Cadence Capital Management Llc decreased its stake in Hollyfrontier Corp (HFC) by 37.88% based on its latest 2018Q3 regulatory filing with the SEC. Cadence Capital Management Llc sold 5,870 shares as the company’s stock declined 22.81% with the market. The institutional investor held 9,626 shares of the integrated oil company at the end of 2018Q3, valued at $673,000, down from 15,496 at the end of the previous reported quarter. Cadence Capital Management Llc who had been investing in Hollyfrontier Corp for a number of months, seems to be less bullish one the $8.82B market cap company. The stock increased 1.62% or $0.83 during the last trading session, reaching $52.03. About 2.10 million shares traded. HollyFrontier Corporation (NYSE:HFC) has risen 21.25% since March 3, 2018 and is uptrending. It has outperformed by 21.25% the S&P500. Some Historical HFC News: 23/03/2018 – DIARY-U.S. refinery operations-Phillips 66 Says Planned Work Underway at Bayway, NJ Refinery; 29/05/2018 – Ethanol, farm groups sue U.S. EPA over refineries’ biofuels exemptions; 02/05/2018 – HollyFrontier 1Q Adj EPS 77c; 07/03/2018 U.S. refinery workers head to Washington to urge biofuels reform; 31/05/2018 – EXCLUSIVE-U.S. EPA AWARDS SINCLAIR OIL, HOLLYFRONTIER MILLIONS OF DOLLARS IN BIOFUELS CREDITS FOR WAIVER DENIALS -SOURCES, FILINGS; 29/05/2018 – HOLLYFRONTIER CORP – ISSUES STATEMENT ON PASSING OF FORMER CHAIRMAN AND CEO, LAMAR NORSWORTHY; 02/05/2018 – HOLLYFRONTIER CONCLUDES 1Q EARNINGS CONFERENCE CALL; 02/05/2018 – HOLLYFRONTIER `PLEASED’ BY RFS DEVELOPMENTS FROM WASHINGTON; 09/05/2018 – HollyFrontier Corporation Announces Regular Cash Dividend; 31/05/2018 – EXCLUSIVE-U.S. EPA AWARDS SINCLAIR OIL, HOLLYFRONTIER MILLIONS OF DOLLARS IN BIOFUELS CREDITS FOR WAIVER DENIALS

Fund Evaluation Group Llc decreased its stake in United Technologies Corp (UTX) by 16.93% based on its latest 2018Q3 regulatory filing with the SEC. Fund Evaluation Group Llc sold 3,815 shares as the company’s stock declined 10.65% with the market. The institutional investor held 18,720 shares of the aerospace company at the end of 2018Q3, valued at $2.62 million, down from 22,535 at the end of the previous reported quarter. Fund Evaluation Group Llc who had been investing in United Technologies Corp for a number of months, seems to be less bullish one the $108.38B market cap company. The stock increased 0.08% or $0.1 during the last trading session, reaching $125.77. About 3.82M shares traded. United Technologies Corporation (NYSE:UTX) has declined 2.44% since March 3, 2018 and is downtrending. It has underperformed by 2.44% the S&P500. Some Historical UTX News: 23/03/2018 – United Technologies Wins $239.7 Million U.S. Navy Contract; 12/04/2018 – UTC AEROSPACE SYSTEMS SAYS BEEN SELECTED BY GKN AEROSPACE’S FOKKER BUSINESS; 23/05/2018 – United Tech’s Pratt & Whitney to Invest Up to $100M in West Palm Beach Facility; 21/05/2018 – UTC Aerospace Systems Unveils Lightweight, Laser-Compliant Optical Payload For Unmanned Aerial Systems; 19/03/2018 – BOEING – FOLLOWING PRODUCTIVE DISCUSSIONS, REACHED “WIN-WIN AGREEMENTS” WITH UNITED TECHNOLOGIES & ROCKWELL COLLINS; 12/04/2018 – UTC Aerospace Systems to Provide GKN Aerospace’s Fokker Business With Long-Term On-Site Support; 14/05/2018 – UNITED TECHNOLOGIES CORP – ALSO PRICED OFFERING OF EUR 750 MLN AGGREGATE PRINCIPAL AMOUNT OF SENIOR FLOATING RATE NOTES DUE 2020; 09/05/2018 – Fit For A King: UTC Aerospace Systems Providing Key Power Transmission Components For America’s Most Powerful Helicopter, The S; 22/05/2018 – UTX CEO:INVESTMENT CASE FOR DUAL-SOURCE ENGINE `MORE DIFFICULT’; 13/03/2018 – RPT-FOCUS-New Boeing jet to accelerate services shake-up

Since January 30, 2019, it had 0 insider buys, and 3 sales for $2.50 million activity. 9,620 shares valued at $1.15M were sold by Dumais Michael R on Wednesday, January 30. Bailey Robert J. had sold 862 shares worth $104,916.

More notable recent United Technologies Corporation (NYSE:UTX) news were published by: Fool.com which released: “Why United Technologies Rose More Than 10% in January – The Motley Fool” on February 05, 2019, also with their article: “Aerospace ETF Hits The Afterburners (NYSE:DFEN)(NYSE:BA)(NYSE:UTX) – Benzinga” published on February 12, 2019, Globenewswire.com published: “New Research: Key Drivers of Growth for United Technologies, Southern, Intuit, Cohen & Steers, Briggs & Stratton, and Watts Water Technologies — Factors of Influence, Major Initiatives and Sustained Production – GlobeNewswire” on February 27, 2019. More interesting news about United Technologies Corporation (NYSE:UTX) were released by: Seekingalpha.com and their article: “GE scores $517M Army helicopter contract – Seeking Alpha” published on February 02, 2019 as well as Gurufocus.com‘s news article titled: “Daniel Loeb Parts Ways With United Technologies in 4th Quarter – GuruFocus.com” with publication date: February 12, 2019.

Investors sentiment increased to 1.09 in 2018 Q3. Its up 0.07, from 1.02 in 2018Q2. It improved, as 31 investors sold UTX shares while 518 reduced holdings. 125 funds opened positions while 474 raised stakes. 628.79 million shares or 0.08% less from 629.27 million shares in 2018Q2 were reported. Moors & Cabot owns 63,157 shares. Tarbox Family Office Inc owns 295 shares for 0.01% of their portfolio. Cap Fund Mgmt has invested 0.12% of its portfolio in United Technologies Corporation (NYSE:UTX). Oakmont invested 0.03% in United Technologies Corporation (NYSE:UTX). Burns J W And Com New York accumulated 29,704 shares. Moreover, Ltd Limited Liability Company has 0.25% invested in United Technologies Corporation (NYSE:UTX) for 30,214 shares. Saratoga Research Investment Management reported 6.43% stake. 5,570 are owned by St Johns Investment Ltd Liability Corporation. Halbert Hargrove Russell Ltd Co holds 1,920 shares or 0.07% of its portfolio. Hawaii-based National Bank & Trust Of Hawaii has invested 0.13% in United Technologies Corporation (NYSE:UTX). Weybosset Rech And Management Limited Liability Corp reported 0.31% of its portfolio in United Technologies Corporation (NYSE:UTX). 268,873 were reported by Janney Cap Mngmt Ltd Liability. Palisade Asset Mgmt Limited Liability Corporation stated it has 97,553 shares or 1.8% of all its holdings. 7,490 were reported by Fruth Investment Mngmt. Berkshire Asset Mngmt Limited Liability Company Pa holds 0.08% or 6,877 shares.

More notable recent HollyFrontier Corporation (NYSE:HFC) news were published by: which released: “Earnings Scheduled For February 20, 2019 – Benzinga” on February 20, 2019, also Seekingalpha.com with their article: “HollyFrontier tops Q4 earnings view as refinery margins surge – Seeking Alpha” published on February 20, 2019, Seekingalpha.com published: “HollyFrontier Q4 2018 Earnings Preview – Seeking Alpha” on February 19, 2019. More interesting news about HollyFrontier Corporation (NYSE:HFC) were released by: Fool.com and their article: “What Can Investors Expect From Holly Energy Partners in 2019? – Motley Fool” published on February 20, 2019 as well as ‘s news article titled: “10 Stocks To Watch For February 20, 2019 – Benzinga” with publication date: February 20, 2019.

Since November 30, 2018, it had 0 insider purchases, and 1 sale for $92,429 activity.

Cadence Capital Management Llc, which manages about $4.62 billion and $1.85 billion US Long portfolio, upped its stake in Metropolitan Bk Hldg Corp by 7,945 shares to 47,305 shares, valued at $1.95 million in 2018Q3, according to the filing. It also increased its holding in Coca Cola Co (NYSE:KO) by 10,269 shares in the quarter, for a total of 261,245 shares, and has risen its stake in Pixelworks Inc (NASDAQ:PXLW).

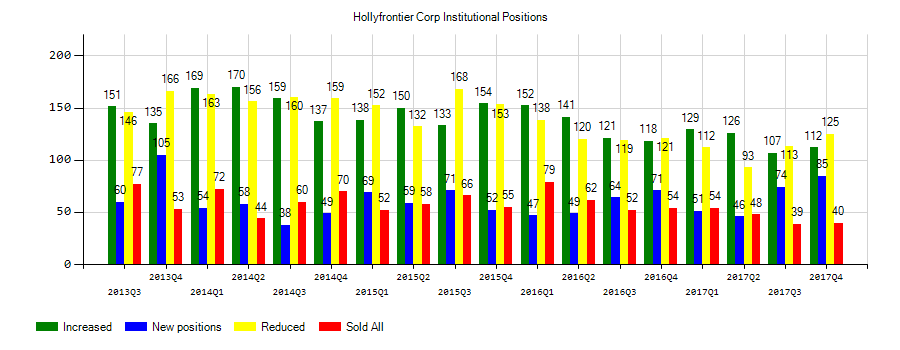

Investors sentiment decreased to 0.96 in Q3 2018. Its down 0.23, from 1.19 in 2018Q2. It dived, as 43 investors sold HFC shares while 180 reduced holdings. 82 funds opened positions while 132 raised stakes. 138.53 million shares or 6.99% less from 148.93 million shares in 2018Q2 were reported. Icon Advisers Inc has 29,700 shares for 0.18% of their portfolio. Garrison Financial has invested 0.14% in HollyFrontier Corporation (NYSE:HFC). Commonwealth Of Pennsylvania Public School Empls Retrmt System reported 13,301 shares stake. Ing Groep Nv has 19,482 shares. Edgestream Prtn Limited Partnership holds 1.99% of its portfolio in HollyFrontier Corporation (NYSE:HFC) for 167,363 shares. Strs Ohio accumulated 0% or 7,141 shares. Ent Financial Ser owns 92 shares or 0% of their US portfolio. Bridgeway Cap Mgmt has 0.8% invested in HollyFrontier Corporation (NYSE:HFC) for 1.18 million shares. Fil Ltd has 0% invested in HollyFrontier Corporation (NYSE:HFC). Moreover, Fmr Ltd Liability has 0.01% invested in HollyFrontier Corporation (NYSE:HFC) for 1.27 million shares. M&R Mgmt Inc reported 96 shares. Renaissance Llc owns 0.01% invested in HollyFrontier Corporation (NYSE:HFC) for 75,082 shares. Korea Invest holds 0.15% in HollyFrontier Corporation (NYSE:HFC) or 456,851 shares. New Mexico Educational Retirement Board reported 0.04% in HollyFrontier Corporation (NYSE:HFC). Coastline has 0.11% invested in HollyFrontier Corporation (NYSE:HFC).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.