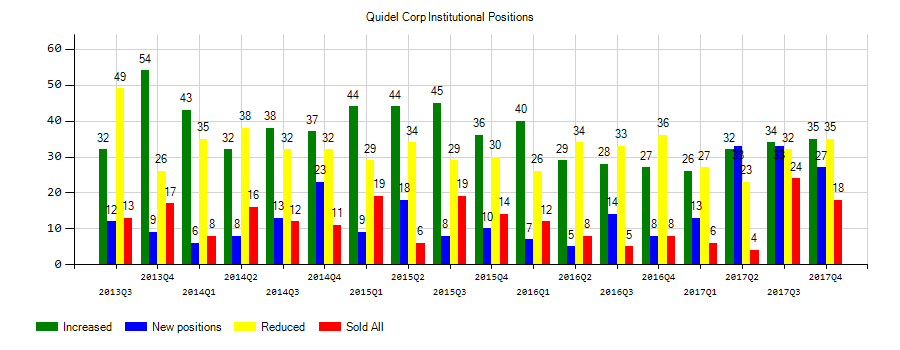

Quidel Corp (QDEL) investors sentiment decreased to 1.14 in Q3 2018. It’s down -0.17, from 1.31 in 2018Q2. The ratio is negative, as 73 funds increased and opened new stock positions, while 64 cut down and sold holdings in Quidel Corp. The funds in our database reported: 34.61 million shares, up from 34.22 million shares in 2018Q2. Also, the number of funds holding Quidel Corp in top ten stock positions decreased from 5 to 3 for a decrease of 2. Sold All: 15 Reduced: 49 Increased: 44 New Position: 29.

Analysts expect Senseonics Holdings, Inc. (NYSEAMERICAN:SENS) to report $-0.15 EPS on March, 12.They anticipate $0.03 EPS change or 25.00% from last quarter’s $-0.12 EPS. After having $-0.14 EPS previously, Senseonics Holdings, Inc.’s analysts see 7.14% EPS growth. The stock decreased 3.77% or $0.09 during the last trading session, reaching $2.3. About 1.90M shares traded or 23.09% up from the average. Senseonics Holdings, Inc. (NYSEAMERICAN:SENS) has risen 15.89% since February 13, 2018 and is uptrending. It has outperformed by 15.89% the S&P500. Some Historical SENS News: 21/05/2018 – Senseonics Holdings Presenting at UBS Conference Tomorrow; 23/04/2018 – DJ Senseonics Holdings Inc, Inst Holders, 1Q 2018 (SENS); 08/05/2018 – Senseonics to Participate in the UBS Global Healthcare Conference; 29/03/2018 – SENSEONICS REPORTS FAVORABLE OUTCOME OF FDA ADVISORY COMMITTEE; 10/05/2018 – Senseonics Holdings 1Q Loss/Shr 16c; 13/03/2018 Senseonics Holdings 4Q Loss $16.3M; 13/03/2018 – Senseonics Holdings 4Q Loss/Shr 12c; 29/03/2018 – Senseonics Announces Favorable Outcome Of FDA Advisory Committee On The Eversense System; 30/03/2018 – SENSEONICS HOLDINGS MAY SELL UP TO $50M SHRS FROM TIME TO TIME; 27/03/2018 – Senseonics Holdings Closes Below 50-Day Average: Technicals

The stock increased 0.64% or $0.39 during the last trading session, reaching $61.13. About 174,810 shares traded. Quidel Corporation (QDEL) has risen 20.89% since February 13, 2018 and is uptrending. It has outperformed by 20.89% the S&P500. Some Historical QDEL News: 08/05/2018 – QUIDEL 1Q ADJ EPS $1.29, EST. $1.01; 08/05/2018 – Quidel 1Q Net $34M; 22/05/2018 – Quidel Presenting at UBS Conference Tomorrow; 08/05/2018 – Quidel 1Q EPS 86c; 08/05/2018 – Quidel 1Q Adj EPS $1.29; 05/03/2018 – QUIDEL GETS FDA CLEARANCE FOR POINT-OF-CARE SOFIA® LYME FLUORES; 08/05/2018 – QUIDEL 1Q REV. $169.1M, EST. $151.5M; 30/04/2018 – MFS New Discovery Fund Adds Quidel, Exits MuleSoft; 09/05/2018 – QUIDEL CORP QDEL.O : BARCLAYS RAISES TARGET PRICE TO $65 FROM $63; 29/03/2018 – New Research Coverage Highlights Digital Realty Trust, United Dominion Realty Trust, Quidel, Brandywine Realty Trust, Beneficia

Since January 1, 0001, it had 0 insider buys, and 9 insider sales for $8.13 million activity.

Quidel Corporation develops, manufactures, and markets diagnostic testing solutions for applications primarily in infectious diseases, POC womenÂ’s and general health, and gastrointestinal diseases. The company has market cap of $2.41 billion. The firm offers Sofia influenza A+B and QuickVue influenza tests to detect viral antigens of influenza type A and B; Sofia strep A fluorescent immunoassay and QuickVue Strep A tests to detect group A Streptococcal antigen from throat swabs; and Sofia Respiratory Syncytial Virus , QuickVue RSV, and Quidel Molecular RSV + human metapneumovirus tests for respiratory syncytial virus. It has a 61.25 P/E ratio. It also provides various products to detect various herpes simplex virus (HSV) and herpes family viruses; H&V-Mix to isolate HSV, VZV, and Cytomegalovirus; R-Mix to detect Influenza A and B, RSV, Adenovirus, and Parainfluenza types 1, 2, and 3; Sofia S.

Analysts await Quidel Corporation (NASDAQ:QDEL) to report earnings on February, 20. They expect $0.54 EPS, up 590.91% or $0.65 from last year’s $-0.11 per share. QDEL’s profit will be $21.24M for 28.30 P/E if the $0.54 EPS becomes a reality. After $0.54 actual EPS reported by Quidel Corporation for the previous quarter, Wall Street now forecasts 0.00% EPS growth.

Oracle Investment Management Inc holds 27.16% of its portfolio in Quidel Corporation for 1.90 million shares. Brown Capital Management Llc owns 5.55 million shares or 3.29% of their US portfolio. Moreover, Investment Management Of Virginia Llc has 2.41% invested in the company for 174,679 shares. The Vermont-based Birchview Capital Lp has invested 1.43% in the stock. Eagle Boston Investment Management Inc, a Massachusetts-based fund reported 206,360 shares.

More notable recent Quidel Corporation (NASDAQ:QDEL) news were published by: Nasdaq.com which released: “Quidel (QDEL) Reports Next Week: Wall Street Expects Earnings Growth – Nasdaq” on February 06, 2019, also Globenewswire.com with their article: “Consolidated Research: 2019 Summary Expectations for Micron Technology, Quidel, Ligand Pharmaceuticals, Altra Industrial Motion, USG, and Equity Lifestyle Properties — Fundamental Analysis, Key Performance Indications – GlobeNewswire” published on February 01, 2019, Nasdaq.com published: “What’s in Store for Cardinal Health’s (CAH) Q2 Earnings? – Nasdaq” on February 04, 2019. More interesting news about Quidel Corporation (NASDAQ:QDEL) were released by: Businesswire.com and their article: “Quidel to Hold Fourth Quarter and Full Year 2018 Financial Results Conference Call on February 13th, 2019 – Business Wire” published on January 30, 2019 as well as Nasdaq.com‘s news article titled: “Quidel (QDEL) Surpasses Q3 Earnings Estimates – Nasdaq” with publication date: November 06, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.