Rothschild Asset Management Inc decreased its stake in Huntington Bancshares Inc (HBAN) by 72.01% based on its latest 2018Q4 regulatory filing with the SEC. Rothschild Asset Management Inc sold 2.75 million shares as the company’s stock declined 2.11% while stock markets rallied. The institutional investor held 1.07M shares of the major banks company at the end of 2018Q4, valued at $12.73 million, down from 3.82 million at the end of the previous reported quarter. Rothschild Asset Management Inc who had been investing in Huntington Bancshares Inc for a number of months, seems to be less bullish one the $14.42 billion market cap company. The stock increased 0.15% or $0.02 during the last trading session, reaching $13.72. About 14.74 million shares traded or 14.68% up from the average. Huntington Bancshares Incorporated (NASDAQ:HBAN) has declined 7.94% since March 13, 2018 and is downtrending. It has underperformed by 12.31% the S&P500.

Timucuan Asset Management Inc decreased its stake in Armstrong World Industries Inc (AWI) by 45.08% based on its latest 2018Q4 regulatory filing with the SEC. Timucuan Asset Management Inc sold 406,248 shares as the company’s stock rose 11.78% with the market. The hedge fund held 494,997 shares of the plastic products company at the end of 2018Q4, valued at $28.81 million, down from 901,245 at the end of the previous reported quarter. Timucuan Asset Management Inc who had been investing in Armstrong World Industries Inc for a number of months, seems to be less bullish one the $3.57B market cap company. The stock decreased 0.55% or $0.41 during the last trading session, reaching $73.58. About 290,486 shares traded. Armstrong World Industries, Inc. (NYSE:AWI) has risen 24.09% since March 13, 2018 and is uptrending. It has outperformed by 19.72% the S&P500.

Analysts await Huntington Bancshares Incorporated (NASDAQ:HBAN) to report earnings on April, 23. They expect $0.33 EPS, up 17.86% or $0.05 from last year’s $0.28 per share. HBAN’s profit will be $346.81 million for 10.39 P/E if the $0.33 EPS becomes a reality. After $0.29 actual EPS reported by Huntington Bancshares Incorporated for the previous quarter, Wall Street now forecasts 13.79% EPS growth.

Since October 25, 2018, it had 2 insider buys, and 3 sales for $614,774 activity. The insider Houston Helga sold $624,454. Another trade for 18,510 shares valued at $249,700 was made by Thompson Mark E on Monday, January 28. $235,723 worth of Huntington Bancshares Incorporated (NASDAQ:HBAN) was bought by STEINOUR STEPHEN D. The insider NEU RICHARD W bought 6,750 shares worth $93,683.

More notable recent Huntington Bancshares Incorporated (NASDAQ:HBAN) news were published by: Nasdaq.com which released: “Huntington Bancshares (HBAN) Reports Next Week: Wall Street Expects Earnings Growth – Nasdaq” on January 17, 2019, also Nasdaq.com with their article: “Huntington Bancshares Named Top Dividend Stock With Insider Buying and 4.03% Yield (HBAN) – Nasdaq” published on October 30, 2018, Bizjournals.com published: “These Pittsburgh banks are among the world’s best, Forbes says – Pittsburgh Business Times” on March 04, 2019. More interesting news about Huntington Bancshares Incorporated (NASDAQ:HBAN) were released by: Nasdaq.com and their article: “Associated Banc-Corp (ASB) to Acquire Huntington’s Operations – Nasdaq” published on February 18, 2019 as well as Nasdaq.com‘s news article titled: “Are Investors Undervaluing Huntington Bancshares (HBAN) Right Now? – Nasdaq” with publication date: September 28, 2018.

Rothschild Asset Management Inc, which manages about $4.79B and $8.29B US Long portfolio, upped its stake in Centerstate Bk Corp (NASDAQ:CSFL) by 21,145 shares to 414,093 shares, valued at $8.71M in 2018Q4, according to the filing. It also increased its holding in Werner Enterprises Inc (NASDAQ:WERN) by 11,037 shares in the quarter, for a total of 260,197 shares, and has risen its stake in Lilly Eli & Co (NYSE:LLY).

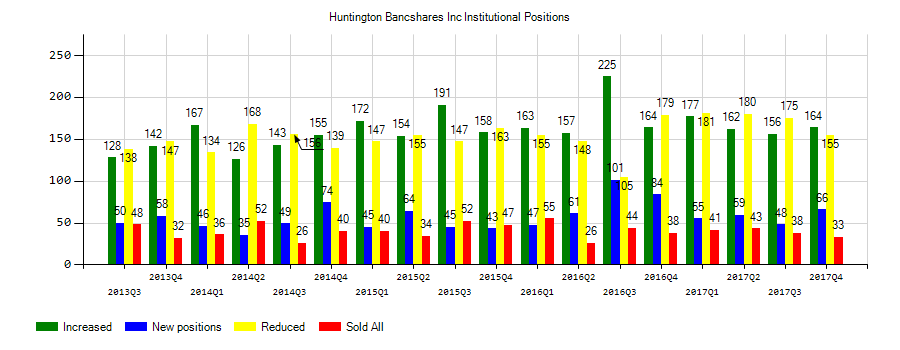

Investors sentiment decreased to 1 in Q4 2018. Its down 0.20, from 1.2 in 2018Q3. It is negative, as 48 investors sold HBAN shares while 191 reduced holdings. 69 funds opened positions while 171 raised stakes. 800.31 million shares or 1.39% more from 789.38 million shares in 2018Q3 were reported. 1,310 are held by Nelson Roberts Invest Advsrs Ltd Liability Corporation. New Mexico-based New Mexico Educational Retirement Board has invested 0.05% in Huntington Bancshares Incorporated (NASDAQ:HBAN). Palouse Capital Mngmt stated it has 454,832 shares. Hrt Financial Ltd Liability Co holds 0.15% or 90,557 shares in its portfolio. First Finance State Bank invested 0.06% of its portfolio in Huntington Bancshares Incorporated (NASDAQ:HBAN). Gulf Bank (Uk) Limited invested in 0.06% or 254,815 shares. Wealthquest owns 30,163 shares for 0.15% of their portfolio. Prelude Cap Ltd Liability invested in 8,852 shares or 0.01% of the stock. Laurion Cap Management Lp accumulated 16,523 shares. Northern Corporation owns 0.04% invested in Huntington Bancshares Incorporated (NASDAQ:HBAN) for 11.37 million shares. Jane Street Grp Limited Liability Corp invested in 84,800 shares or 0% of the stock. The California-based Cap Intl Investors has invested 0.26% in Huntington Bancshares Incorporated (NASDAQ:HBAN). The New York-based Gabelli Funds Lc has invested 0.04% in Huntington Bancshares Incorporated (NASDAQ:HBAN). State Teachers Retirement Sys holds 2.03 million shares or 0.07% of its portfolio. Quantres Asset Limited owns 13,700 shares.

Timucuan Asset Management Inc, which manages about $1.01B and $1.41B US Long portfolio, upped its stake in Alphabet Inc by 1,511 shares to 81,404 shares, valued at $84.30M in 2018Q4, according to the filing. It also increased its holding in Dolby Laboratories Inc Com (NYSE:DLB) by 8,753 shares in the quarter, for a total of 1.25 million shares, and has risen its stake in Hd Supply Holdings Inc (NASDAQ:HDS).

Analysts await Armstrong World Industries, Inc. (NYSE:AWI) to report earnings on April, 29. They expect $0.94 earnings per share, up 18.99% or $0.15 from last year’s $0.79 per share. AWI’s profit will be $45.59 million for 19.57 P/E if the $0.94 EPS becomes a reality. After $0.80 actual earnings per share reported by Armstrong World Industries, Inc. for the previous quarter, Wall Street now forecasts 17.50% EPS growth.

Since September 20, 2018, it had 0 buys, and 3 selling transactions for $332.71 million activity. ValueAct Holdings – L.P. sold $127.12 million worth of Armstrong World Industries, Inc. (NYSE:AWI) on Wednesday, February 27.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.