Leuthold Group Llc increased Marriott Vacations Worldwide C (VAC) stake by 78.93% reported in 2018Q3 SEC filing. Leuthold Group Llc acquired 22,080 shares as Marriott Vacations Worldwide C (VAC)’s stock declined 34.52%. The Leuthold Group Llc holds 50,053 shares with $5.59M value, up from 27,973 last quarter. Marriott Vacations Worldwide C now has $4.31 billion valuation. The stock increased 1.64% or $1.48 during the last trading session, reaching $91.52. About 317,899 shares traded. Marriott Vacations Worldwide Corporation (NYSE:VAC) has declined 45.01% since February 5, 2018 and is downtrending. It has underperformed by 45.01% the S&P500. Some Historical VAC News: 30/04/2018 – Marriott Vacations Expects Deal to Close in 2nd Half; 17/04/2018 – Marcus® Hotels & Resorts Assumes Management of the DoubleTree by Hilton Hotel El Paso Downtown and Courtyard by Marriott El; 09/04/2018 – Scarlett Hotel Group Acquires Third Marriott, the 113-Room Fairfield Inn & Suites Downtown Omaha; 14/05/2018 – Noble Investment Group Acquires Residence Inn by Marriott Tampa Downtown; 01/05/2018 – ILG HOLDER FRONTFOUR SUPPORTS ACQUISITION BY MARRIOTT VACATIONS; 03/05/2018 – ILG MAY BE CUT BY MOODY’S FOLLOWING MARRIOTT PURCHASE PROPOSAL; 16/04/2018 – American Express and Marriott Unveil New and Refreshed Starwood Preferred Guest Co-Branded Credit Cards; 31/05/2018 – LG And Marriott Revolutionize In-Room Guest Experience; 26/04/2018 – MCR BUYS COURTYARD BY MARRIOTT IN DOWNTOWN MILWAUKEE; 07/05/2018 – The Law Offices of Vincent Wong Notifies Investors of an Investigation into ILG, Inc. in Connection with the Sale of the Company to Marriott Vacations Worldwide Corporation — ILG

Berry Global Group, Inc. (BERY) formed inverse H&S with $53.81 target or 9.00% above today’s $49.37 share price. Berry Global Group, Inc. (BERY) has $6.43B valuation. The stock increased 2.30% or $1.11 during the last trading session, reaching $49.37. About 3.06 million shares traded or 90.53% up from the average. Berry Global Group, Inc. (NYSE:BERY) has declined 19.89% since February 5, 2018 and is downtrending. It has underperformed by 19.89% the S&P500. Some Historical BERY News: 16/03/2018 – EXCLUSIVE-Packaging group SIG Combibloc seeks Zurich listing in autumn; 30/04/2018 – Berry Global Closes Below 50-Day Moving Average: Technicals; 09/05/2018 – REMINDER/Conference Call Notice: lntertape Polymer Group Inc. First Quarter 2018 Results; 11/05/2018 – MOODY’S: BERRY’S Ba3 CFR & STABLE OUTLOOK UNCHANGED; 11/05/2018 – Moody’s assigned a Ba2 to Berry’s new repriced term loan “S” and “T”; Ba3 CFR and stable outlook unchanged; 16/03/2018 – SIG COMBIBLOC SEEKS ZURICH LISTING IN AUTUMN, WORKING WITH ROTHSCHILD ROTH.PA AS ADVISOR; 15/05/2018 – Orbis Allan Gray Buys New 1.3% Position in Berry Global; 09/03/2018 Paula A. Sneed Elected to the Board of Directors of Berry Global Group, Inc; 03/05/2018 – BERRY GLOBAL CONFIRMS FY ADJUSTED FCF VIEW; 11/05/2018 – Global Flexible Industrial Packaging Market, 2022 – Key Vendors are Berry Global, Greif, LC Packaging, Mondi Group & Sonoco Products Company – ResearchAndMarkets.com

Investors sentiment increased to 1.06 in Q3 2018. Its up 0.19, from 0.87 in 2018Q2. It improved, as 33 investors sold Berry Global Group, Inc. shares while 89 reduced holdings. 47 funds opened positions while 82 raised stakes. 117.22 million shares or 1.24% more from 115.78 million shares in 2018Q2 were reported. Invesco Limited invested in 0.02% or 1.16M shares. First Republic Investment Mngmt accumulated 23,113 shares or 0.01% of the stock. Zebra Capital Mngmt holds 27,051 shares or 0.6% of its portfolio. Howe & Rusling stated it has 184 shares or 0% of all its holdings. Moreover, Teton Advisors has 0.42% invested in Berry Global Group, Inc. (NYSE:BERY) for 99,111 shares. Renaissance Gp Limited Liability Company holds 0.84% or 496,963 shares in its portfolio. Bw Gestao De Investimentos Ltda holds 65,500 shares. Morgan Stanley accumulated 265,825 shares. Sei Invs holds 0.01% or 41,405 shares in its portfolio. State Of Alaska Department Of Revenue stated it has 14,925 shares. North Star Mngmt invested 0% of its portfolio in Berry Global Group, Inc. (NYSE:BERY). 97,437 were accumulated by Renaissance Llc. Lomas Cap Management Ltd Liability Corporation reported 5.16% in Berry Global Group, Inc. (NYSE:BERY). Vanguard Inc stated it has 0.02% of its portfolio in Berry Global Group, Inc. (NYSE:BERY). State Of Wisconsin Board, a Wisconsin-based fund reported 100,089 shares.

Among 2 analysts covering Berry Global Group (NYSE:BERY), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Berry Global Group had 3 analyst reports since November 16, 2018 according to SRatingsIntel. The firm has “Buy” rating given on Monday, January 7 by Citigroup. The stock of Berry Global Group, Inc. (NYSE:BERY) has “Buy” rating given on Friday, November 16 by Citigroup.

Analysts await Berry Global Group, Inc. (NYSE:BERY) to report earnings on February, 6. They expect $0.73 earnings per share, up 8.96% or $0.06 from last year’s $0.67 per share. BERY’s profit will be $95.12M for 16.91 P/E if the $0.73 EPS becomes a reality. After $0.90 actual earnings per share reported by Berry Global Group, Inc. for the previous quarter, Wall Street now forecasts -18.89% negative EPS growth.

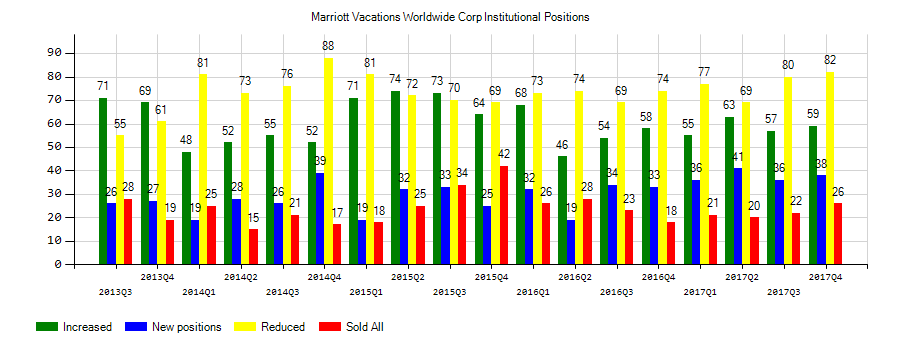

Investors sentiment increased to 3.19 in Q3 2018. Its up 1.50, from 1.69 in 2018Q2. It improved, as 34 investors sold VAC shares while 36 reduced holdings. 101 funds opened positions while 122 raised stakes. 72.81 million shares or 208.06% more from 23.64 million shares in 2018Q2 were reported. Pitcairn Communications stated it has 2,806 shares. Bahl Gaynor Inc has 30,833 shares. San Francisco Sentry Gru (Ca) reported 2 shares. Vanguard Gp owns 3.43 million shares for 0.01% of their portfolio. Baystate Wealth Management Limited Liability has 16 shares for 0% of their portfolio. Gamco Invsts Et Al has 0% invested in Marriott Vacations Worldwide Corporation (NYSE:VAC) for 3,763 shares. Northern Corp has invested 0.03% in Marriott Vacations Worldwide Corporation (NYSE:VAC). Citigroup invested in 26,416 shares or 0% of the stock. Reilly Financial Advisors Ltd Llc has invested 0% in Marriott Vacations Worldwide Corporation (NYSE:VAC). Trustmark Financial Bank Trust Department, Mississippi-based fund reported 8 shares. Sg Americas Ltd Limited Liability Company stated it has 0.02% in Marriott Vacations Worldwide Corporation (NYSE:VAC). Matarin Capital Mngmt Lc holds 120,261 shares or 0% of its portfolio. Nordea Investment Mgmt Ab holds 0.01% or 37,760 shares. Mason Street Lc has invested 0.05% in Marriott Vacations Worldwide Corporation (NYSE:VAC). Thomas J Herzfeld Advisors has invested 0.58% of its portfolio in Marriott Vacations Worldwide Corporation (NYSE:VAC).

Among 2 analysts covering Marriott Vacations (NYSE:VAC), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Marriott Vacations had 2 analyst reports since August 23, 2018 according to SRatingsIntel. The company was maintained on Thursday, August 23 by Nomura. Deutsche Bank maintained Marriott Vacations Worldwide Corporation (NYSE:VAC) rating on Monday, January 7. Deutsche Bank has “Hold” rating and $93 target.

Leuthold Group Llc decreased Proshares Short Russell2000 stake by 13,217 shares to 465,262 valued at $17.55 million in 2018Q3. It also reduced Toll Brothers Inc. (NYSE:TOL) stake by 18,635 shares and now owns 144,468 shares. 3 Mo was reduced too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.