Among 2 analysts covering Trustmark (NASDAQ:TRMK), 0 have Buy rating, 1 Sell and 1 Hold. Therefore 0 are positive. Trustmark had 2 analyst reports since October 29, 2018 according to SRatingsIntel. SunTrust maintained Trustmark Corporation (NASDAQ:TRMK) on Monday, October 29 with “Hold” rating. On Monday, January 7 the stock rating was downgraded by Raymond James to “Underperform”. See Trustmark Corporation (NASDAQ:TRMK) latest ratings:

07/01/2019 Broker: Raymond James Old Rating: Market Perform New Rating: Underperform Downgrade

29/10/2018 Broker: SunTrust Old Rating: Hold New Rating: Hold Old Target: $36 New Target: $31 Maintain

Life Storage, Inc. (LSI) formed double top with $106.47 target or 5.00% above today’s $101.40 share price. Life Storage, Inc. (LSI) has $4.73 billion valuation. The stock increased 0.94% or $0.94 during the last trading session, reaching $101.4. About 254,650 shares traded. Life Storage, Inc. (NYSE:LSI) has risen 12.49% since February 11, 2018 and is uptrending. It has outperformed by 12.49% the S&P500. Some Historical LSI News: 19/03/2018 – Life Storage In Cooperation Agreement With Land & Buildings; 30/05/2018 – Life Storage, Inc. to Participate at REITWeek® 2018; 19/03/2018 – LIFE STORAGE INC – FOUNDERS ROBERT J. ATTEA AND KENNETH F. MYSZKA TO RETIRE; 19/03/2018 – Life Storage Founders Robert Attea, Kenneth Myszka to Retire From Board; 02/05/2018 – LIFE STORAGE 1Q AFFO/SHR $1.30; 19/03/2018 – Life Storage Names CEO David Rogers to Board; 02/05/2018 – Life Storage 1Q Rev $133.1M; 19/03/2018 – LIFE STORAGE,: CHANGES TO BOARD INCLUDING APPOINTMENT OF TWO; 19/03/2018 – LIFE STORAGE INC – COMPANY HAS ENTERED INTO A COOPERATION AGREEMENT WITH LAND & BUILDINGS; 23/04/2018 – DJ Life Storage Inc, Inst Holders, 1Q 2018 (LSI)

Analysts await Life Storage, Inc. (NYSE:LSI) to report earnings on February, 20. They expect $1.37 earnings per share, up 2.24% or $0.03 from last year’s $1.34 per share. LSI’s profit will be $63.91M for 18.50 P/E if the $1.37 EPS becomes a reality. After $1.45 actual earnings per share reported by Life Storage, Inc. for the previous quarter, Wall Street now forecasts -5.52% negative EPS growth.

Investors sentiment increased to Infinity in 2018 Q3. Its up Infinity, from 1 in 2018Q2. It improved, as 0 investors sold Life Storage, Inc. shares while 0 reduced holdings. 1 funds opened positions while 0 raised stakes. 94,494 shares or 4088.56% more from 2,256 shares in 2018Q2 were reported. Gemmer Asset Mngmt Lc reported 36 shares. Grimes And Com holds 0.02% or 2,220 shares. Kentucky Retirement Systems has invested 0.04% in Life Storage, Inc. (NYSE:LSI).

Since November 26, 2018, it had 0 buys, and 3 insider sales for $163,678 activity. 1,500 shares were sold by Woods Charles Scott, worth $47,482 on Monday, November 26. WALKER LEROY G JR had sold 1,789 shares worth $54,296 on Monday, December 10.

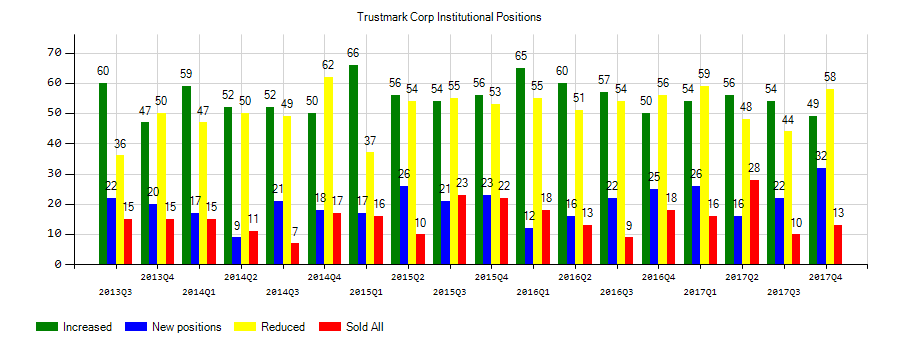

Investors sentiment increased to 1.33 in 2018 Q3. Its up 0.34, from 0.99 in 2018Q2. It increased, as 12 investors sold Trustmark Corporation shares while 45 reduced holdings. 24 funds opened positions while 52 raised stakes. 47.56 million shares or 14.38% more from 41.58 million shares in 2018Q2 were reported. Wilbanks Smith & Thomas Asset Mngmt Llc reported 687 shares. Retirement System Of Alabama reported 87,387 shares. Janney Capital Limited Com has invested 0% in Trustmark Corporation (NASDAQ:TRMK). Profund Advsr Limited has invested 0.01% in Trustmark Corporation (NASDAQ:TRMK). Peoples Corp has 0% invested in Trustmark Corporation (NASDAQ:TRMK). Northern holds 2.01 million shares. Invesco Ltd, Georgia-based fund reported 204,290 shares. 42,547 are held by Texas Permanent School Fund. Northwestern Mutual Wealth Mngmt, Wisconsin-based fund reported 194 shares. Leavell Investment Incorporated reported 0.02% stake. Wells Fargo & Mn has invested 0.02% in Trustmark Corporation (NASDAQ:TRMK). International has 180,964 shares. Acadian Asset Lc has 11,440 shares for 0% of their portfolio. National Bank & Trust Of Montreal Can has 54,215 shares. Moreover, New Mexico Educational Retirement Board has 0.02% invested in Trustmark Corporation (NASDAQ:TRMK) for 15,900 shares.

More notable recent Trustmark Corporation (NASDAQ:TRMK) news were published by: Nasdaq.com which released: “Trustmark (TRMK) Q4 Earnings Beat Estimates – Nasdaq” on January 23, 2019, also Seekingalpha.com with their article: “Trustmark Corporation 2018 Q4 – Results – Earnings Call Slides – Seeking Alpha” published on January 24, 2019, Seekingalpha.com published: “Trustmark Corporation (TRMK) CEO Gerard Host on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” on January 24, 2019. More interesting news about Trustmark Corporation (NASDAQ:TRMK) were released by: Zacks.com and their article: “Trustmark (TRMK) Earnings Expected to Grow: Should You Buy? – Zacks.com” published on January 16, 2019 as well as Businesswire.com‘s news article titled: “Trustmark Corporation Announces Fourth Quarter and Fiscal Year 2018 Financial Results – Business Wire” with publication date: January 23, 2019.

The stock increased 0.40% or $0.13 during the last trading session, reaching $32.78. About 733,672 shares traded or 49.37% up from the average. Trustmark Corporation (NASDAQ:TRMK) has declined 8.99% since February 11, 2018 and is downtrending. It has underperformed by 8.99% the S&P500. Some Historical TRMK News: 24/04/2018 – TRUSTMARK 1Q NET INTEREST MARGIN 3.37%, EST. 3.41%; 24/04/2018 – Trustmark 1Q EPS 54c; 02/05/2018 – Wells Fargo Advisors LLC Exits Position in Trustmark; 21/05/2018 – Bradley Bodell Joins Trustmark as Chief Information Officer; 13/03/2018 – A.M. Best Affirms Credit Ratings of Trustmark Group, Inc. and Its Subsidiaries; 15/03/2018 – S&PGR Lowers Trustmark Corp. L-T Rtg To ‘BBB’; Outlook Stable; 15/03/2018 – S&P REVISES TRUSTMARK NATIONAL BANK TO RATING ‘BBB+’ FROM ‘A-‘; 24/04/2018 – TRUSTMARK 1Q EPS 54C, EST. 48C; 29/05/2018 – Trustmark Closes Below 200-Day Moving Average: Technicals; 12/03/2018 Judy Greffin Joins Trustmark Board of Directors

Trustmark Corporation operates as the bank holding firm for Trustmark National Bank that provides banking and other financial solutions to individuals and corporate institutions in the United States. The company has market cap of $2.16 billion. The firm offers checking, savings, and money market accounts; individual retirement accounts; certificates of deposits; financing for commercial and industrial projects, income producing commercial real estate, owner-occupied real estate, and construction and land development; and installment and real estate loans, and lines of credit. It has a 14.83 P/E ratio. It also provides mortgage banking services, including construction financing, production of conventional and government insured mortgages, and secondary marketing and mortgage servicing; overdraft facilities; safe deposit boxes; and treasury management services.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.