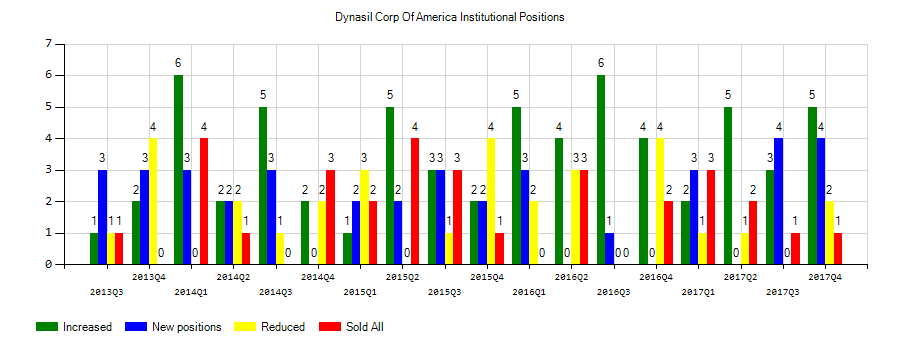

Dynasil Corp Of America (DYSL) investors sentiment decreased to 2.67 in Q3 2018. It’s down -2.33, from 5 in 2018Q2. The ratio turned negative, as 8 funds increased and opened new equity positions, while 3 cut down and sold their equity positions in Dynasil Corp Of America. The funds in our database now possess: 823,740 shares, down from 4.50 million shares in 2018Q2. Also, the number of funds holding Dynasil Corp Of America in top ten equity positions was flat from 0 to 0 for the same number . Sold All: 1 Reduced: 2 Increased: 5 New Position: 3.

Analysts expect Ritchie Bros. Auctioneers Incorporated (TSE:RBA) to report $0.48 EPS on February, 25.They anticipate $0.15 EPS change or 45.45% from last quarter’s $0.33 EPS. T_RBA’s profit would be $52.03 million giving it 24.62 P/E if the $0.48 EPS is correct. After having $0.23 EPS previously, Ritchie Bros. Auctioneers Incorporated’s analysts see 108.70% EPS growth. The stock increased 0.08% or $0.04 during the last trading session, reaching $47.27. About 148,488 shares traded or 4.91% up from the average. Ritchie Bros. Auctioneers Incorporated (TSE:RBA) has 0.00% since February 3, 2018 and is . It has by 0.00% the S&P500. Some Historical RBA News: 07/03/2018 – Redline Communications Names Joan Ritchie as Financial Chief; 08/04/2018 – Deutsche Bank: Global Markets Chief Garth Ritchie Is Made Sole Head of Investment Bank; 12/03/2018 – Rene Ritchie: Like Netflix for magazines but, more importantly, quality coverage from generally trusted sources made more; 30/05/2018 – Ritchie Bros.’ Nashville auction features late-model equipment from close to 100 owners; 17/05/2018 – Ritchie Bros. sells US$44+ million of equipment in Fort Worth, TX auction; 08/04/2018 – DB’S RITCHIE IS SAID TO TAKE OVER INVESTMENT BANKING: HB; 07/05/2018 – Ritchie Bros. Publishes Monthly Auction Metrics; 22/05/2018 – Ritchie Bros Sells Over $41M of Equipment in Netherlands Auction; 08/04/2018 – Deutsche Bank Is Said to Mull Sewing as CEO, Ritchie Promotion; 13/04/2018 – Texas Instruments Senior VP of Technology & Manufacturing Kevin J. Ritchie to Retire Nov. 1

More notable recent Ritchie Bros. Auctioneers Incorporated (TSE:RBA) news were published by: Globenewswire.com which released: “New Research Coverage Highlights Spire, Liberty Broadband, Zillow Group, Ritchie Bros. Auctioneers, GCP Applied Technologies, and Itron — Consolidated Revenues, Company Growth, and Expectations for 2019 – GlobeNewswire” on January 16, 2019, also Investorplace.com with their article: “10 High-Growth Stocks for the Return of the Bull – Investorplace.com” published on January 18, 2019, Seekingalpha.com published: “Ritchie Bros. Auctioneers Inc. (RBA) CEO Ravi Saligram on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” on November 09, 2018. More interesting news about Ritchie Bros. Auctioneers Incorporated (TSE:RBA) were released by: Seekingalpha.com and their article: “Ritchie Bros. Auctioneers’ (RBA) CEO Ravi Saligram on Q2 2018 Results – Earnings Call Transcript – Seeking Alpha” published on August 12, 2018 as well as Investorplace.com‘s news article titled: “7 Canadian Stocks to Buy in 2019 – Investorplace.com” with publication date: December 26, 2018.

Ritchie Bros. Auctioneers Incorporated, together with its subsidiaries, sells industrial equipment and other assets for the construction, agriculture, transportation, energy, mining, forestry, material handling, marine, and real estate industries through its unreserved auctions and online marketplaces. The company has market cap of $5.12 billion. The firm operates a network of auction locations that conduct live and unreserved auctions with on-site and online bidding. It has a 41.91 P/E ratio. It also operates an online-only used equipment marketplace that facilitates the completion of sales through a settlement process.

Since January 1, 0001, it had 0 insider buys, and 1 insider sale for $1.45 million activity.

Dynasil Corporation of America develops, markets, makes, and sells detection, sensing, and analysis technology and optical components in the United States and internationally. The company has market cap of $18.30 million. It operates through three divisions: Contract Research, Optics, and Biomedical. It has a 10.5 P/E ratio. The Contract Research segment develops advanced technology in materials, sensors, and prototype instruments that detect or measure radiation, light, magnetism, or sound for use in security, medical, and industrial applications.

The stock increased 0.96% or $0.01 during the last trading session, reaching $1.05. About 5,043 shares traded. Dynasil Corporation of America (DYSL) has declined 26.67% since February 3, 2018 and is downtrending. It has underperformed by 26.67% the S&P500. Some Historical DYSL News: 05/04/2018 Dynasil Corporation of America Announces RMD’s CLYC Program Featured as Department of Energy Success Story; 14/05/2018 – Dynasil Corp America 2Q Rev $10.3M; 08/05/2018 – Hilger Crystals Achieves ISO 9001:2015 Certification; 17/05/2018 – Dynasil Appoints Nirmal Parikh VP, Marketing; 19/04/2018 – DJ Dynasil Corporation of America, Inst Holders, 1Q 2018 (DYSL); 14/05/2018 – DYNASIL CORPORATION OF AMERICA – QTRLY REVENUE $10.3 MLN VS $10.1 MLN; 14/05/2018 – Dynasil Corp America 2Q EPS 8c

Essex Investment Management Co Llc holds 0.04% of its portfolio in Dynasil Corporation of America for 249,354 shares. Dowling & Yahnke Llc owns 165,777 shares or 0.02% of their US portfolio. Moreover, Blackrock Inc. has 0% invested in the company for 8,739 shares. The Illinois-based Citadel Advisors Llc has invested 0% in the stock. Deutsche Bank Ag, a Germany-based fund reported 21,791 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.