Analysts expect Franco-Nevada Corporation (TSE:FNV) to report $0.35 EPS on March, 6.They anticipate $0.01 EPS change or 2.78% from last quarter’s $0.36 EPS. T_FNV’s profit would be $65.47M giving it 73.64 P/E if the $0.35 EPS is correct. After having $0.38 EPS previously, Franco-Nevada Corporation’s analysts see -7.89% EPS growth. The stock increased 1.95% or $1.97 during the last trading session, reaching $103.09. About 109,546 shares traded. Franco-Nevada Corporation (TSE:FNV) has 0.00% since February 19, 2018 and is . It has by 0.00% the S&P500. Some Historical FNV News: 07/03/2018 – Franco-Nevada 4Q EPS 23c; 15/05/2018 – Odey Asset Adds Finish Line, Exits Franco-Nevada: 13F; 29/05/2018 – FRANCO NEVADA FILES $2B MIXED SECURITES SHELF; 07/03/2018 – Franco-Nevada 4Q Rev $167.2M; 07/03/2018 – FRANCO-NEVADA SEES FY ROYALTY, STREAM PRODUCTION 460K-490K GEOS; 07/03/2018 – FRANCO-NEVADA CORP QTRLY ADJ SHR $0.28; 09/05/2018 – FRANCO-NEVADA CORP – QTRLY ADJ SHR $0.34; 07/03/2018 – Franco-Nevada 4Q Net $43.5M; 07/03/2018 – Franco-Nevada Sees $50M-$60M Revenue From Oil, Gas Assets in 2018; 09/05/2018 – Franco-Nevada 1Q Rev $173.1M

Among 3 analysts covering QTS Realty Trust (NYSE:QTS), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. QTS Realty Trust had 4 analyst reports since September 20, 2018 according to SRatingsIntel. Guggenheim upgraded it to “Buy” rating and $46 target in Wednesday, October 31 report. The stock of QTS Realty Trust, Inc. (NYSE:QTS) has “Outperform” rating given on Wednesday, October 31 by BMO Capital Markets. Berenberg upgraded QTS Realty Trust, Inc. (NYSE:QTS) on Wednesday, October 24 to “Buy” rating. See QTS Realty Trust, Inc. (NYSE:QTS) latest ratings:

31/10/2018 Broker: BMO Capital Markets Old Rating: Outperform New Rating: Outperform Old Target: $51 New Target: $48 Maintain

31/10/2018 Broker: Guggenheim Old Rating: Neutral New Rating: Buy Old Target: $45 New Target: $46 Upgrade

24/10/2018 Broker: Berenberg Old Rating: Hold New Rating: Buy New Target: $52 Upgrade

20/09/2018 Broker: Berenberg Rating: Hold New Target: $50 Initiates Coverage On

More notable recent Franco-Nevada Corporation (TSE:FNV) news were published by: Seekingalpha.com which released: “Streaming/Royalty Sector Review: Abitibi Shares Rally Amid Canadian Malartic Royalty – Seeking Alpha” on February 19, 2019, also Seekingalpha.com with their article: “Franco-Nevada expects 2018 production within guidance – Seeking Alpha” published on February 07, 2019, Fool.com published: “8 Reasons I Just Bought Franco-Nevada Corporation Stock – The Motley Fool” on January 29, 2019. More interesting news about Franco-Nevada Corporation (TSE:FNV) were released by: Gurufocus.com and their article: “Profit From a Rising Gold Price – GuruFocus.com” published on February 08, 2019 as well as Zacks.com‘s news article titled: “Here’s Why Momentum Investors Will Love Franco-Nevada (FNV) – Zacks.com” with publication date: February 07, 2019.

Franco-Nevada Corporation operates as a gold-focused royalty and stream firm in the United States, Canada, Mexico, Peru, Chile, and Africa. The company has market cap of $19.28 billion. The firm also has interests in silver; platinum group metals, including palladium; other minerals, including base metals, iron ore, coal, and industrial and miscellaneous minerals; and gas and oil properties. It has a 90.35 P/E ratio. As of March 21, 2017, it had a portfolio of 259 mineral assets and 80 gas and oil assets.

QTS Realty Trust, Inc. focuses on the ownership, development, and operation of carrier-neutral data centers in the United States. The company has market cap of $2.58 billion.

The stock increased 0.22% or $0.1 during the last trading session, reaching $44.55. About 181,461 shares traded. QTS Realty Trust, Inc. (NYSE:QTS) has declined 24.69% since February 19, 2018 and is downtrending. It has underperformed by 24.69% the S&P500. Some Historical QTS News: 24/04/2018 – QTS Enters Cloud and Managed Services Partnership with GDT; Will Release First Quarter 2018 Earnings Before Market Open on Apri; 31/05/2018 – QTS Partners with Relus Cloud to Expand Support for AWS and Multi-Cloud Management Solutions; 17/05/2018 – QTS Welcomes Passage of Georgia Tax Incentive Legislation for Data Centers; 07/05/2018 – LAND & BUILDINGS INVESTMENT MANAGEMENT – COMMENTED ON VOTING RESULTS OF 2018 ANNUAL MEETING OF STOCKHOLDERS OF QTS REALTY TRUST; 24/04/2018 – QTS Enters Cloud and Managed Services Partnership With GDT; 20/04/2018 – LAND & BUILDINGS SAYS ISS CONCLUDED QTS REALTY TRUST SHAREHOLDERS SHOULD VOTE WITHHOLD ON WILLIAM GRABE, CHAIRMAN OF COMPENSATION COMMITTEE; 25/04/2018 – QTS REALTY SEES FY ADJ EBITDA $218M TO $228M, EST. $216.0M; 24/04/2018 – QTS REALTY TRUST – GDT TO PAY CO RECURRING PARTNER CHANNEL FEE BASED ON REVENUE THAT IS TRANSITIONED, FUTURE GROWTH ON THOSE ACCOUNTS; 30/04/2018 – Land & Buildings: QTS Board Should Be Focused on Separate Chmn and CEO Roles; 24/04/2018 – QTS SEES PACT BACKING REV GROWTH, PROFITABILITY STARTING IN ’19

Since August 29, 2018, it had 1 insider purchase, and 1 insider sale for $596,490 activity. 17,500 shares valued at $685,475 were bought by Williams Chad L. on Friday, November 2. Westhead Stephen E. had sold 1,924 shares worth $88,985.

More notable recent QTS Realty Trust, Inc. (NYSE:QTS) news were published by: Prnewswire.com which released: “QTS Recognized by CRN® for Channel Leadership – PRNewswire” on February 12, 2019, also Prnewswire.com with their article: “Cloudalize Chooses QTS Piscataway Data Center for Global Expansion – PRNewswire” published on January 23, 2019, Seekingalpha.com published: “REITs Offering Value With Brad Thomas (Podcast) – Seeking Alpha” on January 23, 2019. More interesting news about QTS Realty Trust, Inc. (NYSE:QTS) were released by: Seekingalpha.com and their article: “QTS Realty Trust: This 6.50% Fixed-Rate Convertible Perpetual Preferred Stock Has Begun Trading On The NYSE – Seeking Alpha” published on July 02, 2018 as well as Seekingalpha.com‘s news article titled: “Top 2019 Communications Sector Pick: ‘Strong Buy’ QTS Has 40% Upside – Seeking Alpha” with publication date: January 09, 2019.

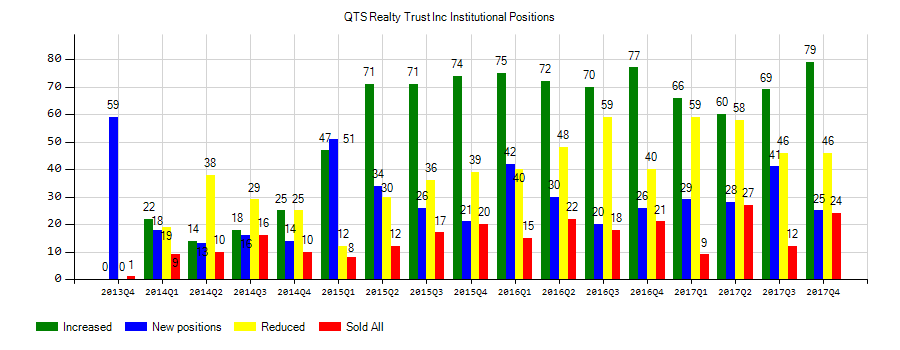

Investors sentiment decreased to 1.29 in 2018 Q3. Its down 0.75, from 2.04 in 2018Q2. It dropped, as 18 investors sold QTS Realty Trust, Inc. shares while 55 reduced holdings. 28 funds opened positions while 66 raised stakes. 49.98 million shares or 2.88% more from 48.58 million shares in 2018Q2 were reported. Sg Americas Secs Limited Com owns 0.01% invested in QTS Realty Trust, Inc. (NYSE:QTS) for 32,427 shares. Granahan Investment Mngmt Ma reported 0.28% of its portfolio in QTS Realty Trust, Inc. (NYSE:QTS). State Of Alaska Department Of Revenue has 16,309 shares. First Quadrant L P Ca owns 474 shares. 682,396 are owned by Schwab Charles Investment Mgmt Inc. State Street stated it has 1.74 million shares or 0.01% of all its holdings. 13,165 are held by Etrade Mngmt Limited Com. Moreover, Wellington Mgmt Group Inc Ltd Liability Partnership has 0% invested in QTS Realty Trust, Inc. (NYSE:QTS). Citadel Advsrs Limited Com, Illinois-based fund reported 584,087 shares. Howe And Rusling has 0% invested in QTS Realty Trust, Inc. (NYSE:QTS) for 265 shares. Amalgamated Financial Bank holds 0.01% of its portfolio in QTS Realty Trust, Inc. (NYSE:QTS) for 5,096 shares. Exane Derivatives accumulated 1 shares. Indexiq Advsrs Limited Com stated it has 44,825 shares. Metropolitan Life Com New York reported 6,304 shares. V3 Cap Mngmt Ltd Partnership owns 3.84% invested in QTS Realty Trust, Inc. (NYSE:QTS) for 414,950 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.