Winslow Evans & Crocker Inc decreased Amazon Com Inc (AMZN) stake by 4.15% reported in 2018Q3 SEC filing. Winslow Evans & Crocker Inc sold 152 shares as Amazon Com Inc (AMZN)’s stock declined 15.37%. The Winslow Evans & Crocker Inc holds 3,512 shares with $7.03M value, down from 3,664 last quarter. Amazon Com Inc now has $806.80 billion valuation. The stock increased 1.00% or $16.26 during the last trading session, reaching $1642.49. About 2.83M shares traded. Amazon.com, Inc. (NASDAQ:AMZN) has risen 41.49% since February 4, 2018 and is uptrending. It has outperformed by 41.49% the S&P500. Some Historical AMZN News: 20/03/2018 – Amazon Isn’t Alone as Transport Costs Climb in Broader Pickup; 02/05/2018 – Amazon Said to Offer Retailers Discounts to Adopt Payment System; 19/04/2018 – Amazon courts Pentagon with marketing blitz ahead of cloud contract decision; 04/04/2018 – Amazon reportedly may offer to buy India’s Flipkart; 20/03/2018 – Amazon Prime Video Announces “All or Nothing” Banner for Upcoming Global Sports Docuseries; 13/03/2018 – CPSC: AMAZON CITES FIRE AND CHEMICAL BURN HAZARDS; 28/03/2018 – President Trump reportedly wants to take on Amazon and the internet retail behemoth’s tax treatment; 28/04/2018 – Quartz India: This could be the way Amazon makes more money with Alexa; 02/05/2018 – Sangam Iyer: AMAZON MAKES FORMAL OFFER TO BUY 60% STAKE IN FLIPKART – CNBC-TV18, CITING SOURCES– RTRS $AMZN #Flipkart; 23/03/2018 – Nicholas Carlson: SCOOP: Whole Foods is slashing marketing jobs in its latest post-Amazon push to cut costs

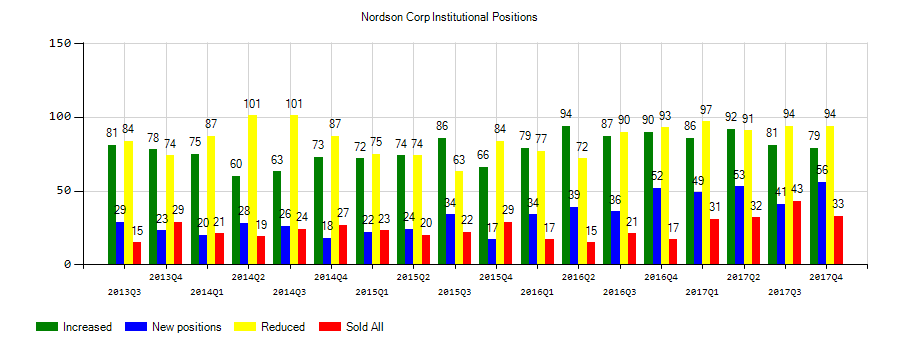

Nordson Corp (NDSN) investors sentiment increased to 1.47 in Q3 2018. It’s up 0.25, from 1.22 in 2018Q2. The ratio is positive, as 131 investment managers increased or started new stock positions, while 89 sold and decreased equity positions in Nordson Corp. The investment managers in our database now own: 38.67 million shares, down from 39.41 million shares in 2018Q2. Also, the number of investment managers holding Nordson Corp in top ten stock positions was flat from 2 to 2 for the same number . Sold All: 19 Reduced: 70 Increased: 89 New Position: 42.

Among 12 analysts covering Amazon.com (NASDAQ:AMZN), 12 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Amazon.com had 15 analyst reports since August 29, 2018 according to SRatingsIntel. The stock of Amazon.com, Inc. (NASDAQ:AMZN) earned “Buy” rating by Bank of America on Friday, October 26. The stock of Amazon.com, Inc. (NASDAQ:AMZN) earned “Buy” rating by DA Davidson on Wednesday, September 5. As per Tuesday, November 27, the company rating was maintained by Loop Capital Markets. On Wednesday, November 28 the stock rating was maintained by Bank of America with “Buy”. The company was maintained on Tuesday, September 25 by Jefferies. On Wednesday, August 29 the stock rating was maintained by Morgan Stanley with “Overweight”. The company was maintained on Thursday, September 27 by Stifel Nicolaus. On Friday, February 1 the stock rating was maintained by Raymond James with “Outperform”. The firm earned “Overweight” rating on Friday, October 26 by Barclays Capital. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Buy” rating given on Wednesday, January 23 by Deutsche Bank.

Investors sentiment decreased to 1.18 in 2018 Q3. Its down 0.16, from 1.34 in 2018Q2. It turned negative, as 55 investors sold AMZN shares while 636 reduced holdings. 157 funds opened positions while 655 raised stakes. 260.67 million shares or 2.89% less from 268.42 million shares in 2018Q2 were reported. Barrett Asset Management Ltd Liability Corp holds 0.51% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 3,893 shares. Supplemental Annuity Collective Of Nj holds 3.97% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 4,800 shares. Kj Harrison & Prtnrs invested 0.92% in Amazon.com, Inc. (NASDAQ:AMZN). Magnetar holds 0.03% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 735 shares. Moneta Grp Inc Investment Advsr Limited Liability Company has invested 0.06% in Amazon.com, Inc. (NASDAQ:AMZN). Shoker Counsel reported 383 shares or 0.56% of all its holdings. Stonebridge Cap invested 0.66% in Amazon.com, Inc. (NASDAQ:AMZN). Van Hulzen Asset Management Ltd holds 2,270 shares. Highbridge Mgmt Lc accumulated 0.6% or 12,616 shares. Edgemoor Invest reported 0.11% in Amazon.com, Inc. (NASDAQ:AMZN). Reliant Inv Mngmt Limited Com, Tennessee-based fund reported 263 shares. Arrowmark Colorado Ltd Co accumulated 1,374 shares or 0.02% of the stock. Cullinan Assoc Inc has invested 0.04% in Amazon.com, Inc. (NASDAQ:AMZN). Stockbridge Partners Ltd Llc holds 7.46% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 93,917 shares. Chilton Cap Ltd Co, a Texas-based fund reported 16,363 shares.

More notable recent Amazon.com, Inc. (NASDAQ:AMZN) news were published by: Nasdaq.com which released: “Time to Focus on Amazon.com (AMZN) for Strong Earnings Growth Potential – Nasdaq” on February 04, 2019, also with their article: “Amazon Posts Big Q4 Earnings Beat, Weak Q1 Sales Guidance (NASDAQ:AMZN) – Benzinga” published on January 31, 2019, Seekingalpha.com published: “Amazon should buy Redfin for data – Susquehanna – Seeking Alpha” on February 04, 2019. More interesting news about Amazon.com, Inc. (NASDAQ:AMZN) were released by: Nasdaq.com and their article: “Amazon (AMZN) Q4 Earnings to Benefit From Cloud Dominance – Nasdaq” published on January 30, 2019 as well as Nasdaq.com‘s news article titled: “Consumer Sector Update for 02/01/2019: SPR,YUMC,DECK,AMZN – Nasdaq” with publication date: February 01, 2019.

Analysts await Amazon.com, Inc. (NASDAQ:AMZN) to report earnings on February, 7. They expect $5.48 earnings per share, up 153.70% or $3.32 from last year’s $2.16 per share. AMZN’s profit will be $2.69B for 74.93 P/E if the $5.48 EPS becomes a reality. After $5.75 actual earnings per share reported by Amazon.com, Inc. for the previous quarter, Wall Street now forecasts -4.70% negative EPS growth.

Winslow Evans & Crocker Inc increased Select Sector Spdr Tr (XLV) stake by 3,384 shares to 4,782 valued at $456,000 in 2018Q3. It also upped Thermo Fisher Scientific Inc (NYSE:TMO) stake by 5,576 shares and now owns 10,038 shares. Square Inc was raised too.

Since August 15, 2018, it had 0 insider buys, and 22 selling transactions for $92.11 million activity. Blackburn Jeffrey M also sold $3.90M worth of Amazon.com, Inc. (NASDAQ:AMZN) on Wednesday, August 15. The insider Reynolds Shelley sold $824,513. 1,726 shares were sold by Jassy Andrew R, worth $2.70M on Thursday, November 15. The insider Huttenlocher Daniel P sold $285,960. On Wednesday, August 15 the insider McGrath Judith A sold $952,500. Zapolsky David had sold 1,929 shares worth $3.02 million. $3.09M worth of Amazon.com, Inc. (NASDAQ:AMZN) shares were sold by WILKE JEFFREY A.

Mcdaniel Terry & Co holds 6.16% of its portfolio in Nordson Corporation for 262,834 shares. Winslow Asset Management Inc owns 102,523 shares or 2.59% of their US portfolio. Moreover, Roffman Miller Associates Inc Pa has 2.35% invested in the company for 152,592 shares. The Us-based Champlain Investment Partners Llc has invested 1.57% in the stock. Atlanta Capital Management Co L L C, a Georgia-based fund reported 1.80 million shares.

More notable recent Nordson Corporation (NASDAQ:NDSN) news were published by: Nasdaq.com which released: “CFX or NDSN: Which Is the Better Value Stock Right Now? – Nasdaq” on January 25, 2019, also Nasdaq.com with their article: “Nordson (NDSN) Up 4.5% Since Last Earnings Report: Can It Continue? – Nasdaq” published on January 11, 2019, Nasdaq.com published: “General Electric (GE) to Post Q4 Earnings: What’s in Store? – Nasdaq” on January 29, 2019. More interesting news about Nordson Corporation (NASDAQ:NDSN) were released by: Nasdaq.com and their article: “Notable Wednesday Option Activity: NDSN, GILD, TLRD – Nasdaq” published on December 12, 2018 as well as Nasdaq.com‘s news article titled: “Nordson (NDSN) Q4 Earnings Lag Estimates, Organic View Solid – Nasdaq” with publication date: December 13, 2018.

Analysts await Nordson Corporation (NASDAQ:NDSN) to report earnings on February, 28. They expect $1.15 EPS, down 14.81% or $0.20 from last year’s $1.35 per share. NDSN’s profit will be $66.25 million for 28.53 P/E if the $1.15 EPS becomes a reality. After $1.44 actual EPS reported by Nordson Corporation for the previous quarter, Wall Street now forecasts -20.14% negative EPS growth.

Since January 1, 0001, it had 0 insider buys, and 5 selling transactions for $3.48 million activity.

The stock increased 0.44% or $0.58 during the last trading session, reaching $131.24. About 45,977 shares traded. Nordson Corporation (NDSN) has declined 11.10% since February 4, 2018 and is downtrending. It has underperformed by 11.10% the S&P500. Some Historical NDSN News: 06/03/2018 – Nordson MARCH Receives NPI Award for Its RollVlA Self-contained Vacuum Plasma System; 31/05/2018 – Nordson MARCH Receives Vision and Innovation Awards at NEPCON China for its RollVIA Self-contained Vacuum Plasma System; 22/04/2018 – DJ Nordson Corporation, Inst Holders, 1Q 2018 (NDSN); 13/03/2018 – New Solder Paste Jetting System from Nordson EFD Provides Fast, Repeatable Non-Contact Dispensing; 21/05/2018 – NORDSON CORP – BACKLOG FOR QTR ENDED APRIL 30, 2018 WAS ABOUT $460 MILLION, AN INCREASE OF 11 PCT COMPARED TO THE SAME PERIOD A YEAR AGO; 27/04/2018 – Nordson EFD’s P-Jet SolderPlus Jet Valve Wins SMT China VISION Award and EM Asia Innovation Award; 21/05/2018 – Nordson Closes Above 50-Day Moving Average: Technicals; 31/05/2018 – Nordson MARCH Receives Vision and Innovation Awards at NEPCON China for its RollVlA Self-contained Vacuum Plasma System; 30/05/2018 – Nordson ASYMTEK Receives Innovation and Vision Awards at NEPCON China; 23/05/2018 – NORDSON – ENTERED AMENDMENT TO CO’S $705 MLN TERM LOAN AGREEMENT TO EXTEND MATURITY DUE DATE OF $200 MLN TRANCHE TO SEPT. 30, 2021 – SEC FILING

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.