M Holdings Securities Inc increased its stake in Johnson & Johnson Com (JNJ) by 20.56% based on its latest 2018Q4 regulatory filing with the SEC. M Holdings Securities Inc bought 4,246 shares as the company’s stock declined 5.44% while stock markets rallied. The institutional investor held 24,900 shares of the major pharmaceuticals company at the end of 2018Q4, valued at $3.21 million, up from 20,654 at the end of the previous reported quarter. M Holdings Securities Inc who had been investing in Johnson & Johnson Com for a number of months, seems to be bullish on the $366.32 billion market cap company. The stock decreased 1.01% or $1.41 during the last trading session, reaching $137.57. About 1.84M shares traded. Johnson & Johnson (NYSE:JNJ) has risen 8.80% since April 2, 2018 and is uptrending. It has outperformed by 4.43% the S&P500. Some Historical JNJ News: 09/05/2018 – @JayJints So incredibly kind JJ. Thanks very much; 26/04/2018 – J&J REPORTS DIV BOOST OF 7.1%; 12/04/2018 – Socrates Health Solutions, Developer of Socrates Companion™ Noninvasive Blood Glucose Self-Monitoring Device, Announces Expanded Role of John Maynard; 02/05/2018 – $JNJ acquires BeneVir for $140M upfront + $900M milestone $MRK acquires Viralytics for $394M Oncolytic virus back to be the hot thing in I/O again? More $AMGN T-Vec + PD1 combo data to come at #ASCO18; 15/05/2018 – Florida Lawsuit Targets Painkiller Makers Purdue Pharma, Endo Pharmaceuticals, Johnson & Johnson, Teva Pharmaceutical and Allergan; 17/04/2018 – JNJ: NO GENERIC COMPETITION EXEPCTED FOR ZYTIGA IN 2018; 11/04/2018 – Johnson & Johnson Required to Pay Damages of $80 Million in Lawsuit Involving Baby Powder; 17/04/2018 – Johnson & Johnson tops earnings, revenue expectations; 05/04/2018 – Former Acelity, J&J Executive Joins Organogenesis as Vice President of Global Medical & Clinical Affairs; 27/03/2018 – FDA: Johnson & Johnson Consumer, Inc.- Johnson & Johnson BAND-AID® Brand First Aid Products HURT-FREE® Wrap (size: 2in)

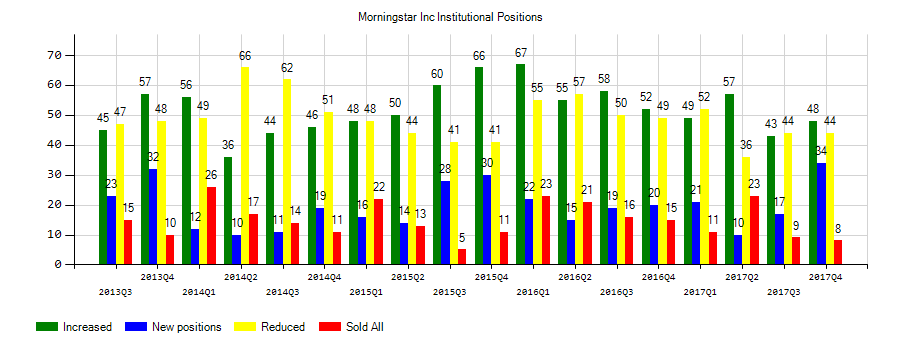

Golden Gate Private Equity Inc decreased its stake in Morningstar Inc. (MORN) by 5.11% based on its latest 2018Q4 regulatory filing with the SEC. Golden Gate Private Equity Inc sold 3,500 shares as the company’s stock rose 4.82% with the market. The institutional investor held 65,000 shares of the finance company at the end of 2018Q4, valued at $7.14 million, down from 68,500 at the end of the previous reported quarter. Golden Gate Private Equity Inc who had been investing in Morningstar Inc. for a number of months, seems to be less bullish one the $5.47B market cap company. The stock decreased 0.34% or $0.44 during the last trading session, reaching $128.45. About 14,974 shares traded. Morningstar, Inc. (NASDAQ:MORN) has risen 34.41% since April 2, 2018 and is uptrending. It has outperformed by 30.04% the S&P500. Some Historical MORN News: 09/05/2018 – COMMONWEALTH BANK OF AUSTRALIA CBA.AX : MORNINGSTAR CUTS FAIR VALUE ESTIMATE TO A$83 FROM A$85; RATING ACCUMULATE; 28/03/2018 – SKYCITY ENTERTAINMENT GROUP LTD SKC.AX : MORNINGSTAR RAISES FAIR VALUE ESTIMATE TO A$4.00 FROM A$3.90; RATING HOLD; 24/04/2018 – ORICA LTD ORI.AX : MORNINGSTAR RAISES FAIR VALUE ESTIMATE TO A$16.5 FROM A$15.0; RATING REDUCE; 15/04/2018 – Morningstar’s Mogarabi Says WPP CEO Should Come From Within (Video); 07/05/2018 – Morningstar Launches Morningstar Direct for Wealth Management, a Comprehensive Software Solution Enabling Collaboration Across; 15/05/2018 – AUTOMOTIVE HOLDINGS GROUP LTD AHG.AX : MORNINGSTAR CUTS FAIR VALUE ESTIMATE TO A$3.70 FROM A$4.00; RATING HOLD; 03/05/2018 – OZ MINERALS LTD OZL.AX : MORNINGSTAR RAISES FAIR VALUE ESTIMATE TO A$8.00 FROM A$7.80; RATING REDUCE; 12/04/2018 – Morningstar: GE Explores Hybrid Deals, Spinoffs in Strategic Review; 18/05/2018 – INFRATIL LTD IFT.NZ : MORNINGSTAR RAISES FAIR VALUE ESTIMATE TO NZ$3.1 FROM NZ$3.0; RATING HOLD; 03/04/2018 – Morningstar Credit Ratings Mall Monitor Finds 2012 Mall-Backed Loans Are Thriving but May Face lncoming Maturity Headwinds

Investors sentiment decreased to 1.06 in Q4 2018. Its down 0.26, from 1.32 in 2018Q3. It turned negative, as 15 investors sold MORN shares while 68 reduced holdings. 24 funds opened positions while 64 raised stakes. 17.23 million shares or 2.91% more from 16.74 million shares in 2018Q3 were reported. The Alabama-based Regions Financial Corporation has invested 0% in Morningstar, Inc. (NASDAQ:MORN). Black Creek Inv Mngmt Inc holds 11,000 shares. Envestnet Asset Mngmt holds 0% of its portfolio in Morningstar, Inc. (NASDAQ:MORN) for 13,161 shares. Voya Inv Mngmt Lc, Georgia-based fund reported 14,744 shares. Victory Capital Incorporated holds 0.01% or 36,116 shares in its portfolio. Cubist Systematic Strategies Limited Liability stated it has 0.03% in Morningstar, Inc. (NASDAQ:MORN). Ashford Cap accumulated 0.1% or 5,545 shares. Stone Ridge Asset Ltd Llc reported 0.09% of its portfolio in Morningstar, Inc. (NASDAQ:MORN). Renaissance Tech Ltd has invested 0.08% in Morningstar, Inc. (NASDAQ:MORN). Parametric Port Associates Llc reported 0.02% of its portfolio in Morningstar, Inc. (NASDAQ:MORN). Tiaa Cref Invest Management Ltd Liability Corp stated it has 0.01% of its portfolio in Morningstar, Inc. (NASDAQ:MORN). Ftb Advsrs, Tennessee-based fund reported 89 shares. Pub Employees Retirement Association Of Colorado holds 0% or 3,450 shares in its portfolio. Invesco Ltd stated it has 19,245 shares or 0% of all its holdings. M&T Bank & Trust Corp has 8,413 shares.

Since October 3, 2018, it had 1 buy, and 33 insider sales for $56.72 million activity. Lyons William M also sold $69,613 worth of Morningstar, Inc. (NASDAQ:MORN) on Monday, October 15. 2,000 Morningstar, Inc. (NASDAQ:MORN) shares with value of $259,500 were sold by Landis Gail S.

Golden Gate Private Equity Inc, which manages about $11.87B and $241.28 million US Long portfolio, upped its stake in First Data Corporation by 121,000 shares to 476,000 shares, valued at $8.05 million in 2018Q4, according to the filing. It also increased its holding in Verint Systems Inc. (NASDAQ:VRNT) by 37,000 shares in the quarter, for a total of 157,000 shares, and has risen its stake in Trinetgroup Inc. (NYSE:TNET).

More notable recent Morningstar, Inc. (NASDAQ:MORN) news were published by: Prnewswire.com which released: “Morningstar Assigns New Analyst Ratings to 18 Strategies, Including Four Collective Investment Trusts; Upgrades Five Strategies; and Downgrades 10 in February 2019 – PRNewswire” on March 13, 2019, also Nasdaq.com with their article: “Notable Two Hundred Day Moving Average Cross – MORN – Nasdaq” published on February 22, 2019, Gurufocus.com published: “Moats Matter: How to Identify Businesses With Competitive Advantages – GuruFocus.com” on March 25, 2019. More interesting news about Morningstar, Inc. (NASDAQ:MORN) were released by: Prnewswire.com and their article: “Morningstar Reports US Mutual Fund and ETF Fund Flows for February 2019 – PRNewswire” published on March 20, 2019 as well as Gurufocus.com‘s news article titled: “Moats Matter: Valuation – GuruFocus.com” with publication date: April 01, 2019.

Investors sentiment decreased to 0.86 in 2018 Q4. Its down 0.19, from 1.05 in 2018Q3. It dived, as 51 investors sold JNJ shares while 851 reduced holdings. 145 funds opened positions while 631 raised stakes. 1.79 billion shares or 5.17% more from 1.70 billion shares in 2018Q3 were reported. Court Place Advisors Limited Liability Corp has 17,291 shares for 1.02% of their portfolio. Aull Monroe Invest Mgmt Corporation invested 3.64% of its portfolio in Johnson & Johnson (NYSE:JNJ). Weatherstone Mngmt has invested 0.79% in Johnson & Johnson (NYSE:JNJ). 2,191 are owned by Greenwich Inv Mgmt. 4.65M are held by Amundi Pioneer Asset Mngmt. Suncoast Equity Management has invested 0.15% in Johnson & Johnson (NYSE:JNJ). Shayne Ltd Liability stated it has 1,800 shares or 0.17% of all its holdings. Eagleclaw Cap Managment Limited Liability Co reported 13,490 shares. Greylin Inv Mangement holds 111,349 shares. Tiverton Asset Mngmt Ltd Liability Com holds 152,788 shares. Koshinski Asset Management invested in 23,947 shares. East Coast Asset Mngmt Limited Com has invested 0.53% in Johnson & Johnson (NYSE:JNJ). Carnegie Capital Asset Ltd Liability holds 132,788 shares or 1.59% of its portfolio. Camarda Lc has 0.37% invested in Johnson & Johnson (NYSE:JNJ). Weatherly Asset Limited Partnership invested 1.58% in Johnson & Johnson (NYSE:JNJ).

M Holdings Securities Inc, which manages about $733.83 million and $322.33 million US Long portfolio, decreased its stake in General Electric Co Com (NYSE:GE) by 55,722 shares to 47,280 shares, valued at $358,000 in 2018Q4, according to the filing. It also reduced its holding in Honeywell Intl Inc Com (NYSE:HON) by 2,373 shares in the quarter, leaving it with 16,672 shares, and cut its stake in Ishares Tr U.S. Tech Etf (IYW).

More notable recent Johnson & Johnson (NYSE:JNJ) news were published by: which released: “Raymond James Expects Johnson & Johnson’s Growth To Accelerate Into 2020 (NYSE:JNJ) – Benzinga” on March 25, 2019, also Seekingalpha.com with their article: “Novartis sues J&J over “misleading” Tremfya data – Seeking Alpha” published on March 04, 2019, Fool.com published: “Better Buy: Verizon vs. Johnson & Johnson – The Motley Fool” on March 24, 2019. More interesting news about Johnson & Johnson (NYSE:JNJ) were released by: Seekingalpha.com and their article: “Johnson & Johnson: Brace For Impact – Seeking Alpha” published on March 08, 2019 as well as Seekingalpha.com‘s news article titled: “J&J prevails in NJ talc case – Seeking Alpha” with publication date: March 27, 2019.

Since November 7, 2018, it had 3 insider purchases, and 6 insider sales for $74.45 million activity. Another trade for 264,465 shares valued at $38.60M was sold by Gorsky Alex. MULCAHY ANNE M had bought 748 shares worth $100,050. 8,441 shares valued at $1.23 million were sold by Kapusta Ronald A on Thursday, November 8. $24.41M worth of stock was sold by Fasolo Peter on Monday, December 3. Another trade for 30,943 shares valued at $4.41M was made by Sneed Michael E on Friday, November 23. $268,731 worth of Johnson & Johnson (NYSE:JNJ) was bought by PRINCE CHARLES on Friday, December 14.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.