Westpac Banking Corp decreased its stake in Hudson Pac Pptys Inc (HPP) by 34.11% based on its latest 2018Q3 regulatory filing with the SEC. Westpac Banking Corp sold 180,737 shares as the company’s stock declined 5.31% with the market. The institutional investor held 349,071 shares of the finance company at the end of 2018Q3, valued at $11.42 billion, down from 529,808 at the end of the previous reported quarter. Westpac Banking Corp who had been investing in Hudson Pac Pptys Inc for a number of months, seems to be less bullish one the $5.13B market cap company. The stock increased 0.18% or $0.06 during the last trading session, reaching $33.28. About 948,041 shares traded. Hudson Pacific Properties, Inc. (NYSE:HPP) has declined 10.11% since March 2, 2018 and is downtrending. It has underperformed by 10.11% the S&P500. Some Historical HPP News: 13/03/2018 – Hudson Pacific Properties Renews Lease With InvenSense; 03/05/2018 – HUDSON PACIFIC PROPERTIES INC HPP.N SEES FY 2018 FFO SHR $1.87 TO $1.95 EXCLUDING ITEMS; 03/05/2018 – HUDSON PACIFIC PROPERTIES INC – QTRLY FFO, INCLUDING SPECIFIED ITEMS, $0.44 PER DILUTED SHARE; 03/05/2018 – Hudson Pacific Properties Sees 2018 Adj FFO/Share $1.87 to $1.95; 03/05/2018 – HPP SEES FY FFO/SHR AS ADJ $1.87 TO $1.95, EST. $1.91; 03/05/2018 – HUDSON PACIFIC PROPERTIES INC – QTRLY TOTAL REVENUE INCREASED 3.5% TO $174.1 MILLION FROM $168.3 MILLION FOR THE SAME QUARTER A YEAR AGO; 22/03/2018 – Fitch Affirms Hudson Pacific’s IDR at ‘BBB-‘; Outlook Stable; 03/05/2018 – HUDSON PACIFIC 1Q FFO/SHR AS ADJ 45C, EST. 45C; 19/04/2018 – DJ Hudson Pacific Properties Inc, Inst Holders, 1Q 2018 (HPP); 03/05/2018 – Hudson Pacific Properties 1Q EPS 31c

Trexquant Investment Lp decreased its stake in Servicenow Inc (NOW) by 12.87% based on its latest 2018Q3 regulatory filing with the SEC. Trexquant Investment Lp sold 2,225 shares as the company’s stock declined 7.09% with the market. The institutional investor held 15,057 shares of the technology company at the end of 2018Q3, valued at $2.95M, down from 17,282 at the end of the previous reported quarter. Trexquant Investment Lp who had been investing in Servicenow Inc for a number of months, seems to be less bullish one the $43.66 billion market cap company. The stock increased 1.70% or $4.08 during the last trading session, reaching $243.52. About 2.06 million shares traded. ServiceNow, Inc. (NYSE:NOW) has risen 52.81% since March 2, 2018 and is uptrending. It has outperformed by 52.81% the S&P500. Some Historical NOW News: 25/04/2018 – ServiceNow 1Q Subscription Revenue $543.3 Million; 25/04/2018 – ServiceNow to Acquire Seattle-based VendorHawk Inc; 10/04/2018 – BAFFLE(™) HIRES VP OF PRODUCTS AND MARKETING; COMPANY CONTINUES TO EXPAND MARKET MOMENTUM AND AWARENESS IN 2018; 21/04/2018 – DJ ServiceNow Inc, Inst Holders, 1Q 2018 (NOW); 25/04/2018 – SERVICENOW INC – FRED LUDDY WILL BECOME NEW BOARD CHAIR, SUCCEEDING FORMER COMPANY PRESIDENT AND CEO FRANK SLOOTMAN; 08/05/2018 – NNT Change Tracker Gen7 Receives Application Certification from ServiceNow®; 01/05/2018 – Biomedical Depot and Imaging Repair Service Now Available from Parts; 25/04/2018 – ServiceNow 1Q Rev $589.2M; 12/04/2018 – Astound Integrates with ServiceNow to Make Every App Intelligent with AI-Driven Automation; 03/05/2018 – SERVICENOW BUYS PARLO, AI WORKFORCE SOLUTION

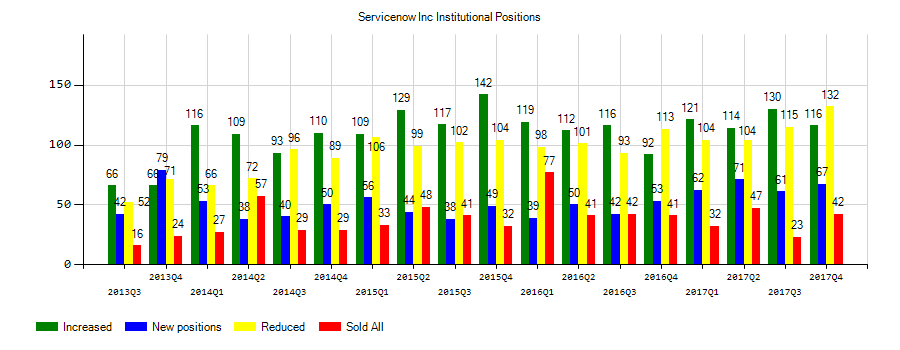

Investors sentiment increased to 1.45 in 2018 Q3. Its up 0.17, from 1.28 in 2018Q2. It increased, as 31 investors sold NOW shares while 151 reduced holdings. 106 funds opened positions while 157 raised stakes. 162.71 million shares or 2.64% less from 167.12 million shares in 2018Q2 were reported. Weatherly Asset Limited Partnership, a California-based fund reported 2,930 shares. Seabridge Invest Advisors Ltd Liability holds 700 shares. Corvex Management LP accumulated 502,056 shares. Rgm Cap Llc has invested 3.73% of its portfolio in ServiceNow, Inc. (NYSE:NOW). 12.72M are owned by Vanguard Grp. Lord Abbett And Limited Liability Company invested 0.21% of its portfolio in ServiceNow, Inc. (NYSE:NOW). Highline Cap Ltd Partnership invested 3.89% of its portfolio in ServiceNow, Inc. (NYSE:NOW). Fiera Cap Corporation stated it has 0% in ServiceNow, Inc. (NYSE:NOW). Natixis Advsr Limited Partnership has 0.03% invested in ServiceNow, Inc. (NYSE:NOW) for 19,178 shares. Japan-based Sumitomo Mitsui Asset Management Limited has invested 0.03% in ServiceNow, Inc. (NYSE:NOW). State Street invested 0.05% of its portfolio in ServiceNow, Inc. (NYSE:NOW). Prudential Fincl Inc accumulated 10,160 shares. Ardsley Advisory Partners has 5,000 shares for 0.13% of their portfolio. Plante Moran Fin Advsr Limited Liability Corp reported 230 shares. Neuberger Berman Group, a New York-based fund reported 193,546 shares.

Since September 12, 2018, it had 0 buys, and 22 sales for $78.03 million activity. On Monday, November 26 the insider Schneider David sold $2.09M. Desai Chirantan Jitendra had sold 2,031 shares worth $373,298 on Friday, October 12. WADORS PATRICIA L also sold $1.53 million worth of ServiceNow, Inc. (NYSE:NOW) shares. LUDDY FREDERIC B also sold $5.65M worth of ServiceNow, Inc. (NYSE:NOW) shares. 39,827 ServiceNow, Inc. (NYSE:NOW) shares with value of $7.13 million were sold by Scarpelli Michael. $2.51 million worth of ServiceNow, Inc. (NYSE:NOW) was sold by Donahoe John J.

More notable recent ServiceNow, Inc. (NYSE:NOW) news were published by: Seekingalpha.com which released: “ServiceNow: Exceptional Q4 Results – Seeking Alpha” on February 06, 2019, also with their article: “ServiceNow Soars After Strong Quarter (NYSE:NOW) – Benzinga” published on January 31, 2019, Seekingalpha.com published: “ServiceNow Grows Through The Addition Of Capital-Efficient Startups – Seeking Alpha” on February 06, 2019. More interesting news about ServiceNow, Inc. (NYSE:NOW) were released by: Prnewswire.com and their article: “CannTrust to Start Trading on NYSE Today – PRNewswire” published on February 25, 2019 as well as Seekingalpha.com‘s news article titled: “ServiceNow: Profitability Is Added To The Growth Story – Seeking Alpha” with publication date: February 05, 2019.

Trexquant Investment Lp, which manages about $105.00M and $1.33B US Long portfolio, upped its stake in Jd Com Inc (NASDAQ:JD) by 35,669 shares to 72,534 shares, valued at $1.89M in 2018Q3, according to the filing. It also increased its holding in Verizon Communications Inc (NYSE:VZ) by 37,435 shares in the quarter, for a total of 105,015 shares, and has risen its stake in Exponent Inc (NASDAQ:EXPO).

More notable recent Hudson Pacific Properties, Inc. (NYSE:HPP) news were published by: Seekingalpha.com which released: “Hudson Pacific Properties, Inc. 2018 Q3 – Results – Earnings Call Slides – Seeking Alpha” on November 01, 2018, also Seekingalpha.com with their article: “Hudson Pacific Properties’ (HPP) CEO Victor Coleman on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” published on November 02, 2018, Seekingalpha.com published: “Hudson Pacific, Allianz Real Estate JV to buy San Francisco Ferry Building – Seeking Alpha” on October 08, 2018. More interesting news about Hudson Pacific Properties, Inc. (NYSE:HPP) were released by: Seekingalpha.com and their article: “Google to lease Hudson Pacific venture’s One Westside redevelopment – Seeking Alpha” published on January 08, 2019 as well as Fool.com‘s news article titled: “Jagged Peak Energy Inc. (JAG) Q4 2018 Earnings Conference Call Transcript – Motley Fool” with publication date: March 01, 2019.

Westpac Banking Corp, which manages about $5832.75B US Long portfolio, upped its stake in Archer Daniels Midland Co (NYSE:ADM) by 10,538 shares to 47,416 shares, valued at $2.38B in 2018Q3, according to the filing. It also increased its holding in Extended Stay Amer Inc (NYSE:STAY) by 40,650 shares in the quarter, for a total of 243,324 shares, and has risen its stake in Discovery Inc (NASDAQ:DISCK).

Investors sentiment decreased to 0.88 in Q3 2018. Its down 0.23, from 1.11 in 2018Q2. It worsened, as 21 investors sold HPP shares while 74 reduced holdings. 27 funds opened positions while 57 raised stakes. 153.73 million shares or 0.40% less from 154.36 million shares in 2018Q2 were reported. Voya Mgmt Ltd Liability Co reported 0% stake. Investec Asset Management holds 22,972 shares or 0% of its portfolio. Moreover, Silvercrest Asset Management Grp Inc Lc has 0.02% invested in Hudson Pacific Properties, Inc. (NYSE:HPP) for 51,802 shares. Citadel Advsr Lc has invested 0.01% in Hudson Pacific Properties, Inc. (NYSE:HPP). Putnam Limited Com, Massachusetts-based fund reported 148,199 shares. State Of Wisconsin Investment Board holds 0% or 53,675 shares in its portfolio. Pensionfund Dsm Netherlands holds 60,500 shares. Hbk Invs Limited Partnership, a Texas-based fund reported 62,200 shares. Bankshares Of America Corp De invested 0% of its portfolio in Hudson Pacific Properties, Inc. (NYSE:HPP). 2.46M are held by Dimensional Fund L P. Cbre Clarion Secs Ltd Company accumulated 5.43 million shares or 2.42% of the stock. Stratos Wealth Prtnrs has invested 0% of its portfolio in Hudson Pacific Properties, Inc. (NYSE:HPP). Pinebridge Investments LP holds 2,050 shares. Nordea Inv Mngmt owns 662,789 shares or 0.05% of their US portfolio. Ajo Lp holds 0.03% in Hudson Pacific Properties, Inc. (NYSE:HPP) or 212,355 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.