Bislett Management Llc increased its stake in Gtt Communications Inc (GTT) by 44.47% based on its latest 2018Q3 regulatory filing with the SEC. Bislett Management Llc bought 120,000 shares as the company’s stock declined 27.23% with the market. The institutional investor held 389,826 shares of the public utilities company at the end of 2018Q3, valued at $16.92M, up from 269,826 at the end of the previous reported quarter. Bislett Management Llc who had been investing in Gtt Communications Inc for a number of months, seems to be bullish on the $1.41 billion market cap company. The stock decreased 1.03% or $0.27 during the last trading session, reaching $25.83. About 88,325 shares traded. GTT Communications, Inc. (NYSE:GTT) has declined 20.90% since February 7, 2018 and is downtrending. It has underperformed by 20.90% the S&P500. Some Historical GTT News: 03/05/2018 – GTT Communications 1Q Loss/Shr 69c; 26/04/2018 – Moody’s Downgrades Gtt’s Senior Secured Bank Credit Facilities To B2 From B1; 21/03/2018 – GTT: GTT NOTIFIED FOR DESIGN OF LNG TANKS OF 2 NEW LNG CARRIERS; 26/03/2018 – Aleph and Crestview to Invest in GTT as Part of Interoute Acquisition; 27/03/2018 – GTT WINS SAMSUNG HEAVY INDUSTRIES TO DESIGN LNG TANKS; 12/04/2018 – GTT 1Q REV. EU64.2M; 05/04/2018 – GTT : GTT RECEIVES TWO NEW ORDERS FROM DSME; 21/03/2018 – GTT GTT.PA – HAS RECEIVED AN ORDER FROM THE KOREAN SHIPYARD HYUNDAI SAMHO HEAVY INDUSTRIES; 12/04/2018 – GTT 1Q REVENUE RISES 12% TO EU64.2M; 12/04/2018 – GTT GTT.PA – CONFIRMS 2018 OBJECTIVES

Garnet Equity Capital Holdings Inc decreased its stake in Belmond Ltd (BEL) by 25% based on its latest 2018Q3 regulatory filing with the SEC. Garnet Equity Capital Holdings Inc sold 50,000 shares as the company’s stock rose 7.44% while stock markets declined. The hedge fund held 150,000 shares of the hotels and resorts company at the end of 2018Q3, valued at $2.74 million, down from 200,000 at the end of the previous reported quarter. Garnet Equity Capital Holdings Inc who had been investing in Belmond Ltd for a number of months, seems to be less bullish one the $2.57 billion market cap company. The stock increased 0.12% or $0.03 during the last trading session, reaching $24.91. About 392,976 shares traded. Belmond Ltd. (NYSE:BEL) has risen 46.75% since February 7, 2018 and is uptrending. It has outperformed by 46.75% the S&P500. Some Historical BEL News: 09/04/2018 – Belmond Senior VP of Organizational Transformation Philippe Cassis Resigns Effective June 30; 08/05/2018 – Belmond 1Q Loss/Shr 15c; 08/05/2018 – Belmond 1Q Rev $89.7M; 08/05/2018 – BELMOND LTD – FULL YEAR 2018 SAME STORE WORLDWIDE OWNED HOTEL REVPAR GROWTH GUIDANCE ON A CONSTANT CURRENCY BASIS OF 2% – 6%; 07/03/2018 Belmond Closes Above 50-Day Moving Average: Technicals

More notable recent GTT Communications, Inc. (NYSE:GTT) news were published by: which released: “Buy The Dip In GTT Communications (NYSE:GTT), KeyBanc Says In Upgrade – Benzinga” on May 04, 2018, also Seekingalpha.com with their article: “GTT -13% on swing to Q2 loss – Seeking Alpha” published on August 03, 2018, Zacks.com published: “Twilio (TWLO) Q4 Earnings: What’s in Store for the Stock? – Zacks.com” on February 07, 2019. More interesting news about GTT Communications, Inc. (NYSE:GTT) were released by: Businesswire.com and their article: “GTT Expands Network for Carglass as Application Usage Grows – Business Wire” published on January 17, 2019 as well as Businesswire.com‘s news article titled: “GTT Announces Earnings Call for Fourth Quarter 2018 – Business Wire” with publication date: January 31, 2019.

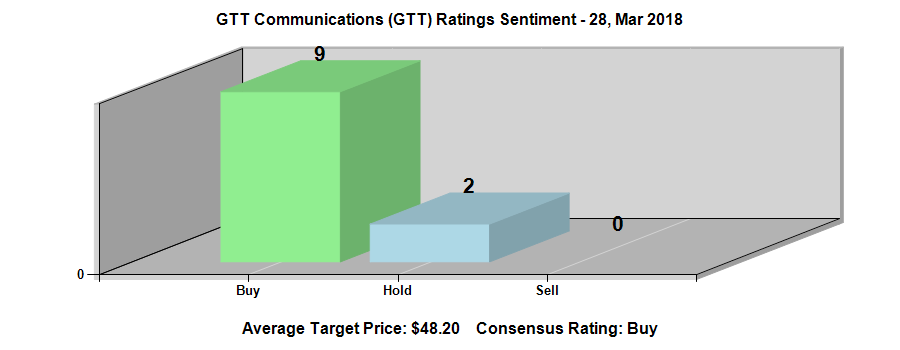

Among 12 analysts covering GTT Communications (NYSE:GTT), 11 have Buy rating, 0 Sell and 1 Hold. Therefore 92% are positive. GTT Communications had 28 analyst reports since August 7, 2015 according to SRatingsIntel. SunTrust maintained GTT Communications, Inc. (NYSE:GTT) rating on Friday, November 3. SunTrust has “Buy” rating and $38.0 target. The stock of GTT Communications, Inc. (NYSE:GTT) has “Buy” rating given on Monday, June 26 by Jefferies. The firm has “Buy” rating by Drexel Hamilton given on Wednesday, November 4. The company was maintained on Friday, March 2 by Cowen & Co. The stock of GTT Communications, Inc. (NYSE:GTT) earned “Overweight” rating by Pacific Crest on Wednesday, September 16. The stock has “Buy” rating by Craig Hallum on Monday, January 22. As per Wednesday, December 19, the company rating was maintained by Raymond James. The firm has “Buy” rating given on Wednesday, October 25 by Jefferies. On Tuesday, December 13 the stock rating was initiated by Suntrust Robinson with “Buy”. The rating was maintained by William Blair with “Buy” on Wednesday, March 28.

Garnet Equity Capital Holdings Inc, which manages about $189.98M and $137.26M US Long portfolio, upped its stake in Cott Corporation (NYSE:COT) by 100,000 shares to 240,000 shares, valued at $3.88M in 2018Q3, according to the filing. It also increased its holding in Kratos Defense & Security (NASDAQ:KTOS) by 319,700 shares in the quarter, for a total of 619,700 shares, and has risen its stake in Del Frisco’s Restaurant Grou (NASDAQ:DFRG).

Analysts await Belmond Ltd. (NYSE:BEL) to report earnings on February, 25. They expect $-0.05 earnings per share, up 16.67% or $0.01 from last year’s $-0.06 per share. After $0.34 actual earnings per share reported by Belmond Ltd. for the previous quarter, Wall Street now forecasts -114.71% negative EPS growth.

Among 7 analysts covering Belmond (NYSE:BEL), 3 have Buy rating, 1 Sell and 3 Hold. Therefore 43% are positive. Belmond had 21 analyst reports since September 3, 2015 according to SRatingsIntel. On Thursday, September 3 the stock rating was downgraded by Zacks to “Hold”. The rating was downgraded by Deutsche Bank to “Hold” on Friday, November 4. The stock of Belmond Ltd. (NYSE:BEL) has “Underweight” rating given on Friday, August 17 by Barclays Capital. The rating was downgraded by Barclays Capital to “Underweight” on Tuesday, July 3. Telsey Advisory Group maintained the shares of BEL in report on Friday, August 5 with “Market Perform” rating. The firm has “Buy” rating by Jefferies given on Friday, August 10. On Wednesday, November 8 the stock rating was maintained by Deutsche Bank with “Hold”. The firm earned “Hold” rating on Monday, August 7 by Deutsche Bank. The stock has “Neutral” rating by M Partners on Monday, December 5. The rating was maintained by Barclays Capital on Thursday, August 10 with “Overweight”.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.