The stock of Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) is a huge mover today! The stock increased 3.44% or $0.105 during the last trading session, reaching $3.155. About 825,351 shares traded. Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) has declined 20.78% since April 2, 2018 and is downtrending. It has underperformed by 25.15% the S&P500. Some Historical ACHN News: 14/05/2018 – Great Point Partners Buys New 2.7% Position in Achillion; 15/05/2018 – Orbimed Advisors LLC Exits Position in Achillion; 02/05/2018 – Achillion Pharmaceuticals 1Q Loss/Shr 15c; 19/04/2018 – DJ Achillion Pharmaceuticals Inc, Inst Holders, 1Q 2018 (ACHN); 10/04/2018 Achillion at Deutsche Bank Health Care Conference May 8; 02/05/2018 – ACHILLION 1Q LOSS/SHR 15C, EST. LOSS/SHR 14C; 02/05/2018 – Achillion Pharmaceuticals Appoints Joseph Truitt CEO; 11/05/2018 – Achillion Announces Upcoming Scientific Presentations at the 55th ERA-EDTA Congress; 07/05/2018 – Achillion at Deutsche Bank Health Care Conference Tomorrow; 02/05/2018 – ACHILLION 1Q CASH & CASH EQUIVALENTS $308.4MThe move comes after 6 months positive chart setup for the $437.65M company. It was reported on Apr, 2 by . We have $3.41 PT which if reached, will make NASDAQ:ACHN worth $35.01M more.

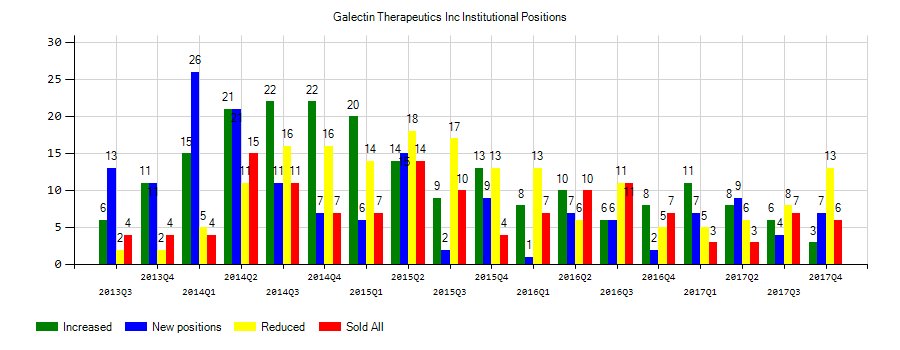

Galectin Therapeutics Inc (GALT) investors sentiment decreased to 1.06 in Q4 2018. It’s down -0.23, from 1.29 in 2018Q3. The ratio dropped, as 19 funds increased and opened new stock positions, while 18 cut down and sold their holdings in Galectin Therapeutics Inc. The funds in our database now hold: 4.77 million shares, down from 5.15 million shares in 2018Q3. Also, the number of funds holding Galectin Therapeutics Inc in top ten stock positions was flat from 0 to 0 for the same number . Sold All: 8 Reduced: 10 Increased: 9 New Position: 10.

Investors sentiment decreased to 0.9 in 2018 Q4. Its down 0.42, from 1.32 in 2018Q3. It fall, as 17 investors sold Achillion Pharmaceuticals, Inc. shares while 34 reduced holdings. 15 funds opened positions while 31 raised stakes. 98.38 million shares or 1.80% less from 100.18 million shares in 2018Q3 were reported. Daiwa Securities Group Inc invested in 762 shares or 0% of the stock. Bluemountain Mngmt Limited Liability reported 0.01% in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). Point72 Asset Mgmt L P stated it has 0% in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). 256,529 were reported by Tiaa Cref Investment Mgmt Ltd Limited Liability Company. Bourgeon Ltd Liability Corp has invested 0.03% of its portfolio in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). South Dakota Council reported 1.19M shares. Qs Investors Limited Liability Company reported 449,303 shares or 0.01% of all its holdings. Teton Advisors owns 10,000 shares. Dekabank Deutsche Girozentrale has invested 0% in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). Ubs Asset Management Americas Inc reported 0% of its portfolio in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). Ameriprise Financial holds 59,210 shares. Vanguard Gp reported 8.62 million shares. 248,279 are held by Credit Suisse Ag. Geode Capital Management Ltd Com owns 1.55M shares or 0% of their US portfolio. Jacobs Levy Equity Mgmt Inc has 267,613 shares for 0.01% of their portfolio.

More notable recent Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) news were published by: Globenewswire.com which released: “Achillion Reports Fourth Quarter and Full Year 2018 Financial Results – GlobeNewswire” on March 07, 2019, also Globenewswire.com with their article: “Achillion to Present at the Barclays Global Healthcare Conference – GlobeNewswire” published on March 08, 2019, Seekingalpha.com published: “Achillion completes enrollment in phase 2 PNH combination trial – Seeking Alpha” on March 27, 2019. More interesting news about Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) were released by: Nasdaq.com and their article: “Achillion Completes Enrollment in Rare Blood Disorder Study – Nasdaq” published on March 28, 2019 as well as Nasdaq.com‘s news article titled: “After Hours Most Active for Mar 28, 2019 : COTY, NLY, V, KEY, XOG, MKC, QCOM, KMI, CMRX, ACHN, AABA, NYMT – Nasdaq” with publication date: March 28, 2019.

Achillion Pharmaceuticals, Inc., a biopharmaceutical company, discovers, develops, and commercializes small molecule drug therapies for infectious diseases and immune system disorders in the United States and internationally. The company has market cap of $437.65 million. The Company’s drug candidates for treating chronic hepatitis C virus infection comprise Odalasvir, a NS5A inhibitor, which has completed Phase IIa clinical trials; ACH-3422, a NS5B nucleotide polymerase inhibitor; and Sovaprevir, a NS3 protease inhibitor that has completed Phase II clinical trial. It currently has negative earnings. The firm is also developing ACH-4471, a complement factor D inhibitor, which is in Phase I clinical trial to treat patients with paroxysmal nocturnal hemoglobinuria and C3G, a disease resulting from alternative pathway over-activation; and other factor D inhibitors.

Benchmark Capital Advisors holds 0.76% of its portfolio in Galectin Therapeutics, Inc. for 222,700 shares. Cutter & Co Brokerage Inc. owns 57,800 shares or 0.08% of their US portfolio. Moreover, D.A. Davidson & Co. has 0.05% invested in the company for 718,923 shares. The New York-based Alpine Global Management Llc has invested 0.02% in the stock. Boothbay Fund Management Llc, a New York-based fund reported 30,562 shares.

Since January 1, 0001, it had 4 insider purchases, and 1 sale for $116,276 activity.

Galectin Therapeutics, Inc., a clinical stage biopharmaceutical company, engages in the research and development of therapies for fibrotic disease and cancer. The company has market cap of $231.40 million. The companyÂ’s lead product candidate includes galectin-3 inhibitor , a galactoarabino-rhamnogalacturonan polysaccharide polymer for the treatment of liver fibrosis and liver cirrhosis in non-alcoholic steatohepatitis patients, as well as for the treatment of cancer. It currently has negative earnings. It also engages in developing GM-CT-01, which is in pre-clinical development state for the treatment of cardiac and vascular fibrosis, as well as focuses on developing GR-MD-02 for the treatment of psoriasis.

Analysts await Galectin Therapeutics, Inc. (NASDAQ:GALT) to report earnings on April, 4. They expect $-0.08 EPS, down 14.29% or $0.01 from last year’s $-0.07 per share. After $-0.07 actual EPS reported by Galectin Therapeutics, Inc. for the previous quarter, Wall Street now forecasts 14.29% negative EPS growth.

More notable recent Galectin Therapeutics, Inc. (NASDAQ:GALT) news were published by: Nasdaq.com which released: “Galectin Therapeutics to Present at the 2019 HC Wainwright Global Life Sciences Conference – Nasdaq” on April 02, 2019, also Seekingalpha.com with their article: “Galectin files for subscription rights offering – Seeking Alpha” published on March 20, 2019, Seekingalpha.com published: “Galectin In NASH, And The Market Assessment – Seeking Alpha” on March 15, 2019. More interesting news about Galectin Therapeutics, Inc. (NASDAQ:GALT) were released by: Globenewswire.com and their article: “Galectin Therapeutics Releases Richard E. Uihlein’s Open Letter to Stockholders – GlobeNewswire” published on March 06, 2019 as well as Nasdaq.com‘s news article titled: “Providence Cancer Institute to Present Findings on GR-MD-02 at the 2019 Keystone Symposia on Molecular and Cellular Biology – Nasdaq” with publication date: March 22, 2019.

The stock increased 1.60% or $0.08 during the last trading session, reaching $5.08. About 144,361 shares traded. Galectin Therapeutics, Inc. (GALT) has risen 31.58% since April 2, 2018 and is uptrending. It has outperformed by 27.21% the S&P500. Some Historical GALT News: 14/05/2018 – GALECTIN THERAPEUTICS TO STUDY GR-MD-02 FOR NASH CIRRHOSIS; 16/04/2018 – GALT: GR-MD-02 SHOWED STAT SIG IMPROVEMENT IN PORTAL PRESSURE; 29/03/2018 – Galectin Therapeutics Reports 2017 Financial Results and Provides Business Update; 16/04/2018 – Galectin Therapeutics Late-Breaker Presentation at The International Liver Congress Reinforces and Extends the Positive Effects of GR-MD-02 in Patients With NASH Cirrhosis; 14/05/2018 – GALECTIN THERAPEUTICS – FDA HAS NOT GRANTED BREAKTHROUGH DESIGNATION FOR PATIENTS WITH NASH CIRRHOSIS; 12/04/2018 – Galectin Therapeutics Closes Below 50-Day Average: Technicals; 02/04/2018 – Galectin Therapeutics Presenting at Conference Apr 9; 14/05/2018 – GALECTIN THERAPEUTICS INC – “DISAGREE WITH FDA’S DECISION NOT TO GRANT BREAKTHROUGH THERAPY DESIGNATION AT THIS TIME”; 11/05/2018 – GALECTIN THERAPEUTICS – HAS ENOUGH CASH TO FUND CURRENTLY PLANNED OPERATIONS, RESEARCH & DEVELOPMENT ACTIVITIES THROUGH AT LEAST MARCH 31, 2019; 14/05/2018 – GALECTIN THERAPEUTICS INC – TARGET POPULATION OF PHASE 3 CLINICAL TRIAL WILL BE PATIENTS WITH NASH CIRRHOSIS WITHOUT ESOPHAGEAL VARICES

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.