Nuveen Asset Management Llc increased Grupo Aeroportuario Del Sure (ASR) stake by 232.26% reported in 2018Q4 SEC filing. Nuveen Asset Management Llc acquired 13,325 shares as Grupo Aeroportuario Del Sure (ASR)’s stock rose 21.46%. The Nuveen Asset Management Llc holds 19,062 shares with $2.87 million value, up from 5,737 last quarter. Grupo Aeroportuario Del Sure now has $4.80 billion valuation. The stock decreased 1.25% or $2.06 during the last trading session, reaching $162.15. About 42,963 shares traded. Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) has declined 6.54% since March 6, 2018 and is downtrending. It has underperformed by 10.91% the S&P500. Some Historical ASR News: 26/04/2018 – ASUR Files Form 20-F with the U.S. Securities and Exchange Commission; 17/04/2018 – AEROPORTUARIO DEL SURESTE ASURB.MX : HSBC RAISES TARGET PRICE TO 365 PESOS FROM 361 PESOS; 05/04/2018 – ASUR Announces Total Passenger Traffic for March 2018; 05/04/2018 – Asur Total Airports Passenger Traffic Rose 5.3% Y/y in March; 23/04/2018 – ASUR 1Q NET INCOME MXN1.45B, EST. MXN1.41B; 23/04/2018 – ASUR 1Q18 Passenger Traffic Increased 9.3% YoY in Mexico and Declined 19.2% in San Juan, Puerto Rico and 5.2% in Colombia; 06/03/2018 – ASUR TOTAL FEB. PASSENGER TRAFFIC ROSE 1.5%; 23/04/2018 – ASUR 1Q REV. MXN3.92B, EST. MXN3.49B; 08/03/2018 – ASUR Calls for a Shareholders’ Meeting; 05/04/2018 – ASUR MARCH PASSENGER TRAFFIC INCREASED 5.3% YOY

Jones Collombin Investment Counsel Inc decreased Brookfield Asset Mgmt Inc (BAM) stake by 32.32% reported in 2018Q4 SEC filing. Jones Collombin Investment Counsel Inc sold 70,225 shares as Brookfield Asset Mgmt Inc (BAM)’s stock rose 2.77%. The Jones Collombin Investment Counsel Inc holds 147,072 shares with $5.64M value, down from 217,297 last quarter. Brookfield Asset Mgmt Inc now has $43.71 billion valuation. The stock increased 0.68% or $0.31 during the last trading session, reaching $45.96. About 425,734 shares traded. Brookfield Asset Management Inc. (NYSE:BAM) has risen 18.56% since March 6, 2018 and is uptrending. It has outperformed by 14.19% the S&P500. Some Historical BAM News: 21/03/2018 – BROOKFIELD TO BUY A 25% STRATEGIC INTEREST IN LINK FINL GROUP; 20/03/2018 – Report on Business: Brookfield to sell bonds in Brazil to help fund pipeline; 21/03/2018 – LCM Partners and Brookfield Asset Management enter into strategic partnership; 18/05/2018 – BROOKFIELD ASSET MANAGEMENT TO BUY BACK UP TO 82.3M CLASS A SHR; 03/05/2018 – S&PGR Afrms Brookfield Real Estate Financial Partners Rnkng; 13/05/2018 – Healthscope Gets Rival Offer From Brookfield That Trumps BGH; 17/05/2018 – Kushner Cos., Brookfield Near a Deal for Stake in 666 Fifth Ave; 07/03/2018 – Brookfield Real Estate 4Q EPS C$0.30; 02/05/2018 – Mall Owner GGP Had No Rival Bids Before Reaching Brookfield Deal; 21/05/2018 – HEALTHSCOPE LTD – DECIDED NOT TO PROVIDE DUE DILIGENCE ACCESS TO EITHER BGH – AUSTRALIANSUPER CONSORTIUM OR BROOKFIELD

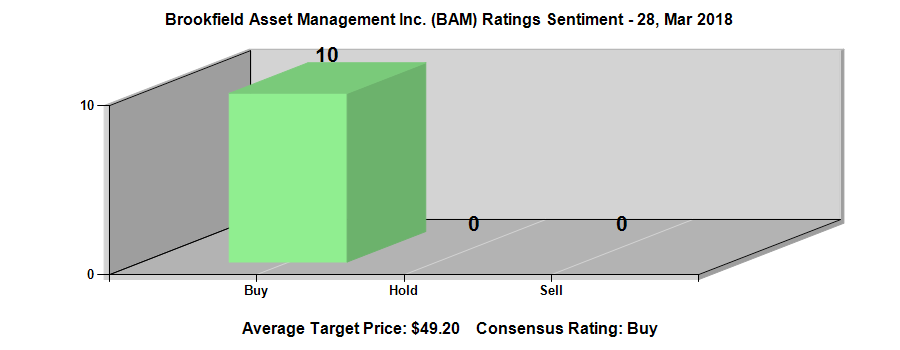

Among 4 analysts covering Brookfield Asset Mgmt (NYSE:BAM), 4 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Brookfield Asset Mgmt had 5 analyst reports since September 20, 2018 according to SRatingsIntel. On Tuesday, February 19 the stock rating was maintained by RBC Capital Markets with “Buy”. As per Friday, November 9, the company rating was upgraded by Credit Suisse.

More notable recent Brookfield Asset Management Inc. (NYSE:BAM) news were published by: Seekingalpha.com which released: “Brookfield Asset Management Q4 2018 Earnings Preview – Seeking Alpha” on February 13, 2019, also Globenewswire.com with their article: “Brookfield Announces Reset Dividend Rate on Its Series 34 and Series 25 Preference Shares – GlobeNewswire” published on March 04, 2019, Fool.com published: “Forget General Electric: Brookfield Asset Management Is a Better Value Stock – The Motley Fool” on February 23, 2019. More interesting news about Brookfield Asset Management Inc. (NYSE:BAM) were released by: Streetinsider.com and their article: “GrafTech International Ltd. (EAF) Announces Proposed 17.5M Share Common Offering – StreetInsider.com” published on March 04, 2019 as well as Globenewswire.com‘s news article titled: “Consolidated Research: 2019 Summary Expectations for The Goldman Sachs Group, Motorola Solutions, Aquantia, Monroe Capital, Brookfield Asset Management, and MEDIFAST INC — Fundamental Analysis, Key Performance Indications – GlobeNewswire” with publication date: February 21, 2019.

Nuveen Asset Management Llc decreased Nrg Energy Inc (NYSE:NRG) stake by 82,586 shares to 244,137 valued at $9.67 million in 2018Q4. It also reduced Energy Transfer Lp (NYSE:ETE) stake by 1.09 million shares and now owns 77,842 shares. Hilton Worldwide Hldgs Inc was reduced too.

More notable recent Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) news were published by: Gurufocus.com which released: “6 Companies Growing Earnings Per Share – GuruFocus.com” on March 05, 2019, also Fool.com with their article: “Aeroportuario del Sureste’s Traffic Soars as Puerto Rico Bounces Back – Motley Fool” published on February 27, 2019, Prnewswire.com published: “ASUR Announces Correction to its 4Q18 Earnings Release Dated February 25, 2019 – PRNewswire” on February 26, 2019. More interesting news about Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) were released by: Streetinsider.com and their article: “UPDATE: Scotiabank Downgrades Grupo Aeroportuario del Sureste SAB de CV (ASURB:MM) (ASR) to Sector Underperform – StreetInsider.com” published on February 11, 2019 as well as Prnewswire.com‘s news article titled: “ASUR Announces Total Passenger Traffic for January 2019 – PRNewswire” with publication date: February 06, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.