Bnp Paribas Investment Partners Sa decreased its stake in Target Corp (TGT) by 37.67% based on its latest 2018Q3 regulatory filing with the SEC. Bnp Paribas Investment Partners Sa sold 42,525 shares as the company’s stock declined 23.46% with the market. The institutional investor held 70,363 shares of the department and specialty retail stores company at the end of 2018Q3, valued at $6.21M, down from 112,888 at the end of the previous reported quarter. Bnp Paribas Investment Partners Sa who had been investing in Target Corp for a number of months, seems to be less bullish one the $37.60B market cap company. The stock increased 0.26% or $0.19 during the last trading session, reaching $72.05. About 261,882 shares traded. Target Corporation (NYSE:TGT) has risen 11.83% since February 8, 2018 and is uptrending. It has outperformed by 11.83% the S&P500. Some Historical TGT News: 06/03/2018 – TARGET CORP TGT.N CEO – TO OFFER FREE TWO DAY DELIVER ON “HUNDREDS OF THOUSANDS OF ITEMS” ON WEBSITE – CONF CALL; 23/05/2018 – TARGET 1Q ADJ EPS $1.32, EST. $1.39; 06/03/2018 – TARGET TO EXPAND RESTOCK PROGRAM TO ABOUT 40 MARKETS IN 2018; 06/03/2018 – TARGET CORP TGT.N FY SHR VIEW $5.27 — THOMSON REUTERS l/B/E/S; 23/05/2018 – Target Backs 2018 View of Adj EPS $5.15-Adj EPS $5.45; 23/05/2018 – TARGET CORP TGT.N CEO SAYS OPERATING INCOME CONTINUES TO REFLECT NEAR-TERM HEADWINDS DRIVEN BY LAST YEAR’S INVESTMENTS TO TRANSFORM THE BUSINESS; 06/03/2018 – TARGET CFO SMITH SPEAKS AT INVESTOR PRESENTATION; 06/03/2018 – TARGET 2-DAY OFFER IS FOR ORDERS OVER $35 OR MADE WITH RED CARD; 23/03/2018 – There is ‘no truth’ to Target-Kroger merger report, source tells CNBC; 06/03/2018 – Target’s Same-Store Sales Surpass Expectations

Kelso & Company Lp decreased its stake in Third Point Reinsurance Ltd. (TPRE) by 38.3% based on its latest 2018Q3 regulatory filing with the SEC. Kelso & Company Lp sold 3.83 million shares as the company’s stock declined 25.63% with the market. The hedge fund held 6.17M shares of the property-casualty insurers company at the end of 2018Q3, valued at $80.21 million, down from 10.00 million at the end of the previous reported quarter. Kelso & Company Lp who had been investing in Third Point Reinsurance Ltd. for a number of months, seems to be less bullish one the $1.02B market cap company. The stock decreased 0.55% or $0.06 during the last trading session, reaching $10.83. About 5,075 shares traded. Third Point Reinsurance Ltd. (NYSE:TPRE) has declined 36.29% since February 8, 2018 and is downtrending. It has underperformed by 36.29% the S&P500. Some Historical TPRE News: 09/05/2018 – THIRD POINT REINSURANCE LTD – QTRLY TOTAL REVENUE $140.3 MLN VS $266.5 MLN; 27/04/2018 – REG-Third Point Offshore: Annual Financial Report; 09/05/2018 – Third Point Reinsurance 1Q Rev $140.3M; 16/03/2018 Third Point Re Closes Above 200-Day Moving Average: Technicals; 30/05/2018 – REG-Third Point Offshore: Notice of AGM; 15/05/2018 – Third Point Adds United Technologies, Exits Aetna: 13F; 15/05/2018 – Third Point Buys New 1.1% Position in PBF Energy; 15/05/2018 – THIRD POINT BOOSTED DOV, ANTM, WP, FB, LEN IN 1Q: 13F; 10/05/2018 – Hedge fund Third Point reportedly seeks to launch ‘blank-check’ company; 15/05/2018 – THIRD POINT REDUCED BABA, BLK, DWDP, GOOGL, MHK IN 1Q: 13F

Investors sentiment decreased to 0.72 in 2018 Q3. Its down 0.10, from 0.82 in 2018Q2. It dived, as 15 investors sold TPRE shares while 57 reduced holdings. 17 funds opened positions while 35 raised stakes. 62.71 million shares or 8.01% less from 68.17 million shares in 2018Q2 were reported. Loomis Sayles Comm LP owns 0% invested in Third Point Reinsurance Ltd. (NYSE:TPRE) for 570 shares. Aviance Cap Ltd Co reported 115,622 shares. 571,777 are owned by Deutsche Bank Ag. California Pub Employees Retirement Systems reported 31,418 shares. Sg Americas Securities Ltd Liability Corporation invested in 0% or 30,659 shares. Parkside Commercial Bank & Tru holds 56 shares or 0% of its portfolio. Bnp Paribas Arbitrage Sa has invested 0% in Third Point Reinsurance Ltd. (NYSE:TPRE). International Group Incorporated Inc owns 0% invested in Third Point Reinsurance Ltd. (NYSE:TPRE) for 61,757 shares. Chicago Equity Prns Ltd Liability Corp owns 22,122 shares or 0.01% of their US portfolio. Quantbot Techs Limited Partnership invested in 17,435 shares or 0.02% of the stock. The Pennsylvania-based Pnc Financial Services Inc has invested 0% in Third Point Reinsurance Ltd. (NYSE:TPRE). Tiaa Cref Ltd Liability reported 1.58 million shares or 0.01% of all its holdings. Insight 2811 reported 51,020 shares. Optimum Advisors has 0% invested in Third Point Reinsurance Ltd. (NYSE:TPRE). Jpmorgan Chase & has 0% invested in Third Point Reinsurance Ltd. (NYSE:TPRE) for 813,942 shares.

Since September 18, 2018, it had 1 buying transaction, and 1 sale for $10.47 million activity. The insider Loeb Daniel S sold $10.52 million.

Analysts await Third Point Reinsurance Ltd. (NYSE:TPRE) to report earnings on February, 27. They expect $-3.06 EPS, down 846.34% or $3.47 from last year’s $0.41 per share. After $-0.14 actual EPS reported by Third Point Reinsurance Ltd. for the previous quarter, Wall Street now forecasts 2,085.71% negative EPS growth.

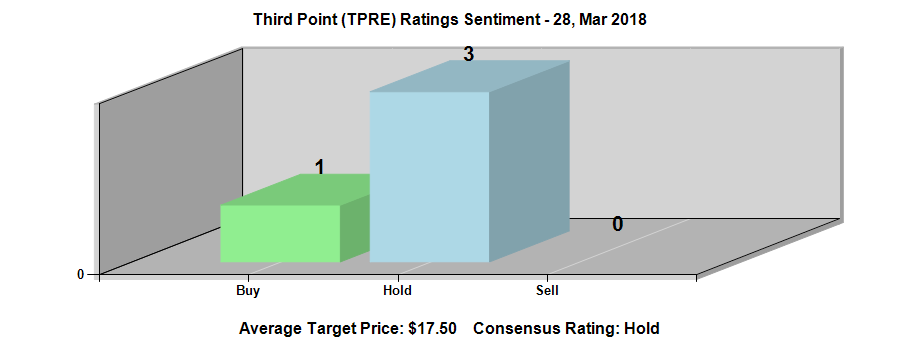

Among 6 analysts covering Third Point Reinsurance (NYSE:TPRE), 4 have Buy rating, 0 Sell and 2 Hold. Therefore 67% are positive. Third Point Reinsurance had 16 analyst reports since August 7, 2015 according to SRatingsIntel. The stock of Third Point Reinsurance Ltd. (NYSE:TPRE) earned “Outperform” rating by Wood on Friday, May 11. Keefe Bruyette & Woods maintained the shares of TPRE in report on Tuesday, October 10 with “Buy” rating. The rating was maintained by Keefe Bruyette & Woods on Thursday, August 3 with “Buy”. Keefe Bruyette & Woods maintained Third Point Reinsurance Ltd. (NYSE:TPRE) rating on Friday, September 8. Keefe Bruyette & Woods has “Buy” rating and $16.5 target. The stock of Third Point Reinsurance Ltd. (NYSE:TPRE) earned “Buy” rating by Keefe Bruyette & Woods on Thursday, May 10. Keefe Bruyette & Woods upgraded Third Point Reinsurance Ltd. (NYSE:TPRE) on Monday, May 8 to “Outperform” rating. Keefe Bruyette & Woods maintained Third Point Reinsurance Ltd. (NYSE:TPRE) on Monday, December 4 with “Hold” rating. Wood maintained the stock with “Market Perform” rating in Thursday, October 1 report. As per Monday, October 16, the company rating was downgraded by Keefe Bruyette & Woods. Bank of America maintained the stock with “Buy” rating in Tuesday, April 3 report.

More notable recent Third Point Reinsurance Ltd. (NYSE:TPRE) news were published by: Businesswire.com which released: “A.M. Best Affirms Credit Ratings of Third Point Reinsurance Ltd. and Its Subsidiaries – Business Wire” on March 28, 2018, also Businesswire.com with their article: “Third Point Publishes Presentation on “#NestléNOW†– Business Wire” published on July 01, 2018, Globenewswire.com published: “Report: Developing Opportunities within Ensco plc, Third Point Reinsurance, Baxter International, Ultrapar Participacoes SA, Endeavour Silver, and Ingles Markets — Future Expectations, Projections Moving into 2019 – GlobeNewswire” on February 04, 2019. More interesting news about Third Point Reinsurance Ltd. (NYSE:TPRE) were released by: Prweb.com and their article: “EA Markets Serves as Financial Advisor and Arranger for Third Point Reinsurance Ltd.’s Inaugural $200,000,000 Unsecured Credit Facility – PR Web” published on August 14, 2018 as well as Zacks.com‘s news article titled: “What Makes Third Point Reinsurance (TPRE) a Strong Sell? – Zacks.com” with publication date: December 13, 2018.

More notable recent Target Corporation (NYSE:TGT) news were published by: Streetinsider.com which released: “Call Buying Activity Continues in Target (TGT), Highlighting Upside in Shares Through February -Susquehanna – StreetInsider.com” on February 01, 2019, also Seekingalpha.com with their article: “Target: The Valuation Article – Seeking Alpha” published on January 14, 2019, Nasdaq.com published: “TGT Won’t Break Above Resistance at $72.50 Before Earnings – Nasdaq” on January 24, 2019. More interesting news about Target Corporation (NYSE:TGT) were released by: Fool.com and their article: “3 Dividend Stocks That Pay You Better Than Coca-Cola Does – The Motley Fool” published on January 10, 2019 as well as Seekingalpha.com‘s news article titled: “Credit Suisse sees Target as underappreciated – Seeking Alpha” with publication date: January 15, 2019.

Among 33 analysts covering Target Corporation (NYSE:TGT), 14 have Buy rating, 3 Sell and 16 Hold. Therefore 42% are positive. Target Corporation had 111 analyst reports since July 21, 2015 according to SRatingsIntel. The stock has “Underweight” rating by Barclays Capital on Thursday, May 19. Bank of America maintained it with “Buy” rating and $72.0 target in Tuesday, January 9 report. On Thursday, August 20 the stock rating was upgraded by Zacks to “Hold”. Jefferies maintained Target Corporation (NYSE:TGT) rating on Thursday, August 31. Jefferies has “Hold” rating and $59.0 target. Morgan Stanley maintained the shares of TGT in report on Saturday, August 22 with “Underweight” rating. The stock of Target Corporation (NYSE:TGT) earned “Buy” rating by Bank of America on Friday, August 18. Stifel Nicolaus reinitiated Target Corporation (NYSE:TGT) on Friday, January 20 with “Hold” rating. The stock of Target Corporation (NYSE:TGT) has “Buy” rating given on Monday, April 2 by Tigress Financial. Vetr upgraded the stock to “Strong-Buy” rating in Wednesday, September 2 report. As per Thursday, November 19, the company rating was maintained by UBS.

Bnp Paribas Investment Partners Sa, which manages about $13.02B US Long portfolio, upped its stake in Electronic Arts Inc (NASDAQ:EA) by 84,919 shares to 141,094 shares, valued at $17.00M in 2018Q3, according to the filing. It also increased its holding in Steel Dynamics Inc (NASDAQ:STLD) by 69,339 shares in the quarter, for a total of 159,987 shares, and has risen its stake in Facebook Inc (NASDAQ:FB).

Analysts await Target Corporation (NYSE:TGT) to report earnings on March, 5. They expect $1.51 earnings per share, up 10.22% or $0.14 from last year’s $1.37 per share. TGT’s profit will be $787.97M for 11.93 P/E if the $1.51 EPS becomes a reality. After $1.09 actual earnings per share reported by Target Corporation for the previous quarter, Wall Street now forecasts 38.53% EPS growth.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.