Quantum Capital Management decreased its stake in Great Lakes Dredge & Dock Co (GLDD) by 78% based on its latest 2018Q3 regulatory filing with the SEC. Quantum Capital Management sold 217,571 shares as the company’s stock rose 19.83% while stock markets declined. The institutional investor held 61,350 shares of the military and government and technical company at the end of 2018Q3, valued at $380,000, down from 278,921 at the end of the previous reported quarter. Quantum Capital Management who had been investing in Great Lakes Dredge & Dock Co for a number of months, seems to be less bullish one the $536.70M market cap company. The stock decreased 1.72% or $0.15 during the last trading session, reaching $8.59. About 559,673 shares traded or 22.15% up from the average. Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) has risen 39.80% since March 4, 2018 and is uptrending. It has outperformed by 39.80% the S&P500. Some Historical GLDD News: 20/04/2018 – DJ Great Lakes Dredge & Dock Corporati, Inst Holders, 1Q 2018 (GLDD); 23/03/2018 – Sen. Baldwin: U.S. Senator Tammy Baldwin Secures Full Funding for Great Lakes Restoration Initiative; 21/05/2018 – GREAT LAKES AFRICA ENERGY TO BUILD, OWN, OPERATE 250MW PLANT; 21/05/2018 – MOZAMBIQUE, GREAT LAKES AFRICA ENERGY SIGN MOU ON ROVUMA GAS; 28/03/2018 – Macomb Daily: Latest scoop: Haagen-Dazs grand opening at Great Lakes Crossing is April 7; 28/03/2018 – Federal Register: Great Lakes Pilotage Advisory Committee; Vacancies; 02/04/2018 – Global Finance Ranks Citizens Bank as Best Bank in Northeast and Great Lakes Regions for 2018; 23/03/2018 – Michigan.gov: Great Lakes Invasive Carp Challenge finalists to compete Tuesday in livestream event; 23/03/2018 – Sen. Stabenow: Restoring Cuts to Great Lakes Funding; 20/03/2018 – Federal Register: Great Lakes Pilotage Advisory Committee

Benin Management Corp decreased its stake in Medtronic Plc (MDT) by 36.54% based on its latest 2018Q3 regulatory filing with the SEC. Benin Management Corp sold 6,500 shares as the company’s stock declined 0.92% with the market. The institutional investor held 11,290 shares of the electromedical & electrotherapeutic apparatus company at the end of 2018Q3, valued at $1.11M, down from 17,790 at the end of the previous reported quarter. Benin Management Corp who had been investing in Medtronic Plc for a number of months, seems to be less bullish one the $123.28B market cap company. The stock decreased 0.14% or $0.13 during the last trading session, reaching $91.96. About 3.01M shares traded. Medtronic plc (NYSE:MDT) has risen 18.51% since March 4, 2018 and is uptrending. It has outperformed by 18.51% the S&P500. Some Historical MDT News: 08/03/2018 – Medtronic EVP & CVG President Mike Coyle to Speak at Cowen Healthcare Conference; 11/05/2018 – Medtronic: Study Confirms Feasibility of New Extravascular Approach to ICD Therapy; 01/05/2018 – MEDTRONIC CITES DBS AS THERAPY FOR PARTIAL-ONSET SEIZURES; 24/05/2018 – Medtronic: Current Forex Rates Would Cut FY19 Rev by $50M-$150M; 24/05/2018 – Medtronic PLC 4Q Net $1.46B; 16/05/2018 – MEDTRONIC BEGINS CLINICAL STUDY OF DES FOR BIFURCATION LESIONS; 07/05/2018 – Medtronic: Weinstein Was a Managing Director at J.P. Morgan Chase; 21/03/2018 – Moody’s Affirms Medtronic’s A3 Senior Unsecured and Prime-2 Comml Paper Ratings; 12/03/2018 – Orthopedic Devices Market in Japan (2017-2021) With Key Players DePuy Synthes, Medtronic, Smith & Nephew, Stryker and Zimmer Biomet – ResearchAndMarkets.com; 09/04/2018 – Globes: Exclusive: Medtronic to buy Israeli co Visionsense for $75m

Benin Management Corp, which manages about $278.88 million and $249.43M US Long portfolio, upped its stake in Spdr S&P 500 Etf Tr (SPY) by 34,825 shares to 211,923 shares, valued at $61.61M in 2018Q3, according to the filing.

More notable recent Medtronic plc (NYSE:MDT) news were published by: Globenewswire.com which released: “Medtronic EVP & MITG President Bob White to Speak at Cowen Healthcare Conference – GlobeNewswire” on March 01, 2019, also Seekingalpha.com with their article: “FDA clears Medtronic nerve ablation platform – Seeking Alpha” published on February 27, 2019, Seekingalpha.com published: “Medtronic plc 2019 Q3 – Results – Earnings Call Slides – Seeking Alpha” on February 19, 2019. More interesting news about Medtronic plc (NYSE:MDT) were released by: Forbes.com and their article: “How Much Can Medtronic’s Earnings Grow In Fiscal 2019? – Forbes” published on February 22, 2019 as well as Seekingalpha.com‘s news article titled: “Medtronic Q3 2018 Earnings Preview – Seeking Alpha” with publication date: February 18, 2019.

Investors sentiment increased to 1.07 in Q3 2018. Its up 0.09, from 0.98 in 2018Q2. It improved, as 24 investors sold MDT shares while 440 reduced holdings. 140 funds opened positions while 355 raised stakes. 1.02 billion shares or 0.96% less from 1.03 billion shares in 2018Q2 were reported. Crawford Inv Counsel, Georgia-based fund reported 746,383 shares. Stanley reported 11,436 shares. Santa Barbara Asset Limited Liability Corporation holds 1.48 million shares or 2.11% of its portfolio. Tradition Lc reported 1.64% in Medtronic plc (NYSE:MDT). Dumont & Blake Ltd Liability has invested 0.49% in Medtronic plc (NYSE:MDT). 6,375 were accumulated by Bowen Hanes Incorporated. Community Finance Service Group Incorporated Lc has 2,915 shares for 0.1% of their portfolio. Moreover, Hartline Invest Corp has 0.52% invested in Medtronic plc (NYSE:MDT). Kentucky Retirement System holds 0.35% of its portfolio in Medtronic plc (NYSE:MDT) for 82,425 shares. Front Barnett Associate Lc holds 106,593 shares. Mcrae Cap Management has invested 4.77% in Medtronic plc (NYSE:MDT). City Company has 0.84% invested in Medtronic plc (NYSE:MDT) for 29,742 shares. Amer Registered Advisor reported 5,308 shares stake. 20,537 are owned by Dowling & Yahnke Limited Liability Com. Wms Prns Ltd Company invested in 4,116 shares or 0.05% of the stock.

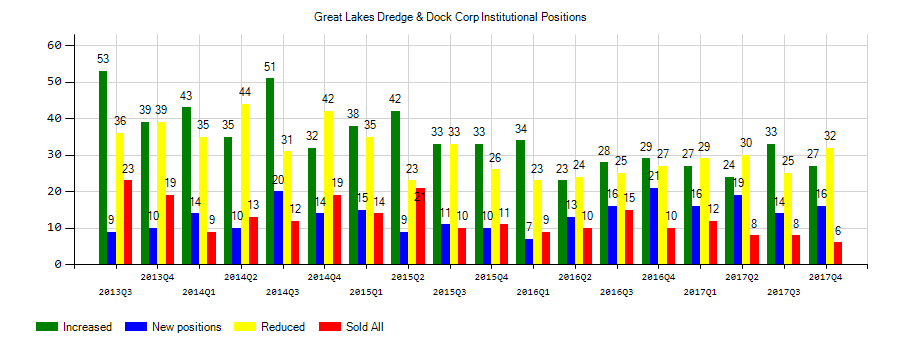

Investors sentiment increased to 1.31 in 2018 Q3. Its up 0.11, from 1.2 in 2018Q2. It improved, as 8 investors sold GLDD shares while 21 reduced holdings. 9 funds opened positions while 29 raised stakes. 43.37 million shares or 6.70% more from 40.65 million shares in 2018Q2 were reported. Renaissance Technology Ltd Liability Com holds 118,200 shares or 0% of its portfolio. Quantum Cap Mngmt owns 61,350 shares. Strs Ohio stated it has 0% of its portfolio in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). Umb Bancorporation N A Mo accumulated 0% or 13,290 shares. North Star Inv Mgmt Corporation reported 550 shares. Raymond James & has invested 0% in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). Bankshares Of Montreal Can has 392 shares. D E Shaw has 866,271 shares for 0.01% of their portfolio. Geode Ltd Com stated it has 0% in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). Natl Bank Of America Corp De holds 135,810 shares or 0% of its portfolio. Tcw reported 807,995 shares or 0.04% of all its holdings. Deltec Asset Limited invested in 45,000 shares or 0.05% of the stock. Foundry Prtnrs Ltd Co has 0.16% invested in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) for 675,400 shares. Picton Mahoney Asset Mgmt stated it has 0.08% of its portfolio in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). New York-based American Gp has invested 0% in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD).

More notable recent Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) news were published by: Nasdaq.com which released: “Weyerhaeuser’s (WY) Q4 Earnings Miss Estimates, Down Y/Y – Nasdaq” on February 01, 2019, also Nasdaq.com with their article: “5 Stocks With Recent Price Strength to Maximize Your Gains – Nasdaq” published on March 04, 2019, Nasdaq.com published: “Will Great Lakes Dredge & Dock Continue to Surge Higher? – Nasdaq” on March 04, 2019. More interesting news about Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) were released by: Nasdaq.com and their article: “5 Stocks That Could Help Russell 2000 Rebound in 2019 – Nasdaq” published on December 31, 2018 as well as Nasdaq.com‘s news article titled: “New Strong Buy Stocks for February 22nd – Nasdaq” with publication date: February 22, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.