Harvest Fund Advisors Llc decreased its stake in Oneok Inc New (OKE) by 3.03% based on its latest 2018Q4 regulatory filing with the SEC. Harvest Fund Advisors Llc sold 112,067 shares as the company’s stock rose 8.89% with the market. The hedge fund held 3.59M shares of the public utilities company at the end of 2018Q4, valued at $193.43 million, down from 3.70M at the end of the previous reported quarter. Harvest Fund Advisors Llc who had been investing in Oneok Inc New for a number of months, seems to be less bullish one the $28.49B market cap company. The stock decreased 0.14% or $0.1 during the last trading session, reaching $69.22. About 118,767 shares traded. ONEOK, Inc. (NYSE:OKE) has risen 16.62% since April 4, 2018 and is uptrending. It has outperformed by 12.25% the S&P500. Some Historical OKE News: 03/04/2018 – Oneok Temporarily Disable Service With a Third-Party Electronic Data Interchange Over Security Concerns; 03/04/2018 – ONEOK GAS LINES SAY ELECTRONIC DATA INTERCHANGE IS UNAVAILABLE; 03/05/2018 – ONEOK INC OKE.N : CITIGROUP RAISES TARGET PRICE TO $67 FROM $64; 15/05/2018 – Capital Research Global Investors Buys 1.8% of Oneok Inc; 03/05/2018 – ONEOK INC OKE.N : RBC RAISES TARGET PRICE TO $72 FROM $70; 19/04/2018 – Oneok Raises Dividend to 79.5c Vs. 77c; 01/05/2018 – ONEOK MAINTAINS 2018 FINL GUIDANCE; 15/05/2018 – Brookfield Asset Management Buys New 1.1% Position in Oneok Inc; 03/04/2018 – ONEOK Natural Gas Pipelines Operating Normally; 08/05/2018 – Consolidated Research: 2018 Summary Expectations for ONEOK, People’s United Financial, Spirit Realty Capital, Stryker, Ultra Cl

Parsec Financial Management Inc decreased its stake in Western Digital Corp (WDC) by 29.68% based on its latest 2018Q4 regulatory filing with the SEC. Parsec Financial Management Inc sold 33,582 shares as the company’s stock rose 9.26% with the market. The institutional investor held 79,571 shares of the electronic components company at the end of 2018Q4, valued at $2.94 million, down from 113,153 at the end of the previous reported quarter. Parsec Financial Management Inc who had been investing in Western Digital Corp for a number of months, seems to be less bullish one the $14.80 billion market cap company. The stock decreased 2.19% or $1.14 during the last trading session, reaching $50.87. About 1.17M shares traded. Western Digital Corporation (NASDAQ:WDC) has declined 39.72% since April 4, 2018 and is downtrending. It has underperformed by 44.09% the S&P500. Some Historical WDC News: 26/04/2018 – WESTERN DIGITAL 3Q ADJ EPS $3.63, EST. $3.30; 26/04/2018 – Western Digital 3Q Net $61M; 26/04/2018 – Western Digital 3Q Adj EPS $3.63; 15/05/2018 – Western Digital’s Buybacks: Do They Mean NAND Is Doing Much Better Than Feared? — Barron’s Blog; 15/05/2018 – Viking Global Investors Buys New 1% Position in Western Digital; 14/05/2018 – Western Digital Presenting at JPMorgan Conference Tomorrow; 15/03/2018 – Western Digital Forms Golden Cross: Technicals; 07/05/2018 – Western Digital Board Amends Bylaws to Allow Proxy Access; 09/03/2018 – WESTERN DIGITAL TO INVEST 500B YEN IN TOSHIBA CHIP JV: NIKKEI; 27/03/2018 – Western Digital Provides Cost-Effective, Hybrid-Cloud Backup and Recovery Solution with StorReduce Software for Enterprises

More notable recent ONEOK, Inc. (NYSE:OKE) news were published by: Fool.com which released: “3 Stocks to Buy With Dividends Yielding Way More Than 3% – The Motley Fool” on March 09, 2019, also with their article: “Investor Expectations to Drive Momentum within Twitter, ONEOK, Rollins, SEACOR, SeaWorld Entertainment, and Standard Motor Products — Discovering Underlying Factors of Influence – GlobeNewswire” published on April 01, 2019, published: “Benzinga’s Top Upgrades, Downgrades For April 1, 2019 – Benzinga” on April 01, 2019. More interesting news about ONEOK, Inc. (NYSE:OKE) were released by: Fool.com and their article: “Why ONEOK Could Deliver Market-Crushing Total Returns Through at Least 2021 – The Motley Fool” published on March 23, 2019 as well as Nasdaq.com‘s news article titled: “Investing in These Stocks Could Enrich Your Retirement – Nasdaq” with publication date: March 30, 2019.

Analysts await ONEOK, Inc. (NYSE:OKE) to report earnings on May, 7. They expect $0.70 EPS, up 9.37% or $0.06 from last year’s $0.64 per share. OKE’s profit will be $288.13 million for 24.72 P/E if the $0.70 EPS becomes a reality. After $0.70 actual EPS reported by ONEOK, Inc. for the previous quarter, Wall Street now forecasts 0.00% EPS growth.

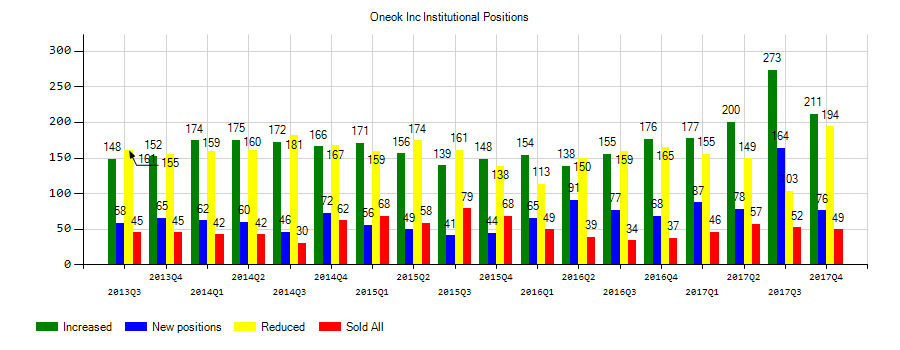

Investors sentiment decreased to 1.04 in Q4 2018. Its down 0.12, from 1.16 in 2018Q3. It worsened, as 71 investors sold OKE shares while 213 reduced holdings. 77 funds opened positions while 219 raised stakes. 300.23 million shares or 3.87% more from 289.04 million shares in 2018Q3 were reported. Payden And Rygel holds 1.19% or 272,900 shares in its portfolio. New York State Teachers Retirement owns 521,705 shares. 87,451 are held by Proshare Advisors Lc. Dnb Asset Mgmt As holds 57,434 shares or 0% of its portfolio. Smithfield Trust, Pennsylvania-based fund reported 3,290 shares. Manitoba – Canada-based Great West Life Assurance Can has invested 0.09% in ONEOK, Inc. (NYSE:OKE). Contravisory Mngmt owns 6,095 shares. 116,000 are held by Rr Advsrs Ltd Llc. Utah Retirement holds 0.09% or 76,294 shares. Putnam Ltd holds 0.01% or 104,404 shares. Ferguson Wellman Cap Mgmt, Oregon-based fund reported 15,981 shares. The Nebraska-based Walnut Private Equity Partners Lc has invested 7.38% in ONEOK, Inc. (NYSE:OKE). Brown Advisory Incorporated owns 29,629 shares for 0.01% of their portfolio. Gsa Cap Prtnrs Llp holds 53,427 shares or 0.33% of its portfolio. Moreover, Navellier Assoc has 0.68% invested in ONEOK, Inc. (NYSE:OKE) for 73,853 shares.

Harvest Fund Advisors Llc, which manages about $5.20B and $8.66 billion US Long portfolio, upped its stake in Buckeye Partners Lp (NYSE:BPL) by 2.75M shares to 5.57M shares, valued at $161.56 million in 2018Q4, according to the filing. It also increased its holding in Mplx Lp (NYSE:MPLX) by 28,468 shares in the quarter, for a total of 11.05 million shares, and has risen its stake in Cheniere Energy Inc (NYSEMKT:LNG).

More notable recent Western Digital Corporation (NASDAQ:WDC) news were published by: Nasdaq.com which released: “Notable Thursday Option Activity: ANET, PYPL, WDC – Nasdaq” on March 21, 2019, also Nasdaq.com with their article: “Tuesday Sector Leaders: Financial, Technology & Communications – Nasdaq” published on April 02, 2019, Nasdaq.com published: “Interesting WDC Put And Call Options For May 3rd – Nasdaq” on March 25, 2019. More interesting news about Western Digital Corporation (NASDAQ:WDC) were released by: Fool.com and their article: “Is Micron Technology a Buy? – The Motley Fool” published on March 26, 2019 as well as Fool.com‘s news article titled: “Better Buy: Western Digital vs. Cypress Semiconductor – The Motley Fool” with publication date: March 22, 2019.

Parsec Financial Management Inc, which manages about $1.56 billion and $1.38B US Long portfolio, upped its stake in Spdr Portfolio S&P 500 Growth (SPYG) by 26,968 shares to 64,193 shares, valued at $2.09M in 2018Q4, according to the filing. It also increased its holding in Amgen Inc (NASDAQ:AMGN) by 3,070 shares in the quarter, for a total of 140,153 shares, and has risen its stake in Gilead Sciences (NASDAQ:GILD).

Since November 2, 2018, it had 0 insider buys, and 1 sale for $80,148 activity.

Investors sentiment decreased to 0.75 in 2018 Q4. Its down 0.35, from 1.1 in 2018Q3. It dropped, as 92 investors sold WDC shares while 198 reduced holdings. 66 funds opened positions while 151 raised stakes. 246.93 million shares or 5.05% more from 235.05 million shares in 2018Q3 were reported. Whittier Trust Of Nevada Inc has invested 0% in Western Digital Corporation (NASDAQ:WDC). Fil Limited accumulated 1.72 million shares or 0.11% of the stock. Ironwood Financial Limited Liability Company stated it has 203 shares. New York State Teachers Retirement Systems stated it has 0.04% of its portfolio in Western Digital Corporation (NASDAQ:WDC). Canada Pension Plan Inv Board accumulated 886,018 shares. Artemis Inv Mgmt Llp has 0.96% invested in Western Digital Corporation (NASDAQ:WDC) for 1.99M shares. Howe & Rusling Incorporated stated it has 517 shares or 0% of all its holdings. Meeder Asset Management holds 0.01% of its portfolio in Western Digital Corporation (NASDAQ:WDC) for 3,027 shares. Moreover, Caisse De Depot Et Placement Du Quebec has 0.02% invested in Western Digital Corporation (NASDAQ:WDC). Glenmede Trust Company Na reported 114,224 shares. The Ohio-based Strs Ohio has invested 0.1% in Western Digital Corporation (NASDAQ:WDC). Nexus Management Inc has 252,738 shares for 1.63% of their portfolio. Mackenzie Financial accumulated 59,687 shares. Oregon Employees Retirement Fund holds 0.16% or 8.20 million shares. New Mexico Educational Retirement Board invested in 0.04% or 24,814 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.