Wedge Capital Management L LP decreased Molina Healthcare Inc. (MOH) stake by 25.2% reported in 2018Q3 SEC filing. Wedge Capital Management L LP sold 82,575 shares as Molina Healthcare Inc. (MOH)’s stock declined 5.17%. The Wedge Capital Management L LP holds 245,136 shares with $36.45 million value, down from 327,711 last quarter. Molina Healthcare Inc. now has $8.81B valuation. The stock increased 0.58% or $0.82 during the last trading session, reaching $141.15. About 187,091 shares traded. Molina Healthcare, Inc. (NYSE:MOH) has risen 78.86% since February 28, 2018 and is uptrending. It has outperformed by 78.86% the S&P500. Some Historical MOH News: 30/04/2018 – CORRECT: MOLINA SEES 2018 ADJ. EPS $4.24 – $4.74, EST. $3.68; 06/03/2018 – MOLINA HEALTHCARE INC – TRANSACTIONS WILL NOT HAVE A MATERIAL IMPACT ON COMPANY’S CASH POSITION; 29/05/2018 – Molina Healthcare Elects Richard Zoretic to Bd of Directors; 13/03/2018 – Kansas CC: In the Matter of the Investigation of Gustavo Molina, d/b/a GM Trucking; 06/03/2018 – MOLINA HEALTHCARE INC – ON A NET BASIS, CO WILL NOT RECEIVE PROCEEDS FROM TRANSACTIONS, WILL PAY CUSTOMARY FEES AND EXPENSES IN CONNECTION THEREWITH; 24/05/2018 – MOLINA HEALTHCARE INC – BOARD APPOINTED THOMAS L. TRAN AS NEW CHIEF FINANCIAL OFFICER, EFFECTIVE JUNE 4, 2018; 29/05/2018 – The Klein Law Firm Notifies Investors of a Class Action Filed on Behalf of Molina Healthcare, Inc. Shareholders and a Lead; 12/03/2018 – Molina Healthcare Awarded Texas CHIP Contracts; 06/03/2018 Molina Healthcare Announces Pricing of Synthetic Exchange Transaction; 06/03/2018 – MOLINA HEALTHCARE REPORTS PRICING OF SYNTHETIC EXCHANGE TRANSAC

Third Point Reinsurance LTD (TPRE) investors sentiment decreased to 0.72 in 2018 Q3. It’s down -0.10, from 0.82 in 2018Q2. The ratio has dropped, as 52 active investment managers increased and started new holdings, while 72 trimmed and sold holdings in Third Point Reinsurance LTD. The active investment managers in our database now hold: 62.71 million shares, down from 68.17 million shares in 2018Q2. Also, the number of active investment managers holding Third Point Reinsurance LTD in top ten holdings was flat from 1 to 1 for the same number . Sold All: 15 Reduced: 57 Increased: 35 New Position: 17.

The stock decreased 8.38% or $0.97 during the last trading session, reaching $10.6. About 405,810 shares traded. Third Point Reinsurance Ltd. (TPRE) has declined 36.29% since February 28, 2018 and is downtrending. It has underperformed by 36.29% the S&P500. Some Historical TPRE News: 15/05/2018 – Third Point Buys New 1.4% Position in Wynn Resorts; 28/03/2018 – A.M. Best Affirms Credit Ratings of Third Point Reinsurance Ltd. and Its Subsidiaries; 29/03/2018 – REG-Third Point Offshore: Total Voting Rights; 04/05/2018 – UNITED TECHNOLOGIES CORP SAYS IS IN RECEIPT OF A CORRESPONDENCE FROM THIRD POINT IN WHICH IT EXPRESSES ITS VIEWS ON THE COMPANY’S PORTFOLIO STRUCTURE; 09/05/2018 – THIRD POINT REINSURANCE LTD – QTRLY TOTAL REVENUE $140.3 MLN VS $266.5 MLN; 04/05/2018 – Activist Third Point Pushes for Breakup of United Technologies; 10/05/2018 – THIRD POINT’S DAN LOEB COMMENTS ON EARNINGS CALL; 14/05/2018 – REG-Third Point Offshore: Suspension of Monthly Share Conversion Scheme; 03/04/2018 – REG-Third Point Offshore: Third Point March Performance; 26/03/2018 – UNITED TECHNOLOGIES, THIRD POINT GRANTED HSR EARLY TERMINATION

Third Point Reinsurance Ltd., through its subsidiaries, provides specialty property and casualty reinsurance products to insurance and reinsurance companies in the Americas, Europe, the Middle East, Africa, and Asia. The company has market cap of $998.20 million. The firm underwrites property, workers compensation, personal automobile, general and professional liability, mortgage, and extended warranty insurance products, as well as multi-line reinsurance products. It has a 43.27 P/E ratio.

Since January 1, 0001, it had 1 insider buy, and 1 insider sale for $10.47 million activity.

Kelso & Company L.P. holds 100% of its portfolio in Third Point Reinsurance Ltd. for 6.17 million shares. New Vernon Investment Management Llc owns 183,949 shares or 2.83% of their US portfolio. Moreover, Dean Capital Management has 1.9% invested in the company for 207,675 shares. The Ohio-based Dean Investment Associates Llc has invested 0.94% in the stock. Insight 2811 Inc., a Michigan-based fund reported 51,020 shares.

More notable recent Third Point Reinsurance Ltd. (NYSE:TPRE) news were published by: Globenewswire.com which released: “Report: Developing Opportunities within Ensco plc, Third Point Reinsurance, Baxter International, Ultrapar Participacoes SA, Endeavour Silver, and Ingles Markets — Future Expectations, Projections Moving into 2019 – GlobeNewswire” on February 04, 2019, also Seekingalpha.com with their article: “Third Point Reinsurance’s (TPRE) CEO Rob Bredahl on Q2 2018 Results – Earnings Call Transcript – Seeking Alpha” published on August 01, 2018, Seekingalpha.com published: “Third Point (Dan Loeb) Q3 2018 Investor Letter: The Good Place – Seeking Alpha” on November 10, 2018. More interesting news about Third Point Reinsurance Ltd. (NYSE:TPRE) were released by: Seekingalpha.com and their article: “Third Point Reinsurance’s (TPRE) CEO Rob Bredahl on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” published on November 07, 2018 as well as Seekingalpha.com‘s news article titled: “Tracking Dan Loeb’s Third Point Portfolio – Q4 2018 Update – Seeking Alpha” with publication date: February 12, 2019.

Among 4 analysts covering Molina Healthcare (NYSE:MOH), 3 have Buy rating, 0 Sell and 1 Hold. Therefore 75% are positive. Molina Healthcare had 7 analyst reports since September 5, 2018 according to SRatingsIntel. As per Tuesday, January 8, the company rating was upgraded by JP Morgan. The stock has “Overweight” rating by Morgan Stanley on Thursday, October 18. Jefferies upgraded Molina Healthcare, Inc. (NYSE:MOH) on Tuesday, November 13 to “Buy” rating. Morgan Stanley maintained the shares of MOH in report on Wednesday, February 13 with “Overweight” rating. The firm has “Hold” rating by Jefferies given on Friday, October 12. The stock has “Overweight” rating by Morgan Stanley on Wednesday, September 5.

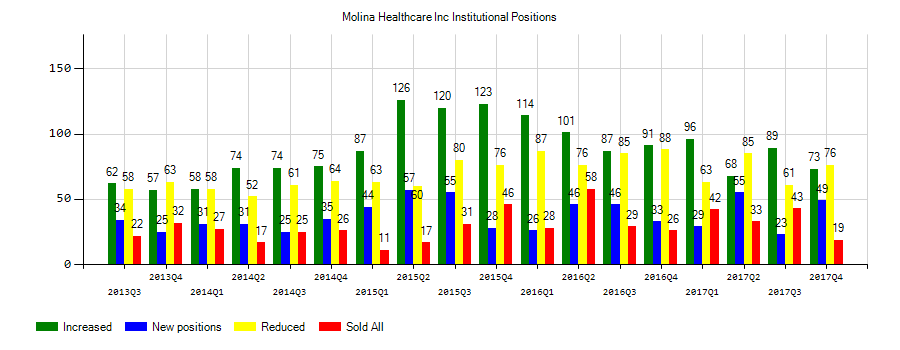

Investors sentiment increased to 1.34 in 2018 Q3. Its up 0.15, from 1.19 in 2018Q2. It improved, as 24 investors sold MOH shares while 92 reduced holdings. 73 funds opened positions while 83 raised stakes. 65.39 million shares or 5.83% less from 69.43 million shares in 2018Q2 were reported. Renaissance Tech Limited Liability Co reported 3.74M shares or 0.57% of all its holdings. Michigan-based Comerica Fincl Bank has invested 0.04% in Molina Healthcare, Inc. (NYSE:MOH). 400 are owned by Cordasco Ntwk. Epoch Invest Ptnrs Inc holds 0.17% or 302,620 shares in its portfolio. M&T Retail Bank owns 1,608 shares for 0% of their portfolio. 13 were accumulated by Farmers And Merchants Invs. Retail Bank Of America De holds 101,541 shares. Systematic Management Ltd Partnership invested in 0.04% or 10,198 shares. Sg Americas Securities accumulated 18,403 shares. Signaturefd Limited Liability Co invested in 338 shares. Aqr Cap Management Limited Com has invested 0.1% in Molina Healthcare, Inc. (NYSE:MOH). Bluemountain Cap Mgmt Limited Liability accumulated 42,315 shares or 0.11% of the stock. Royal National Bank & Trust Of Canada holds 0.01% or 108,022 shares in its portfolio. Federated Investors Inc Pa stated it has 152,015 shares. Columbus Circle Investors accumulated 0.44% or 148,781 shares.

Since September 4, 2018, it had 1 insider buy, and 8 sales for $2.47 million activity. Another trade for 4,000 shares valued at $542,260 was made by WOLF DALE B on Friday, November 9. ROMNEY RONNA sold $28,246 worth of Molina Healthcare, Inc. (NYSE:MOH) on Monday, December 3. Shares for $458,225 were sold by FEDAK CHARLES Z. ORLANDO STEVEN J sold $135,860 worth of Molina Healthcare, Inc. (NYSE:MOH) on Wednesday, November 14. WOYS JAMES had bought 25,000 shares worth $3.72M.

Wedge Capital Management L LP increased Edison International (NYSE:EIX) stake by 12,435 shares to 187,691 valued at $12.70 million in 2018Q3. It also upped Ameriprise Financial Inc. (NYSE:AMP) stake by 4,483 shares and now owns 219,923 shares. Reliance Steel & Aluminum Co. (NYSE:RS) was raised too.

More notable recent Molina Healthcare, Inc. (NYSE:MOH) news were published by: Seekingalpha.com which released: “Molina Q4 top line down 5% – Seeking Alpha” on February 11, 2019, also Seekingalpha.com with their article: “Molina Healthcare beats by $1.44, beats on revenue – Seeking Alpha” published on February 11, 2019, Seekingalpha.com published: “Molina Healthcare Q4 2018 Earnings Preview – Seeking Alpha” on February 10, 2019. More interesting news about Molina Healthcare, Inc. (NYSE:MOH) were released by: Globenewswire.com and their article: “Investor Expectations to Drive Momentum within Bristow Group, Royal Caribbean Cruises, Molina Healthcare, Noble Midstream Partners LP, MDU Resources Group, and Insperity — Discovering Underlying Factors of Influence – GlobeNewswire” published on February 21, 2019 as well as ‘s news article titled: “44 Stocks Moving In Tuesday’s Mid-Day Session – Benzinga” with publication date: February 12, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.