A-R-T- Advisors Llc increased Covanta Hldg Corp (CVA) stake by 90.5% reported in 2018Q4 SEC filing. A-R-T- Advisors Llc acquired 32,400 shares as Covanta Hldg Corp (CVA)’s stock rose 2.02%. The A-R-T- Advisors Llc holds 68,200 shares with $915,000 value, up from 35,800 last quarter. Covanta Hldg Corp now has $2.30 billion valuation. The stock increased 0.40% or $0.07 during the last trading session, reaching $17.56. About 521,222 shares traded. Covanta Holding Corporation (NYSE:CVA) has risen 11.13% since April 3, 2018 and is uptrending. It has outperformed by 6.76% the S&P500. Some Historical CVA News: 26/04/2018 – COVANTA HOLDING CORP CVA.N – QTRLY REVENUE $458 MLN VS $404 MLN LAST YEAR; 11/05/2018 – Covanta’s Alex Piscitelli Honored by the Chester Environmental Partnership for Exceptional Record of Compliance; 19/04/2018 – DJ Covanta Holding Corporation, Inst Holders, 1Q 2018 (CVA); 26/04/2018 – Covanta Holding 1Q EPS $1.53; 16/03/2018 – Covanta Holding Closes Below 200-Day Moving Average: Technicals; 26/04/2018 – COVANTA HOLDING 1Q OPER REV. $458M, EST. $431.3M; 18/04/2018 – COVANTA ENVIRONMENTAL SOLUTIONS- AWARDED CONTRACT FOR NEW YORK DEPARTMENT OF ENVIRONMENTAL CONSERVATION’S PILOT PHARMACEUTICAL TAKE BACK PROGRAM; 26/04/2018 – COVANTA HOLDING 1Q ADJ LOSS/SHR 9C, EST. LOSS/SHR 23C; 10/05/2018 – Covanta and Partners Collect Nearly Four Tons of E-Waste at Annual Event in Newark; 05/03/2018 Covanta Holding Closes Above 200-Day Moving Average: Technicals

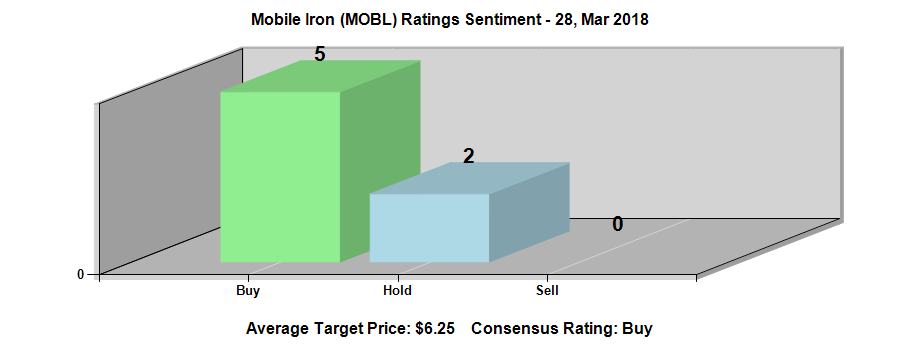

Analysts expect MobileIron, Inc. (NASDAQ:MOBL) to report $-0.11 EPS on April, 25.They anticipate $0.06 EPS change or 35.29% from last quarter’s $-0.17 EPS. After having $-0.07 EPS previously, MobileIron, Inc.’s analysts see 57.14% EPS growth. The stock increased 1.25% or $0.07 during the last trading session, reaching $5.67. About 323,219 shares traded. MobileIron, Inc. (NASDAQ:MOBL) has risen 2.29% since April 3, 2018 and is uptrending. It has underperformed by 2.08% the S&P500. Some Historical MOBL News: 20/03/2018 – MobileIron Reports Inducement Grants Under NASDAQ Listing Rule 5635(c)(4); 16/05/2018 – MobileIron and ThinPrint Partner to Bring Managed and Secure Mobile Printing to Enterprises; 26/04/2018 – MOBILEIRON INC QTRLY BILLINGS WERE $46.0 MLN, UP 1% YEAR-OVER-YEAR; 23/05/2018 – MobileIron Closes Above 200-Day Moving Average: Technicals; 19/03/2018 – Sohail Parekh Joins Mobilelron to Lead Engineering; 06/03/2018 – MobileIron Announces Participation in the 30th Annual ROTH Conference; 26/04/2018 – MOBILEIRON INC MOBL.O SEES FY 2018 REVENUE $190 MLN TO $200 MLN; 09/03/2018 – Cortado Server 9.0 Enhances Features for Secure Management of Mobile Productivity; 03/04/2018 – MobileIron Shortlisted for Four Data News Awards for Excellence; 02/05/2018 – Canon Medical Systems Securely Optimizes Customer and Employee Support with MobileIron

Investors sentiment increased to 2.07 in 2018 Q4. Its up 0.51, from 1.56 in 2018Q3. It improved, as 4 investors sold MobileIron, Inc. shares while 24 reduced holdings. 26 funds opened positions while 32 raised stakes. 57.46 million shares or 21.64% more from 47.24 million shares in 2018Q3 were reported. Qs Invsts Ltd Liability owns 908 shares or 0% of their US portfolio. Renaissance Llc invested in 2.25M shares or 0.01% of the stock. Citadel Ltd, a Illinois-based fund reported 243,100 shares. Product Prtn Lc has 79,991 shares. Panagora Asset Mngmt holds 252,203 shares or 0.01% of its portfolio. New York-based Ny State Common Retirement Fund has invested 0% in MobileIron, Inc. (NASDAQ:MOBL). Stone Ridge Asset Limited Liability Company owns 24,326 shares or 0.01% of their US portfolio. Deutsche State Bank Ag stated it has 405,222 shares. Raymond James And stated it has 0% in MobileIron, Inc. (NASDAQ:MOBL). Rhumbline Advisers invested 0% in MobileIron, Inc. (NASDAQ:MOBL). Geode Mgmt Ltd Llc stated it has 881,132 shares or 0% of all its holdings. Metropolitan Life Ins New York holds 0% or 21,024 shares. Connor Clark Lunn Investment Limited holds 27,873 shares. The Ohio-based Pub Employees Retirement System Of Ohio has invested 0.01% in MobileIron, Inc. (NASDAQ:MOBL). Barclays Plc reported 7,088 shares or 0% of all its holdings.

More recent MobileIron, Inc. (NASDAQ:MOBL) news were published by: Businesswire.com which released: “MobileIron Earns Prestigious Certification for World-Class Customer Support for a Second Year – Business Wire” on March 12, 2019. Also Businesswire.com published the news titled: “MobileIron and NetMotion Partner to Enable Secure, Uninterrupted Access to Apps for the Mobile Enterprise – Business Wire” on March 05, 2019. Nasdaq.com‘s news article titled: “Here’s Why You Should Buy MobileIron (MOBL) Stock Right Now – Nasdaq” with publication date: December 27, 2018 was also an interesting one.

MobileIron, Inc. provides a purpose-built mobile IT platform that enables enterprises to secure and manage mobile applications, content, and devices while providing their employees with device choice, privacy, and a native user experience. The company has market cap of $605.52 million. The Company’s MobileIron platform offers enterprise mobility management solution that configures and delivers applications to smartphones, tablets, laptops, and desktops running operating systems, such as Android, iOS, macOS, and Windows 10; and secures data-at-rest and data-in-motion on modern endpoints and across the corporate network, as well as secures access to back-end corporate networks and cloud services. It currently has negative earnings. The firm serves financial service, government, healthcare, legal, manufacturing, professional service, retail, technology, and telecommunication industries in the United States and internationally.

A-R-T- Advisors Llc decreased Apple Hospitality Reit Inc stake by 42,100 shares to 16,200 valued at $231,000 in 2018Q4. It also reduced Tractor Supply Co (NASDAQ:TSCO) stake by 30,700 shares and now owns 22,900 shares. Amarin Corp Plc (NASDAQ:AMRN) was reduced too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.