Costain Group PLC (LON:COST) had its stock rating noted as Buy by research professionals at Liberum Capital. This was revealed in a research report on 8 March.

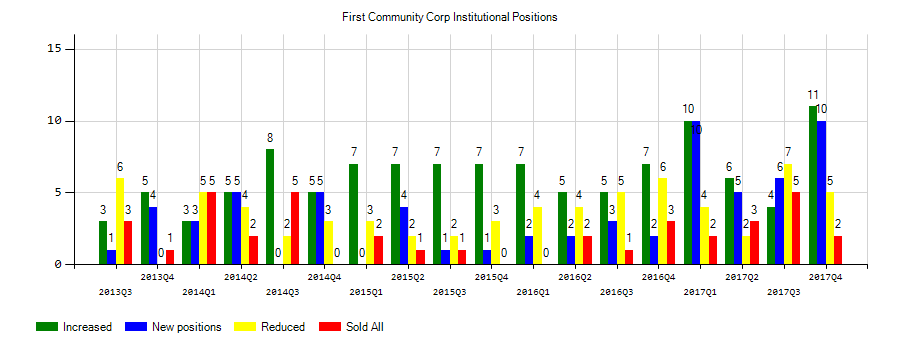

First Community Corp (FCCO) investors sentiment decreased to 0.83 in 2018 Q4. It’s down -0.56, from 1.39 in 2018Q3. The ratio worsened, as 20 investment professionals increased or opened new equity positions, while 24 sold and reduced positions in First Community Corp. The investment professionals in our database now possess: 3.62 million shares, down from 3.71 million shares in 2018Q3. Also, the number of investment professionals holding First Community Corp in top ten equity positions was flat from 0 to 0 for the same number . Sold All: 8 Reduced: 16 Increased: 19 New Position: 1.

More important recent Costain Group PLC (LON:COST) news were published by: Courant.com which released: “Community News For The South Windsor Edition – Hartford Courant” on March 07, 2019, also Businessinsider.com published article titled: “Tesla reached an agreement with a group of Chinese banks to secure over $500 million in loans for its new Gigafactory in Shanghai – Business Insider”, Tucson.com published: “23 things to do in Tucson this weekend, March 7-10 – Arizona Daily Star” on March 06, 2019. More interesting news about Costain Group PLC (LON:COST) was released by: and their article: “Hochman: Harper could put Cards over the top — but at what cost? – STLtoday.com” with publication date: February 14, 2019.

Investors sentiment decreased to 1.04 in 2018 Q4. Its down 0.07, from 1.11 in 2018Q3. It turned negative, as 70 investors sold Costain Group PLC shares while 431 reduced holdings. 121 funds opened positions while 400 raised stakes. 336.90 million shares or 12.99% more from 298.17 million shares in 2018Q3 were reported. Sta Wealth Ltd Co reported 1,752 shares or 0.12% of all its holdings. Cambridge Advsrs Inc accumulated 54,362 shares or 0.12% of the stock. National Bank & Trust holds 28,628 shares. Brown Advisory accumulated 1.78M shares. Marble Harbor Investment Counsel Ltd Llc owns 0.15% invested in Costain Group PLC (LON:COST) for 3,691 shares. Ontario Teachers Pension Plan Board reported 7,814 shares. 1832 Asset Mngmt L P holds 1.12% of its portfolio in Costain Group PLC (LON:COST) for 1.39M shares. Rafferty Asset Mngmt Limited Company reported 0.04% of its portfolio in Costain Group PLC (LON:COST). Jefferies Group Incorporated Ltd holds 0.01% or 8,901 shares in its portfolio. Jpmorgan Chase And has 0.08% invested in Costain Group PLC (LON:COST) for 1.63M shares. Pennsylvania-based Mount Lucas Mngmt L P has invested 0.29% in Costain Group PLC (LON:COST). Motley Fool Asset Mgmt Llc accumulated 45,708 shares. Sfmg Ltd Company has 0.08% invested in Costain Group PLC (LON:COST). Leavell Inv Mgmt invested in 1,128 shares or 0.03% of the stock. Btc Capital Mngmt Inc invested in 5,946 shares.

Since October 1, 2018, it had 0 buys, and 8 selling transactions for $14.33 million activity. The insider LIBENSON RICHARD M sold 2,049 shares worth $458,976. On Friday, January 4 DECKER SUSAN L sold $332,108 worth of Costain Group PLC (LON:COST) or 1,611 shares. The insider Vachris Roland Michael sold $1.49 million. 4,163 Costain Group PLC (LON:COST) shares with value of $945,940 were sold by GALANTI RICHARD A. JELINEK W CRAIG sold $5.03 million worth of stock or 22,500 shares. Shares for $707,430 were sold by MEISENBACH JOHN W on Monday, October 1. LAZARUS FRANZ E also sold $5.22 million worth of Costain Group PLC (LON:COST) shares.

Costain Group Plc provides engineering solutions for various energy, water, and transportation infrastructures in the United Kingdom, Spain, and internationally. The company has market cap of 383.26 million GBP. It operates in two divisions, Natural Resources and Infrastructure. It has a 11.85 P/E ratio. The Natural Resources segment engages in the water, power, and gas and oil markets.

The stock decreased 1.24% or GBX 4.5 during the last trading session, reaching GBX 358. About 24,627 shares traded. Costain Group PLC (LON:COST) has 0.00% since March 8, 2018 and is . It has underperformed by 4.37% the S&P500. Some Historical COST News: 24/04/2018 – COSTCO WHOLESALE CORP- APPROVED A QUARTERLY INCREASE FROM 50 TO 57 CENTS PER SHARE, OR $2.28 ON AN ANNUALIZED BASIS PAYABLE MAY 25, 2018; 31/03/2018 – Boxed, often dubbed the “Costco for millennials,” sells and delivers a range of goods including sparkling water, chips, cookies and toilet paper in bulk; 29/05/2018 – Costco Wholesale Corp expected to post earnings of $1.69 a share – Earnings Preview; 07/03/2018 – Costco Sees Growth in Same-Store, E-Commerce Sales — Earnings Review; 04/05/2018 – MOODY’S DOWNGRADES BEVMO’S CFR TO CAA1; OUTLOOK NEGATIVE; 16/05/2018 – As Skin-Baring Season Dawns, SeroVital’s hGH Booster Becomes Easier to Find Through National Costco Distribution; 07/03/2018 – COSTCO FEB. U.S. COMP SALES EX-GAS UP 7.5%, EST. UP 6.2%; 07/03/2018 – COSTCO WHOLESALE CORP – QTRLY COMPARABLE SALES UP 5.4 PCT, W/O GAS INFLATION & FX; 07/03/2018 – COSTCO WHOLESALE CORP COST.O – TOTAL CARDHOLDERS AT 92.2 MILLION AT THE END OF THE QUARTER, UP FROM 91.5 MILLION 12 WEEKS EARLIER. – CONF CALL; 08/05/2018 – Costco 3Q EPS $1.38

Analysts await First Community Corporation (NASDAQ:FCCO) to report earnings on April, 17. They expect $0.35 EPS, 0.00% or $0.00 from last year’s $0.35 per share. FCCO’s profit will be $2.67M for 14.46 P/E if the $0.35 EPS becomes a reality. After $0.35 actual EPS reported by First Community Corporation for the previous quarter, Wall Street now forecasts 0.00% EPS growth.

Since January 1, 0001, it had 0 insider purchases, and 2 insider sales for $198,453 activity.

First Community Corporation operates as the bank holding firm for First Community Bank which offers various commercial and retail banking services and products to small-to-medium sized businesses, professional concerns, and individuals. The company has market cap of $154.58 million. The firm operates through four divisions: Commercial and Retail Banking, Mortgage Banking, Investment Advisory and Non-Deposit, and Corporate. It has a 13.97 P/E ratio. The Company’s deposit products include demand deposit accounts, checking accounts, NOW accounts, and savings accounts, as well as other time deposits, such as daily money market accounts and longer-term certificates of deposits.

The stock decreased 0.49% or $0.1 during the last trading session, reaching $20.25. About 12,799 shares traded. First Community Corporation (FCCO) has declined 3.70% since March 8, 2018 and is downtrending. It has underperformed by 8.07% the S&P500. Some Historical FCCO News: 17/04/2018 First Community Solar Plus Storage Project in Massachusetts Dedicated Today; 10/05/2018 – PG&E Signs on First Community Solar Project for Regional Renewable Choice Program; 24/04/2018 – The New Home Company Announces Model Home Grand Opening for First Community in San Diego; 18/04/2018 – FIRST COMMUNITY CORP FCCO.O SETS QUARTERLY CASH DIVIDEND OF $0.10/SHR; 18/04/2018 – First Community (SC) 1Q EPS 35c; 19/04/2018 – DJ First Community Corporation, Inst Holders, 1Q 2018 (FCCO); 19/04/2018 – DJ First Community Corporation, Inst Holders, 1Q 2018 (FCCT); 10/05/2018 – ForeFront Power to Develop First Community Solar Project for PG&E’s Regional Renewable Choice Program

Elizabeth Park Capital Advisors Ltd. holds 2.39% of its portfolio in First Community Corporation for 300,762 shares. Mendon Capital Advisors Corp owns 264,595 shares or 0.6% of their US portfolio. Moreover, Banc Funds Co Llc has 0.29% invested in the company for 198,768 shares. The California-based Rbf Capital Llc has invested 0.18% in the stock. Rmb Capital Management Llc, a Illinois-based fund reported 356,888 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.