Lasalle Investment Management Securities Llc increased its stake in Prologis Inc (PLD) by 2.33% based on its latest 2018Q3 regulatory filing with the SEC. Lasalle Investment Management Securities Llc bought 38,380 shares as the company’s stock declined 0.90% with the market. The institutional investor held 1.69 million shares of the consumer services company at the end of 2018Q3, valued at $114.39M, up from 1.65M at the end of the previous reported quarter. Lasalle Investment Management Securities Llc who had been investing in Prologis Inc for a number of months, seems to be bullish on the $46.99B market cap company. The stock increased 0.48% or $0.34 during the last trading session, reaching $71.19. About 2.21 million shares traded. Prologis, Inc. (NYSE:PLD) has risen 0.18% since February 16, 2018 and is uptrending. It has outperformed by 0.18% the S&P500. Some Historical PLD News: 19/03/2018 – Prologis Announces New Independent Director Nominee Cristina Bita; 29/04/2018 – Prologis: Annual Stabilized Core Funds From Operations Expected to Increase 6c-8c Per Shr; 07/03/2018 – FIBRA Prologis Declares Quarterly Distribution; 29/03/2018 – LatinFinanc[Reg]: Fibra Prologis secures five-year loan; 29/04/2018 – DCT Deal Could Be Announced Sun; 17/04/2018 – PROLOGIS BOOSTS FORECAST; 16/04/2018 – Prologis Inc expected to post earnings of 35 cents a share – Earnings Preview; 17/04/2018 – Prologis 1Q Core FFO 80c/Share; 02/05/2018 – Moody’s Places Dct Industrial Trust Ratings On Review For Upgrade Following Prologis’ Announcement To Acquire Dct; 17/04/2018 – PROLOGIS INC – SEES FY2018 SHR $2.50 TO $2.60

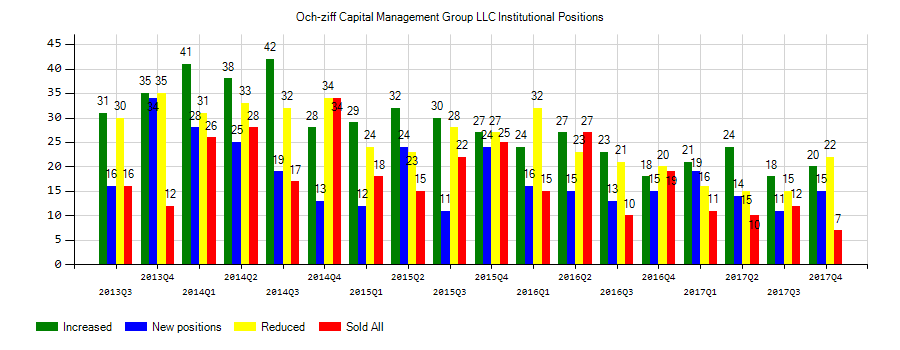

Continental Advisors Llc decreased its stake in Och Ziff Cap Mgmt Group (Call) (OZM) by 92.57% based on its latest 2018Q3 regulatory filing with the SEC. Continental Advisors Llc sold 622,800 shares as the company’s stock declined 14.12% with the market. The hedge fund held 50,000 shares of the investment managers company at the end of 2018Q3, valued at $74,000, down from 672,800 at the end of the previous reported quarter. Continental Advisors Llc who had been investing in Och Ziff Cap Mgmt Group (Call) for a number of months, seems to be less bullish one the $3.75 billion market cap company. The stock decreased 0.45% or $0.06 during the last trading session, reaching $13.3. About 42,443 shares traded. Och-Ziff Capital Management Group LLC (NYSE:OZM) has declined 48.41% since February 16, 2018 and is downtrending. It has underperformed by 48.41% the S&P500. Some Historical OZM News: 02/05/2018 – OCH-ZIFF EST. AUM ABOUT $32.7B AS OF MAY 1, UP $.4B VS APRIL 1; 26/03/2018 – HedgeCo.net: Hot Hedge Fund Coatue Hires Ex-Och-Ziff Executive; 02/05/2018 – OCH-ZIFF 1Q AUM $32.8B; 16/03/2018 – OCH-ZIFF MGMT SHORT POSITION IN ARCADIS: 0.98% VS 0.62%; 02/05/2018 – OCH-ZIFF 1Q NET OUTFLOWS $2.4B; 05/04/2018 – OCH-ZIFF CAPITAL ARRANGES $100M REVOLVING FACILITY; 02/05/2018 – Och-Ziff Capital Mgmt 1Q EPS 2c; 14/03/2018 Och-Ziff to Shutter European Hedge Fund as New CEO Shifts Focus; 17/04/2018 – Och-Ziff’s Haas Departs Hedge Fund Firm to Join Coinbase as CFO; 17/04/2018 – Och-Ziff Management Appoints Thomas M. Sipp Chief Fincl Officer

More notable recent Prologis, Inc. (NYSE:PLD) news were published by: Investorplace.com which released: “3 Big Stock Charts for Wednesday: CenterPoint Energy, Prologis and Mohawk Industries – Investorplace.com” on January 23, 2019, also Seekingalpha.com with their article: “What A SWAN Looks Like: Prologis – Seeking Alpha” published on January 18, 2019, published: “Earnings Scheduled For January 22, 2019 – Benzinga” on January 22, 2019. More interesting news about Prologis, Inc. (NYSE:PLD) were released by: and their article: “Jones Lang LaSalle Incorporated (NYSE:JLL), Prologis (NYSE:PLD) – Prologis Injects Some Cautious Prudence Amid Strong 2018 Results – Benzinga” published on January 23, 2019 as well as ‘s news article titled: “Prologis (NYSE:PLD) – “Not Your Grandfather’s Warehouse”: Prologis Workforce Initiative Takes Aim At Labor Shortage – Benzinga” with publication date: January 22, 2019.

Among 26 analysts covering Prologis (NYSE:PLD), 19 have Buy rating, 1 Sell and 6 Hold. Therefore 73% are positive. Prologis had 81 analyst reports since July 22, 2015 according to SRatingsIntel. Evercore maintained it with “Buy” rating and $44 target in Tuesday, September 8 report. Jefferies maintained it with “Hold” rating and $68.0 target in Tuesday, January 23 report. The rating was maintained by Stifel Nicolaus with “Buy” on Tuesday, April 17. The rating was downgraded by TheStreet to “Hold” on Friday, September 4. The company was maintained on Monday, October 30 by Jefferies. Deutsche Bank upgraded the shares of PLD in report on Tuesday, December 18 to “Buy” rating. The firm earned “Buy” rating on Tuesday, January 23 by Cantor Fitzgerald. The stock has “Outperform” rating by Robert W. Baird on Wednesday, January 24. The firm has “Buy” rating by SunTrust given on Thursday, October 12. The firm earned “Buy” rating on Monday, October 16 by KeyBanc Capital Markets.

Investors sentiment increased to 2.4 in 2018 Q3. Its up 1.14, from 1.26 in 2018Q2. It improved, as 40 investors sold PLD shares while 100 reduced holdings. 81 funds opened positions while 255 raised stakes. 569.42 million shares or 16.65% more from 488.14 million shares in 2018Q2 were reported. Kistler stated it has 2,357 shares or 0.07% of all its holdings. Wellington Shields Cap Mngmt Lc holds 0.1% or 8,950 shares. Lenox Wealth Management stated it has 326 shares. Yhb Invest Advsr accumulated 0.23% or 22,362 shares. Reilly Fincl Advisors Limited Liability Corporation reported 1,329 shares. Moreover, Spectrum Grp Inc has 0.39% invested in Prologis, Inc. (NYSE:PLD). Roosevelt Investment Gru holds 1.07% or 173,739 shares in its portfolio. Verition Fund Mngmt Ltd reported 0.02% of its portfolio in Prologis, Inc. (NYSE:PLD). Pension Ser has 562,614 shares for 0.16% of their portfolio. Agf holds 0.29% or 418,612 shares in its portfolio. Zacks Investment Mngmt reported 502,778 shares or 0.71% of all its holdings. Amica Pension Fund Board Of Trustees owns 15,945 shares. Bnp Paribas Asset Mgmt Hldgs Sa reported 0.11% stake. Farmers & Merchants Invests Incorporated reported 205 shares. Fincl Bank Of Montreal Can holds 0.06% or 1.12 million shares.

Lasalle Investment Management Securities Llc, which manages about $4.60B US Long portfolio, decreased its stake in Equity Residential (NYSE:EQR) by 1.07 million shares to 4.55M shares, valued at $301.19 million in 2018Q3, according to the filing. It also reduced its holding in Crown Castle Intl Corp (NYSE:CCI) by 240,994 shares in the quarter, leaving it with 1.04M shares, and cut its stake in Hcp Inc (NYSE:HCP).

Investors sentiment increased to 0.84 in Q3 2018. Its up 0.07, from 0.77 in 2018Q2. It improved, as 10 investors sold OZM shares while 15 reduced holdings. 6 funds opened positions while 15 raised stakes. 72.87 million shares or 5.44% more from 69.11 million shares in 2018Q2 were reported. Moors Cabot owns 0.01% invested in Och-Ziff Capital Management Group LLC (NYSE:OZM) for 50,000 shares. Credit Suisse Ag has invested 0% in Och-Ziff Capital Management Group LLC (NYSE:OZM). Freestone Holding Limited Liability Company invested in 0% or 456,792 shares. Tru Department Mb Commercial Bank N A stated it has 2,000 shares. Gabelli Funds Ltd Liability reported 0% of its portfolio in Och-Ziff Capital Management Group LLC (NYSE:OZM). Deutsche Bancorp Ag has 1.02M shares. Manufacturers Life Ins Commerce The reported 0% stake. Kamunting Street Capital Management Lp reported 1.06M shares. Knott David M, a New York-based fund reported 2,000 shares. Rathbone Brothers Public Ltd Co owns 73,176 shares. 444,097 are held by California Public Employees Retirement System. Finance Architects Inc stated it has 25,320 shares. Moreover, Artemis Mngmt Llp has 0.07% invested in Och-Ziff Capital Management Group LLC (NYSE:OZM). Glacier Peak Capital Ltd Limited Liability Company accumulated 5.63% or 3.48M shares. Oppenheimer reported 32,000 shares.

Among 10 analysts covering Och-Ziff Capital Management Group (NYSE:OZM), 4 have Buy rating, 0 Sell and 6 Hold. Therefore 40% are positive. Och-Ziff Capital Management Group had 35 analyst reports since August 6, 2015 according to SRatingsIntel. The rating was maintained by Citigroup with “Buy” on Monday, October 5. Compass Point maintained Och-Ziff Capital Management Group LLC (NYSE:OZM) on Wednesday, November 4 with “Buy” rating. The rating was maintained by Keefe Bruyette & Woods on Monday, September 4 with “Hold”. As per Wednesday, June 28, the company rating was maintained by Jefferies. The company was downgraded on Thursday, August 25 by Citigroup. The rating was downgraded by Wood on Monday, July 11 to “Market Perform”. The stock has “Hold” rating by Jefferies on Monday, September 25. The stock of Och-Ziff Capital Management Group LLC (NYSE:OZM) has “Hold” rating given on Wednesday, August 2 by Keefe Bruyette & Woods. The stock has “Sell” rating by Zacks on Thursday, August 20. The rating was maintained by RBC Capital Markets with “Outperform” on Tuesday, May 31.

Since August 23, 2018, it had 0 buys, and 3 insider sales for $65,097 activity. 1,758 shares were sold by Elisha Erez, worth $21,355.

More notable recent Och-Ziff Capital Management Group LLC (NYSE:OZM) news were published by: Seekingalpha.com which released: “Why Och-Ziff Shares Have 50% Upside – Seeking Alpha” on October 23, 2017, also Seekingalpha.com with their article: “Snapshot Of Cumulative Dividend Cuts In Q2 2018 – Seeking Alpha” published on May 22, 2018, Globenewswire.com published: “Pomerantz LLP and The Rosen Law Firm, PA Announce Proposed Class Action Settlement on Behalf of Purchasers of Securities of Och-Ziff Capital Management Group LLC — OZM – GlobeNewswire” on October 26, 2018. More interesting news about Och-Ziff Capital Management Group LLC (NYSE:OZM) were released by: Seekingalpha.com and their article: “Tracking David Abrams’ Abrams Capital Management Portfolio – Q1 2018 Update – Seeking Alpha” published on May 15, 2018 as well as Globenewswire.com‘s news article titled: “GECAS and Oz Management Close STARR 2018-1 NYSE:OZM – GlobeNewswire” with publication date: June 27, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.