KILLIAM APT REAL ESTATE INVT TR UNIT CA (OTCMKTS:KMMPF) had a decrease of 72.7% in short interest. KMMPF’s SI was 8,300 shares in February as released by FINRA. Its down 72.7% from 30,400 shares previously. With 100 avg volume, 83 days are for KILLIAM APT REAL ESTATE INVT TR UNIT CA (OTCMKTS:KMMPF)’s short sellers to cover KMMPF’s short positions. The stock decreased 0.21% or $0.03 during the last trading session, reaching $13.59. About 14,000 shares traded or 4066.67% up from the average. Killam Apartment REIT (OTCMKTS:KMMPF) has 0.00% since February 22, 2018 and is . It has by 0.00% the S&P500.

The stock of Aerohive Networks, Inc. (NYSE:HIVE) hit a new 52-week high and has $4.98 target or 5.00% above today’s $4.74 share price. The 6 months bullish chart indicates low risk for the $263.43M company. The 1-year high was reported on Feb, 22 by . If the $4.98 price target is reached, the company will be worth $13.17 million more. The stock decreased 1.01% or $0.0483 during the last trading session, reaching $4.7417. About 373,648 shares traded or 32.07% up from the average. Aerohive Networks, Inc. (NYSE:HIVE) has declined 35.41% since February 22, 2018 and is downtrending. It has underperformed by 35.41% the S&P500. Some Historical HIVE News: 25/05/2018 – Aerohive® Announces GDPR Readiness of Its Public, Private, and Portable Cloud Networking Architecture and HiveManager® Network Management Application; 16/03/2018 – Glancy Prongay & Murray LLP Reminds Investors of the March 20, 2018 Deadline in the Class Action Lawsuit Against Aerohive; 02/05/2018 – Aerohive Networks 1Q Rev $35.8M; 10/05/2018 – AEROHIVE® SENIOR DIRECTOR OF GLOBAL TALENT ACQUISITION APPOINTED TO FORBES HUMAN RESOURCES COUNCIL; 30/04/2018 – Aerohive® to Showcase Latest Innovations at Dell Technologies World; 12/04/2018 – Aerohive® Helps Customers Look Forward by Looking Back with Historical Comparative Analytics; 02/04/2018 – Aerohive® Given 5-Star Rating in CRN’s 2018 Partner Program Guide; 21/05/2018 – Nutreco Boosts Global Operations and Innovation with Cloud Networking from Aerohive®; 04/04/2018 – The lndustry’s First Enterprise-Class Pluggable Access Points Now Shipping; 04/04/2018 – The Industry’s First Enterprise-Class Pluggable Access Points Now Shipping

Killam Apartment Real Estate Investment Trust is a real estate investment trust. The company has market cap of $1.23 billion.

More notable recent Killam Apartment REIT (OTCMKTS:KMMPF) news were published by: Investorplace.com which released: “3 REITs That Will Soar on Rising Interest Rates – Investorplace.com” on November 14, 2017, also Seekingalpha.com with their article: “Northview Apartment REIT: Favorable Outlook In 2019 – Seeking Alpha” published on November 20, 2018, Seekingalpha.com published: “Investing In Canadian Rentals With Northview Apartment- Monthly 6.3% Yield, Upside, And Diversification – Seeking Alpha” on December 10, 2018. More interesting news about Killam Apartment REIT (OTCMKTS:KMMPF) were released by: Seekingalpha.com and their article: “Northview Apartment REIT: Will Its Growth Momentum Continue In 2018? – Seeking Alpha” published on June 17, 2018 as well as Seekingalpha.com‘s news article titled: “Northview Apartment: Attractive 6.4% Dividend And Trading At A Significant Discount – Seeking Alpha” with publication date: March 02, 2018.

More notable recent Aerohive Networks, Inc. (NYSE:HIVE) news were published by: Seekingalpha.com which released: “Subscription growth a bright spot in mixed Aerohive quarter – Seeking Alpha” on February 06, 2019, also Seekingalpha.com with their article: “Aerohive Networks’ (HIVE) CEO David Flynn on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” published on February 06, 2019, Globenewswire.com published: “Market Trends Toward New Normal in Unisys, First Data, LPL Financial, Aerohive Networks, Torchmark, and Heidrick & Struggles International — Emerging Consolidated Expectations, Analyst Ratings – GlobeNewswire” on February 14, 2019. More interesting news about Aerohive Networks, Inc. (NYSE:HIVE) were released by: Businesswire.com and their article: “Aerohive Networksâ„¢ Vice President of Americas Sales Ron Gill, and Vice President of Channels and Strategic Partnerships Ben Moebes Recognized as 2019 CRN® Channel Chiefs – Business Wire” published on February 12, 2019 as well as Zacks.com‘s news article titled: “Analysts Estimate Aerohive Networks (HIVE) to Report a Decline in Earnings: What to Look Out for – Zacks.com” with publication date: January 30, 2019.

Aerohive Networks, Inc., together with its subsidiaries, creates and develops cloud networking and enterprise Wi-Fi solutions in Americas, Europe, the Middle East and Africa, and the Asia Pacific. The company has market cap of $263.43 million. The firm provides hardware products, such as wireless access points, branch routers, and switches; tiered maintenance and support services comprising technical support, bug fixes, access to priority hardware replacement service, and unspecified upgrades; and Software as a Service subscriptions, including comparable maintenance and support services. It currently has negative earnings. The Company’s cloud product comprises HiveManager, a network management application; and Mobility Suite, which includes guest access, personal device access, ID manager, and social login applications.

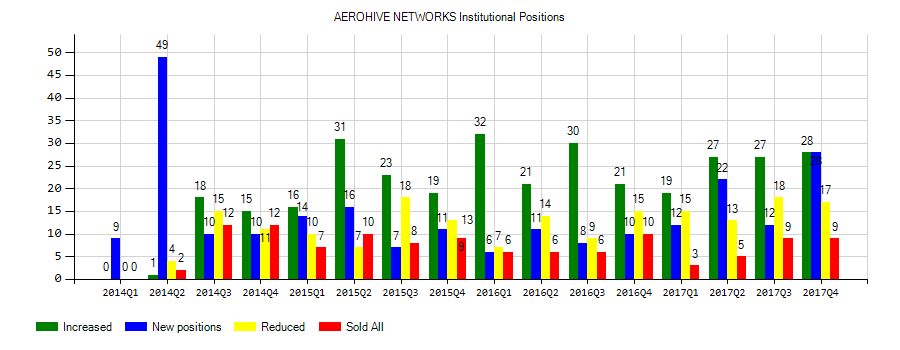

Investors sentiment increased to 1.6 in Q3 2018. Its up 0.05, from 1.55 in 2018Q2. It increased, as 9 investors sold Aerohive Networks, Inc. shares while 21 reduced holdings. 19 funds opened positions while 29 raised stakes. 25.40 million shares or 17.06% more from 21.69 million shares in 2018Q2 were reported. Stone Ridge Asset Mngmt Limited Liability Corporation, a New York-based fund reported 52,504 shares. Jasper Ridge Prtnrs L P has 12,362 shares for 0% of their portfolio. Bnp Paribas Arbitrage reported 1,055 shares or 0% of all its holdings. Moreover, Gsa Prtn Ltd Liability Partnership has 0.03% invested in Aerohive Networks, Inc. (NYSE:HIVE) for 151,000 shares. State Treasurer State Of Michigan reported 0.01% of its portfolio in Aerohive Networks, Inc. (NYSE:HIVE). Geode Management Ltd Liability Co holds 0% of its portfolio in Aerohive Networks, Inc. (NYSE:HIVE) for 474,034 shares. D E Shaw And Company holds 0% of its portfolio in Aerohive Networks, Inc. (NYSE:HIVE) for 694,159 shares. 18,178 are owned by Alpinvest Partners Bv. Fmr Limited Liability Com has invested 0% in Aerohive Networks, Inc. (NYSE:HIVE). Bank Of America De reported 288,143 shares or 0% of all its holdings. Tiaa Cref Invest Ltd Company, a New York-based fund reported 303,234 shares. Barclays Public Limited Company holds 0% of its portfolio in Aerohive Networks, Inc. (NYSE:HIVE) for 25,116 shares. Arrowstreet Capital Ltd Partnership stated it has 0% of its portfolio in Aerohive Networks, Inc. (NYSE:HIVE). 190,900 are owned by California Employees Retirement. Boston Prns has invested 0% in Aerohive Networks, Inc. (NYSE:HIVE).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.