De Burlo Group Inc increased its stake in Thermo Fisher Scientific Inc (TMO) by 20.65% based on its latest 2018Q3 regulatory filing with the SEC. De Burlo Group Inc bought 8,950 shares as the company’s stock declined 0.05% with the market. The institutional investor held 52,289 shares of the industrial machinery and components company at the end of 2018Q3, valued at $12.76 million, up from 43,339 at the end of the previous reported quarter. De Burlo Group Inc who had been investing in Thermo Fisher Scientific Inc for a number of months, seems to be bullish on the $98.03 billion market cap company. The stock increased 0.25% or $0.6 during the last trading session, reaching $243.51. About 794,599 shares traded. Thermo Fisher Scientific Inc. (NYSE:TMO) has risen 27.72% since February 9, 2018 and is uptrending. It has outperformed by 27.72% the S&P500. Some Historical TMO News: 12/04/2018 – Thermo Fisher Presenting at Conference Apr 15; 02/04/2018 – THERMO FISHER SCIENTIFIC INC TMO.N : MORGAN STANLEY RAISES TARGET PRICE TO $228 FROM $227; 19/03/2018 – Cubic Names Rhys Williams as New Vice President, Treasurer; 23/04/2018 – STL Today: Thermo Fisher to make $50 million investment, add 80 jobs in St. Louis; 13/04/2018 – Global Gas Analyzer Market Forecast to 2023 with ABB Group, Emerson Electric, General Electric, Figaro Engineering, and Thermo Fishers Scientific Dominating – ResearchAndMarkets.com; 16/05/2018 – Testing for all lung cancer mutations at once found cost effective-study; 15/03/2018 – Charité — Universitätsmedizin Berlin Joins Thermo Fisher Scientific’s Next-Generation Sequencing Center of Excellence; 25/04/2018 – Thermo Fisher Sees FY Adj EPS $10.80-Adj EPS $10.96; 25/04/2018 – THERMO FISHER 1Q REV. $5.85B, EST. $5.63B; 01/05/2018 – Thermo Fisher Scientific Signs New Agreements to Expand Oncomine Dx Target Test

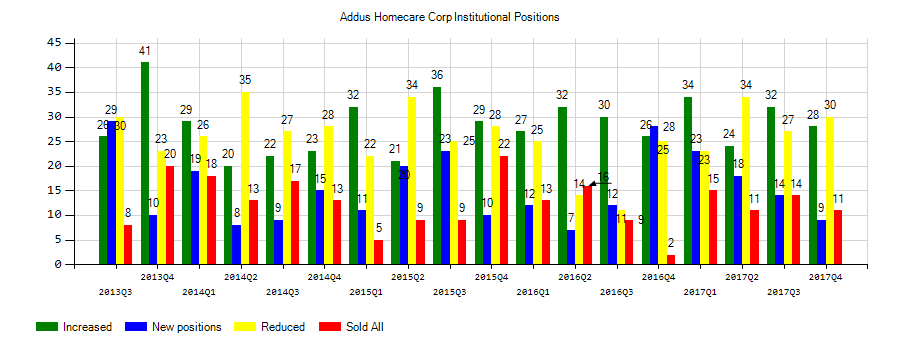

Cambridge Investment Research Advisors Inc decreased its stake in Addus Homecare (ADUS) by 37.59% based on its latest 2018Q3 regulatory filing with the SEC. Cambridge Investment Research Advisors Inc sold 7,249 shares as the company’s stock rose 9.87% while stock markets declined. The institutional investor held 12,033 shares of the medical and nursing services company at the end of 2018Q3, valued at $844,000, down from 19,282 at the end of the previous reported quarter. Cambridge Investment Research Advisors Inc who had been investing in Addus Homecare for a number of months, seems to be less bullish one the $812.08M market cap company. The stock decreased 1.67% or $1.09 during the last trading session, reaching $64.3. About 88,152 shares traded. Addus HomeCare Corporation (NASDAQ:ADUS) has risen 128.51% since February 9, 2018 and is uptrending. It has outperformed by 128.51% the S&P500. Some Historical ADUS News: 05/03/2018 – Addus HomeCare 4Q EPS 28c; 02/04/2018 – ADDUS HOMECARE CORP – ADDUS CLOSED TRANSACTION ON APRIL 1, 2018 WITH FUNDING FROM DELAYED DRAW TERM LOAN PORTION OF ITS CREDIT FACILITY; 13/04/2018 – Analysis: Positioning to Benefit within Addus HomeCare, Adamas Pharmaceuticals, ManTech International, Yintech Investment, GRID; 05/03/2018 Addus HomeCare 4Q Rev $112M; 02/04/2018 – Addus HomeCare Announces Purchase Of Arcadia Home Care & Staffing Business; 07/05/2018 – ADDUS HOMECARE CORP – QTRLY SAME-STORE SALES INCREASE 4.6%; 23/04/2018 – DJ Addus HomeCare Corporation, Inst Holders, 1Q 2018 (ADUS); 05/03/2018 – Addus HomeCare 4Q Adj EPS 46c; 01/05/2018 – Addus HomeCare Completes Purchase Of Ambercare

Investors sentiment decreased to 0.85 in Q3 2018. Its down 0.23, from 1.08 in 2018Q2. It dropped, as 41 investors sold TMO shares while 434 reduced holdings. 111 funds opened positions while 295 raised stakes. 333.46 million shares or 0.38% more from 332.19 million shares in 2018Q2 were reported. Citadel Advsr Ltd Co invested in 3,401 shares. Trustco Natl Bank N Y holds 0.3% of its portfolio in Thermo Fisher Scientific Inc. (NYSE:TMO) for 1,151 shares. Douglass Winthrop Advisors Ltd Com has invested 0.06% in Thermo Fisher Scientific Inc. (NYSE:TMO). Winslow Cap stated it has 1.48 million shares or 1.8% of all its holdings. Valley Advisers, a Pennsylvania-based fund reported 23 shares. Bradley Foster And Sargent Ct has 243,159 shares. State Treasurer State Of Michigan has invested 0.66% of its portfolio in Thermo Fisher Scientific Inc. (NYSE:TMO). Everence Capital Mgmt, a Indiana-based fund reported 11,629 shares. Ruggie Group Incorporated reported 29 shares. 18,321 were reported by Meiji Yasuda Life. Davenport Ltd has 1,707 shares for 0% of their portfolio. Moreover, Moneta Grp Incorporated Inv Llc has 0.04% invested in Thermo Fisher Scientific Inc. (NYSE:TMO). Howard Cap, New York-based fund reported 52,111 shares. Martingale Asset Lp has 0.08% invested in Thermo Fisher Scientific Inc. (NYSE:TMO) for 29,751 shares. Oakbrook Invs Ltd Liability Corporation holds 0.02% or 1,250 shares.

Among 20 analysts covering Thermo Fisher Scientific (NYSE:TMO), 17 have Buy rating, 0 Sell and 3 Hold. Therefore 85% are positive. Thermo Fisher Scientific had 74 analyst reports since July 24, 2015 according to SRatingsIntel. The firm earned “Outperform” rating on Monday, October 9 by Leerink Swann. The firm earned “Buy” rating on Wednesday, October 10 by Citigroup. The rating was maintained by Morgan Stanley on Thursday, July 26 with “Overweight”. Goldman Sachs upgraded Thermo Fisher Scientific Inc. (NYSE:TMO) on Tuesday, December 8 to “Americas Conviction Buy List” rating. On Wednesday, October 25 the stock rating was maintained by Cowen & Co with “Buy”. The rating was maintained by Robert W. Baird with “Outperform” on Thursday, October 25. The stock of Thermo Fisher Scientific Inc. (NYSE:TMO) has “Overweight” rating given on Thursday, February 1 by Morgan Stanley. The company was maintained on Monday, September 25 by Barclays Capital. The stock of Thermo Fisher Scientific Inc. (NYSE:TMO) has “Buy” rating given on Monday, October 23 by Robert W. Baird. On Thursday, January 7 the stock rating was initiated by Deutsche Bank with “Buy”.

Since October 1, 2018, it had 0 insider buys, and 5 sales for $39.04 million activity. Another trade for 125,520 shares valued at $31.07 million was sold by CASPER MARC N. Jacks Tyler sold $277,176 worth of stock. Williamson Stephen sold $2.29 million worth of stock.

More notable recent Thermo Fisher Scientific Inc. (NYSE:TMO) news were published by: Prnewswire.com which released: “Thermo Fisher Scientific to Acquire Advanced Bioprocessing Business from BD – PR Newswire” on September 07, 2018, also Themiddlemarket.com with their article: “M&A wrap: Thoma Bravo, Veracode, Apttus, Centrify, PHC Holdings, Century Par – Mergers & Acquisitions” published on January 29, 2019, Seekingalpha.com published: “Thermo Fisher Scientific – Buying Its Way To The Top – Seeking Alpha” on August 08, 2016. More interesting news about Thermo Fisher Scientific Inc. (NYSE:TMO) were released by: Seekingalpha.com and their article: “Thermo Fisher Scientific (TMO) Investor Presentation – Slideshow – Seeking Alpha” published on May 25, 2018 as well as Seekingalpha.com‘s news article titled: “Thermo Fisher in-licenses CRISPR technologies – Seeking Alpha” with publication date: September 18, 2018.

De Burlo Group Inc, which manages about $619.44 million and $533.15M US Long portfolio, decreased its stake in Amedisys Inc (NASDAQ:AMED) by 27,400 shares to 53,250 shares, valued at $6.65M in 2018Q3, according to the filing. It also reduced its holding in Zoetis Inc (NYSE:ZTS) by 27,000 shares in the quarter, leaving it with 45,200 shares, and cut its stake in Qualys Inc (NASDAQ:QLYS).

Among 7 analysts covering Addus Homecare (NASDAQ:ADUS), 7 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Addus Homecare had 11 analyst reports since August 4, 2015 according to SRatingsIntel. Oppenheimer maintained Addus HomeCare Corporation (NASDAQ:ADUS) on Tuesday, August 29 with “Buy” rating. The firm has “Outperform” rating given on Tuesday, August 4 by Oppenheimer. Robert W. Baird maintained Addus HomeCare Corporation (NASDAQ:ADUS) rating on Sunday, November 5. Robert W. Baird has “Hold” rating and $40.0 target. The rating was maintained by Robert W. Baird with “Hold” on Tuesday, March 13. As per Monday, April 2, the company rating was maintained by Stephens. The rating was upgraded by Robert W. Baird to “Outperform” on Monday, February 4.

More notable recent Addus HomeCare Corporation (NASDAQ:ADUS) news were published by: Nasdaq.com which released: “5 Quality Stock Picks Based on DuPont Analysis – Nasdaq” on January 08, 2019, also Streetinsider.com with their article: “Lamb Weston Holdings (LW), Maxim Integrated Products (MXIM) and Diamondback Energy (FANG) Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600 – StreetInsider.com” published on November 26, 2018, Marketwatch.com published: “Could ‘granny flats’ be the solution to America’s affordable-housing crisis? – MarketWatch” on March 26, 2018. More interesting news about Addus HomeCare Corporation (NASDAQ:ADUS) were released by: Nasdaq.com and their article: “HealthSouth Corp (HLS) Looks Good: Stock Moves 8% Higher – Nasdaq” published on May 01, 2017 as well as Nasdaq.com‘s news article titled: “Park-Ohio Holdings Corp. (PKOH) Ex-Dividend Date Scheduled for November 13, 2018 – Nasdaq” with publication date: November 12, 2018.

Investors sentiment decreased to 1.32 in Q3 2018. Its down 1.15, from 2.47 in 2018Q2. It fall, as 19 investors sold ADUS shares while 38 reduced holdings. 40 funds opened positions while 35 raised stakes. 199.29 million shares or 1838.54% more from 10.28 million shares in 2018Q2 were reported. Tudor Inv Et Al holds 0.01% in Addus HomeCare Corporation (NASDAQ:ADUS) or 2,896 shares. 9,000 are owned by State Common Retirement Fund. Gsa Capital Partners Llp owns 3,600 shares. Eaton Vance Management owns 126,253 shares. Castleark Lc holds 136,775 shares. Vanguard Incorporated holds 544,748 shares or 0% of its portfolio. State Teachers Retirement System holds 0% of its portfolio in Addus HomeCare Corporation (NASDAQ:ADUS) for 700 shares. Us Retail Bank De has 0% invested in Addus HomeCare Corporation (NASDAQ:ADUS). Bogle Invest Ltd Partnership De holds 0.05% or 10,049 shares. Smith Asset Management Gru Ltd Partnership holds 0.05% in Addus HomeCare Corporation (NASDAQ:ADUS) or 26,034 shares. Driehaus Cap Limited Liability Corp has invested 0.03% in Addus HomeCare Corporation (NASDAQ:ADUS). The Wyoming-based Friess Associates Ltd Liability Com has invested 0.36% in Addus HomeCare Corporation (NASDAQ:ADUS). Timessquare Cap Management Limited Liability reported 729,420 shares or 0.34% of all its holdings. Moreover, State Street has 0% invested in Addus HomeCare Corporation (NASDAQ:ADUS). Bankshares Of America De accumulated 3,389 shares.

Cambridge Investment Research Advisors Inc, which manages about $19.96B and $10.47B US Long portfolio, upped its stake in First Tr Exchange Traded (FXN) by 32,281 shares to 183,476 shares, valued at $3.21M in 2018Q3, according to the filing. It also increased its holding in Netease Inc Sponsored (NASDAQ:NTES) by 3,930 shares in the quarter, for a total of 5,633 shares, and has risen its stake in Danaher Corp Del (NYSE:DHR).

Since August 20, 2018, it had 0 insider buys, and 9 selling transactions for $201.51 million activity. ALLISON R DIRK had sold 1,080 shares worth $68,040 on Tuesday, January 22. FIRST MARK L sold 540,000 shares worth $39.13M. Shares for $39.13 million were sold by Eos Capital Partners III L P. On Thursday, January 17 BICKHAM W BRADLEY sold $45,212 worth of Addus HomeCare Corporation (NASDAQ:ADUS) or 705 shares. Shares for $71,910 were sold by Manning Laurie on Monday, November 19. On Friday, November 16 ZOCCOLI JAMES sold $1.78M worth of Addus HomeCare Corporation (NASDAQ:ADUS) or 25,000 shares.

Analysts await Addus HomeCare Corporation (NASDAQ:ADUS) to report earnings on March, 4. They expect $0.47 earnings per share, up 11.90% or $0.05 from last year’s $0.42 per share. ADUS’s profit will be $5.94M for 34.20 P/E if the $0.47 EPS becomes a reality. After $0.41 actual earnings per share reported by Addus HomeCare Corporation for the previous quarter, Wall Street now forecasts 14.63% EPS growth.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.