American International Group Inc decreased Navient Corp (NAVI) stake by 10% reported in 2018Q3 SEC filing. American International Group Inc sold 53,268 shares as Navient Corp (NAVI)’s stock declined 24.41%. The American International Group Inc holds 479,229 shares with $6.46M value, down from 532,497 last quarter. Navient Corp now has $3.08B valuation. The stock increased 0.97% or $0.12 during the last trading session, reaching $12.44. About 1.58 million shares traded. Navient Corporation (NASDAQ:NAVI) has declined 19.95% since February 24, 2018 and is downtrending. It has underperformed by 19.95% the S&P500. Some Historical NAVI News: 21/05/2018 – Navient Forms Golden Cross: Technicals; 29/03/2018 – Navient Foundation supports YMCA of Delaware’s Black Achievers Program annual college tour; 04/04/2018 – CANYON CAPITAL ADVISORS SAYS INTEND TO DISCUSS POTENTIAL DIRECTOR NOMINEES WITH NAVIENT’S MANAGEMENT & BOARD; 09/05/2018 – S&PGR Asgns Navient Private Edu Ln Tr 2018-B Nts Prlm Rtgs; 22/03/2018 – Moody’s Affirms Navient’s Ba3 Senior Unsecured Debt Rating; Outlook Stable; 24/04/2018 – NAVIENT CORP QTRLY CORE SHR $0.40; 16/05/2018 – Navient Presenting at Barclays Conference May 22; 04/04/2018 – CANYON CAPITAL ADVISORS SAYS ENGAGED IN DISCUSSIONS WITH NAVIENT’S BOARD REGARDING STRATEGY, STRATEGIC TRANSACTIONS, AMONG OTHERS; 09/04/2018 – NAVIENT AMENDS BYLAWS TO IMPLEMENT PROXY ACCESS; 22/03/2018 – NAVIENT OUTLOOK STABLE BY MOODY’S

PANDA GREEN ENERGY GROUP LTD ORDINARY SH (OTCMKTS:PVLTF) had a decrease of 24.05% in short interest. PVLTF’s SI was 10.42M shares in February as released by FINRA. Its down 24.05% from 13.72 million shares previously. It closed at $0.04 lastly. It is down 0.00% since February 24, 2018 and is . It has by 0.00% the S&P500.

Panda Green Energy Group Limited, an investment holding company, engages in the investment, development, operation, and management of solar power plants in the PeopleÂ’s Republic of China. The company has market cap of $. As of December 31, 2016, the firm owned 31 solar power plants with an aggregate installed capacity of 1,291.4 MW in 13 provinces, municipalities, and autonomous regions. It currently has negative earnings. It is also involved in the design and installation of solar power systems; and research and development of solar power products and solar technology.

More notable recent Navient Corporation (NASDAQ:NAVI) news were published by: Nasdaq.com which released: “Financial Sector Update for 02/21/2019: NAVI,FOCS,EFX,GDOT – Nasdaq” on February 21, 2019, also Nasdaq.com with their article: “Financial Sector Update for 02/19/2019: UNIT,NAVI,UE – Nasdaq” published on February 19, 2019, Nasdaq.com published: “Financial Sector Update for 02/19/2019: NAVI, DB, BCS, JPM, WFC, BAC, C, USB – Nasdaq” on February 19, 2019. More interesting news about Navient Corporation (NASDAQ:NAVI) were released by: Seekingalpha.com and their article: “Navient rejects “expression of interest” from Canyon and Platinum – Seeking Alpha” published on February 18, 2019 as well as Seekingalpha.com‘s news article titled: “Navient rejects “expression of interest” from Canyon and Plantinum – Seeking Alpha” with publication date: February 18, 2019.

Investors sentiment decreased to 0.72 in Q3 2018. Its down 0.18, from 0.9 in 2018Q2. It worsened, as 24 investors sold NAVI shares while 115 reduced holdings. 38 funds opened positions while 62 raised stakes. 234.29 million shares or 1.53% less from 237.94 million shares in 2018Q2 were reported. Moreover, Amp Cap Invsts has 0% invested in Navient Corporation (NASDAQ:NAVI). Ameritas Invest Ptnrs has 0.04% invested in Navient Corporation (NASDAQ:NAVI) for 69,593 shares. Parametric Port Associate Limited Com, Washington-based fund reported 2.32M shares. California State Teachers Retirement System holds 0.01% of its portfolio in Navient Corporation (NASDAQ:NAVI) for 459,503 shares. California Employees Retirement System accumulated 803,211 shares or 0.01% of the stock. 298,418 were accumulated by Commonwealth National Bank & Trust Of Australia. North Star Corporation invested in 400 shares or 0% of the stock. Tiaa Cref Mgmt Ltd Liability Com stated it has 0.01% of its portfolio in Navient Corporation (NASDAQ:NAVI). Omers Administration accumulated 56,700 shares. The Colorado-based Institute For Wealth Mngmt Limited Com has invested 0.1% in Navient Corporation (NASDAQ:NAVI). Ent Ser invested in 113 shares. Oppenheimer Asset Management Incorporated owns 22,038 shares for 0.01% of their portfolio. Cadence Cap Mngmt Ltd Liability Corp accumulated 0.03% or 35,339 shares. The Connecticut-based Point72 Asset Mgmt Limited Partnership has invested 0.02% in Navient Corporation (NASDAQ:NAVI). Assetmark Inc holds 13,772 shares.

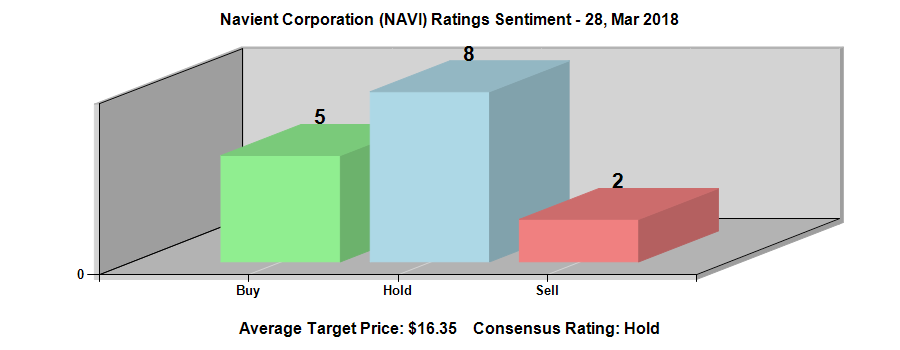

Among 2 analysts covering Navient (NASDAQ:NAVI), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Navient had 2 analyst reports since October 25, 2018 according to SRatingsIntel. On Wednesday, January 16 the stock rating was upgraded by JP Morgan to “Neutral”. The rating was maintained by Citigroup on Thursday, October 25 with “Buy”.

American International Group Inc increased Tyler Technologies Inc (NYSE:TYL) stake by 6,868 shares to 78,779 valued at $19.31M in 2018Q3. It also upped Whirlpool Corp (NYSE:WHR) stake by 9,878 shares and now owns 36,951 shares. Metlife Inc (NYSE:MET) was raised too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.