EU: In a report revealed to investors on Friday morning, Citigroup maintained their Hold rating on shares of Roku Inc (ROKU). They currently have a $53 TP on the company. Citigroup’s target would suggest a potential downside of -15.69% from the company’s current price.

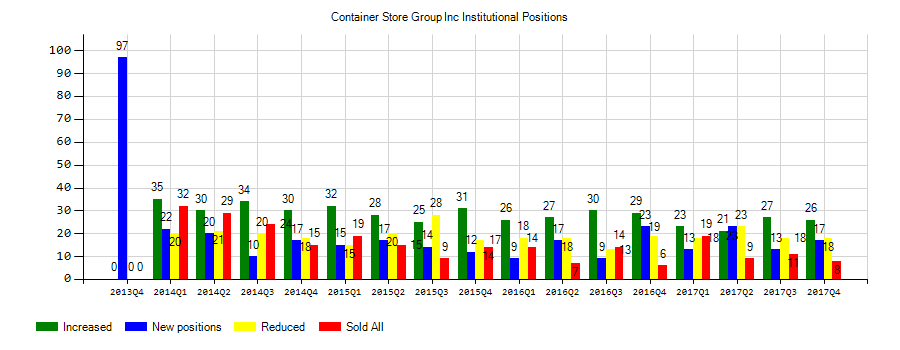

Container Store Group Inc (TCS) investors sentiment increased to 1.66 in 2018 Q3. It’s up 0.35, from 1.31 in 2018Q2. The ratio is more positive, as 48 active investment managers started new and increased equity positions, while 29 sold and trimmed stock positions in Container Store Group Inc. The active investment managers in our database now possess: 38.41 million shares, up from 36.87 million shares in 2018Q2. Also, the number of active investment managers holding Container Store Group Inc in top ten equity positions was flat from 1 to 1 for the same number . Sold All: 10 Reduced: 19 Increased: 25 New Position: 23.

Leonard Green & Partners L.P. holds 17.67% of its portfolio in The Container Store Group, Inc. for 27.51 million shares. Rutabaga Capital Management Llc Ma owns 594,848 shares or 1.51% of their US portfolio. Moreover, Eam Investors Llc has 0.19% invested in the company for 114,174 shares. The New York-based Spark Investment Management Llc has invested 0.19% in the stock. Driehaus Capital Management Llc, a Illinois-based fund reported 272,807 shares.

More notable recent The Container Store Group, Inc. (NYSE:TCS) news were published by: Fool.com which released: “Why The Container Store Stock Surged 50% in January – Motley Fool” on February 04, 2019, also Seekingalpha.com with their article: “The Container Store Group, Inc. (TCS) CEO Melissa Reiff on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” published on February 05, 2019, Nasdaq.com published: “Mid-Afternoon Market Update: Container Store Drops On Earnings Miss; MacroGenics Shares Climb – Nasdaq” on February 06, 2019. More interesting news about The Container Store Group, Inc. (NYSE:TCS) were released by: Seekingalpha.com and their article: “Navios Maritime Partners LP: NMCI Earnings Disappoint – Seeking Alpha” published on February 21, 2019 as well as Nasdaq.com‘s news article titled: “Mid-Day Market Update: Snap Surges After Strong Q4 Results; Arlo Technologies Shares Slide – Nasdaq” with publication date: February 06, 2019.

The Container Store Group, Inc. engages in the retailing of storage and organization products and solutions in the United States. The company has market cap of $322.33 million. The firm operates through two divisions, The Container Store and Elfa. It has a 59.91 P/E ratio. The Company’s retail stores provide various lifestyle products, including bath, box, closets, collections, containers, gift packaging, hooks, kitchen, laundry, office, shelving, storage, trash, and travel, as well as elfa branded products.

The stock decreased 0.75% or $0.05 during the last trading session, reaching $6.59. About 111,653 shares traded. The Container Store Group, Inc. (TCS) has declined 18.78% since February 22, 2018 and is downtrending. It has underperformed by 18.78% the S&P500. Some Historical TCS News: 22/05/2018 – CONTAINER STORE GROUP – ISSUES FISCAL 2018 OUTLOOK FOR COMPARABLE STORE SALES OF FLAT TO UP 1%; 21/04/2018 – DJ The Container Store Group Inc, Inst Holders, 1Q 2018 (TCS); 05/04/2018 – Mizco International Recalls Power Bank Charging Stations Due to Fire and Burn Hazards; Sold at The Container Store; 22/05/2018 – CONTAINER STORE 4Q EPS 18C; 22/05/2018 – Container Store Group Sees FY Adj EPS 35c-Adj EPS 45c; 22/05/2018 – Container Store Group Sees FY EPS 27c-EPS 37c; 05/04/2018 – CPSC: MIZCO SOLD RECALLED CHARGING STATIONS AT CONTAINER STORE; 16/03/2018 Container Store Forms Golden Cross: Technicals; 22/05/2018 – CONTAINER STORE GROUP SEES 2018 GAAP EPS OF $0.27 TO $0.37 AND ADJ EPS OF $0.35 TO $0.45; 22/05/2018 – Container Store Group 4Q Loss/Shr 1c

Roku, Inc. primarily operates a TV streaming platform. The company has market cap of $6.86 billion. The Company’s platform allows users to discover and access a range of movies and TV episodes, as well as live sports, music, news, and others. It currently has negative earnings. As of June 30, 2017, the firm had approximately 13.3 million subscribers.

More notable recent Roku, Inc. (NASDAQ:ROKU) news were published by: which released: “3 Analysts React To Roku (NASDAQ:ROKU) Earnings – Benzinga” on February 22, 2019, also Nasdaq.com with their article: “ROKU Q4 Earnings Beat Estimates, Active Accounts Jump Y/Y – Nasdaq” published on February 22, 2019, Nasdaq.com published: “Roku (ROKU) Beats Q4 Earnings and Revenue Estimates – Nasdaq” on February 21, 2019. More interesting news about Roku, Inc. (NASDAQ:ROKU) were released by: Nasdaq.com and their article: “ROKU April 5th Options Begin Trading – Nasdaq” published on February 21, 2019 as well as Seekingalpha.com‘s news article titled: “Roku Q4 2018 Earnings Preview – Seeking Alpha” with publication date: February 20, 2019.

The stock increased 22.11% or $11.38 during the last trading session, reaching $62.86. About 37.00 million shares traded or 240.83% up from the average. Roku, Inc. (ROKU) has declined 12.51% since February 22, 2018 and is downtrending. It has underperformed by 12.51% the S&P500. Some Historical ROKU News: 09/05/2018 – Roku Sees FY18 Rev $685M-$705M; 16/04/2018 – POINT72 ASSET MANAGEMENT, L.P. REPORTS 5.1 PCT PASSIVE STAKE IN ROKU INC AS OF APRIL 13 – SEC FILING; 24/05/2018 – Roku: Mai Fyfield Elected to Roku Bd of Directors; 09/05/2018 – ROKU INC – QTRLY TOTAL NET REVENUE UP 36% YOY TO $136.6 MILLION; 04/04/2018 – ROKU INC – SANYO ROKU TVS EXPECTED TO BE AVAILABLE SOON IN CANADA; 16/03/2018 – ROKU – CO, HAYU LAUNCH OF ALL REALITY STREAMING SERVICE ON ROKU STREAMING PLAYERS IN UK; 24/05/2018 – Roku: Fyfield Served as a Roku Board Observer From 2014 Until the Company’s IPO in 2017; 25/05/2018 – Citron Changes our Position on ROKU; 16/04/2018 – ROKU INC – ESPN+ IS AVAILABLE THROUGH ESPN CHANNEL IN ROKU CHANNEL STORE; 16/04/2018 – POINT72 ASSET MANAGEMENT REPORTS PASSIVE ROKU STAKE

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.