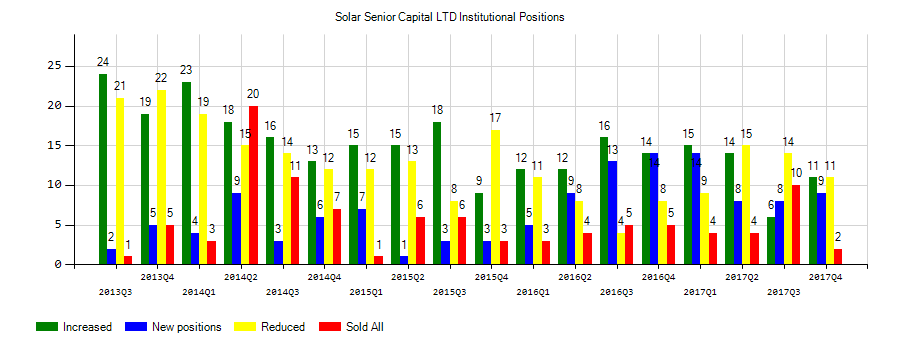

Solar Senior Capital LTD (SUNS) investors sentiment increased to 1 in 2018 Q3. It’s up 0.14, from 0.86 in 2018Q2. The ratio is better, as 13 investment managers opened new or increased holdings, while 13 sold and decreased their equity positions in Solar Senior Capital LTD. The investment managers in our database now hold: 2.87 million shares, down from 3.02 million shares in 2018Q2. Also, the number of investment managers holding Solar Senior Capital LTD in top ten holdings was flat from 0 to 0 for the same number . Sold All: 3 Reduced: 10 Increased: 4 New Position: 9.

Analysts expect Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS) to report $-0.29 EPS on March, 5.They anticipate $0.09 EPS change or 45.00% from last quarter’s $-0.2 EPS. After having $-0.27 EPS previously, Marinus Pharmaceuticals, Inc.’s analysts see 7.41% EPS growth. The stock increased 5.38% or $0.185 during the last trading session, reaching $3.625. About 168,678 shares traded. Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS) has declined 39.35% since February 14, 2018 and is downtrending. It has underperformed by 39.35% the S&P500. Some Historical MRNS News: 23/04/2018 – DJ Marinus Pharmaceuticals Inc, Inst Holders, 1Q 2018 (MRNS); 02/05/2018 – Marinus Pharmaceuticals 1Q Loss/Shr 15c; 07/03/2018 – STAT Plus: Marinus Pharma finds the biotech imitation game can only last so long; 14/05/2018 – Marinus Pharma Presenting at UBS Conference May 21; 15/05/2018 – Three Bays Capital Buys New 2.3% Position in Marinus Pharma; 15/05/2018 – Nexthera Capital LP Exits Position in Marinus Pharma; 06/03/2018 – MARINUS PHARMACEUTICALS – BELIEVE CASH, CASH EQUIVALENTS AS OF DEC 31, 2017 TO ENABLE FUNDING OPER EXPENSES AND CAPEX NEEDS INTO 2020; 02/05/2018 – Marinus Pharmaceuticals Provides Business Update and First Quarter 2018 Financial Results; 06/03/2018 – $MRNS increased enrollment in PPD study, data readout pushed back to 3Q18; 15/05/2018 – GMT Capital Buys New 3.1% Position in Marinus Pharma

The stock decreased 0.15% or $0.02 during the last trading session, reaching $16.73. About 13,503 shares traded. Solar Senior Capital Ltd. (SUNS) has declined 13.92% since February 14, 2018 and is downtrending. It has underperformed by 13.92% the S&P500. Some Historical SUNS News: 22/05/2018 – SUN PHARMACEUTICAL INDUSTRIES – CHURCHILL PHARMACEUTICALS, ELIGIBLE TO GET UPFRONT AND SALES-LINKED MILESTONE PAYMENT AND ROYALTIES ON SALES FROM CO; 22/05/2018 – SUN PHARMACEUTICAL INDUSTRIES LTD SUN.NS – U.S.FDA APPROVAL OF YONSA; 03/04/2018 – Solar Senior Capital Ltd. Schedules the Release of its Financial Results for the Quarter Ended March 31, 2018; 23/05/2018 – Sun Pharma Announces USFDA Approval of YONSA® (abiraterone acetate) To Treat Metastatic Castration-Resistant Prostate Cancer In Combination With Methylprednisolone; 14/05/2018 – SUNTRUST HOME DEVELOPERS INC SUN.PS – QTRLY GROSS REVENUE 121.5 MLN PESOS VS 108.7 MLN PESOS; 21/03/2018 SUN PHARMACEUTICAL INDUSTRIES LTD – CO GETS U.S. FDA APPROVAL OF ILUMYA (TILDRAKIZUMAB-ASMN) FOR TREATMENT OF MODERATE-TO-SEVERE PLAQUE PSORIASIS; 25/05/2018 – SUN PHARMACEUTICAL INDUSTRIES LTD SUN.NS – MARCH QTR CONSOL TOTAL REVENUE FROM OPS 69.77 BLN RUPEES VS 71.37 BLN RUPEES LAST YEAR; 25/05/2018 – SUN PHARMACEUTICAL INDUSTRIES LTD SUN.NS CONSENSUS FORECAST FOR MARCH QTR CONSOL PROFIT WAS 9.47 BLN RUPEES; 25/05/2018 – INDIA’S SUN PHARMACEUTICAL INDUSTRIES LTD SUN.NS – MARCH QTR CONSOL NET PROFIT 13.09 BLN RUPEES VS PROFIT OF 12.24 BLN RUPEES LAST YEAR; 07/05/2018 – Solar Senior Capital 4Q EPS 34c

More notable recent Solar Senior Capital Ltd. (NASDAQ:SUNS) news were published by: Nasdaq.com which released: “Earnings Preview: Solar Senior (SUNS) Q4 Earnings Expected to Decline – Nasdaq” on February 14, 2019, also Nasdaq.com with their article: “Ares Capital (ARCC) Stock Gains 2.8% on Q4 Earnings Beat – Nasdaq” published on February 13, 2019, Nasdaq.com published: “Solar Senior Capital Ltd. (SUNS) Ex-Dividend Date Scheduled for January 23, 2019 – Nasdaq” on January 22, 2019. More interesting news about Solar Senior Capital Ltd. (NASDAQ:SUNS) were released by: Nasdaq.com and their article: “MEDLEY CAPITAL SENDS LETTER TO SHAREHOLDERS – Nasdaq” published on January 22, 2019 as well as Bizjournals.com‘s news article titled: “Phoenix Suns get arena renovation deal approved with help from friends in high places – Phoenix Business Journal” with publication date: January 24, 2019.

Analysts await Solar Senior Capital Ltd. (NASDAQ:SUNS) to report earnings on February, 21 after the close. They expect $0.33 earnings per share, down 5.71% or $0.02 from last year’s $0.35 per share. SUNS’s profit will be $5.29M for 12.67 P/E if the $0.33 EPS becomes a reality. After $0.36 actual earnings per share reported by Solar Senior Capital Ltd. for the previous quarter, Wall Street now forecasts -8.33% negative EPS growth.

West Family Investments Inc. holds 1.96% of its portfolio in Solar Senior Capital Ltd. for 495,609 shares. Clear Harbor Asset Management Llc owns 90,541 shares or 0.29% of their US portfolio. Moreover, Menlo Advisors Llc has 0.2% invested in the company for 17,660 shares. The Colorado-based Advisors Asset Management Inc. has invested 0.08% in the stock. Guggenheim Capital Llc, a Illinois-based fund reported 279,393 shares.

Solar Senior Capital Ltd. is a business development firm specializing in investments in leveraged, middle-market companies in the United States. The company has market cap of $268.28 million. The fund invests in the form of senior secured loans, including first lien, unitranche, and second lien debt instruments. It has a 11.83 P/E ratio. It does not invest in start-up companies or companies having speculative business plans.

Marinus Pharmaceuticals, Inc., a clinical stage biopharmaceutical company, focuses on developing and commercializing therapeutics to treat epilepsy and neuropsychiatric disorders. The company has market cap of $190.40 million. The firm is developing ganaxolone, a small molecule, which is in Phase III clinical trials to treat adults with refractory focal onset epileptic seizures; and is in Phase II clinical trials for the treatment of genetic orphan disorders, as well as is in Phase II clinical trial to treat Fragile X Syndrome, an orphan indication. It currently has negative earnings. The firm is also developing ganaxolone IV formulation to treat status epilepticus.

Investors sentiment decreased to 1.8 in 2018 Q3. Its down 0.30, from 2.1 in 2018Q2. It worsened, as 11 investors sold Marinus Pharmaceuticals, Inc. shares while 14 reduced holdings. 26 funds opened positions while 19 raised stakes. 22.33 million shares or 7.47% more from 20.78 million shares in 2018Q2 were reported. Tci Wealth Advisors holds 0% or 400 shares. Invesco invested 0% in Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS). California State Teachers Retirement, a California-based fund reported 55,718 shares. State Street, a Massachusetts-based fund reported 581,696 shares. New York-based Virtu Lc has invested 0% in Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS). Manufacturers Life Ins The holds 26,126 shares or 0% of its portfolio. Partner Fund Limited Partnership reported 1.77M shares. Proshare Advsr Lc has invested 0% of its portfolio in Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS). Millennium Ltd Com holds 0% in Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS) or 179,012 shares. State Common Retirement Fund owns 25,800 shares. Perceptive Advsr Ltd Limited Liability Company holds 907,732 shares or 0.24% of its portfolio. Deutsche Savings Bank Ag invested in 0% or 72,851 shares. Geode Cap Mngmt Limited Liability Corp has invested 0% in Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS). Metropolitan Life Insurance reported 2,962 shares. Bnp Paribas Arbitrage Sa holds 0% or 1,190 shares in its portfolio.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.