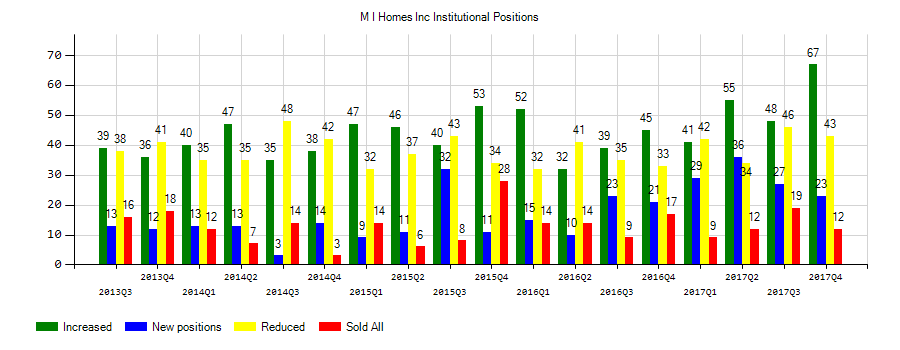

M I Homes Inc (MHO) investors sentiment increased to 0.97 in 2018 Q4. It’s up 0.08, from 0.89 in 2018Q3. The ratio is better, as 57 institutional investors increased or started new equity positions, while 59 sold and reduced stock positions in M I Homes Inc. The institutional investors in our database now own: 26.60 million shares, down from 26.87 million shares in 2018Q3. Also, the number of institutional investors holding M I Homes Inc in top ten equity positions increased from 2 to 3 for an increase of 1. Sold All: 11 Reduced: 48 Increased: 40 New Position: 17.

Prudential Plc decreased Mckesson Corp (MCK) stake by 6.69% reported in 2018Q4 SEC filing. Prudential Plc sold 80,300 shares as Mckesson Corp (MCK)’s stock declined 5.55%. The Prudential Plc holds 1.12 million shares with $123.68M value, down from 1.20 million last quarter. Mckesson Corp now has $22.10 billion valuation. The stock increased 0.11% or $0.13 during the last trading session, reaching $115.21. About 801,629 shares traded. McKesson Corporation (NYSE:MCK) has declined 18.04% since April 4, 2018 and is downtrending. It has underperformed by 22.41% the S&P500. Some Historical MCK News: 24/04/2018 – POLARITYTE ANNOUNCES APPOINTMENT OF MCKESSON’S WILLIE BOGAN TO BOARD OF DIRECTORS; 25/04/2018 – MCKESSON CORP – INITIATIVE INCLUDES A COMPREHENSIVE REVIEW OF COMPANY’S OPERATIONS AND COST STRUCTURE; 25/04/2018 – McKesson Launches Multi-Year Strategic Growth Initiative; Reaffirms Fiscal 2018 Outlook and Provides Preliminary Fiscal 2019; 24/05/2018 – McKesson: Qui Tam Complaint Filed Against Company, Units in April; 04/04/2018 – McKesson Specialty Health and CoverMyMeds Launch ExpressCoverage™, an Integrated eServices Platform Designed to Improve the Patient Care Journey; 30/04/2018 – McKesson Board Increases to Nine Members, Eight of Whom Are Independent; 05/04/2018 – McKesson Specialty Health Partners with CoverMyMeds to Deliver Keynote Address at eyeforpharma Philadelphia 2018; 24/05/2018 – MCKESSON CORP MCK.N FY SHR VIEW $13.35 — THOMSON REUTERS l/B/E/S; 25/04/2018 – McKesson: Plan Designed to Increase Efficiency, Accelerate Execution, Improve Long-Term Performance; 07/03/2018 – U.S. HEALTH CARE SERVICES: BARCLAYS SAYS NEUTRAL ON DRUG DISTRIBUTION SUBSECTOR

Prudential Plc increased Schlumberger (NYSE:SLB) stake by 352,562 shares to 1.30 million valued at $46.94M in 2018Q4. It also upped Henry Schein Inc (NASDAQ:HSIC) stake by 196,500 shares and now owns 581,400 shares. Invesco Senior Incom (VVR) was raised too.

More notable recent McKesson Corporation (NYSE:MCK) news were published by: Seekingalpha.com which released: “McKesson: Don’t Sell Into Pending Upmove – Seeking Alpha” on March 17, 2019, also Seekingalpha.com with their article: “Broyhill Asset Management – McKesson Corporation – Seeking Alpha” published on March 13, 2019, Seekingalpha.com published: “Keep On Buying McKesson – Seeking Alpha” on March 19, 2019. More interesting news about McKesson Corporation (NYSE:MCK) were released by: Seekingalpha.com and their article: “McKesson: Long-Term Technicals Remain Bullish – Seeking Alpha” published on March 22, 2019 as well as Seekingalpha.com‘s news article titled: “Walgreens Boots FQ2 weighs on drug wholesalers – Seeking Alpha” with publication date: April 02, 2019.

Among 4 analysts covering McKesson (NYSE:MCK), 0 have Buy rating, 0 Sell and 4 Hold. Therefore 0 are positive. McKesson had 7 analyst reports since October 26, 2018 according to SRatingsIntel. The firm earned “Equal-Weight” rating on Friday, October 26 by Barclays Capital. The rating was upgraded by Deutsche Bank on Friday, January 25 to “Hold”. The firm has “Equal-Weight” rating given on Monday, December 3 by Morgan Stanley.

Analysts await McKesson Corporation (NYSE:MCK) to report earnings on May, 23. They expect $3.68 EPS, up 5.44% or $0.19 from last year’s $3.49 per share. MCK’s profit will be $705.91M for 7.83 P/E if the $3.68 EPS becomes a reality. After $3.40 actual EPS reported by McKesson Corporation for the previous quarter, Wall Street now forecasts 8.24% EPS growth.

Investors sentiment increased to 0.74 in 2018 Q4. Its up 0.03, from 0.71 in 2018Q3. It is positive, as 51 investors sold MCK shares while 289 reduced holdings. 76 funds opened positions while 174 raised stakes. 169.00 million shares or 3.93% more from 162.62 million shares in 2018Q3 were reported. 29,783 are held by Capital Fund. Janney Montgomery Scott Limited Liability Com reported 16,078 shares. Hanson Mcclain has 382 shares for 0% of their portfolio. Victory reported 0% in McKesson Corporation (NYSE:MCK). Bb&T Corporation reported 26,409 shares or 0.06% of all its holdings. Parametric Port Associate reported 487,679 shares. 4,045 are held by Cypress Cap Grp. Prudential invested 0.06% in McKesson Corporation (NYSE:MCK). Los Angeles Cap Mngmt Equity Rech Inc holds 0.05% or 70,227 shares. M&T National Bank Corporation holds 28,576 shares or 0.02% of its portfolio. Rockland Tru holds 0% or 100 shares. The Japan-based Hikari Tsushin has invested 0.08% in McKesson Corporation (NYSE:MCK). Jane Street Gp Ltd Com reported 13,804 shares. Ci Investments, a Ontario – Canada-based fund reported 1.36 million shares. Provise Mngmt Grp Limited Liability holds 0.28% or 15,839 shares.

Since January 16, 2019, it had 0 insider purchases, and 1 insider sale for $946,792 activity. Schechter Lori A. sold $946,792 worth of McKesson Corporation (NYSE:MCK) on Wednesday, January 16.

Q Global Advisors Llc holds 3.86% of its portfolio in M/I Homes, Inc. for 241,195 shares. Towle & Co owns 1.09 million shares or 2.96% of their US portfolio. Moreover, Gratia Capital Llc has 2.57% invested in the company for 71,766 shares. The New York-based Donald Smith & Co. Inc. has invested 1.98% in the stock. Delphi Management Inc Ma, a Massachusetts-based fund reported 76,413 shares.

Another recent and important M/I Homes, Inc. (NYSE:MHO) news was published by Seekingalpha.com which published an article titled: “M/I Homes, Inc. (MHO) CEO Bob Schottenstein on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” on February 05, 2019.

Since January 1, 0001, it had 0 insider buys, and 1 sale for $293,341 activity.

M/I Homes, Inc., together with its subsidiaries, operates as a builder of single-family homes. The company has market cap of $736.20 million. The firm operates through Midwest Homebuilding, Southern Homebuilding, Mid-Atlantic Homebuilding, and Financial Services divisions. It has a 7.22 P/E ratio. It designs, constructs, markets, and sells single-family homes and attached townhomes to first-time, move-up, empty-nester, and luxury buyers under the M/I Homes and Showcase Collection brand names.

The stock increased 1.48% or $0.39 during the last trading session, reaching $26.75. About 219,423 shares traded. M/I Homes, Inc. (MHO) has declined 10.96% since April 4, 2018 and is downtrending. It has underperformed by 15.33% the S&P500. Some Historical MHO News: 25/04/2018 – M/I Homes 1Q Rev $437.9M; 25/04/2018 – M/I Homes 1Q New Contracts Increased 20%; 25/04/2018 – M/I Homes Closes Below 50-Day Moving Average: Technicals; 04/04/2018 – M/I Homes Closes Above 50-Day Moving Average: Technicals; 21/05/2018 – M I Acquisitions, Inc. Announces Date of Annual Meeting of Shareholders and Record Date; 20/04/2018 – DJ M I ACQUISITIONS INC UNIT, Inst Holders, 1Q 2018 (MACQU); 23/04/2018 – DJ M/I Homes Inc, Inst Holders, 1Q 2018 (MHO); 25/04/2018 – M/I HOMES 1Q REV. $438M, EST. $460.0M (2 EST.); 19/04/2018 – DJ M I Acquisitions Inc, Inst Holders, 1Q 2018 (MACQ); 25/04/2018 – M/I Homes 1Q EPS 60c

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.