Somerset Capital Management Llp decreased its stake in Copa Holdings (CPA) by 34.2% based on its latest 2018Q3 regulatory filing with the SEC. Somerset Capital Management Llp sold 17,100 shares as the company’s stock declined 0.51% with the market. The institutional investor held 32,900 shares of the transportation company at the end of 2018Q3, valued at $2.63M, down from 50,000 at the end of the previous reported quarter. Somerset Capital Management Llp who had been investing in Copa Holdings for a number of months, seems to be less bullish one the $4.08B market cap company. The stock decreased 0.64% or $0.62 during the last trading session, reaching $96.22. About 193,778 shares traded. Copa Holdings, S.A. (NYSE:CPA) has declined 42.40% since February 10, 2018 and is downtrending. It has underperformed by 42.40% the S&P500. Some Historical CPA News: 18/05/2018 – CPA, AAL, BA: @StevenCejas Cubana doesn’t operate 737s – so it’s another airline or the wrong type of plane. – ! $CPA $AAL $BA; 11/04/2018 – COPA HOLDINGS SA – FOR MONTH OF MARCH 2018 CAPACITY (ASMS) INCREASED 12.3%; 09/05/2018 – COPA HOLDINGS SA – FOR 1Q18, CONSOLIDATED PASSENGER TRAFFIC GREW 10.4% WHILE CONSOLIDATED CAPACITY GREW 8.4%; 14/05/2018 – Copa Holdings April Load Factor 81.9% Vs 82%; 14/05/2018 – COPA HOLDINGS APRIL TRAFFIC UP 11.9% Y/Y; 05/04/2018 – COPA HOLDINGS SA CPA.N : MORGAN STANLEY RAISES TARGET PRICE TO $156 FROM $150; 24/05/2018 – COPA HOLDINGS SA CPA.N : UBS RAISES TO BUY FROM SELL; 09/05/2018 – Copa Holdings Reports Net Income of $136.5 million and EPS of $3.22 for the First Quarter of 2018; 14/05/2018 – COPA HOLDINGS SA – APRIL 2018 RPM 1,712.5 MLN, UP 11.9 PCT; 09/05/2018 – COPA HOLDINGS SA – CONSOLIDATED LOAD FACTOR FOR QUARTER INCREASED 1.5 PERCENTAGE POINTS TO 83.0%

Perkins Capital Management Inc decreased its stake in Biolife Solutions Inc (BLFS) by 11.82% based on its latest 2018Q3 regulatory filing with the SEC. Perkins Capital Management Inc sold 18,650 shares as the company’s stock declined 43.71% with the market. The institutional investor held 139,150 shares of the health care company at the end of 2018Q3, valued at $2.44 million, down from 157,800 at the end of the previous reported quarter. Perkins Capital Management Inc who had been investing in Biolife Solutions Inc for a number of months, seems to be less bullish one the $297.11M market cap company. The stock increased 1.07% or $0.17 during the last trading session, reaching $16.06. About 64,980 shares traded. BioLife Solutions, Inc. (NASDAQ:BLFS) has risen 109.87% since February 10, 2018 and is uptrending. It has outperformed by 109.87% the S&P500. Some Historical BLFS News: 10/05/2018 – BIOLIFE SOLUTIONS INC – AFFIRMING BIOPRESERVATION MEDIA REVENUE IS NOW EXPECTED TO RANGE BETWEEN $14.5 MLN TO $15.5 MLN FOR 2018; 16/05/2018 – BioLife Solutions Makes Investment in SAVSU Technologies to Support Growth and Capture Additional Regenerative Medicine Cold Chain Opportunities; 09/03/2018 – BioLife Solutions Short-Interest Ratio Rises 335% to 37 Days; 26/03/2018 – BioLife Solutions and SAVSU Technologies to be Awarded Second Patent for Next Generation Cold Chain Technologies Designed for C; 08/03/2018 – BioLife Solutions Expects to Achieve GAAP Operating Profitability for First Time in 2018; 26/03/2018 – BioLife Solutions and SAVSU Technologies to be Awarded Second Patent for Next Generation Cold Chain Technologies Designed for Cell and Gene Therapies; 02/04/2018 – BIOLIFE SOLUTIONS INC – SEES FY GAAP OPERATING PROFIT WITH PROPORTIONAL INCREASES IN ADJUSTED EBITDA AND CASH FLOW FROM OPERATIONS; 02/04/2018 – BIOLIFE SOLUTIONS INC – SEES 2018 GROSS MARGIN TO BE BETWEEN 62 PCT AND 64 PCT, UP FROM 61 PCT FOR 2017; 09/04/2018 – Casdin Capital to Become Shareholder in BioLife Solutions; 22/04/2018 – DJ BioLife Solutions Inc, Inst Holders, 1Q 2018 (BLFS)

Among 18 analysts covering Copa Holdings SA (NYSE:CPA), 8 have Buy rating, 2 Sell and 8 Hold. Therefore 44% are positive. Copa Holdings SA had 67 analyst reports since August 4, 2015 according to SRatingsIntel. HSBC upgraded the stock to “Buy” rating in Friday, June 22 report. The stock has “Peer Perform” rating by Wolfe Research on Monday, December 14. Cowen & Co maintained Copa Holdings, S.A. (NYSE:CPA) on Monday, September 11 with “Hold” rating. The firm has “Market Perform” rating by Raymond James given on Monday, October 22. Cowen & Co maintained the shares of CPA in report on Friday, May 11 with “Hold” rating. As per Friday, May 6, the company rating was downgraded by Credit Suisse. The company was downgraded on Friday, November 9 by Evercore. The stock of Copa Holdings, S.A. (NYSE:CPA) has “Buy” rating given on Wednesday, September 12 by Buckingham Research. The firm earned “Hold” rating on Thursday, August 10 by Cowen & Co. The stock of Copa Holdings, S.A. (NYSE:CPA) has “Hold” rating given on Friday, August 5 by HSBC.

More notable recent Copa Holdings, S.A. (NYSE:CPA) news were published by: Prnewswire.com which released: “Copa Holdings Announces Monthly Traffic Statistics for December 2018 – PRNewswire” on January 17, 2019, also Seekingalpha.com with their article: “Copa Holdings, S.A. – Flying Under Investors’ Radars – Seeking Alpha” published on July 26, 2018, Zacks.com published: “Copa Holdings (CPA) Expected to Beat Earnings Estimates: Should You Buy? – Zacks.com” on February 06, 2019. More interesting news about Copa Holdings, S.A. (NYSE:CPA) were released by: Bostonglobe.com and their article: “GE is shedding more light on its political donations – The Boston Globe” published on January 17, 2019 as well as Seekingalpha.com‘s news article titled: “Copa Buffeted By Macro Issues – Seeking Alpha” with publication date: August 10, 2018.

Analysts await Copa Holdings, S.A. (NYSE:CPA) to report earnings on February, 20. They expect $0.99 earnings per share, down 58.05% or $1.37 from last year’s $2.36 per share. CPA’s profit will be $42.00 million for 24.30 P/E if the $0.99 EPS becomes a reality. After $1.36 actual earnings per share reported by Copa Holdings, S.A. for the previous quarter, Wall Street now forecasts -27.21% negative EPS growth.

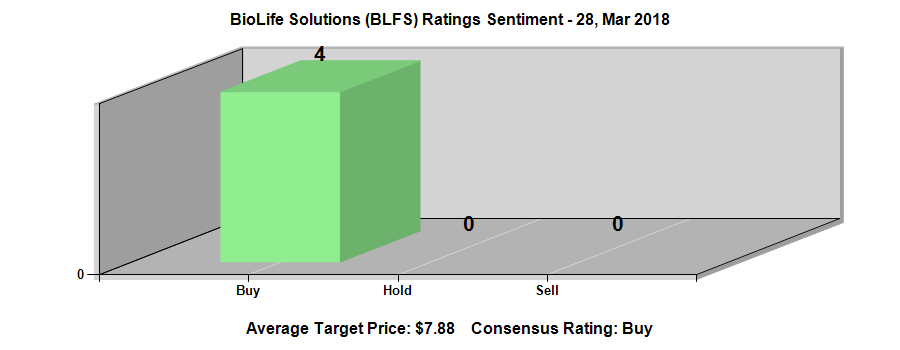

Among 4 analysts covering BioLife Solutions (NASDAQ:BLFS), 4 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. BioLife Solutions had 10 analyst reports since June 14, 2017 according to SRatingsIntel. The firm has “Buy” rating by Maxim Group given on Monday, July 31. Maxim Group maintained the stock with “Buy” rating in Wednesday, June 14 report. The firm earned “Buy” rating on Friday, August 11 by Maxim Group. The rating was initiated by FBR Capital with “Buy” on Thursday, June 7. As per Friday, May 11, the company rating was maintained by Maxim Group. As per Monday, March 12, the company rating was initiated by Northland Capital. The firm earned “Buy” rating on Friday, November 10 by Maxim Group. The stock has “Buy” rating by Maxim Group on Thursday, November 30. The stock of BioLife Solutions, Inc. (NASDAQ:BLFS) earned “Buy” rating by FBR Capital on Wednesday, October 3. As per Wednesday, July 5, the company rating was upgraded by Janney Capital.

More notable recent BioLife Solutions, Inc. (NASDAQ:BLFS) news were published by: Nasdaq.com which released: “GW Pharma (GWPH) Q3 Earnings: Is a Turnaround in the Cards? – Nasdaq” on August 06, 2018, also Nasdaq.com with their article: “Top Ranked Momentum Stocks to Buy for August 3rd – Nasdaq” published on August 03, 2018, Seekingalpha.com published: “BioLife Earnings: Here’s What To Expect – Seeking Alpha” on August 09, 2017. More interesting news about BioLife Solutions, Inc. (NASDAQ:BLFS) were released by: Seekingalpha.com and their article: “Biolife Solutions, Inc. (BLFS) CEO Michael Rice on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” published on November 09, 2018 as well as Seekingalpha.com‘s news article titled: “BioLife Solutions, Inc. 2018 Q3 – Results – Earnings Call Slides – Seeking Alpha” with publication date: November 09, 2018.

Analysts await BioLife Solutions, Inc. (NASDAQ:BLFS) to report earnings on March, 14. They expect $0.04 earnings per share, up 180.00% or $0.09 from last year’s $-0.05 per share. BLFS’s profit will be $739,993 for 100.38 P/E if the $0.04 EPS becomes a reality. After $0.05 actual earnings per share reported by BioLife Solutions, Inc. for the previous quarter, Wall Street now forecasts -20.00% negative EPS growth.

Investors sentiment decreased to 1.88 in Q3 2018. Its down 5.62, from 7.5 in 2018Q2. It worsened, as 5 investors sold BLFS shares while 12 reduced holdings. 15 funds opened positions while 17 raised stakes. 4.68 million shares or 19.16% less from 5.80 million shares in 2018Q2 were reported. Hudock Capital Gp Lc invested in 43 shares. Cadence Mngmt Ltd holds 135,179 shares or 0.13% of its portfolio. Millennium Management Limited Liability holds 0% of its portfolio in BioLife Solutions, Inc. (NASDAQ:BLFS) for 213,210 shares. Eam Investors Limited Liability Com reported 78,535 shares. Geode Cap Management Ltd reported 62,321 shares stake. Invesco holds 33,517 shares or 0% of its portfolio. Granite Limited Liability Corporation owns 82,162 shares for 0.08% of their portfolio. Pennsylvania-based Federated Invsts Incorporated Pa has invested 0% in BioLife Solutions, Inc. (NASDAQ:BLFS). 621 were accumulated by Quantbot Techs Ltd Partnership. 41,726 were reported by Northern Corporation. Venator Cap Management holds 403,211 shares. 135,181 were reported by Granahan Invest Mgmt Inc Ma. Acadian Asset Mngmt Ltd Liability reported 69,361 shares. Natl Bank Of New York Mellon reported 47,721 shares. Wells Fargo & Mn stated it has 0% of its portfolio in BioLife Solutions, Inc. (NASDAQ:BLFS).

Since August 16, 2018, it had 0 buys, and 15 insider sales for $2.28 million activity. $48,200 worth of stock was sold by Hinson Andrew G on Thursday, December 13. DE GREEF RODERICK also sold $100,000 worth of BioLife Solutions, Inc. (NASDAQ:BLFS) shares. 12,540 shares were sold by Rice Michael, worth $220,328. Schick Joseph C sold $123,689 worth of BioLife Solutions, Inc. (NASDAQ:BLFS) on Friday, August 24. The insider Berard Todd sold $36,360.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.