INSURANCE AUSTRALIA GROUP LTD ORDINARY S (OTCMKTS:IAUGF) had a decrease of 2.6% in short interest. IAUGF’s SI was 67,500 shares in March as released by FINRA. Its down 2.6% from 69,300 shares previously. With 100 avg volume, 675 days are for INSURANCE AUSTRALIA GROUP LTD ORDINARY S (OTCMKTS:IAUGF)’s short sellers to cover IAUGF’s short positions. It closed at $5.4 lastly. It is up 0.00% since March 26, 2018 and is . It has underperformed by 4.37% the S&P500.

The stock of TC PipeLines, LP (NYSE:TCP) hit a new 52-week high and has $38.47 target or 3.00% above today’s $37.35 share price. The 5 months bullish chart indicates low risk for the $2.66B company. The 1-year high was reported on Mar, 26 by . If the $38.47 price target is reached, the company will be worth $79.89M more. The stock increased 0.76% or $0.28 during the last trading session, reaching $37.35. About 31,344 shares traded. TC PipeLines, LP (NYSE:TCP) has declined 33.75% since March 26, 2018 and is downtrending. It has underperformed by 38.12% the S&P500. Some Historical TCP News: 19/04/2018 – DJ TC PipeLines LP, Inst Holders, 1Q 2018 (TCP); 17/05/2018 – TC PipeLines, LP to Attend 2018 MLP & Energy Infrastructure Conference; 02/05/2018 – TC PIPELINES 1Q EPS $1.32, EST. $1.07; 27/04/2018 – TC PIPELINES ACKNOWLEDGES STATEMENTS BY SPONSOR ON FERC IMPACT; 19/03/2018 – TC PIPELINES DOESN’T SEE MATREIAL FINANCIAL EFFECT; 27/04/2018 – TC PipeLines, LP Acknowledges Statements By Sponsor Regarding the Impact of 2018 FERC Actions; 02/05/2018 – TC PIPELINES CUTS QUARTER DISTRIBUTION TO 65C/SHR FROM $1; 15/03/2018 TC PipeLines Debt Risk Rises 3 Levels in Bloomberg Model; 02/05/2018 – TC PipeLines: Doesn’t Anticipate Further Asset Dropdowns to Partnership at This Time; 02/04/2018 – TransCanada Places Final Section of 2017 NGTL Expansion Program into Service

Insurance Australia Group Limited underwrites general insurance products. The company has market cap of $12.56 billion. The firm operates through Consumer Division , Business Division (Australia), New Zealand, Asia, and Corporate and Other divisions. It has a 18.62 P/E ratio. It offers consumer insurance products, such as motor vehicle, home and contents, lifestyle and leisure, and compulsory third party, as well as travel insurance, life insurance, and income protection products; business insurance products, including business package, farm and crop, commercial property, construction and engineering, commercial and fleet motor, marine, workers' compensation, professional indemnity, directors' and officers', and public and products liability, as well as consumer credit, pleasure craft, boat, caravan, and travel insurance products.

Another recent and important Insurance Australia Group Limited (OTCMKTS:IAUGF) news was published by Seekingalpha.com which published an article titled: “IAG Ups Multi-Year Cover In $7bn 2017 Catastrophe Reinsurance Renewal – Seeking Alpha” on January 05, 2017.

More notable recent TC PipeLines, LP (NYSE:TCP) news were published by: Fool.com which released: “5 High-Yield Dividend Stocks to Watch – The Motley Fool” on March 17, 2019, also Seekingalpha.com with their article: “TC PipeLines: Takeover Candidate At 0% Premium – Seeking Alpha” published on December 20, 2018, Globenewswire.com published: “TC PipeLines, LP Announces Third Quarter 2018 Cash Distribution – GlobeNewswire” on October 23, 2018. More interesting news about TC PipeLines, LP (NYSE:TCP) were released by: Globenewswire.com and their article: “TC PipeLines, LP Announces 2018 Third Quarter Financial Results – GlobeNewswire” published on November 09, 2018 as well as Globenewswire.com‘s news article titled: “TC PipeLines, LP to Release 2018 Fourth Quarter and Year End Financial Results on February 21 – GlobeNewswire” with publication date: January 31, 2019.

Analysts await TC PipeLines, LP (NYSE:TCP) to report earnings on May, 1. They expect $1.05 earnings per share, down 20.45% or $0.27 from last year’s $1.32 per share. TCP’s profit will be $74.86M for 8.89 P/E if the $1.05 EPS becomes a reality. After $1.06 actual earnings per share reported by TC PipeLines, LP for the previous quarter, Wall Street now forecasts -0.94% negative EPS growth.

Among 6 analysts covering TC Pipelines (NYSE:TCP), 0 have Buy rating, 4 Sell and 2 Hold. Therefore 0 are positive. TC Pipelines had 9 analyst reports since October 9, 2018 according to SRatingsIntel. JP Morgan downgraded it to “Underweight” rating and $35 target in Friday, February 1 report. The rating was maintained by Barclays Capital with “Sell” on Thursday, February 21. J.P. Morgan maintained the shares of TCP in report on Monday, March 18 with “Sell” rating. The rating was maintained by JP Morgan on Monday, March 18 with “Underweight”. The stock of TC PipeLines, LP (NYSE:TCP) earned “Hold” rating by UBS on Friday, February 22. The company was maintained on Friday, February 22 by RBC Capital Markets.

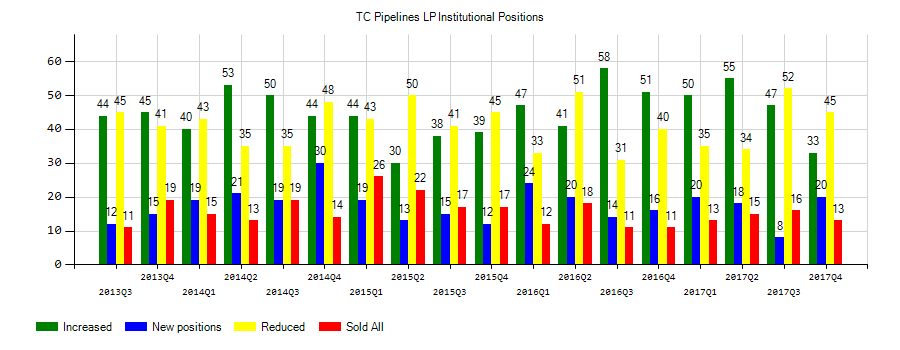

Investors sentiment decreased to 0.73 in 2018 Q4. Its down 0.09, from 0.82 in 2018Q3. It fall, as 15 investors sold TC PipeLines, LP shares while 37 reduced holdings. 14 funds opened positions while 24 raised stakes. 42.28 million shares or 0.86% less from 42.64 million shares in 2018Q3 were reported. Neuberger Berman Group Limited Com invested 0% of its portfolio in TC PipeLines, LP (NYSE:TCP). Kayne Anderson Cap Advisors Limited Partnership holds 457,557 shares or 0.23% of its portfolio. Fort Washington Investment Advisors Incorporated Oh reported 29,201 shares. Argyll Ltd Co holds 16.14% in TC PipeLines, LP (NYSE:TCP) or 1.59M shares. Janney Montgomery Scott Limited Liability Corporation, a Pennsylvania-based fund reported 9,237 shares. Blackhill Capital has 95,400 shares. Qs Investors Limited Co owns 0.02% invested in TC PipeLines, LP (NYSE:TCP) for 37,784 shares. Royal Bancorp Of Canada reported 19,317 shares. Cypress Cap Management Ltd Liability (Wy) reported 1,000 shares. Moreover, Endurance Wealth has 0% invested in TC PipeLines, LP (NYSE:TCP) for 125 shares. 133,260 were reported by Texas Yale. California Public Employees Retirement Sys accumulated 0% or 73,329 shares. Barclays Public Ltd Com invested in 0.01% or 209,316 shares. Goldman Sachs Gru holds 0.01% of its portfolio in TC PipeLines, LP (NYSE:TCP) for 1.19M shares. New York-based Clearbridge Invests has invested 0.06% in TC PipeLines, LP (NYSE:TCP).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.