 271,671 shares. Madison Investment Holdg holds 0.33% of its portfolio in Bank of America Corporation (NYSE:BAC) for 671,104 shares. California-based Check Cap Mngmt Ca has invested 0.02% in Bank of America Corporation (NYSE:BAC). Kistler has invested 0.18% in Bank of America Corporation (NYSE:BAC). Moreover, Whittier Trust Of Nevada has 0.16% invested in Bank of America Corporation (NYSE:BAC). Polar Ltd Liability Partnership owns 0.68% invested in Bank of America Corporation (NYSE:BAC) for 2.59 million shares. Accredited Investors owns 12,659 shares or 0.07% of their US portfolio. Aperio Grp Inc Ltd Liability Com reported 0.63% of its portfolio in Bank of America Corporation (NYSE:BAC). Logan Mgmt Inc stated it has 0.02% of its portfolio in Bank of America Corporation (NYSE:BAC). Delphi Mngmt Ma reported 0.45% stake.

Analysts await Papa John's International, Inc. (NASDAQ:PZZA) to report earnings on May, 14. They expect $0.21 EPS, down 58.00% or $0.29 from last year’s $0.5 per share. PZZA’s profit will be $6.67 million for 61.35 P/E if the $0.21 EPS becomes a reality. After $0.15 actual EPS reported by Papa John's International, Inc. for the previous quarter, Wall Street now forecasts 40.00% EPS growth.

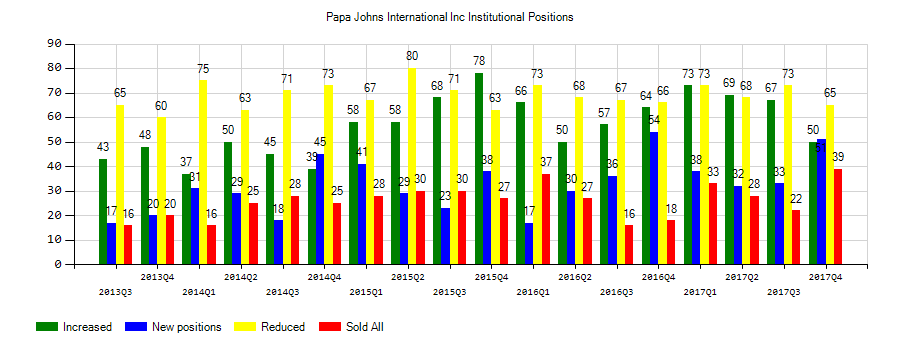

Investors sentiment increased to 0.9 in Q4 2018. Its up 0.15, from 0.75 in 2018Q3. It is positive, as 38 investors sold PZZA shares while 48 reduced holdings. 34 funds opened positions while 43 raised stakes. 21.64 million shares or 2.56% less from 22.21 million shares in 2018Q3 were reported. Wells Fargo & Mn holds 72,017 shares or 0% of its portfolio. Susquehanna Int Group Llp stated it has 78,991 shares or 0% of all its holdings. Principal Grp owns 96,347 shares. Dimensional Fund Advsrs Limited Partnership has 0.02% invested in Papa John's International, Inc. (NASDAQ:PZZA). Comerica National Bank & Trust holds 0.01% of its portfolio in Papa John's International, Inc. (NASDAQ:PZZA) for 15,416 shares. Stifel Financial holds 0% or 14,445 shares in its portfolio. Grp One Trading LP stated it has 52,612 shares or 0.02% of all its holdings. Moreover, Mutual Of America Cap Mgmt Llc has 0.01% invested in Papa John's International, Inc. (NASDAQ:PZZA) for 19,592 shares. Carroll Associates reported 100 shares stake. Nuveen Asset Management Limited Liability Co reported 51,179 shares stake. Synovus Fincl stated it has 0% of its portfolio in Papa John's International, Inc. (NASDAQ:PZZA). Cubist Systematic Strategies Lc holds 0.03% of its portfolio in Papa John's International, Inc. (NASDAQ:PZZA) for 18,192 shares. Morgan Stanley invested 0% in Papa John's International, Inc. (NASDAQ:PZZA). Moreover, Riverhead Cap Mngmt Limited Liability Com has 0.01% invested in Papa John's International, Inc. (NASDAQ:PZZA) for 5,263 shares. Sei Investments stated it has 7,898 shares.

Levin Capital Strategies Lp, which manages about $8.28B and $4.54 billion US Long portfolio, upped its stake in Apple Inc (NASDAQ:AAPL) by 41,038 shares to 806,880 shares, valued at $127.28M in 2018Q4, according to the filing. It also increased its holding in Facebook Inc (NASDAQ:FB) by 16,900 shares in the quarter, for a total of 24,935 shares, and has risen its stake in General Electric Co (NYSE:GE).

More notable recent Papa John's International, Inc. (NASDAQ:PZZA) news were published by: which released: “Benzinga’s Top Upgrades, Downgrades For March 27, 2019 – Benzinga” on March 27, 2019, also Nasdaq.com with their article: “Earnings Reaction History: PAPA JOHNS INTL, 50.0% Follow-Through Indicator, 5.0% Sensitive – Nasdaq” published on February 26, 2019, published: “Stifel Downgrades Papa John’s To Sell Amid ‘Fraternal Corporate Culture’ (NASDAQ:PZZA) – Benzinga” on July 23, 2018. More interesting news about Papa John's International, Inc. (NASDAQ:PZZA) were released by: Nasdaq.com and their article: “Papa John’s News: PZZA Stock Pops on John Schnatter Exit – Nasdaq” published on March 05, 2019 as well as Seekingalpha.com‘s news article titled: “Papa John’s: Valuing A Slice After Dad Burned The PZZA – Seeking Alpha” with publication date: September 23, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.