Campbell Newman Asset Management Inc decreased its stake in Raytheon Co. (RTN) by 2.08% based on its latest 2018Q3 regulatory filing with the SEC. Campbell Newman Asset Management Inc sold 1,991 shares as the company’s stock declined 14.04% with the market. The institutional investor held 93,906 shares of the industrial machinery and components company at the end of 2018Q3, valued at $19.41M, down from 95,897 at the end of the previous reported quarter. Campbell Newman Asset Management Inc who had been investing in Raytheon Co. for a number of months, seems to be less bullish one the $49.68B market cap company. The stock decreased 0.85% or $1.49 during the last trading session, reaching $174.59. About 739,141 shares traded. Raytheon Company (NYSE:RTN) has declined 8.02% since February 8, 2018 and is downtrending. It has underperformed by 8.02% the S&P500. Some Historical RTN News: 16/03/2018 – Raytheon wins $511 mln U.S. defense contract – Pentagon; 31/05/2018 – /DISREGARD RELEASE: Raytheon Company/; 26/04/2018 – Raytheon 1Q Cont Ops EPS $2.20; 19/04/2018 – RAYTHEON: $83M PACT FOR BARRACUDA MINE NEUTRALIZATION SYSTEM; 13/03/2018 – Raytheon: Adriane M. Brown Elected to Bd of Directors; 22/03/2018 – RTN/@StateDeptPM: .@StateDept authorizes a proposed Foreign Military Sale (FMS) to #SaudiArabia for TOW 2B (BGM-71F-Series) Missiles, estimated at $670 million @StateDeptPM #FMSupdate-; 16/04/2018 – Media group FCW honors Raytheon executive Dave Wajsgras with top federal Information Technology industry award; 16/05/2018 – Sparton and Raytheon Team on Next Generation Mine Neutralization System; 03/05/2018 – Raytheon named key partner to develop America’s first, most advanced drone-testing airspace corridor; 23/04/2018 – Raytheon, Virsec establish alliance to protect government and critical infrastructure from advanced cyberattacks

Howe & Rusling Inc decreased its stake in Pfizer Inc (PFE) by 78.35% based on its latest 2018Q3 regulatory filing with the SEC. Howe & Rusling Inc sold 272,767 shares as the company’s stock rose 5.56% while stock markets declined. The institutional investor held 75,353 shares of the health care company at the end of 2018Q3, valued at $3.32M, down from 348,120 at the end of the previous reported quarter. Howe & Rusling Inc who had been investing in Pfizer Inc for a number of months, seems to be less bullish one the $241.16B market cap company. The stock increased 0.05% or $0.02 during the last trading session, reaching $41.72. About 10.16 million shares traded. Pfizer Inc. (NYSE:PFE) has risen 25.07% since February 8, 2018 and is uptrending. It has outperformed by 25.07% the S&P500. Some Historical PFE News: 23/03/2018 – PFIZER SAYS CONTINUES TO EVALUATE POTENTIAL STRATEGIC ALTERNATIVES FOR THE CONSUMER HEALTHCARE BUSINESS, INCLUDING A SPIN-OFF,SALE OR OTHER TRANSACTION, AND PFIZER ULTIMATELY RETAINING THE BUSINESS; 22/03/2018 – British consumer goods group Reckitt Benckiser has pulled out of discussions with Pfizer over buying its consumer healthcare business; 08/03/2018 – Pfizer is the latest big drug company to give up on neuroscience research; 06/04/2018 – Susan G. Komen and Pfizer Team Up To Support Metastatic Breast Cancer Patients and Caregivers in the U.S. with Educational; 18/05/2018 – U.S. FDA SAYS THERE WAS NO CHANGE IN THE ADVERSE EVENT PROFILE OF KEYTRUDA OR TECENTRIQ; 15/05/2018 – Pfizer’s Biosimilar RETACRIT® (epoetin alfa-epbx) Approved by U.S. FDA; 24/05/2018 – The settlement announced by the U.S. Department of Justice resolves allegations that Pfizer violated the federal False Claims Act between 2012 and 2016; 17/04/2018 – Methicillin-Resistant Staphylococcus Aureus Infections Pipeline Highlights 2018 – ResearchAndMarkets.com; 15/05/2018 – Pfizer: RETACRIT Is First U.S. Biosimilar Erythropoiesis-Stimulating Agent Now Approved Across All Indications; 23/03/2018 – PFIZER: CHANTIX/CHAMPIX STUDY DID NOT MEET PRIMARY ENDPOINT

Among 22 analysts covering Raytheon Company (NYSE:RTN), 17 have Buy rating, 1 Sell and 4 Hold. Therefore 77% are positive. Raytheon Company had 89 analyst reports since July 28, 2015 according to SRatingsIntel. Cowen & Co maintained it with “Buy” rating and $23500 target in Tuesday, April 17 report. The firm earned “Overweight” rating on Wednesday, November 14 by Morgan Stanley. The rating was maintained by Barclays Capital with “Equal Weight” on Monday, May 2. Robert W. Baird maintained Raytheon Company (NYSE:RTN) rating on Thursday, August 10. Robert W. Baird has “Buy” rating and $21200 target. As per Friday, January 29, the company rating was maintained by RBC Capital Markets. Argus Research upgraded it to “Buy” rating and $135 target in Thursday, November 12 report. Credit Suisse downgraded it to “Neutral” rating and $219 target in Tuesday, May 22 report. RBC Capital Markets maintained Raytheon Company (NYSE:RTN) on Monday, August 28 with “Buy” rating. As per Tuesday, April 11, the company rating was maintained by Cowen & Co. On Sunday, October 8 the stock rating was maintained by RBC Capital Markets with “Buy”.

Investors sentiment increased to 1.19 in Q3 2018. Its up 0.18, from 1.01 in 2018Q2. It improved, as 32 investors sold RTN shares while 350 reduced holdings. 112 funds opened positions while 341 raised stakes. 198.59 million shares or 1.14% less from 200.87 million shares in 2018Q2 were reported. Federated Invsts Inc Pa accumulated 546,541 shares. Highbridge Capital Management Limited invested in 11,906 shares. New Mexico Educational Retirement Board holds 0.2% or 25,643 shares. 2,910 are owned by Duff & Phelps Inv Mngmt Co. Moreover, Nomura Asset Mgmt Limited has 0.54% invested in Raytheon Company (NYSE:RTN) for 271,420 shares. Cumberland Prtnrs Limited accumulated 102,734 shares. Epoch Investment reported 0.07% in Raytheon Company (NYSE:RTN). Sequoia Finance holds 0.03% in Raytheon Company (NYSE:RTN) or 1,360 shares. Whittier Trust Of Nevada holds 5,522 shares or 0.08% of its portfolio. Guardian Ltd Partnership invested 0.27% in Raytheon Company (NYSE:RTN). Sigma Invest Counselors invested in 0.06% or 2,430 shares. Moreover, Alpine Woods Cap Limited Com has 0.56% invested in Raytheon Company (NYSE:RTN) for 13,161 shares. 691 are owned by Salem Investment Counselors. 23,909 were reported by Oakbrook Investments Lc. Origin Asset Mgmt Ltd Liability Partnership owns 36,085 shares for 0.49% of their portfolio.

Since August 30, 2018, it had 0 insider buys, and 1 sale for $657,854 activity.

More notable recent Raytheon Company (NYSE:RTN) news were published by: Streetinsider.com which released: “Raytheon (RTN) Secures $72M Contract Award from Dept. of Defense for Production of Aegis Weapon System Fire Control System – StreetInsider.com” on January 22, 2019, also Streetinsider.com with their article: “Raytheon (RTN) Secures $9.573M Contract from Dept. of Defense for Advanced Medium Range Air-to-Air Missile Support – StreetInsider.com” published on January 15, 2019, Investorplace.com published: “10 of the Best Stocks to Invest In for February – Investorplace.com” on January 24, 2019. More interesting news about Raytheon Company (NYSE:RTN) were released by: Streetinsider.com and their article: “Raytheon (RTN) Secures Contract from US Marine Corps for Classic Hornet AESA Radar Upgrade – StreetInsider.com” published on January 15, 2019 as well as ‘s news article titled: “Aerospace And Defense: Morgan Stanley Stays Bullish On Raytheon (NYSE:RTN), Upgrades Boeing (NYSE:BA), Downgrades Lockheed (NYSE:LMT) – Benzinga” with publication date: January 10, 2019.

Among 23 analysts covering Pfizer (NYSE:PFE), 9 have Buy rating, 1 Sell and 13 Hold. Therefore 39% are positive. Pfizer had 92 analyst reports since July 29, 2015 according to SRatingsIntel. The firm earned “Outperform” rating on Thursday, January 31 by Credit Suisse. The stock of Pfizer Inc. (NYSE:PFE) earned “Neutral” rating by Credit Suisse on Wednesday, October 31. The firm earned “Outperform” rating on Monday, May 9 by Credit Suisse. BMO Capital Markets maintained Pfizer Inc. (NYSE:PFE) rating on Monday, June 12. BMO Capital Markets has “Hold” rating and $3300 target. Berenberg initiated it with “Hold” rating and $38 target in Thursday, May 12 report. The firm earned “Hold” rating on Wednesday, October 28 by S&P Research. Credit Suisse downgraded the shares of PFE in report on Thursday, July 20 to “Neutral” rating. The firm has “Buy” rating given on Friday, December 15 by BMO Capital Markets. On Wednesday, August 1 the stock rating was maintained by Credit Suisse with “Neutral”. The stock of Pfizer Inc. (NYSE:PFE) has “Buy” rating given on Tuesday, October 31 by Piper Jaffray.

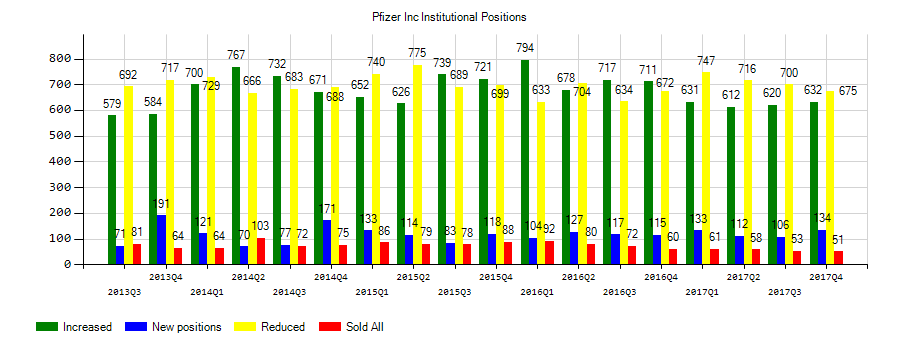

Investors sentiment increased to 0.85 in 2018 Q3. Its up 0.07, from 0.78 in 2018Q2. It is positive, as 41 investors sold PFE shares while 741 reduced holdings. 142 funds opened positions while 520 raised stakes. 3.96 billion shares or 0.44% less from 3.98 billion shares in 2018Q2 were reported. Narwhal Management holds 1.81% or 186,147 shares in its portfolio. Peapack Gladstone Fin Corporation holds 0.52% or 240,306 shares in its portfolio. Zeke Cap Advsr Limited Liability Company, Pennsylvania-based fund reported 187,642 shares. Valley National Advisers reported 1.22% stake. Rathbone Brothers Public Limited Company holds 0.64% of its portfolio in Pfizer Inc. (NYSE:PFE) for 424,174 shares. Sound Shore Management Ct invested in 4.02% or 5.34 million shares. Umb Comml Bank N A Mo reported 0.69% in Pfizer Inc. (NYSE:PFE). Supplemental Annuity Collective Tru Of Nj accumulated 1.7% or 93,645 shares. Northeast Financial Consultants holds 4.63% of its portfolio in Pfizer Inc. (NYSE:PFE) for 382,346 shares. 28,300 were reported by Her Majesty The Queen In Right Of The Province Of Alberta As Represented By Alberta Invest. Fishman Jay A Limited Mi has invested 0.01% of its portfolio in Pfizer Inc. (NYSE:PFE). 100,957 are owned by Wealthtrust Axiom Limited Liability. Bender Robert And Associates reported 12,822 shares. Dekabank Deutsche Girozentrale reported 7.52 million shares stake. General Amer Investors has 1.44% invested in Pfizer Inc. (NYSE:PFE).

More notable recent Pfizer Inc. (NYSE:PFE) news were published by: Seekingalpha.com which released: “Pfizer: Still A Cash Cow – Seeking Alpha” on January 22, 2019, also Streetinsider.com with their article: “Pfizer (PFE) Reports FDA Accepts Regulatory Submissions for Review of Tafamidis to Treat Transthyretin Amyloid Cardiomyopathy – StreetInsider.com” published on January 14, 2019, Seekingalpha.com published: “Pfizer to shutter two plants in India – Seeking Alpha” on January 09, 2019. More interesting news about Pfizer Inc. (NYSE:PFE) were released by: Fool.com and their article: “Amarin Corporation’s Stock Heats Up on Buyout Chatter – Motley Fool” published on January 10, 2019 as well as Fool.com‘s news article titled: “Here’s How Pfizer Gained 20.5% in 2018 – The Motley Fool” with publication date: January 14, 2019.

Howe & Rusling Inc, which manages about $798.49M and $598.66M US Long portfolio, upped its stake in Jerash Hldgs Us Inc by 130,000 shares to 130,300 shares, valued at $840,000 in 2018Q3, according to the filing. It also increased its holding in Valero Energy Corp New (NYSE:VLO) by 128,848 shares in the quarter, for a total of 128,860 shares, and has risen its stake in Cvs Health Corp (NYSE:CVS).

Since August 13, 2018, it had 0 buys, and 2 sales for $2.23 million activity. LANKLER DOUGLAS M sold $1.81M worth of Pfizer Inc. (NYSE:PFE) on Wednesday, January 30.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.