Boothbay Fund Management Llc decreased Ehealth Inc (EHTH) stake by 60.38% reported in 2018Q3 SEC filing. Boothbay Fund Management Llc sold 12,916 shares as Ehealth Inc (EHTH)’s stock rose 36.10%. The Boothbay Fund Management Llc holds 8,474 shares with $239,000 value, down from 21,390 last quarter. Ehealth Inc now has $1.33B valuation. The stock decreased 3.96% or $2.51 during the last trading session, reaching $60.94. About 463,120 shares traded or 21.85% up from the average. eHealth, Inc. (NASDAQ:EHTH) has risen 86.51% since February 5, 2018 and is uptrending. It has outperformed by 86.51% the S&P500. Some Historical EHTH News: 26/04/2018 – EHEALTH INC EHTH.O SEES FY 2018 REVENUE $217.5 MLN TO $227.5 MLN; 16/03/2018 – Morning eHealth: VA-Cerner numbers skyrocket; 09/05/2018 – eHealth Survey Reveals a Gap Between the Benefits Consumers Think All Health Insurance Plans Should Cover and Those They Are; 22/03/2018 – ClinicalTrial US: An eHealth Intervention for Obsessive Compulsive Disorder in Youth With Autism Spectrum Disorder; 26/04/2018 – EHealth Sees FY18 Adj EPS 69c-Adj EPS 95c; 26/04/2018 – EHEALTH INC EHTH.O SEES FY 2018 NON-GAAP SHR $0.69 TO $0.95; 07/03/2018 Demand for Short-Term Health Insurance Has Steadily Grown Since Implementation of the ACA; 26/04/2018 – eHealth 1Q Rev $43.1M; 21/04/2018 – DJ eHealth Inc, Inst Holders, 1Q 2018 (EHTH); 25/04/2018 – Small Group Health Insurance Emerges as a More Affordable Alternative to Individual and Family Coverage, According to eHealth

Baltimore-Washington Financial Advisors Inc decreased Blackrock Inc Com (BLK) stake by 10.12% reported in 2018Q3 SEC filing. Baltimore-Washington Financial Advisors Inc sold 1,929 shares as Blackrock Inc Com (BLK)’s stock declined 16.99%. The Baltimore-Washington Financial Advisors Inc holds 17,137 shares with $8.08 million value, down from 19,066 last quarter. Blackrock Inc Com now has $66.01B valuation. The stock decreased 0.37% or $1.56 during the last trading session, reaching $416.42. About 304,483 shares traded. BlackRock, Inc. (NYSE:BLK) has declined 23.25% since February 5, 2018 and is downtrending. It has underperformed by 23.25% the S&P500. Some Historical BLK News: 09/05/2018 – Blackrock Group Limited Buys New 1.1% Position in Aptiv; 13/03/2018 – BlackRock’s Lowest Cost ETFs Devour Almost Half of U.S. Flows; 18/04/2018 – DEUTSCHE WOHNEN: BLACKROCK TO EXERT INFLUENCE ON SPVY BODIES; 29/05/2018 – SHAILY ENGINEERING PLASTICS LTD SEPL.BO SAYS DSP BLACKROCK TRUSTEE COMPANY PVT LTD CUTS STAKE IN CO BY 2.40 PCT TO 4.10 PCT; 09/03/2018 – BlackRock Latin American Investment Trust Plc: Disclosure of Portfolio Holdings; 05/03/2018 – BANCO COMERCIAL PORTUGUES: BLACKROCK HOLDS 3.39% STAKE; 17/04/2018 – REG-BlackRock World Mng: Research Update; 26/04/2018 – LLOYDS FUND BIDDING ROUND ATTRACTS BLACKROCK, SCHRODERS: FT; 20/03/2018 – REG-BlackRock Latin Am: Portfolio Update; 29/05/2018 – SAPERSTEIN SAYS MS IS USING BLACKROCK’S ALADDIN FOR WEALTH UNIT

Analysts await eHealth, Inc. (NASDAQ:EHTH) to report earnings on March, 7. They expect $1.72 earnings per share, up 260.75% or $2.79 from last year’s $-1.07 per share. EHTH’s profit will be $37.57 million for 8.86 P/E if the $1.72 EPS becomes a reality. After $-0.33 actual earnings per share reported by eHealth, Inc. for the previous quarter, Wall Street now forecasts -621.21% EPS growth.

More notable recent eHealth, Inc. (NASDAQ:EHTH) news were published by: Nasdaq.com which released: “Analysis: Positioning to Benefit within ArcBest, International Game Technology, eHealth, Syros Pharmaceuticals, La Jolla Pharmaceutical, and Virtus Investment Partners — Research Highlights Growth, Revenue, and Consolidated Results – Nasdaq” on February 05, 2019, also Seekingalpha.com with their article: “EHealth nets $126.2M in equity offering – Seeking Alpha” published on January 28, 2019, Seekingalpha.com published: “EHealth sees strong Q4; shares up 2% after hours – Seeking Alpha” on January 22, 2019. More interesting news about eHealth, Inc. (NASDAQ:EHTH) were released by: Nasdaq.com and their article: “eHealth (EHTH) Reports Preliminary Results for Q4 and FY18 – Nasdaq” published on January 24, 2019 as well as Nasdaq.com‘s news article titled: “Noteworthy Thursday Option Activity: USM, MYGN, EHTH – Nasdaq” with publication date: January 24, 2019.

Boothbay Fund Management Llc increased Acacia Communications Inc stake by 14,562 shares to 21,612 valued at $894,000 in 2018Q3. It also upped Highland Floatng Rate Opprt stake by 46,705 shares and now owns 111,924 shares. Danaher Corp Del (NYSE:DHR) was raised too.

Among 3 analysts covering eHealth (NASDAQ:EHTH), 3 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. eHealth had 3 analyst reports since August 16, 2018 according to SRatingsIntel.

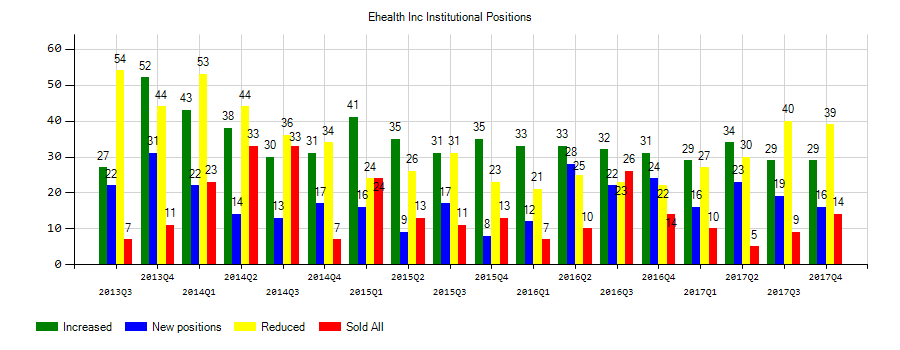

Investors sentiment decreased to 1.48 in Q3 2018. Its down 0.27, from 1.75 in 2018Q2. It turned negative, as 8 investors sold EHTH shares while 32 reduced holdings. 26 funds opened positions while 33 raised stakes. 18.01 million shares or 3.97% more from 17.32 million shares in 2018Q2 were reported. Barrow Hanley Mewhinney Strauss Limited Liability holds 0.01% of its portfolio in eHealth, Inc. (NASDAQ:EHTH) for 193,037 shares. Janney Montgomery Scott Limited Liability invested in 14,055 shares or 0% of the stock. Sector Pension Board accumulated 11,538 shares. Jpmorgan Chase And Communications accumulated 4,345 shares or 0% of the stock. Great West Life Assurance Company Can reported 19,199 shares stake. Bridgeway Management has invested 0.01% in eHealth, Inc. (NASDAQ:EHTH). Dimensional Fund Advsrs Lp holds 0.01% or 682,474 shares. Schwab Charles Invest Mgmt holds 0% or 91,397 shares in its portfolio. Stifel owns 13,050 shares for 0% of their portfolio. Deutsche Natl Bank Ag has invested 0% in eHealth, Inc. (NASDAQ:EHTH). State Board Of Administration Of Florida Retirement Sys holds 0% of its portfolio in eHealth, Inc. (NASDAQ:EHTH) for 18,729 shares. Pnc Financial Grp Incorporated Inc invested in 0% or 303 shares. Tower Research Lc (Trc) stated it has 107 shares. Teachers Retirement System Of The State Of Kentucky holds 0% or 5,800 shares in its portfolio. Comerica Retail Bank invested 0% of its portfolio in eHealth, Inc. (NASDAQ:EHTH).

Among 8 analysts covering BlackRock (NYSE:BLK), 6 have Buy rating, 0 Sell and 2 Hold. Therefore 75% are positive. BlackRock had 13 analyst reports since August 16, 2018 according to SRatingsIntel. The stock has “Buy” rating by Citigroup on Wednesday, December 19. The firm has “Buy” rating by Deutsche Bank given on Thursday, August 16. Deutsche Bank downgraded BlackRock, Inc. (NYSE:BLK) on Friday, January 11 to “Hold” rating. The stock of BlackRock, Inc. (NYSE:BLK) earned “Overweight” rating by Morgan Stanley on Wednesday, November 14. The stock of BlackRock, Inc. (NYSE:BLK) has “Buy” rating given on Monday, October 8 by UBS. The firm has “Buy” rating by Jefferies given on Tuesday, January 29. JP Morgan maintained the shares of BLK in report on Monday, October 8 with “Overweight” rating. Deutsche Bank maintained BlackRock, Inc. (NYSE:BLK) rating on Thursday, September 27. Deutsche Bank has “Buy” rating and $559 target. The firm has “Market Perform” rating given on Thursday, October 11 by Wells Fargo. The stock of BlackRock, Inc. (NYSE:BLK) has “Buy” rating given on Thursday, October 11 by Deutsche Bank.

Investors sentiment decreased to 1.14 in 2018 Q3. Its down 0.18, from 1.32 in 2018Q2. It fall, as 42 investors sold BLK shares while 340 reduced holdings. 109 funds opened positions while 325 raised stakes. 125.14 million shares or 1.77% less from 127.39 million shares in 2018Q2 were reported. Dnb Asset Mgmt As has invested 0% of its portfolio in BlackRock, Inc. (NYSE:BLK). Sun Life reported 0.03% of its portfolio in BlackRock, Inc. (NYSE:BLK). Geode Cap Mgmt Ltd Liability Corporation invested in 1.38 million shares. Torray Ltd reported 1.12% stake. Trustmark Natl Bank Department reported 2,260 shares or 0.08% of all its holdings. Citadel Ltd Liability Corporation reported 210,447 shares or 0.04% of all its holdings. Canada Pension Plan Inv Board holds 190,014 shares or 0.17% of its portfolio. Old Second National Bank Of Aurora reported 1.99% in BlackRock, Inc. (NYSE:BLK). Kornitzer Capital Management Ks accumulated 0.01% or 1,100 shares. Bb&T Corporation accumulated 0.04% or 4,323 shares. Pggm Investments holds 24,201 shares. Stephens Ar holds 6,312 shares or 0.07% of its portfolio. Scotia holds 0.1% or 17,523 shares. 113,471 were reported by Great West Life Assurance Can. Mai accumulated 8,662 shares.

More notable recent BlackRock, Inc. (NYSE:BLK) news were published by: Seekingalpha.com which released: “Invest Unfairly – Seeking Alpha” on January 29, 2019, also Seekingalpha.com with their article: “JPMorgan said to be Venezuela’s status in bond indexes: Bloomberg – Seeking Alpha” published on February 05, 2019, Seekingalpha.com published: “The squeeze on iShares’ fees – Seeking Alpha” on January 10, 2019. More interesting news about BlackRock, Inc. (NYSE:BLK) were released by: Seekingalpha.com and their article: “BlackRock plan environmentally aware money market fund – Seeking Alpha” published on January 22, 2019 as well as Seekingalpha.com‘s news article titled: “JPMorgan pushes ahead in ETFs – Seeking Alpha” with publication date: January 28, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.