Etns Linked TO the Velocityshares Daily 4X Long GB (NYSEARCA:UGBP) had an increase of 2733.33% in short interest. UGBP’s SI was 8,500 shares in February as released by FINRA. Its up 2733.33% from 300 shares previously. With 4,000 avg volume, 2 days are for Etns Linked TO the Velocityshares Daily 4X Long GB (NYSEARCA:UGBP)’s short sellers to cover UGBP’s short positions. The stock decreased 1.93% or $0.37 during the last trading session, reaching $18.86. About 1,750 shares traded. Citigroup ETNs lnkd VS Dly 4X Lng GBPUSD (NYSEARCA:UGBP) has 0.00% since February 15, 2018 and is . It has by 0.00% the S&P500.

The stock increased 0.89% or $2.06 during the last trading session, reaching $234.03. About 1.30M shares traded. ServiceNow, Inc. (NYSE:NOW) has risen 52.81% since February 15, 2018 and is uptrending. It has outperformed by 52.81% the S&P500. Some Historical NOW News: 14/03/2018 – Skedulo Launches Independent Platform to Simplify the Complexity of Today’s Modern Workforce and Transform the Customer Experience; 03/05/2018 – SERVICENOW BUYS PARLO, AI WORKFORCE SOLUTION; 21/04/2018 – DJ ServiceNow Inc, Inst Holders, 1Q 2018 (NOW); 10/05/2018 – Engage ESM Launches New ServiceNow Integration for Amazon Web Services to Improve Enterprise Productivity and Governance; 07/05/2018 – TimelinePl Intelligent Process Mining Receives Application Certification from ServiceNow; 25/04/2018 – SERVICENOW INC – FRED LUDDY WILL BECOME NEW BOARD CHAIR, SUCCEEDING FORMER COMPANY PRESIDENT AND CEO FRANK SLOOTMAN; 25/04/2018 – SERVICENOW INC SEES FY2018 SUBSCRIPTION GAAP REVENUES $2,400 MLN – $2,415 MLN; 05/04/2018 – ServiceNow Research Uncovers Security’s Patching Paradox; 25/04/2018 – SERVICENOW INC QTRLY ADJ SHR $0.56; 02/05/2018 – Nuvolo Launches Medical Device Cyber Security – Powered by ServiceNow

According to a public report that’s submitted to the SEC on 14-02-2019, Chirantan Desai an insider in Servicenow Inc and currently Chief Product Officer, made a sale of shares worth $468,369 USD in the company. He sold 2,031 shares, at average $230.6 per share. This is not his first insider trade, in the last month, he unloaded another 2,031 shares worth $381,564 USD. Chirantan Desai now has rights to 20,840 shares of Servicenow Inc.

More notable recent ServiceNow, Inc. (NYSE:NOW) news were published by: Seekingalpha.com which released: “ServiceNow: Profitability Is Added To The Growth Story – Seeking Alpha” on February 05, 2019, also Fool.com with their article: “5 Marijuana Stocks That Call the NYSE Home – Motley Fool” published on February 13, 2019, Seekingalpha.com published: “ServiceNow Grows Through The Addition Of Capital-Efficient Startups – Seeking Alpha” on February 07, 2019. More interesting news about ServiceNow, Inc. (NYSE:NOW) were released by: and their article: “ServiceNow Soars After Strong Quarter (NYSE:NOW) – Benzinga” published on January 31, 2019 as well as ‘s news article titled: “Christian Fromhertz’s ServiceNow Trade (NYSE:NOW) – Benzinga” with publication date: January 30, 2019.

ServiceNow, Inc. provides enterprise cloud computing solutions that define, structure, manage, and automate services for enterprises worldwide. The company has market cap of $41.96 billion. The firm offers service management solutions for customer support, human resources, security operations, and other enterprise departments. It currently has negative earnings. It operates ServiceNow platform that provides workflow, configuration management database, service catalog, service portal, knowledge management, reporting and analytics, data benchmarking, visual task boards, built-in and optional encryption capabilities, and collaboration and developer tools.

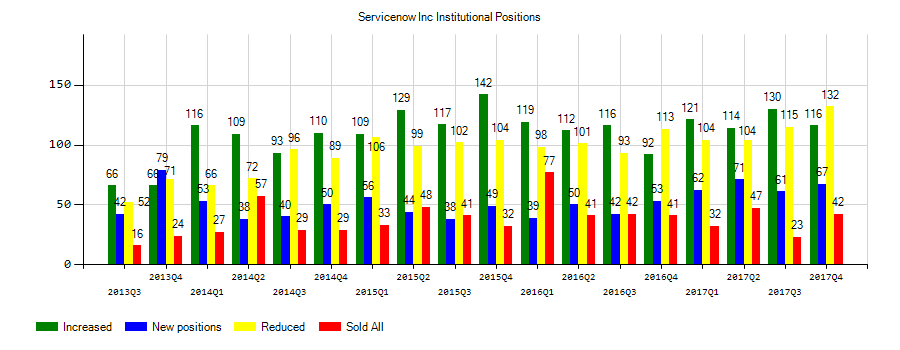

Investors sentiment increased to 1.45 in 2018 Q3. Its up 0.17, from 1.28 in 2018Q2. It increased, as 31 investors sold ServiceNow, Inc. shares while 151 reduced holdings. 106 funds opened positions while 157 raised stakes. 162.71 million shares or 2.64% less from 167.12 million shares in 2018Q2 were reported. Assetmark, California-based fund reported 226 shares. Driehaus Capital Mgmt Ltd Liability Co, a Illinois-based fund reported 3,200 shares. Art Advisors Limited Liability Company accumulated 5,600 shares. Boston Private Wealth Limited Liability reported 1,189 shares. Telemus Capital Llc holds 0.09% of its portfolio in ServiceNow, Inc. (NYSE:NOW) for 6,000 shares. Cobblestone Advsrs Lc Ny owns 2,500 shares. Advsrs Asset Mngmt reported 0.05% stake. Los Angeles And Equity Rech reported 179,512 shares. Sumitomo Mitsui Asset holds 10,694 shares or 0.03% of its portfolio. Bancshares Of Mellon reported 1.31M shares. Bollard Gp Limited Liability Co has 200 shares. Scott Selber holds 1.01% of its portfolio in ServiceNow, Inc. (NYSE:NOW) for 10,528 shares. Cypress Asset Mgmt Tx accumulated 3,460 shares. Jasper Ridge Limited Partnership holds 0.63% or 58,961 shares in its portfolio. Metropolitan Life Ny stated it has 13,537 shares or 0.05% of all its holdings.

Since August 17, 2018, it had 0 insider buys, and 23 selling transactions for $85.79 million activity. Desai Chirantan Jitendra had sold 2,031 shares worth $381,564 on Monday, January 14. LUDDY FREDERIC B also sold $5.65 million worth of ServiceNow, Inc. (NYSE:NOW) shares. Donahoe John J also sold $2.51M worth of ServiceNow, Inc. (NYSE:NOW) shares. The insider Scarpelli Michael sold 39,827 shares worth $7.13M. WADORS PATRICIA L also sold $1.53 million worth of ServiceNow, Inc. (NYSE:NOW) shares. CODD RONALD E F sold $22.01 million worth of stock. Another trade for 10,252 shares valued at $1.86 million was sold by Schneider David.

Among 9 analysts covering ServiceNow (NYSE:NOW), 7 have Buy rating, 0 Sell and 2 Hold. Therefore 78% are positive. ServiceNow has $260 highest and $15 lowest target. $204.56’s average target is -12.59% below currents $234.03 stock price. ServiceNow had 9 analyst reports since September 7, 2018 according to SRatingsIntel. On Thursday, January 31 the stock rating was maintained by KeyBanc Capital Markets with “Overweight”. The stock of ServiceNow, Inc. (NYSE:NOW) has “Buy” rating given on Friday, February 1 by Goldman Sachs. The company was maintained on Thursday, January 31 by UBS. Barclays Capital maintained ServiceNow, Inc. (NYSE:NOW) on Friday, September 7 with “Overweight” rating. On Tuesday, October 23 the stock rating was maintained by Morgan Stanley with “Overweight”. JP Morgan maintained it with “Neutral” rating and $15 target in Monday, September 17 report.

More notable recent Citigroup ETNs lnkd VS Dly 4X Lng GBPUSD (NYSEARCA:UGBP) news were published by: Etftrends.com which released: “British Pound ETFs Strengthen as Brexit Negotiations Drag On – ETF Trends” on January 22, 2019, also Seekingalpha.com with their article: “Brexit, Delayed – Seeking Alpha” published on January 31, 2019, Seekingalpha.com published: “EU won’t reopen U.K. withdrawal negotiations; pound falls – Seeking Alpha” on January 28, 2019. More interesting news about Citigroup ETNs lnkd VS Dly 4X Lng GBPUSD (NYSEARCA:UGBP) were released by: Etftrends.com and their article: “British Pound ETF Climbs on Progress in Brexit Negotiations – ETF Trends” published on August 29, 2018 as well as Seekingalpha.com‘s news article titled: “ETF Deathwatch For June 2018 – Seeking Alpha” with publication date: July 13, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.