M&T Bank Corp decreased Travelers Companies Inc (TRV) stake by 2.02% reported in 2018Q3 SEC filing. M&T Bank Corp sold 2,953 shares as Travelers Companies Inc (TRV)’s stock declined 3.61%. The M&T Bank Corp holds 143,423 shares with $18.60M value, down from 146,376 last quarter. Travelers Companies Inc now has $33.16 billion valuation. The stock decreased 0.77% or $0.97 during the last trading session, reaching $125.79. About 1.25 million shares traded. The Travelers Companies, Inc. (NYSE:TRV) has declined 8.35% since February 10, 2018 and is downtrending. It has underperformed by 8.35% the S&P500. Some Historical TRV News: 10/04/2018 – Airbus Will Let Travelers Sleep in the Cargo Hold (Video); 17/04/2018 – Denihan to Celebrate National Business Travelers Day on April 24, 2018; 13/03/2018 – OLD MUTUAL PLC OML.L – OLD MUTUAL PLC NOTES THAT TRAVELERS COMPANIES, INC. AND ST; 24/04/2018 – Travelers 1Q Adj EPS $2.46; 08/05/2018 – PAUL GLOVER JOINS G2 INSURANCE SERVICES AS ASSISTANT VICE PRESIDENT AND PRODUCER; 03/05/2018 – Travelers Named Noteworthy Company by DiversityInc; 31/05/2018 – Hurricane Season Begins, Travelers Seeking Advice; 13/03/2018 – VisaHQ Collaborates with Alibaba’s Fliggy to Expedite Outbound Tourism for Chinese Travelers; 24/04/2018 – TRAVELERS COMPANIES INC TRV.N – QTRLY NET INVESTMENT INCOME OF $603 MLN PRE-TAX VS $610 MLN; 24/04/2018 – Travelers 1Q EPS $2.42

Allen Investment Management Llc increased Workday Inc (WDAY) stake by 11.59% reported in 2018Q3 SEC filing. Allen Investment Management Llc acquired 3,319 shares as Workday Inc (WDAY)’s stock rose 11.15%. The Allen Investment Management Llc holds 31,955 shares with $4.67M value, up from 28,636 last quarter. Workday Inc now has $41.29 billion valuation. The stock increased 1.50% or $2.8 during the last trading session, reaching $189.41. About 1.57 million shares traded. Workday, Inc. (NYSE:WDAY) has risen 53.24% since February 10, 2018 and is uptrending. It has outperformed by 53.24% the S&P500. Some Historical WDAY News: 08/03/2018 – Workday Announces Annual Stockholder Meeting; 11/04/2018 – Workday Continues European Growth with Italy Launch; 07/03/2018 DocuSign picks banks for potential IPO in April; 16/03/2018 – Workday Ranks #3 as a Best Place to Work in Germany; 17/04/2018 – Workday Closes Above 50-Day Moving Average: Technicals; 08/03/2018 – WORKDAY INC WDAY.O : UBS RAISES TARGET PRICE TO $112 FROM $95; 22/04/2018 – DJ Workday Inc Class A, Inst Holders, 1Q 2018 (WDAY); 26/04/2018 – Workday Ranks #1 Best Place to Work in the UK; 30/04/2018 – Fidelity Select Software Adds Box, Cuts Workday; 11/04/2018 – WORKDAY INC – ANNOUNCED IT IS EXPANDING ITS OPERATIONS INTO ITALY

More notable recent Workday, Inc. (NASDAQ:WDAY) news were published by: Seekingalpha.com which released: “Workday: Revenue Growth At The Cost Of Operating Margins – Seeking Alpha” on February 01, 2019, also Seekingalpha.com with their article: “Workday +5% on reported Accenture HR deal (update) – Seeking Alpha” published on January 31, 2019, Seekingalpha.com published: “VC Deals Of The Week: Strong Start For Uber Competitors – Seeking Alpha” on January 12, 2019. More interesting news about Workday, Inc. (NASDAQ:WDAY) were released by: Seekingalpha.com and their article: “3 Stocks To Buy In February 2019 (Podcast) – Seeking Alpha” published on January 28, 2019 as well as Investorideas.com‘s news article titled: “Newswire – The #AI Eye: Genpact (NYSE: $G) and Workday (NasdaqGS: $WDAY) Partner For Digital Transformation and Alteryx (NYSE: $AYX) Named Challenger in Gartner’s 2019 Magic Quadrant – InvestorIdeas.com” with publication date: January 31, 2019.

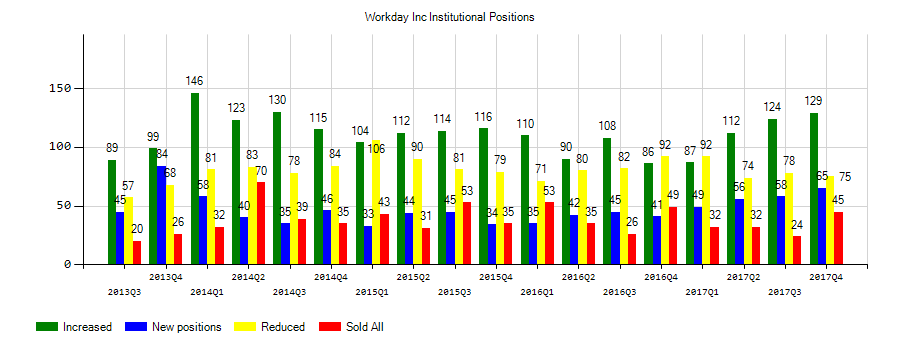

Investors sentiment decreased to 1.12 in Q3 2018. Its down 0.42, from 1.54 in 2018Q2. It dived, as 31 investors sold WDAY shares while 120 reduced holdings. 58 funds opened positions while 111 raised stakes. 147.63 million shares or 1.61% more from 145.29 million shares in 2018Q2 were reported. Advisory owns 4,909 shares or 0.01% of their US portfolio. Clearbridge Invests Ltd Liability Corp invested 0.03% in Workday, Inc. (NASDAQ:WDAY). Ameritas Invest Prns has 2,556 shares. Allen Limited Liability Company invested in 111,992 shares. Highland Cap Ltd Limited Liability Company has 2,300 shares for 0.02% of their portfolio. Symphony Asset Llc has invested 0.57% in Workday, Inc. (NASDAQ:WDAY). Banbury Partners Limited Liability Corporation invested in 57,610 shares or 2.23% of the stock. Bailard holds 0.01% of its portfolio in Workday, Inc. (NASDAQ:WDAY) for 1,617 shares. Signaturefd Ltd reported 139 shares. Dnb Asset As holds 17,611 shares or 0% of its portfolio. Teachers Retirement Sys Of The State Of Kentucky has 38,574 shares for 0.07% of their portfolio. Tower Research Capital Lc (Trc) reported 967 shares. Deutsche Commercial Bank Ag reported 835,815 shares. 31,645 were accumulated by Secor L P. Daiwa Securities accumulated 24,141 shares.

Since September 6, 2018, it had 0 buys, and 34 selling transactions for $237.62 million activity. Shares for $296,776 were sold by Stankey Michael A. on Tuesday, January 15. Another trade for 12,000 shares valued at $1.72M was sold by STILL GEORGE J JR. Another trade for 6,699 shares valued at $985,207 was made by Dermetzis Petros on Monday, September 17. The insider Bozzini James sold 4,024 shares worth $663,398. Fernandez Gomez Luciano sold $573,755 worth of stock or 3,483 shares. Another trade for 1,545 shares valued at $254,729 was made by Shaughnessy James P on Tuesday, January 15. The insider DUFFIELD DAVID A sold 374,488 shares worth $50.01M.

Allen Investment Management Llc decreased Ishares Tr (ACWI) stake by 26,000 shares to 21,479 valued at $1.60M in 2018Q3. It also reduced Anheuser Busch Inbev Sa/Nv (NYSE:BUD) stake by 148,979 shares and now owns 507,207 shares. Mongodb Inc was reduced too.

Among 12 analysts covering Workday (NYSE:WDAY), 6 have Buy rating, 0 Sell and 6 Hold. Therefore 50% are positive. Workday had 17 analyst reports since August 21, 2018 according to SRatingsIntel. The rating was maintained by BMO Capital Markets on Wednesday, September 5 with “Market Perform”. Morgan Stanley maintained Workday, Inc. (NASDAQ:WDAY) rating on Wednesday, September 5. Morgan Stanley has “Overweight” rating and $154 target. Credit Suisse maintained the stock with “Neutral” rating in Wednesday, September 5 report. Credit Suisse maintained it with “Neutral” rating and $155 target in Friday, November 30 report. The stock has “Overweight” rating by KeyBanc Capital Markets on Thursday, August 30. The stock of Workday, Inc. (NASDAQ:WDAY) has “Outperform” rating given on Wednesday, October 17 by Bernstein. KeyBanc Capital Markets maintained Workday, Inc. (NASDAQ:WDAY) rating on Friday, November 30. KeyBanc Capital Markets has “Overweight” rating and $179 target. BMO Capital Markets maintained it with “Market Perform” rating and $170 target in Friday, November 30 report. The firm has “Buy” rating given on Tuesday, August 21 by Guggenheim. Stifel Nicolaus maintained it with “Hold” rating and $150 target in Wednesday, September 5 report.

M&T Bank Corp increased L3 Technologies Inc stake by 7,763 shares to 7,768 valued at $1.65M in 2018Q3. It also upped Autohome Inc (NYSE:ATHM) stake by 5,466 shares and now owns 24,982 shares. Fedex Corp (NYSE:FDX) was raised too.

More notable recent The Travelers Companies, Inc. (NYSE:TRV) news were published by: which released: “Hurricane Michael, Fires Boost Catastrophic Losses For Travelers (NYSE:TRV), But Earnings Beat Street Estimates – Benzinga” on January 22, 2019, also Seekingalpha.com with their article: “Travelers’ Q4 2018 Earnings Review – Seeking Alpha” published on January 30, 2019, Seekingalpha.com published: “Travelers: Unfavorable Trends, Still Undervalued – Seeking Alpha” on January 31, 2019. More interesting news about The Travelers Companies, Inc. (NYSE:TRV) were released by: Seekingalpha.com and their article: “Travelers: Great Results Despite Earnings Miss – Seeking Alpha” published on January 24, 2019 as well as Seekingalpha.com‘s news article titled: “The Travelers Companies, Inc. (TRV) CEO Alan Schnitzer on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” with publication date: January 22, 2019.

Among 6 analysts covering Travelers Companies (NYSE:TRV), 2 have Buy rating, 1 Sell and 3 Hold. Therefore 33% are positive. Travelers Companies had 6 analyst reports since October 19, 2018 according to SRatingsIntel. Wells Fargo maintained it with “Market Perform” rating and $136 target in Friday, October 19 report. RBC Capital Markets downgraded The Travelers Companies, Inc. (NYSE:TRV) on Tuesday, December 11 to “Sector Perform” rating. Citigroup downgraded the shares of TRV in report on Friday, October 19 to “Neutral” rating. The company was maintained on Thursday, January 3 by Morgan Stanley. The rating was upgraded by Barclays Capital to “Overweight” on Wednesday, January 9.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.