Mairs & Power Inc decreased its stake in Baxter International (BAX) by 1.74% based on its latest 2018Q3 regulatory filing with the SEC. Mairs & Power Inc sold 12,887 shares as the company’s stock declined 12.57% with the market. The institutional investor held 729,609 shares of the medical and dental instruments company at the end of 2018Q3, valued at $56.25M, down from 742,496 at the end of the previous reported quarter. Mairs & Power Inc who had been investing in Baxter International for a number of months, seems to be less bullish one the $39.08B market cap company. The stock increased 1.37% or $0.99 during the last trading session, reaching $73.43. About 2.37M shares traded. Baxter International Inc. (NYSE:BAX) has risen 3.09% since February 17, 2018 and is uptrending. It has outperformed by 3.09% the S&P500. Some Historical BAX News: 29/03/2018 – Moody’s Upgrades Baxter International To Baa1 From Baa2, Stable Outlook; 22/05/2018 – BAXTER CEO: LOOKING AT ADVANCED SURGERY, MEDICAL MANAGEMENT; 22/05/2018 – BAXTER CEO: BALANCE SHEET ALLOWS FOR TUCK-IN ACQUISITIONS; 26/04/2018 – BAXTER INTERNATIONAL INC BAX.N SEES FY 2018 GAAP SHR $2.49 TO $2.62; 22/05/2018 – Baxter to Grow Six Percent by 2023 Says CEO (Video); 26/04/2018 – BAXTER INTERNATIONAL INC BAX.N FY2018 SHR VIEW $2.78, REV VIEW $11.25 BLN — THOMSON REUTERS l/B/E/S; 21/03/2018 – FDA: New Drug Application (NDA): 016677 Company: BAXTER HLTHCARE; 08/05/2018 – BAXTER BOOSTS QTR DIV TO 19C/SHR FROM 16C, EST. 19.5C; 26/04/2018 – Global Dialysis Market 2018 Forecast to 2022 – Key Players are Fresenius Medical Care, DaVita, Baxter and B. Braun – ResearchAndMarkets.com; 29/03/2018 – MOODY’S UPGRADES BAXTER INTL TO Baa1 FROM Baa2, STABLE OUTLOOK

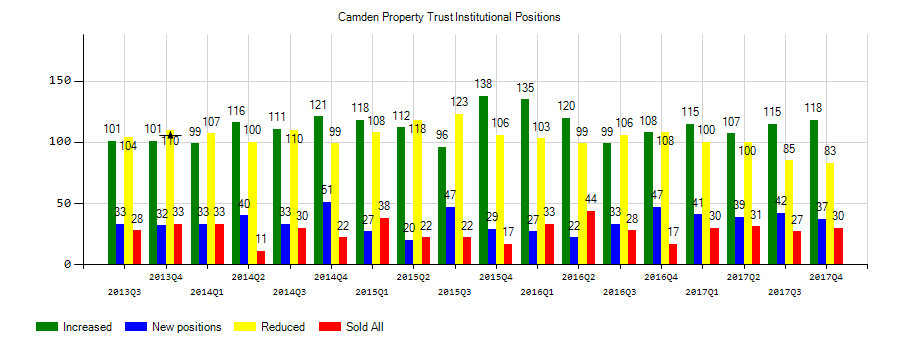

Chilton Capital Management Llc decreased its stake in Camden Ppty Tr (CPT) by 5.22% based on its latest 2018Q3 regulatory filing with the SEC. Chilton Capital Management Llc sold 11,438 shares as the company’s stock declined 1.45% with the market. The institutional investor held 207,510 shares of the real estate investment trusts company at the end of 2018Q3, valued at $19.42M, down from 218,948 at the end of the previous reported quarter. Chilton Capital Management Llc who had been investing in Camden Ppty Tr for a number of months, seems to be less bullish one the $9.61 billion market cap company. The stock increased 0.09% or $0.09 during the last trading session, reaching $98.7. About 522,464 shares traded. Camden Property Trust (NYSE:CPT) has risen 1.22% since February 17, 2018 and is uptrending. It has outperformed by 1.22% the S&P500. Some Historical CPT News: 24/05/2018 – CPT DRIVES AND POWER PCL CPT.BK – ACKNOWLEDGES RESIGNATION OF CHAROONG SUPANPONG, THE CHAIRMAN OF BOARD; 03/05/2018 – Camden Property Trust 1Q EPS 41c; 09/04/2018 – CPT TECHNOLOGY 000536.SZ SAYS MARCH CONSOLIDATED REVENUE AT 337.8 MLN YUAN; 10/04/2018 – ClinicalTrial US: A Study of Systemic Chemotherapy With CPT-11 Plus HAI (FUDR+L-OHP) in Patients With Initially Unresectable; 16/03/2018 – DIGNITANA INITIATES ACTION WITH AMERICAN MEDICAL ASSOCIATION TO ADD CPT® CODES FOR INSURANCE COVERAGE OF FDA-CLEARED SCALP COOLING MEDICAL DEVICES

Since August 15, 2018, it had 0 buys, and 6 selling transactions for $15.93 million activity. The insider CAMPO RICHARD J sold $5.97 million. $202,790 worth of Camden Property Trust (NYSE:CPT) was sold by MCGUIRE WILLIAM B on Tuesday, October 30. 63,000 shares were sold by ODEN D KEITH, worth $5.97M. Gallagher Michael P sold 1,841 shares worth $173,754. $915,257 worth of Camden Property Trust (NYSE:CPT) shares were sold by Jessett Alexander J.. $1.01M worth of Camden Property Trust (NYSE:CPT) shares were sold by PAULSEN WILLIAM F.

More notable recent Camden Property Trust (NYSE:CPT) news were published by: Streetinsider.com which released: “Barclays Downgrades Apartment Investment Management (AIV) to Equalweight – StreetInsider.com” on February 04, 2019, also Seekingalpha.com with their article: “Camden Property Trust’s (CPT) CEO Ric Campo on Q2 2018 Results – Earnings Call Transcript – Seeking Alpha” published on August 04, 2018, published: “7 Biggest Price Target Changes For Monday – Benzinga” on February 04, 2019. More interesting news about Camden Property Trust (NYSE:CPT) were released by: Globenewswire.com and their article: “New Research Coverage Highlights Camden Property Trust, The Western Union, MINDBODY, Balchem, TransMontaigne Partners, and Cubic — Consolidated Revenues, Company Growth, and Expectations for 2019 – GlobeNewswire” published on January 23, 2019 as well as Seekingalpha.com‘s news article titled: “Camden Property Trust declares $0.80 dividend – Seeking Alpha” with publication date: January 31, 2019.

Chilton Capital Management Llc, which manages about $1.18B and $1.21 billion US Long portfolio, upped its stake in Cisco Sys Inc (NASDAQ:CSCO) by 36,754 shares to 242,235 shares, valued at $11.79 million in 2018Q3, according to the filing. It also increased its holding in Invesco Exchng Traded Fd Tr by 10,970 shares in the quarter, for a total of 53,938 shares, and has risen its stake in Ishares Inc (IEMG).

Investors sentiment increased to 1.13 in Q3 2018. Its up 0.07, from 1.06 in 2018Q2. It is positive, as 23 investors sold CPT shares while 102 reduced holdings. 38 funds opened positions while 103 raised stakes. 82.60 million shares or 0.32% more from 82.33 million shares in 2018Q2 were reported. Pub Employees Retirement System Of Ohio accumulated 167,850 shares. Picton Mahoney Asset Management invested in 1.15% or 175,200 shares. National Bank & Trust Of America De holds 331,720 shares. Rhumbline Advisers holds 0.03% or 175,004 shares in its portfolio. Fil holds 0.02% in Camden Property Trust (NYSE:CPT) or 155,233 shares. Gsa Cap Partners Llp accumulated 19,406 shares or 0.1% of the stock. 3,625 were reported by Raymond James Fincl Svcs. Cubist Systematic Strategies Limited Liability Company has invested 0.03% in Camden Property Trust (NYSE:CPT). Bancorporation Of New York Mellon reported 0.04% of its portfolio in Camden Property Trust (NYSE:CPT). Lincluden Mgmt Limited stated it has 48,425 shares or 0.38% of all its holdings. Profund Advsr Ltd Llc invested 0.05% in Camden Property Trust (NYSE:CPT). St Johns Inv Mngmt Limited Company invested in 0.01% or 82 shares. Meiji Yasuda Asset Mngmt holds 15,419 shares or 0.12% of its portfolio. Earnest Partners Limited Liability Corp owns 0% invested in Camden Property Trust (NYSE:CPT) for 39 shares. Teachers And Annuity Association Of America accumulated 113,654 shares.

Among 24 analysts covering Camden Property (NYSE:CPT), 16 have Buy rating, 0 Sell and 8 Hold. Therefore 67% are positive. Camden Property had 87 analyst reports since July 21, 2015 according to SRatingsIntel. The firm has “Underperform” rating given on Monday, October 26 by BMO Capital Markets. The stock of Camden Property Trust (NYSE:CPT) earned “Buy” rating by Mizuho on Monday, March 21. The firm has “Neutral” rating by Robert W. Baird given on Wednesday, August 10. Bank of America upgraded the shares of CPT in report on Wednesday, November 23 to “Buy” rating. The stock of Camden Property Trust (NYSE:CPT) has “Outperform” rating given on Friday, November 6 by RBC Capital Markets. On Friday, June 8 the stock rating was maintained by Bank of America with “Buy”. The stock of Camden Property Trust (NYSE:CPT) earned “Buy” rating by BMO Capital Markets on Wednesday, January 24. The firm has “Overweight” rating given on Friday, September 15 by KeyBanc Capital Markets. As per Thursday, February 1, the company rating was maintained by BMO Capital Markets. KeyBanc Capital Markets upgraded Camden Property Trust (NYSE:CPT) on Wednesday, December 16 to “Overweight” rating.

Mairs & Power Inc, which manages about $7.72 billion and $8.59 billion US Long portfolio, upped its stake in Microsoft (NASDAQ:MSFT) by 143,160 shares to 1.30 million shares, valued at $148.74 million in 2018Q3, according to the filing. It also increased its holding in Littelfuse Inc. (NASDAQ:LFUS) by 88,539 shares in the quarter, for a total of 168,889 shares, and has risen its stake in Visa Inc (NYSE:V).

More news for Baxter International Inc. (NYSE:BAX) were recently published by: Globenewswire.com, which released: “Report: Developing Opportunities within Ensco plc, Third Point Reinsurance, Baxter International, Ultrapar Participacoes SA, Endeavour Silver, and Ingles Markets — Future Expectations, Projections Moving into 2019 – GlobeNewswire” on February 04, 2019. Seekingalpha.com‘s article titled: “Baxter Q4 2018 Earnings Preview – Seeking Alpha” and published on January 30, 2019 is yet another important article.

Investors sentiment decreased to 0.84 in Q3 2018. Its down 0.04, from 0.88 in 2018Q2. It worsened, as 43 investors sold BAX shares while 324 reduced holdings. 92 funds opened positions while 218 raised stakes. 422.39 million shares or 1.97% less from 430.86 million shares in 2018Q2 were reported. Moreover, Comerica State Bank has 0.08% invested in Baxter International Inc. (NYSE:BAX). Liberty Mutual Grp Asset Mgmt Inc owns 19,692 shares or 0.03% of their US portfolio. Jpmorgan Chase Com invested 0.02% in Baxter International Inc. (NYSE:BAX). Lodestar Investment Counsel Limited Liability Corp Il invested in 0.13% or 15,339 shares. The Ontario – Canada-based Picton Mahoney Asset Mngmt has invested 0.24% in Baxter International Inc. (NYSE:BAX). The California-based Planning Advisors Ltd Com has invested 0.92% in Baxter International Inc. (NYSE:BAX). Missouri-based Buckingham Asset Mgmt Limited Company has invested 0.04% in Baxter International Inc. (NYSE:BAX). Shelton Cap holds 0.66% or 151,180 shares. Barr E S Communications stated it has 2,648 shares. Wms Limited Liability Corporation invested 0.02% of its portfolio in Baxter International Inc. (NYSE:BAX). Cubic Asset Mngmt Llc holds 0.9% in Baxter International Inc. (NYSE:BAX) or 42,579 shares. Amica Retiree Medical Trust holds 0.19% or 3,040 shares in its portfolio. Motco stated it has 733 shares. Douglass Winthrop Advisors Limited Liability owns 0.02% invested in Baxter International Inc. (NYSE:BAX) for 4,578 shares. Advsrs Asset Mngmt has 0.03% invested in Baxter International Inc. (NYSE:BAX) for 23,038 shares.

Among 22 analysts covering Baxter International (NYSE:BAX), 17 have Buy rating, 0 Sell and 5 Hold. Therefore 77% are positive. Baxter International had 80 analyst reports since July 30, 2015 according to SRatingsIntel. On Tuesday, July 11 the stock rating was upgraded by BMO Capital Markets to “Outperform”. Piper Jaffray upgraded the shares of BAX in report on Thursday, April 14 to “Overweight” rating. Bank of America upgraded Baxter International Inc. (NYSE:BAX) on Tuesday, January 2 to “Buy” rating. The rating was maintained by Credit Suisse with “Neutral” on Monday, April 25. Leerink Swann maintained it with “Outperform” rating and $77 target in Thursday, November 1 report. The stock has “Overweight” rating by Cantor Fitzgerald on Friday, June 30. The firm has “Sector Perform” rating by RBC Capital Markets given on Wednesday, October 26. The firm earned “Equal-Weight” rating on Friday, February 1 by Barclays Capital. The company was maintained on Thursday, October 26 by Morgan Stanley. On Monday, April 30 the stock rating was maintained by Citigroup with “Neutral”.

Since September 17, 2018, it had 0 insider buys, and 9 insider sales for $560.56 million activity. The insider STALLKAMP THOMAS T sold 1,638 shares worth $120,803. The insider Third Point LLC sold $548.96M. 37,274 shares were sold by Mason Jeanne K, worth $2.68M. The insider Eyre Brik V sold $6.03 million. FORSYTH JOHN D also sold $100,530 worth of Baxter International Inc. (NYSE:BAX) on Thursday, December 13. $1.36M worth of Baxter International Inc. (NYSE:BAX) shares were sold by Accogli Giuseppe.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.