Analysts expect Cloud Peak Energy Inc. (NYSE:CLD) to report $-0.13 EPS on February, 21.They anticipate $0.03 EPS change or 18.75% from last quarter’s $-0.16 EPS. After having $0.16 EPS previously, Cloud Peak Energy Inc.’s analysts see -181.25% EPS growth. The stock increased 3.27% or $0.0137 during the last trading session, reaching $0.4324. About 11.34M shares traded or 244.50% up from the average. Cloud Peak Energy Inc. (NYSE:CLD) has declined 83.06% since February 10, 2018 and is downtrending. It has underperformed by 83.06% the S&P500. Some Historical CLD News: 26/04/2018 – Cloud Peak Energy 1Q Rev $216.3M; 24/05/2018 – CLOUD PEAK ENERGY – MAXIMUM BORROWING CAPACITY UNDER AMENDED CREDIT AGREEMENT REDUCED TO $150 MLN, FROM PREVIOUS MAXIMUM CAPACITY OF $400 MLN; 26/04/2018 – Cloud Peak Energy 1Q Loss/Shr 10c; 27/03/2018 – Hootsuite Awarded Adobe Exchange Partner of the Year; 15/05/2018 – Leucadia National Buys New 1.3% Position in Cloud Peak Energy; 26/04/2018 – CLOUD PEAK 1Q EARNINGS CALL ENDS; 30/05/2018 – Cloud Peak Energy Closes Above 200-Day Average: Technicals; 24/05/2018 – CLOUD PEAK ENERGY EXTENDS & AMENDS REVOLVING CREDIT LINE &; 08/04/2018 – Quantum Cloud Partners with AWS to Provide Global Cloud Rendering; 24/05/2018 – Cloud Peak Energy Extends and Amends Revolving Credit Facility and Receivables Securitization Facility

TS03 INC TRUST UNITS (OTCMKTS:TSTIF) had an increase of 1.96% in short interest. TSTIF’s SI was 10,400 shares in February as released by FINRA. Its up 1.96% from 10,200 shares previously. With 56,800 avg volume, 0 days are for TS03 INC TRUST UNITS (OTCMKTS:TSTIF)’s short sellers to cover TSTIF’s short positions. The stock decreased 7.17% or $0.0342 during the last trading session, reaching $0.4428. About 26,500 shares traded or 352.22% up from the average. TSO3 Inc. (OTCMKTS:TSTIF) has 0.00% since February 10, 2018 and is . It has by 0.00% the S&P500.

More news for TSO3 Inc. (OTCMKTS:TSTIF) were recently published by: Seekingalpha.com, which released: “TSO3 Inc.: Taking The Fight To The Superbugs – Seeking Alpha” on September 21, 2017. Seekingalpha.com‘s article titled: “Prometic: Still A Buy Despite The Delay In Plasminogen’s BLA – Seeking Alpha” and published on March 30, 2018 is yet another important article.

TSO3 Inc. engages in the research, development, production, maintenance, sale, and licensing of sterilization processes, related consumable supplies, and accessories for heat and moisture sensitive medical devices. The company has market cap of $41.16 million. The companyÂ’s principal product is the STERIZONE VP4 sterilizer, a dual sterilant, low temperature sterilization system that utilizes vaporized hydrogen peroxide and ozone that is marketed in Canada and the United States. It currently has negative earnings. It also develops and sells the STERIZONE 125L+ sterilizer, which is designed for terminal sterilization of heat and moisture sensitive medical devices, and is intended for the reprocessing of general instruments, rigid channel instruments, and single/multi-channel rigid endoscopes, as well as short and long single/multi-channel flexible endoscopes; and STERIZONE CI+ chemical indicator in Canada.

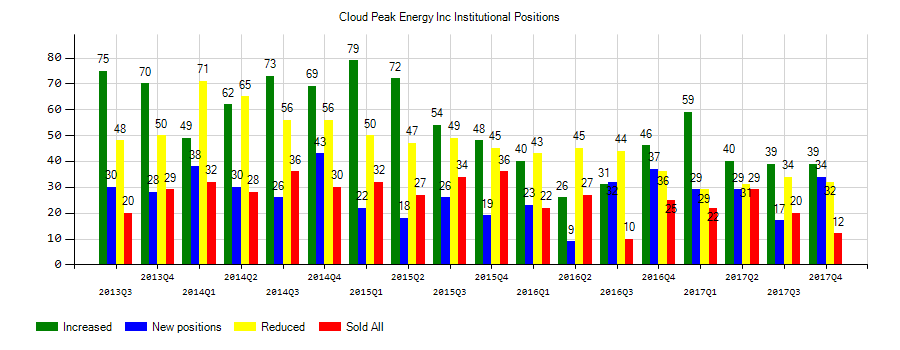

Investors sentiment decreased to 0.9 in Q3 2018. Its down 0.86, from 1.76 in 2018Q2. It turned negative, as 18 investors sold Cloud Peak Energy Inc. shares while 32 reduced holdings. 11 funds opened positions while 34 raised stakes. 55.67 million shares or 5.28% less from 58.77 million shares in 2018Q2 were reported. Aqr Cap Mgmt Limited Liability Corporation reported 0% in Cloud Peak Energy Inc. (NYSE:CLD). Prudential has invested 0% in Cloud Peak Energy Inc. (NYSE:CLD). Barnett And invested in 6,000 shares. Louisiana State Employees Retirement System reported 0% stake. D E Shaw Com stated it has 0% in Cloud Peak Energy Inc. (NYSE:CLD). Tci Wealth Advisors owns 8 shares. First Tru Financial Bank Limited reported 635,100 shares. Moreover, Stratos Wealth Prtn Ltd has 0% invested in Cloud Peak Energy Inc. (NYSE:CLD) for 500 shares. Barclays Public Ltd Co holds 82,745 shares or 0% of its portfolio. Oakworth Cap holds 0% or 41 shares. 1.68M are held by Invesco Limited. The New York-based Jane Street Grp Ltd Limited Liability Company has invested 0% in Cloud Peak Energy Inc. (NYSE:CLD). Sector Pension Investment Board has 0% invested in Cloud Peak Energy Inc. (NYSE:CLD). Alliancebernstein Lp reported 27,100 shares. Bancshares Of Ny Mellon has invested 0% in Cloud Peak Energy Inc. (NYSE:CLD).

More notable recent Cloud Peak Energy Inc. (NYSE:CLD) news were published by: Globenewswire.com which released: “Recent Analysis Shows HP, Viasat, Consolidated Communications, Guess?, Cloud Peak Energy, and Newpark Resources Market Influences — Renewed Outlook, Key Drivers of Growth – GlobeNewswire” on February 01, 2019, also with their article: “36 Stocks Moving In Monday’s Mid-Day Session – Benzinga” published on January 28, 2019, Zacks.com published: “Cloud Peak Energy (CLD) Outpaces Stock Market Gains: What You Should Know – Zacks.com” on February 01, 2019. More interesting news about Cloud Peak Energy Inc. (NYSE:CLD) were released by: Seekingalpha.com and their article: “Cloud Peak Energy: Problems Continue – Seeking Alpha” published on October 26, 2018 as well as Seekingalpha.com‘s news article titled: “Cloud Peak Energy: Still Putting Coal In Investors’ Stockings – Seeking Alpha” with publication date: December 30, 2018.

Cloud Peak Energy Inc. produces coal in the Powder River Basin in the United States. The company has market cap of $32.77 million. The firm operates through Owned and Operated Mines, and Logistics and Related Activities. It currently has negative earnings. It owns and operates three surface coal mines comprising the Antelope Mine and the Cordero Rojo Mine located in Wyoming; and the Spring Creek Mine located in Montana.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.