Analysts expect DMC Global Inc. (NASDAQ:BOOM) to report $0.47 EPS on April, 25.They anticipate $0.02 EPS change or 4.08% from last quarter’s $0.49 EPS. BOOM’s profit would be $7.00M giving it 26.07 P/E if the $0.47 EPS is correct. After having $0.46 EPS previously, DMC Global Inc.’s analysts see 2.17% EPS growth. The stock increased 3.42% or $1.62 during the last trading session, reaching $49.01. About 89,486 shares traded. DMC Global Inc. (NASDAQ:BOOM) has risen 114.85% since March 28, 2018 and is uptrending. It has outperformed by 110.48% the S&P500. Some Historical BOOM News: 26/04/2018 – DMC GLOBAL INC BOOM.O SEES FY SALES $290 MLN TO $305 MLN; 05/03/2018 DMC Global Chairman Gerard Munera to Retire; Independent Director David Aldous to Assume Role of Chairman; 26/04/2018 – DMC Global 1Q Adj EPS 49c; 15/03/2018 – DMC Global Declares Quarterly Cash Dividend; 26/04/2018 – DMC Global Sees FY18 Sales $290M-$305M; 26/04/2018 – DMC GLOBAL INC BOOM.O SEES FY 2018 SHR $1.60 TO $1.70; 08/03/2018 – DMC GLOBAL INC – KUTA SAID TOTAL DEBT IS ANTICIPATED TO PEAK AT APPROXIMATELY $40 MLN DURING 2018; 05/03/2018 – DMC Global: Independent Director David Aldous to Assume Role of Chmn; 20/04/2018 – DJ DMC Global Inc, Inst Holders, 1Q 2018 (BOOM); 08/03/2018 – DMC GLOBAL INC – CAPITAL EXPENDITURES IN 2018 ARE EXPECTED TO TOTAL APPROXIMATELY $30 MLN

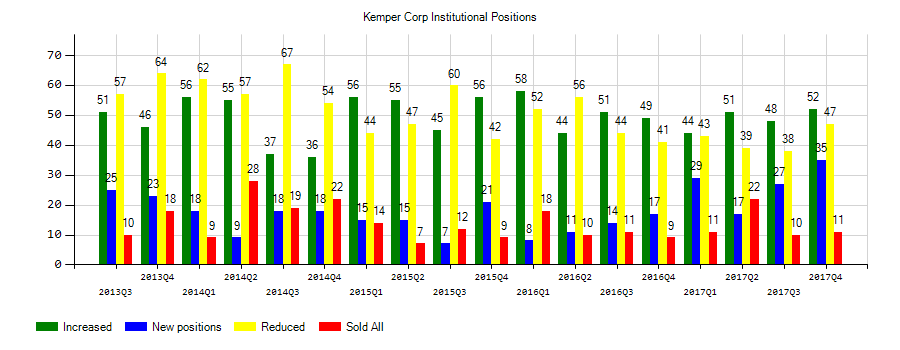

Kemper Corp (KMPR) investors sentiment decreased to 0.99 in 2018 Q4. It’s down -2.31, from 3.3 in 2018Q3. The ratio worsened, as 94 active investment managers increased and started new stock positions, while 95 decreased and sold equity positions in Kemper Corp. The active investment managers in our database now possess: 42.67 million shares, down from 80.92 million shares in 2018Q3. Also, the number of active investment managers holding Kemper Corp in top ten stock positions was flat from 1 to 1 for the same number . Sold All: 28 Reduced: 67 Increased: 58 New Position: 36.

Central Securities Corp holds 2.44% of its portfolio in Kemper Corporation for 200,000 shares. Channing Capital Management Llc owns 584,096 shares or 1.94% of their US portfolio. Moreover, Nicholas Investment Partners Lp has 1.78% invested in the company for 248,742 shares. The Illinois-based Skyline Asset Management Lp has invested 1.52% in the stock. Thompson Rubinstein Investment Management Inc Or, a Oregon-based fund reported 49,877 shares.

The stock decreased 1.54% or $1.2 during the last trading session, reaching $76.79. About 118,958 shares traded. Kemper Corporation (KMPR) has risen 47.23% since March 28, 2018 and is uptrending. It has outperformed by 42.86% the S&P500. Some Historical KMPR News: 14/03/2018 – Kemper Executives to Speak at the 22nd Annual CFA Society of New York Insurance Industry Conference; 13/03/2018 – Kemper Corp: Transaction Is Expected to Close in the 3Q; 30/04/2018 – Kemper Corp 1Q EPS $1.02; 02/05/2018 – Kemper Announces Quarterly Dividend; 13/03/2018 – KEMPER CORP – THE NOTICE IS WITH RESPECT TO PENDING TRANSACTION BETWEEN PARTIES ANNOUNCED ON FEBRUARY 13, 2018; 22/03/2018 – FITCH AFFIRMS KEMPER CORPORATION’S RATINGS; OUTLOOK STABLE; 30/04/2018 – KEMPER 1Q NET INVESTMENT INCOME $79.2M; 13/03/2018 – FTC: 20180848: Kemper Corporation; Infinity Property and Casualty Corporation; 13/03/2018 Kemper Announces Early Termination of HSR Waiting Period; 30/04/2018 – Kemper Corp 1Q Adj EPS $1.10

Analysts await Kemper Corporation (NYSE:KMPR) to report earnings on April, 29. They expect $1.37 earnings per share, up 24.55% or $0.27 from last year’s $1.1 per share. KMPR’s profit will be $88.95 million for 14.01 P/E if the $1.37 EPS becomes a reality. After $0.91 actual earnings per share reported by Kemper Corporation for the previous quarter, Wall Street now forecasts 50.55% EPS growth.

Kemper Corporation, a diversified insurance holding company, provides property and casualty, and life and health insurance to individuals and businesses in the United States. The company has market cap of $4.99 billion. The companys Property & Casualty Insurance segment provides automobile, homeowners, renters, fire, umbrella, and other types of property and casualty insurance to individuals; and commercial automobile insurance to businesses. It has a 23.86 P/E ratio. This segment distributes its products through independent agents and brokers.

More notable recent Kemper Corporation (NYSE:KMPR) news were published by: Globenewswire.com which released: “Capitala Group Announces Formation of Capitala Senior Loan Fund II, LLC – GlobeNewswire” on February 27, 2019, also Seekingalpha.com with their article: “Kemper Corporation 2018 Q4 – Results – Earnings Call Slides – Seeking Alpha” published on February 11, 2019, Seekingalpha.com published: “Kemper’s Self-Improvement Plan Is Generating Strong Results – Seeking Alpha” on August 15, 2018. More interesting news about Kemper Corporation (NYSE:KMPR) were released by: Seekingalpha.com and their article: “Kemper Corporation (KMPR) CEO Joe Lacher on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” published on February 11, 2019 as well as Seekingalpha.com‘s news article titled: “Kemper Corporation (KMPR) CEO Joe Lacher on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” with publication date: November 05, 2018.

Among 3 analysts covering DMC Global Inc (NASDAQ:BOOM), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. DMC Global Inc had 4 analyst reports since February 22, 2019 according to SRatingsIntel. Sidoti maintained the shares of BOOM in report on Friday, February 22 with “Buy” rating. On Friday, March 22 the stock rating was maintained by Roth Capital with “Buy”. The firm has “Buy” rating given on Friday, February 22 by Stifel Nicolaus.

More notable recent DMC Global Inc. (NASDAQ:BOOM) news were published by: Nasdaq.com which released: “DMC Global Issues Letter to Stockholders From CEO Kevin Longe – Nasdaq” on March 26, 2019, also Nasdaq.com with their article: “Here is Why Growth Investors Should Buy DMC Global (BOOM) Now – Nasdaq” published on March 19, 2019, Nasdaq.com published: “Apogee (APOG) Up 23% YTD After 35% Drop in 2018: What’s Next? – Nasdaq” on March 28, 2019. More interesting news about DMC Global Inc. (NASDAQ:BOOM) were released by: Globenewswire.com and their article: “Recent Analysis Shows Stitch Fix, Athene Holding, Leggett & Platt, Open Text, Artisan Partners Asset Management, and DMC Global Market Influences — Renewed Outlook, Key Drivers of Growth – GlobeNewswire” published on March 28, 2019 as well as Nasdaq.com‘s news article titled: “4 Stocks to Gain from Online Apparel Rental Market Boom – Nasdaq” with publication date: March 01, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.