Wheatland Advisors Inc increased its stake in Procter And Gamble Co (PG) by 24.76% based on its latest 2018Q3 regulatory filing with the SEC. Wheatland Advisors Inc bought 3,760 shares as the company’s stock rose 12.93% while stock markets declined. The institutional investor held 18,948 shares of the package goods and cosmetics company at the end of 2018Q3, valued at $1.58M, up from 15,188 at the end of the previous reported quarter. Wheatland Advisors Inc who had been investing in Procter And Gamble Co for a number of months, seems to be bullish on the $243.83B market cap company. The stock increased 1.04% or $1 during the last trading session, reaching $97.47. About 12.72 million shares traded or 18.35% up from the average. The Procter & Gamble Company (NYSE:PG) has risen 3.25% since February 3, 2018 and is uptrending. It has outperformed by 3.25% the S&P500. Some Historical PG News: 04/04/2018 – STAT Plus: Pharmalittle: Will P&G buy the Pfizer consumer unit? China looks to boost generic production; 18/04/2018 – Pantene and Priyanka Chopra Team Up to Encourage Others to #GoGentle in a Harsh World; 19/04/2018 – PROCTER & GAMBLE OUTLOOK STABLE BY MOODY’S ON MERCK KGAA DEAL; 03/04/2018 – RPT-PFIZER, P&G FAR APART ON PRICE IN CONSUMER BUSINESS SALE – CNBC, CITING; 19/04/2018 – TEVA PHARMACEUTICAL INDUSTRIES LTD – NO SIGNIFICANT (MATERIAL) NET FINANCIAL TRANSFER BETWEEN TEVA AND P&G WILL RESULT FROM DISSOLUTION; 19/04/2018 – TEVA PHARMACEUTICAL – WILL MERGE ITS OTC INTERESTS RETURNING FROM PGT WITH A PORTFOLIO OF OTC ASSETS ACQUIRED IN 2016 VIA ACTAVIS ACQUISITION; 13/03/2018 – Procter & Gamble Resolves Crest® Whitestrips Patent Infringement Dispute with Ranir; 07/03/2018 – LIVE MARKETS-Ad agencies WPP, Publicis hit by P&G spending cut; 19/04/2018 – P&G – “OTC JV WITH TEVA DELIVERED DISPROPORTIONATE TOP AND BOTTOM-LINE GROWTH”; 19/04/2018 – P&G Acquires The Consumer Health Business Of Merck KGaA, Darmstadt, Germany

Ing Groep Nv decreased its stake in Pfizer Inc (PFE) by 1.21% based on its latest 2018Q3 regulatory filing with the SEC. Ing Groep Nv sold 13,648 shares as the company’s stock rose 5.56% while stock markets declined. The institutional investor held 1.12 million shares of the health care company at the end of 2018Q3, valued at $49.27 million, down from 1.13 million at the end of the previous reported quarter. Ing Groep Nv who had been investing in Pfizer Inc for a number of months, seems to be less bullish one the $247.87 billion market cap company. The stock increased 1.01% or $0.43 during the last trading session, reaching $42.88. About 25.84 million shares traded. Pfizer Inc. (NYSE:PFE) has risen 25.07% since February 3, 2018 and is uptrending. It has outperformed by 25.07% the S&P500. Some Historical PFE News: 18/05/2018 – ASTRAZENECA PLC AZN.L – OFFSET BY EROSION OF CRESTOR SALES; 19/03/2018 – BioDuro Collaboration with Pfizer Inc. Leads to Creation of a Shelf-Stable Fluorosulfation Reagent; 09/03/2018 – JPMorgan Large Cap Value Adds Pfizer, Exits AT&T, Cuts Wex; 09/04/2018 – Pfizer Canada and MaRS Innovation Partner to Convert Great Science into Solutions to Benefit Canadians’ Health; 09/05/2018 – Seeking Insights into Rare Diseases, Pfizer Scales AI Analytics Platform; 05/03/2018 – Dan R. Littman Elected to Pfizer’s Bd of Directors; 01/05/2018 – Pfizer New Drug Sales Show Strength as Investors Wait for M&A; 10/04/2018 – I think that reviewing architectural drawings has to be universally popular — I love it. $PFE’s new digs; 01/05/2018 – Pfizer Sees FY Rev $53.5B-$55.5B; 19/03/2018 – ASTELLAS: FDA GRANTS PRIORITY REVIEW FOR SNDA FOR XTANDI

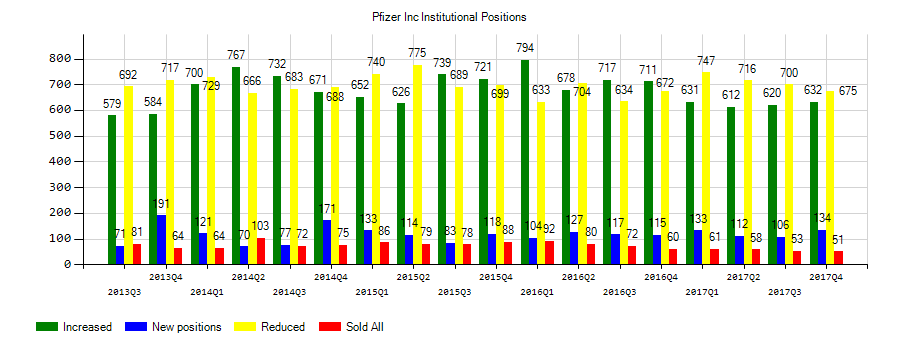

Investors sentiment increased to 0.85 in 2018 Q3. Its up 0.07, from 0.78 in 2018Q2. It increased, as 41 investors sold PFE shares while 741 reduced holdings. 142 funds opened positions while 520 raised stakes. 3.96 billion shares or 0.44% less from 3.98 billion shares in 2018Q2 were reported. Wafra, New York-based fund reported 51,051 shares. Cibc World Mkts Corp holds 0.66% or 1.76 million shares in its portfolio. Regent Invest Mgmt holds 59,536 shares. James Inv Inc holds 657,886 shares. 1.41 million are held by South Dakota Invest Council. 120,125 are held by Marshwinds Advisory. 312,579 were reported by Massmutual Trust Com Fsb Adv. Rhenman And Asset Mgmt has 0.04% invested in Pfizer Inc. (NYSE:PFE) for 8,754 shares. Opus Inv Mngmt has invested 1.07% in Pfizer Inc. (NYSE:PFE). Amica Retiree Trust invested in 1.06% or 28,927 shares. 29,463 are owned by Warren Averett Asset Mgmt Ltd Liability. State Of Tennessee Treasury Department accumulated 3.94 million shares or 0.84% of the stock. Brown Advisory accumulated 1.27 million shares or 0.16% of the stock. Investment Management Of Virginia Limited Liability Corp owns 79,302 shares for 0.74% of their portfolio. Petrus Lta has 7,454 shares.

More notable recent Pfizer Inc. (NYSE:PFE) news were published by: Fool.com which released: “A War on High Drug Prices Could Boost Biosimilars – Motley Fool” on February 03, 2019, also Investorplace.com with their article: “5 Dow Jones Stocks Under Pressure – Investorplace.com” published on January 28, 2019, Streetinsider.com published: “Pfizer (PFE) Enters Collaboration Agreement with CytoReason – StreetInsider.com” on January 07, 2019. More interesting news about Pfizer Inc. (NYSE:PFE) were released by: Seekingalpha.com and their article: “Pfizer: Still A Cash Cow – Seeking Alpha” published on January 22, 2019 as well as Seekingalpha.com‘s news article titled: “Pfizer to shutter two plants in India – Seeking Alpha” with publication date: January 09, 2019.

Among 23 analysts covering Pfizer (NYSE:PFE), 9 have Buy rating, 1 Sell and 13 Hold. Therefore 39% are positive. Pfizer had 92 analyst reports since July 29, 2015 according to SRatingsIntel. The company was downgraded on Thursday, July 20 by Credit Suisse. Leerink Swann maintained it with “Market Perform” rating and $34.70 target in Monday, May 2 report. BMO Capital Markets maintained Pfizer Inc. (NYSE:PFE) rating on Tuesday, September 5. BMO Capital Markets has “Buy” rating and $37.0 target. Jefferies maintained it with “Buy” rating and $39 target in Tuesday, September 13 report. BMO Capital Markets downgraded the stock to “Market Perform” rating in Thursday, November 1 report. The stock has “Buy” rating by Bank of America on Wednesday, August 1. Jefferies maintained the shares of PFE in report on Monday, October 16 with “Hold” rating. Credit Suisse maintained the shares of PFE in report on Wednesday, October 31 with “Neutral” rating. Jefferies maintained the stock with “Buy” rating in Monday, June 20 report. The stock of Pfizer Inc. (NYSE:PFE) earned “Outperform” rating by Credit Suisse on Monday, May 9.

Ing Groep Nv, which manages about $5.88 billion and $5.79B US Long portfolio, upped its stake in Tjx Cos Inc New (NYSE:TJX) by 75,328 shares to 78,873 shares, valued at $8.84M in 2018Q3, according to the filing. It also increased its holding in Facebook Inc (NASDAQ:FB) by 81,087 shares in the quarter, for a total of 648,508 shares, and has risen its stake in Edwards Lifesciences Corp (NYSE:EW).

Since August 13, 2018, it had 0 buys, and 1 sale for $418,774 activity.

Investors sentiment increased to 0.79 in 2018 Q3. Its up 0.01, from 0.78 in 2018Q2. It improved, as 37 investors sold PG shares while 756 reduced holdings. 139 funds opened positions while 490 raised stakes. 1.41 billion shares or 1.36% less from 1.43 billion shares in 2018Q2 were reported. Aqr Management Ltd Liability holds 2.31M shares. Greenleaf holds 0.03% or 22,380 shares. 11,000 are owned by Cornerstone Cap Incorporated. Fincl Advisory owns 14,358 shares. Rench Wealth accumulated 46,497 shares or 2.58% of the stock. Geode Mgmt Limited Company holds 0.74% or 31.58 million shares in its portfolio. Westwood Grp Incorporated, a Texas-based fund reported 17,821 shares. Eastern National Bank & Trust has invested 1.18% in The Procter & Gamble Company (NYSE:PG). Teacher Retirement Systems Of Texas stated it has 0.91% in The Procter & Gamble Company (NYSE:PG). Payden & Rygel holds 0% of its portfolio in The Procter & Gamble Company (NYSE:PG) for 680 shares. Maryland-based Consulate has invested 0.38% in The Procter & Gamble Company (NYSE:PG). Trust Of Oklahoma invested in 0% or 5,950 shares. Department Mb Retail Bank N A invested 1.22% in The Procter & Gamble Company (NYSE:PG). Estabrook Mgmt has 0% invested in The Procter & Gamble Company (NYSE:PG) for 46,014 shares. Argi Invest Svcs Limited Liability Company holds 54,279 shares.

Since August 13, 2018, it had 0 buys, and 63 selling transactions for $108.39 million activity. Moeller Jon R sold $21.03 million worth of stock or 228,905 shares. 3,227 shares were sold by Magesvaran Suranjan, worth $269,526 on Wednesday, August 22. On Monday, August 13 the insider Pritchard Marc S. sold $242,261. 3,410 shares valued at $284,810 were sold by Keith R. Alexandra on Tuesday, August 21. Taylor David S had sold 16,338 shares worth $1.55M. Another trade for 6,000 shares valued at $499,012 was made by Skoufalos Ioannis on Friday, August 24.

Among 26 analysts covering Proctor & Gamble (NYSE:PG), 11 have Buy rating, 0 Sell and 15 Hold. Therefore 42% are positive. Proctor & Gamble had 108 analyst reports since August 4, 2015 according to SRatingsIntel. The stock has “Hold” rating by Stifel Nicolaus on Friday, April 20. The rating was maintained by Deutsche Bank with “Hold” on Wednesday, August 1. The rating was maintained by Stifel Nicolaus on Wednesday, January 24 with “Hold”. The stock of The Procter & Gamble Company (NYSE:PG) earned “Overweight” rating by Morgan Stanley on Friday, December 14. The firm has “Neutral” rating by Citigroup given on Tuesday, November 17. The firm has “Neutral” rating given on Wednesday, January 24 by JP Morgan. The firm earned “Market Perform” rating on Tuesday, November 15 by Wells Fargo. B. Riley & Co maintained it with “Buy” rating and $106 target in Wednesday, October 26 report. The firm earned “Buy” rating on Friday, July 22 by Stifel Nicolaus. Jefferies maintained The Procter & Gamble Company (NYSE:PG) rating on Tuesday, October 3. Jefferies has “Buy” rating and $104.0 target.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.