Tpg Group Holdings Sbs Advisors Inc increased Air Prods & Chems Inc. (APD) stake by 14.59% reported in 2018Q4 SEC filing. Tpg Group Holdings Sbs Advisors Inc acquired 94,904 shares as Air Prods & Chems Inc. (APD)’s stock rose 13.89%. The Tpg Group Holdings Sbs Advisors Inc holds 745,506 shares with $119.32M value, up from 650,602 last quarter. Air Prods & Chems Inc. now has $40.56 billion valuation. The stock decreased 0.14% or $0.25 during the last trading session, reaching $184.65. About 944,850 shares traded. Air Products and Chemicals, Inc. (NYSE:APD) has risen 12.35% since March 21, 2018 and is uptrending. It has outperformed by 7.98% the S&P500. Some Historical APD News: 26/04/2018 – Air Products & Chemicals Sees 3Q Adj EPS $1.80-Adj EPS $1.85; 29/03/2018 – Air Products’ Industrial Gases Executive Vice President Corning Painter Provides Thought Leadership on Coal Gasification at China Petroleum and Chemical Industry Federation Dialogue in Beíjing; 24/04/2018 – AIRBUS CEO: NEXT FIGHTER PLATFORM WILL BE RANGE OF AIR-PRODUCTS; 02/04/2018 – Air Products’ Texas Plant Onstream Adds Hydrogen Supply to Gulf Coast Pipeline Network; 26/04/2018 – AIR PRODUCTS SAYS LU’AN TO ADD 25C TO FY 2019 EPS; 08/03/2018 – Linde, Praxair expect bids for planned divestitures this month; 02/05/2018 – Air Products Will Host MidAtlantic Rubber and Plastics Group’s Spring Technical Meeting; 14/05/2018 – Air Products Presenting at Goldman Sachs Conference Tomorrow; 02/04/2018 – AIR PRODUCTS SAYS INCREASED SUPPLY CAPACITY OF ITS GULF COAST HYDROGEN PIPELINE SUPPLY NETWORK BY APPROXIMATELY 40 MLN STANDARD CUBIC FEET PER DAY; 07/03/2018 Air Products’ CEO to Speak at J.P. Morgan Aviation, Transportation and Industrials Conference on March 14

Analysts expect Lindsay Corporation (NYSE:LNN) to report $0.62 EPS on April, 4.They anticipate $0.06 EPS change or 10.71% from last quarter’s $0.56 EPS. LNN’s profit would be $6.69M giving it 39.56 P/E if the $0.62 EPS is correct. After having $0.38 EPS previously, Lindsay Corporation’s analysts see 63.16% EPS growth. The stock increased 0.13% or $0.13 during the last trading session, reaching $98.1. About 154,183 shares traded or 65.22% up from the average. Lindsay Corporation (NYSE:LNN) has risen 6.44% since March 21, 2018 and is uptrending. It has outperformed by 2.07% the S&P500. Some Historical LNN News: 29/03/2018 – LINDSAY 2Q EPS 16C; 21/04/2018 – DJ Lindsay Corporation, Inst Holders, 1Q 2018 (LNN); 18/04/2018 – Lindsay Forms Golden Cross: Technicals; 09/04/2018 – Gabelli & Company’s 12th Annual Omaha Research Trip; 09/04/2018 – Lindsay at Non-Deal Roadshow Hosted By Seaport Today; 16/03/2018 – DEEP ECO: Lindsay May Benefit, Industry Posts 5th Straight Gain; 29/03/2018 – LINDSAY 2Q OPER REV. $130.3M, EST. $131.8M; 22/03/2018 – Lindsay Closes Below 200-Day Moving Average: Technicals; 29/03/2018 – LINDSAY CORP – BACKLOG OF UNSHIPPED ORDERS AT FEBRUARY 28, 2018 WAS $90.2 MLN, COMPARED WITH $62.3 MLN AT FEBRUARY 28, 2017; 04/05/2018 – Lindsay Corporation Announces Quarterly Cash Dividend

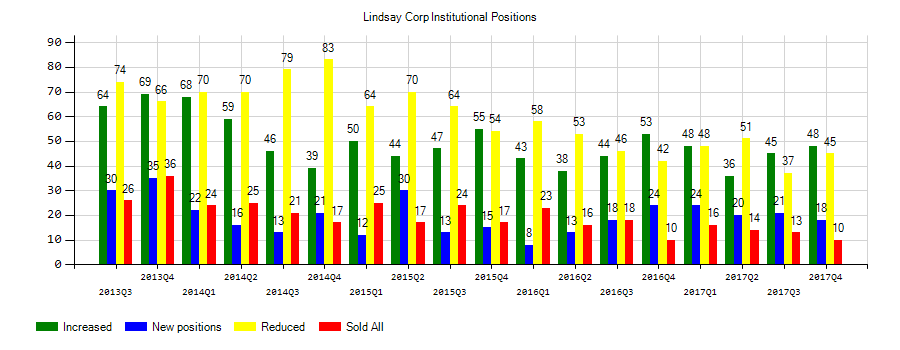

Investors sentiment decreased to 0.97 in Q4 2018. Its down 0.22, from 1.19 in 2018Q3. It worsened, as 11 investors sold Lindsay Corporation shares while 49 reduced holdings. 16 funds opened positions while 42 raised stakes. 9.43 million shares or 0.60% less from 9.48 million shares in 2018Q3 were reported. Nelson Van Denburg & Campbell Wealth Mngmt Grp Limited Liability accumulated 93 shares. Suffolk Management Ltd Liability Co reported 2,679 shares. First Interstate Bank & Trust reported 173 shares. Prudential has 17,681 shares. Guggenheim Cap Ltd invested in 2,928 shares. Texas Permanent School Fund reported 7,039 shares or 0.01% of all its holdings. Sg Americas Securities Ltd Com accumulated 2,015 shares or 0% of the stock. Bluemountain Mgmt Ltd Limited Liability Company holds 0.01% of its portfolio in Lindsay Corporation (NYSE:LNN) for 4,044 shares. Royal Bancorp Of Canada reported 0% in Lindsay Corporation (NYSE:LNN). King Luther Capital Corporation owns 65,985 shares or 0.06% of their US portfolio. Nuance Invs Limited holds 9,512 shares or 0.06% of its portfolio. Price T Rowe Md accumulated 5,445 shares. Manchester Cap Lc holds 9,440 shares. Covington Cap Mngmt holds 0% or 110 shares in its portfolio. Vanguard Gru holds 1.18M shares or 0.01% of its portfolio.

Lindsay Corporation, together with its subsidiaries, provides water management and road infrastructure services and products in the United States and internationally. The company has market cap of $1.06 billion. The companyÂ’s Irrigation segment makes and markets center pivot, lateral move irrigation systems, and irrigation controls under the Zimmatic brand; hose reel travelers under the Perrot and Greenfield brands; and chemical injection systems, variable rate irrigation systems, flow meters, weather stations, soil moisture sensors, and remote monitoring and control systems under the GrowSmart brand. It has a 58.08 P/E ratio. This segment also offers repair and replacement parts for irrigation systems and controls; water pumping stations and controls for agriculture, golf, landscape, and municipal markets under the Watertronics brand; filtration solutions for groundwater, agriculture, industrial, and heat transfer markets under the LAKOS brand; and M2M communication technology solutions, data acquisition and management systems, and custom electronic equipment under the Elecsys brand.

Among 2 analysts covering Lindsay (NYSE:LNN), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Lindsay had 4 analyst reports since October 8, 2018 according to SRatingsIntel. The stock of Lindsay Corporation (NYSE:LNN) has “Hold” rating given on Monday, October 8 by Stifel Nicolaus. Boenning & Scattergood maintained Lindsay Corporation (NYSE:LNN) on Thursday, February 28 with “Buy” rating.

More notable recent Lindsay Corporation (NYSE:LNN) news were published by: Globenewswire.com which released: “Detailed Research: Economic Perspectives on Zosano Pharma, Appian, Ross Stores, Alleghany, ZAGG, and Lindsay — What Drives Growth in Today’s Competitive Landscape – GlobeNewswire” on February 25, 2019, also Businesswire.com with their article: “Lindsay Corporation to Present at Upcoming Investor Conferences – Business Wire” published on February 25, 2019, Seekingalpha.com published: “Lindsay Corporation: Low International Irrigation Revenues Concerning – Seeking Alpha” on December 18, 2018. More interesting news about Lindsay Corporation (NYSE:LNN) were released by: Seekingalpha.com and their article: “Stocks To Watch: CES Headlines Action-Packed Week – Seeking Alpha” published on January 05, 2019 as well as Seekingalpha.com‘s news article titled: “Lindsay Corporation: A Free Cash Flow Desert – Seeking Alpha” with publication date: August 07, 2018.

Among 3 analysts covering Air Products \u0026 Chemicals (NYSE:APD), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Air Products \u0026 Chemicals had 3 analyst reports since September 24, 2018 according to SRatingsIntel. The firm earned “Outperform” rating on Thursday, March 7 by Credit Suisse. The firm has “Buy” rating given on Tuesday, November 13 by Citigroup.

Since November 12, 2018, it had 1 buy, and 0 selling transactions for $3.20 million activity. 20,000 Air Products and Chemicals, Inc. (NYSE:APD) shares with value of $3.20 million were bought by Ghasemi Seifi.

More notable recent Air Products and Chemicals, Inc. (NYSE:APD) news were published by: Crainscleveland.com which released: “Nordson Corp. CEO Michael Hilton announces plan to retire – Crain’s Cleveland Business” on February 28, 2019, also Gurufocus.com with their article: “Air Products’ CFO to Speak at JP Morgan Aviation, Transportation and Industrials Conference on March 7 – GuruFocus.com” published on February 28, 2019, Tucson.com published: “Entegris and Versum Materials Announce Expiration of HSR Act Waiting Period – Arizona Daily Star” on March 10, 2019. More interesting news about Air Products and Chemicals, Inc. (NYSE:APD) were released by: Businesswire.com and their article: “Versum Materials Responds to Unsolicited Proposal from Merck KGaA – Business Wire” published on February 27, 2019 as well as Businesswire.com‘s news article titled: “Versum Materials Board of Directors Rejects Unsolicited Proposal from Merck KGaA – Business Wire” with publication date: March 01, 2019.

Tpg Group Holdings Sbs Advisors Inc decreased Pagseguro Digital Ltd. stake by 267,269 shares to 1.39 million valued at $26.11M in 2018Q4. It also reduced Iqvia Hldgs Inc. stake by 3.57 million shares and now owns 12.58 million shares. Skyline Champion Corporation (NYSEMKT:SKY) was reduced too.

Investors sentiment increased to 1.17 in 2018 Q4. Its up 0.11, from 1.06 in 2018Q3. It is positive, as 48 investors sold APD shares while 271 reduced holdings. 107 funds opened positions while 265 raised stakes. 190.17 million shares or 4.29% more from 182.35 million shares in 2018Q3 were reported. Wealth Architects Lc reported 1,779 shares. Vigilant Capital Limited Com has 0.03% invested in Air Products and Chemicals, Inc. (NYSE:APD) for 1,016 shares. Adirondack Communication reported 22 shares stake. Lodestar Counsel Ltd Liability Il stated it has 0.19% in Air Products and Chemicals, Inc. (NYSE:APD). 3,169 are owned by Indiana Tru And Inv Management. Boston Family Office Lc holds 0.34% or 17,227 shares in its portfolio. Hendley And holds 27,475 shares or 2.57% of its portfolio. Quadrant Capital Mngmt Lc owns 7,630 shares. James Investment holds 0% or 11 shares in its portfolio. Chesley Taft & Associates Ltd has invested 0.32% in Air Products and Chemicals, Inc. (NYSE:APD). Mackenzie Fincl Corporation holds 0.05% or 112,791 shares. Moreover, Bluestein R H And has 0.03% invested in Air Products and Chemicals, Inc. (NYSE:APD) for 2,605 shares. Fil holds 29,073 shares. Peoples Fin Corporation stated it has 10,063 shares. Tarbox Family Office Inc invested in 109 shares or 0.01% of the stock.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.