Chemours (NYSE:CC) was lowered by BidaskScore to a Buy rating in a an analyst note sent to investors on Wednesday morning.

PAO GROUP INC (OTCMKTS:PAOG) had an increase of 672.73% in short interest. PAOG’s SI was 8,500 shares in March as released by FINRA. Its up 672.73% from 1,100 shares previously. The stock increased 7.69% or $0.0003 during the last trading session, reaching $0.0042. About 80,339 shares traded. PAO Group, Inc. (OTCMKTS:PAOG) has 0.00% since March 27, 2018 and is . It has underperformed by 4.37% the S&P500.

The stock decreased 0.40% or $0.14 during the last trading session, reaching $35.28. About 552,697 shares traded. The Chemours Company (NYSE:CC) has declined 21.88% since March 27, 2018 and is downtrending. It has underperformed by 26.25% the S&P500. Some Historical CC News: 26/03/2018 – CHEMOURS CO – NOW EXPECTS EARNINGS TO BE IN TOP END OF ITS PREVIOUSLY ANNOUNCED RANGE; 04/05/2018 – CHEMOURS SEES OPTEON REFRIGERANT SALES RISING 20% IN 2018; 26/03/2018 – CHEMOURS CO – CURRENTLY EVALUATING IMPACT OF MORE FAVORABLE CONDITIONS TO LONGER-TERM TARGETS; 08/05/2018 – CHEMOURS CO CC.N : CITIGROUP RAISES TARGET PRICE TO $69 FROM $66; 03/04/2018 – Chemours Credit Pact Includes Term Loans of $900M and EUR350M and $800M Revolving Credit Facility; 26/03/2018 – The Chemours Co Updates 2018 Outlook; 26/03/2018 – CHEMOURS CO. SEES 2018 ADJ EBITDA AT HIGH END OF PRIOR VIEW; 07/05/2018 – CHEMOURS REPORTS SODIUM CYANIDE PRICE BOOST OF 15$; 03/04/2018 – CHEMOURS – NEW TERM LOAN FACILITY PROVIDES FOR $900 MLN AND EUR350 MLN; 29/03/2018 – Chemours Announces Fluoropolymer Price Increase

Analysts await The Chemours Company (NYSE:CC) to report earnings on May, 2. They expect $1.06 earnings per share, down 24.82% or $0.35 from last year’s $1.41 per share. CC’s profit will be $176.25M for 8.32 P/E if the $1.06 EPS becomes a reality. After $1.05 actual earnings per share reported by The Chemours Company for the previous quarter, Wall Street now forecasts 0.95% EPS growth.

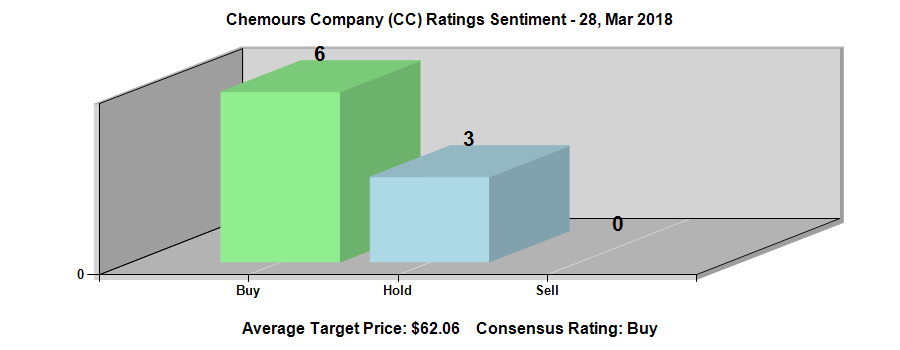

Among 6 analysts covering Chemours (NYSE:CC), 4 have Buy rating, 0 Sell and 2 Hold. Therefore 67% are positive. Chemours has $58 highest and $37 lowest target. $46.17’s average target is 30.87% above currents $35.28 stock price. Chemours had 9 analyst reports since October 11, 2018 according to SRatingsIntel. The firm has “Buy” rating given on Thursday, March 21 by Jefferies. The company was maintained on Friday, February 22 by RBC Capital Markets. The firm has “Hold” rating given on Tuesday, February 19 by SunTrust. The stock of The Chemours Company (NYSE:CC) earned “Buy” rating by Citigroup on Wednesday, February 20. Citigroup downgraded The Chemours Company (NYSE:CC) rating on Friday, November 2. Citigroup has “Neutral” rating and $38 target. The rating was maintained by BMO Capital Markets with “Outperform” on Monday, November 5. On Thursday, October 11 the stock rating was maintained by Citigroup with “Buy”. The firm earned “Hold” rating on Wednesday, February 20 by UBS.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.