Biltmore Wealth Management Llc decreased its stake in Target Corp (TGT) by 37.88% based on its latest 2018Q3 regulatory filing with the SEC. Biltmore Wealth Management Llc sold 4,112 shares as the company’s stock declined 23.46% with the market. The institutional investor held 6,744 shares of the department and specialty retail stores company at the end of 2018Q3, valued at $595,000, down from 10,856 at the end of the previous reported quarter. Biltmore Wealth Management Llc who had been investing in Target Corp for a number of months, seems to be less bullish one the $38.03 billion market cap company. The stock increased 0.60% or $0.43 during the last trading session, reaching $72.87. About 469,606 shares traded. Target Corporation (NYSE:TGT) has risen 11.83% since February 5, 2018 and is uptrending. It has outperformed by 11.83% the S&P500. Some Historical TGT News: 06/03/2018 – TARGET CORP TGT.N CEO – TO OFFER FREE TWO DAY DELIVER ON “HUNDREDS OF THOUSANDS OF ITEMS” ON WEBSITE – CONF CALL; 23/05/2018 – TARGET CORP – QTRLY TOTAL REV $16,781 MLN; 05/04/2018 – The lawsuit claimed Target’s use of criminal background checks disqualified job applicants for convictions that were unrelated to the work they sought; 15/03/2018 – TARGET CORP TGT.N SETS QUARTERLY DIVIDEND OF $0.62/SHR; 23/05/2018 – TARGET CORP TGT.N CEO SAYS SALES IN TEMPERATURE-SENSITIVE CATEGORIES DUE TO LATE SPRING HAVE ACCELERATED DRAMATICALLY IN THE SECOND QUARTER; 31/05/2018 – Target and Shipt Launch Same-Day Delivery in Illinois; 03/04/2018 – Target is planning to open small-format stores in New York’s Upper East Side neighborhood, Staten Island and Astoria, Queens; 15/04/2018 – PREVIEW-South Dakota e-commerce sale tax fight reaches U.S. Supreme Court; 30/05/2018 – Pura Naturals Announces Additional Staff Appointments in Sales and Marketing; 23/03/2018 – Baz Hiralal: Exclusive: As Grocery Wars Rage, Target $TGT And Kroger $KG Mull A Merger

Oppenheimer & Company Inc decreased its stake in Rogers Communications Inc (RCI) by 18.76% based on its latest 2018Q3 regulatory filing with the SEC. Oppenheimer & Company Inc sold 8,190 shares as the company’s stock rose 1.49% while stock markets declined. The institutional investor held 35,460 shares of the consumer services company at the end of 2018Q3, valued at $1.82 million, down from 43,650 at the end of the previous reported quarter. Oppenheimer & Company Inc who had been investing in Rogers Communications Inc for a number of months, seems to be less bullish one the $28.00 billion market cap company. The stock increased 1.08% or $0.59 during the last trading session, reaching $55.13. About 91,287 shares traded. Rogers Communications Inc. (NYSE:RCI) has risen 2.76% since February 5, 2018 and is uptrending. It has outperformed by 2.76% the S&P500. Some Historical RCI News: 08/03/2018 Rogers Communications Inc. Files Annual Financial Statements and Report to Shareholders; 19/04/2018 – ROGERS COMMUNICATIONS INC – QTRLY TOTAL REVENUE, WITH ADOPTION OF IFRS 15, C$3.63 BLN; 22/03/2018 – Research Report Identifies Westinghouse Air Brake Technologies, National Western Life Group, Impinj, Ingles Markets, RCI Hospit; 20/04/2018 – Rogers Communications Announces Voting Results from Annual Meeting of Shareholders; 19/04/2018 – ROGERS COMMUNICATIONS INC – ADOPTED IFRS 15 AND IFRS 9, FINANCIAL INSTRUMENTS EFFECTIVE JANUARY 1, 2018; 14/05/2018 – RCI® Affiliates Recognized for Leading the Way in Sustainability; 19/04/2018 – ROGERS COMMUNICATIONS 1Q ADJ EPS C$0.93, EST. C$0.74; 19/04/2018 – Rogers Communications’ quarterly profit rises 37 pct; 13/03/2018 – Rogers Communications 1Q18 Investment Community Teleconference April 19, 2018 at 4:30 p.m. ET; 13/04/2018 – REG-RCI Banque : PLACEMENT OF A 722.8 MILLION EURO SECURITIZATION BACKED BY FRENCH AUTO LOANS

Analysts await Target Corporation (NYSE:TGT) to report earnings on March, 5. They expect $1.51 earnings per share, up 10.22% or $0.14 from last year’s $1.37 per share. TGT’s profit will be $787.99M for 12.06 P/E if the $1.51 EPS becomes a reality. After $1.09 actual earnings per share reported by Target Corporation for the previous quarter, Wall Street now forecasts 38.53% EPS growth.

More notable recent Target Corporation (NYSE:TGT) news were published by: Investorplace.com which released: “Target Stock Has Much More Room to Run From Here – Investorplace.com” on January 24, 2019, also Bizjournals.com with their article: “Target follows Harry’s expansion into women’s shaving with Flamingo – Minneapolis / St. Paul Business Journal” published on February 04, 2019, Seekingalpha.com published: “Credit Suisse sees Target as underappreciated – Seeking Alpha” on January 15, 2019. More interesting news about Target Corporation (NYSE:TGT) were released by: Seekingalpha.com and their article: “Target gains again ahead of huge holiday sales report – Seeking Alpha” published on January 09, 2019 as well as Fool.com‘s news article titled: “Could Patriots Win Show Dick’s Sporting Goods a Path to Retail Victory? – Motley Fool” with publication date: February 04, 2019.

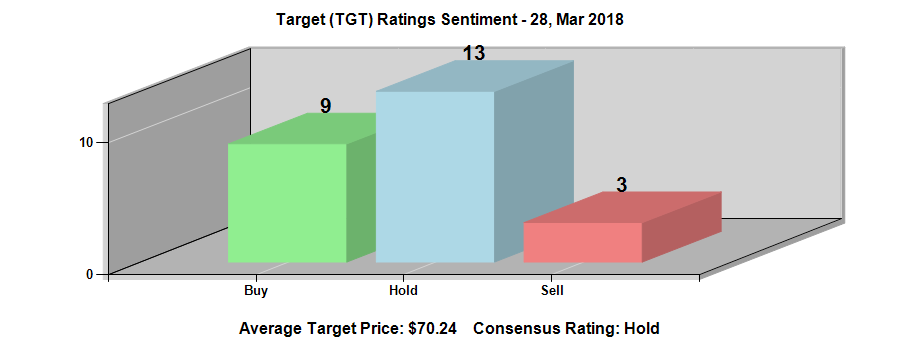

Among 33 analysts covering Target Corporation (NYSE:TGT), 14 have Buy rating, 3 Sell and 16 Hold. Therefore 42% are positive. Target Corporation had 111 analyst reports since July 21, 2015 according to SRatingsIntel. The firm earned “Positive” rating on Wednesday, January 10 by Susquehanna. Telsey Advisory Group maintained Target Corporation (NYSE:TGT) on Wednesday, January 18 with “Outperform” rating. JP Morgan maintained it with “Neutral” rating and $78 target in Thursday, May 19 report. The stock of Target Corporation (NYSE:TGT) earned “Buy” rating by Credit Suisse on Monday, February 26. On Wednesday, December 26 the stock rating was upgraded by Standpoint Research to “Buy”. Jefferies maintained Target Corporation (NYSE:TGT) on Tuesday, January 9 with “Hold” rating. UBS maintained the shares of TGT in report on Friday, August 17 with “Neutral” rating. The company was maintained on Thursday, August 23 by Barclays Capital. M Partners maintained the stock with “Buy” rating in Tuesday, June 5 report. The company was maintained on Thursday, February 8 by Cowen & Co.

Among 10 analysts covering Rogers Comms (NYSE:RCI), 2 have Buy rating, 0 Sell and 8 Hold. Therefore 20% are positive. Rogers Comms had 19 analyst reports since October 9, 2015 according to SRatingsIntel. The stock of Rogers Communications Inc. (NYSE:RCI) earned “Equal-Weight” rating by Morgan Stanley on Thursday, December 17. Goldman Sachs initiated the shares of RCI in report on Friday, December 4 with “Neutral” rating. The rating was maintained by Barclays Capital on Friday, July 20 with “Equal-Weight”. The stock has “Sector Perform” rating by IBC on Wednesday, April 5. The firm earned “Outperform” rating on Tuesday, October 20 by Macquarie Research. As per Monday, October 22, the company rating was downgraded by Desjardins Securities. The company was upgraded on Friday, December 11 by TD Securities. RBC Capital Markets downgraded the stock to “Sector Perform” rating in Monday, January 9 report. The rating was downgraded by Edward Jones to “Hold” on Thursday, November 29. Desjardins Securities upgraded Rogers Communications Inc. (NYSE:RCI) on Monday, January 8 to “Buy” rating.

More notable recent Rogers Communications Inc. (NYSE:RCI) news were published by: Seekingalpha.com which released: “Wireless gains pace Rogers to beat in Q4 – Seeking Alpha” on January 24, 2019, also Fool.ca with their article: “When Should You Buy the Best Telecom Stock? – The Motley Fool Canada” published on October 27, 2018, published: “Benzinga’s Top Upgrades, Downgrades For January 25, 2019 – Benzinga” on January 25, 2019. More interesting news about Rogers Communications Inc. (NYSE:RCI) were released by: Fool.ca and their article: “2 Canadian Super-Stocks to Consider Buying Before Nutrien (TSX:NTR) – The Motley Fool Canada” published on February 02, 2019 as well as Fool.ca‘s news article titled: “Is Rogers Communications (TSX:RCI.B) Planning to Sell the Toronto Blue Jays? – The Motley Fool Canada” with publication date: September 04, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.