Headinvest Llc decreased its stake in Abb Ltd Adr (ABB) by 71.39% based on its latest 2018Q3 regulatory filing with the SEC. Headinvest Llc sold 30,594 shares as the company’s stock declined 18.75% with the market. The institutional investor held 12,261 shares of the electrical products company at the end of 2018Q3, valued at $290,000, down from 42,855 at the end of the previous reported quarter. Headinvest Llc who had been investing in Abb Ltd Adr for a number of months, seems to be less bullish one the $41.42B market cap company. The stock increased 0.31% or $0.06 during the last trading session, reaching $19.36. About 667,707 shares traded. ABB Ltd (NYSE:ABB) has declined 26.62% since February 14, 2018 and is downtrending. It has underperformed by 26.62% the S&P500. Some Historical ABB News: 06/04/2018 – ABB Robotics US : ABB to Invest EUR100 Million in Global Innovation and Training Campus; 29/03/2018 – ABB CEO SAYS IN THE NATURAL RESOURCES SECTOR, SUBSTANTIAL GROWTH IN DEMAND IS EXPECTEDIN THE MEDIUM TERM; 29/03/2018 – ABB LTD ABBN.S CEO SAYS COMPANY LOOKING AT ORGANIC INVESTMENT, PARTNERSHIPS AND SELECTIVE ACQUISITIONS IN ARTIFICIAL INTELLIGENCE AREA; 29/03/2018 – ABB LTD ABBN.S CEO SAYS LATE CYCLE BUSINESS HAS STABILISED AND WILL GET BETTER TOWARDS END OF 2018; 07/03/2018 – ABB SWITZERLAND HEAD REMO LUETOLF RESIGNS, CONT. AS ADVISER; 19/04/2018 – ABB 1Q Net Pft $572M; 19/04/2018 – Automation in Africa, Asia and the Middle East is booming, ABB CEO says; 17/05/2018 – ABB LTD ABBN.S SAYS WON AN ORDER TO DELIVER A COMPREHENSIVE PROCESS AND POWER SOLUTION THAT WILL DOUBLE CAPACITY OF KAZ MINERALS’ SULPHIDE ORE PROCESSING PLANT IN AKTOGAY, KAZAKHSTAN; 08/05/2018 – ABB INDIA 1Q REV. 25B RUPEES; 08/03/2018 – TERMO2POWER SA T2P.WA – IN TALKS WITH SWEDISH-SWISS COMPANY ABB WHICH IS INTERESTED IN CO’S TECHNOLOGY

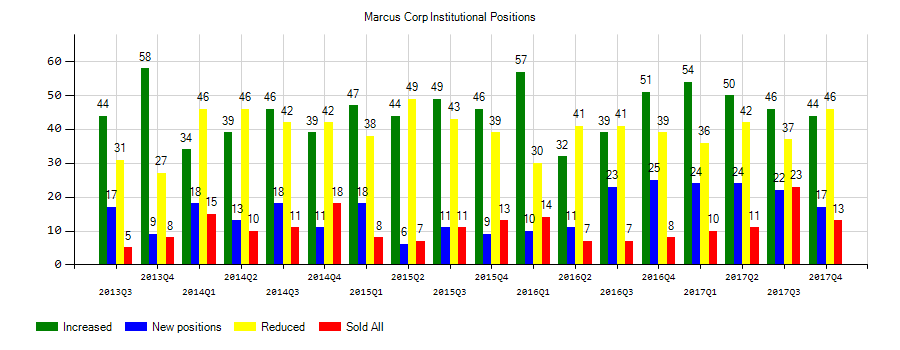

Savant Capital Llc increased its stake in Marcus Corp (MCS) by 28.02% based on its latest 2018Q3 regulatory filing with the SEC. Savant Capital Llc bought 11,259 shares as the company’s stock rose 1.37% while stock markets declined. The institutional investor held 51,439 shares of the movies and entertainment company at the end of 2018Q3, valued at $2.16 million, up from 40,180 at the end of the previous reported quarter. Savant Capital Llc who had been investing in Marcus Corp for a number of months, seems to be bullish on the $1.23B market cap company. The stock increased 0.13% or $0.05 during the last trading session, reaching $39.93. About 11,871 shares traded. The Marcus Corporation (NYSE:MCS) has risen 47.99% since February 14, 2018 and is uptrending. It has outperformed by 47.99% the S&P500. Some Historical MCS News: 26/04/2018 – The Marcus Corporation Reports Record Revenues and Earnings for the First Quarter of Fiscal 2018; 22/04/2018 – DJ Marcus Corporation, Inst Holders, 1Q 2018 (MCS); 26/04/2018 – MARCUS CORP 1Q EPS 35C, EST. 34C; 08/05/2018 – The Marcus Corporation Declares Quarterly Dividend; 17/04/2018 – Marcus® Hotels & Resorts Assumes Management of the DoubleTree by Hilton Hotel El Paso Downtown and Courtyard by Marriott El; 16/05/2018 – Marcus Theatres® Brings New Amenities to 23 More Theatres, in Time for Summer Blockbuster Season; 15/05/2018 – Nationally Recognized Firms Selected to Design Milwaukee’s First Arts-Focused Hotel; 07/03/2018 Marcus Theatres® to Host Second Annual Marcus CineLatino Milwaukee Film Festival, April 11-15, 2018; 26/04/2018 – Marcus Corp 1Q Rev $168.2M; 09/05/2018 – The Marcus Corporation to Participate in 19th Annual B. Riley & Co. Investor Conference May 23

More recent ABB Ltd (NYSE:ABB) news were published by: Seekingalpha.com which released: “5 Power And Pollution Disrupters – Seeking Alpha” on January 31, 2019. Also Investorplace.com published the news titled: “7 of the Best Sector Funds for 2019 – Investorplace.com” on January 28, 2019. Businesswire.com‘s news article titled: “Sight Machine Wins ABB Award for Industrial Automation and Energy Efficiency; Named to 2019 Global Cleantech 100 – Business Wire” with publication date: January 30, 2019 was also an interesting one.

Among 16 analysts covering ABB Ltd (NYSE:ABB), 8 have Buy rating, 2 Sell and 6 Hold. Therefore 50% are positive. ABB Ltd had 41 analyst reports since August 21, 2015 according to SRatingsIntel. As per Tuesday, May 23, the company rating was downgraded by BNP Paribas. The rating was downgraded by HSBC on Friday, August 19 to “Hold”. The stock of ABB Ltd (NYSE:ABB) has “Neutral” rating given on Wednesday, April 20 by JP Morgan. BNP Paribas reinitiated the shares of ABB in report on Tuesday, February 9 with “Underperform” rating. The stock of ABB Ltd (NYSE:ABB) has “Neutral” rating given on Friday, January 22 by UBS. The stock of ABB Ltd (NYSE:ABB) earned “Sell” rating by Berenberg on Friday, September 4. The rating was maintained by Jefferies on Monday, November 27 with “Sell”. The stock of ABB Ltd (NYSE:ABB) has “Overweight” rating given on Wednesday, December 9 by Barclays Capital. On Tuesday, June 13 the stock rating was maintained by Jefferies with “Sell”. The company was maintained on Wednesday, August 23 by Robert W. Baird.

Among 6 analysts covering Marcus Corp (NYSE:MCS), 5 have Buy rating, 0 Sell and 1 Hold. Therefore 83% are positive. Marcus Corp had 18 analyst reports since July 24, 2015 according to SRatingsIntel. The stock of The Marcus Corporation (NYSE:MCS) earned “Buy” rating by B. Riley & Co on Wednesday, July 19. B. Riley & Co upgraded the stock to “Buy” rating in Friday, July 24 report. The firm has “Buy” rating given on Friday, July 28 by B. Riley & Co. On Friday, July 29 the stock rating was maintained by Benchmark with “Buy”. FBR Capital maintained The Marcus Corporation (NYSE:MCS) on Wednesday, April 25 with “Buy” rating. On Friday, July 28 the stock rating was maintained by Barrington Research with “Outperform”. The rating was maintained by FBR Capital with “Buy” on Tuesday, January 30. The rating was initiated by Gabelli on Thursday, October 15 with “Buy”. The stock of The Marcus Corporation (NYSE:MCS) has “Buy” rating given on Thursday, February 22 by FBR Capital. B. Riley & Co maintained The Marcus Corporation (NYSE:MCS) rating on Friday, October 27. B. Riley & Co has “Buy” rating and $36.0 target.

Investors sentiment decreased to 1.41 in 2018 Q3. Its down 0.14, from 1.55 in 2018Q2. It fall, as 9 investors sold MCS shares while 49 reduced holdings. 36 funds opened positions while 46 raised stakes. 17.48 million shares or 4.26% more from 16.76 million shares in 2018Q2 were reported. Hsbc Public Limited Com reported 30,393 shares. Teachers Retirement Systems Of The State Of Kentucky holds 0% in The Marcus Corporation (NYSE:MCS) or 8,281 shares. 31,163 are owned by Etrade Cap Management Limited. Sei Invs holds 1,327 shares or 0% of its portfolio. Panagora Asset Mngmt Inc has 0.02% invested in The Marcus Corporation (NYSE:MCS). Arizona State Retirement Sys has 28,550 shares. New York-based Indexiq Lc has invested 0.1% in The Marcus Corporation (NYSE:MCS). Bnp Paribas Arbitrage holds 0% or 658 shares. 50,900 are held by Employees Retirement System Of Ohio. Swiss Bancorporation reported 31,800 shares or 0% of all its holdings. Manufacturers Life Ins The reported 12,872 shares. Axa invested 0.02% of its portfolio in The Marcus Corporation (NYSE:MCS). Teton Advsrs, a New York-based fund reported 364,112 shares. Victory Cap Mgmt Incorporated reported 88,334 shares stake. Northern Tru holds 927,718 shares.

Since August 15, 2018, it had 0 insider purchases, and 8 sales for $73.65 million activity. 10,450 shares were sold by RODRIGUEZ ROLANDO B, worth $423,876 on Friday, August 31. 6,000 The Marcus Corporation (NYSE:MCS) shares with value of $248,246 were sold by KISSINGER THOMAS F. On Wednesday, February 6 the insider VSS-Southern Holdings LLC sold $68.71M. MILSTEIN PHILIP L sold $211,619 worth of The Marcus Corporation (NYSE:MCS) on Tuesday, November 27. The insider Marcus Gregory S sold $3.66M.

More notable recent The Marcus Corporation (NYSE:MCS) news were published by: Zacks.com which released: “HUD or MCS: Which Is the Better Value Stock Right Now? – Zacks.com” on January 16, 2019, also Streetinsider.com with their article: “Marcus Corporation (MCS) Prices 1.5M Common Stock Offering by Shareholder at $40.25/Share – StreetInsider.com” published on February 05, 2019, Bizjournals.com published: “Intercontinental rebrand Saint Kate names Scott Sloan general manager – Milwaukee Business Journal” on January 31, 2019. More interesting news about The Marcus Corporation (NYSE:MCS) were released by: Businesswire.com and their article: “The Marcus Corporation (NYSE: MCS) celebrated 25 years of trading on the New York Stock Exchange (NYSE) by ringing today’s Opening Bell®; Photo Available on Business Wire’s Website and the Associated Press Photo Network – Business Wire” published on December 14, 2018 as well as Seekingalpha.com‘s news article titled: “U.S. box office down 16% in January – Seeking Alpha” with publication date: February 06, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.