Goodnow Investment Group Llc increased its stake in Sei Investments Co (SEIC) by 10% based on its latest 2018Q3 regulatory filing with the SEC. Goodnow Investment Group Llc bought 26,440 shares as the company’s stock declined 20.51% with the market. The hedge fund held 290,815 shares of the investment bankers and brokers and service company at the end of 2018Q3, valued at $17.77 million, up from 264,375 at the end of the previous reported quarter. Goodnow Investment Group Llc who had been investing in Sei Investments Co for a number of months, seems to be bullish on the $7.65B market cap company. The stock increased 3.49% or $1.66 during the last trading session, reaching $49.2. About 1.51 million shares traded or 86.12% up from the average. SEI Investments Co. (NASDAQ:SEIC) has declined 30.44% since February 2, 2018 and is downtrending. It has underperformed by 30.44% the S&P500. Some Historical SEIC News: 30/05/2018 – SEI Adds $3.5 B in New OCIO Assets in Six Mos; 07/03/2018 – SEI INVESTMENTS-ANNOUNCED STRATEGIC PARTNERSHIP WITH SYNECHRON TO SUPPORT SEI’S EFFORTS TO EMPLOY BLOCKCHAIN TECHNOLOGY IN FINANCIAL SERVICES INDUSTRY; 25/04/2018 – SEI 1Q EPS 86C; 25/04/2018 – SEI Investments 1Q EPS 86c; 30/05/2018 – SEI Adds $3.5 Billion in New OCIO Assets in Six Months; 07/03/2018 – SEI & SYNECHRON JOIN FORCES FOR BLOCKCHAIN UTILIZATION; 14/05/2018 – Bremer Bank Adopts SEI Wealth Platform; 03/04/2018 – SEI Closes Above 50-Day Moving Average: Technicals; 25/04/2018 – SEI INVESTMENTS CO – QTRLY REVENUES $405.6 MLN, UP 13%; 12/03/2018 – Something curious between SEI Investments Co. and the SEC (published 18-Jan) $SEIC

Brahman Capital Corp decreased its stake in Marvell Technology Group Ltd (MRVL) by 0.98% based on its latest 2018Q3 regulatory filing with the SEC. Brahman Capital Corp sold 59,492 shares as the company’s stock declined 19.34% with the market. The hedge fund held 6.04M shares of the semiconductors company at the end of 2018Q3, valued at $116.58M, down from 6.10 million at the end of the previous reported quarter. Brahman Capital Corp who had been investing in Marvell Technology Group Ltd for a number of months, seems to be less bullish one the $12.10 billion market cap company. The stock decreased 0.65% or $0.12 during the last trading session, reaching $18.41. About 7.98 million shares traded. Marvell Technology Group Ltd. (NASDAQ:MRVL) has declined 30.23% since February 2, 2018 and is downtrending. It has underperformed by 30.23% the S&P500. Some Historical MRVL News: 25/05/2018 – San Jose Bus Jrn: Exclusive: Here’s the privacy-protecting cloud storage idea Marvell’s co-founder is about to unveil; 08/03/2018 – MARVELL TECH SEES 1Q ADJ EPS CONT OPS 29C TO 33C; 07/05/2018 – Marvell Technology Names Bethany Mayer and Donna Morris to Board; 14/05/2018 – Global SSD Controllers Market 2018-2022 with Marvell, Samsung, Toshiba & Western Digital Dominating – ResearchAndMarkets.com; 15/05/2018 – Standard Life Aberdeen Buys New 2.5% Position in Marvell Tech; 16/03/2018 – MARVELL TECHNOLOGY GROUP SAYS EXPECTS TRANSACTION TO CLOSE MID-CALENDAR YEAR 2018; 08/03/2018 – Marvell Technology Sees 1Q Rev $585M-$615M; 08/03/2018 – MARVELL TECH 4Q ADJ EPS 32C, EST. 31C; 18/05/2018 – Kalray hires Allegra Finance to advise on Euronext IPO – CEO; 27/03/2018 – Marvell Announces Integration of Industry’s First Secure Automotive Ethernet Switch into NVIDIA DRIVE Pegasus Platform for Level 5 Autonomy

Among 8 analysts covering SEI Investments (NASDAQ:SEIC), 6 have Buy rating, 0 Sell and 2 Hold. Therefore 75% are positive. SEI Investments had 28 analyst reports since July 23, 2015 according to SRatingsIntel. The stock of SEI Investments Co. (NASDAQ:SEIC) has “Hold” rating given on Thursday, December 21 by Keefe Bruyette & Woods. Keefe Bruyette & Woods maintained SEI Investments Co. (NASDAQ:SEIC) rating on Friday, June 23. Keefe Bruyette & Woods has “Hold” rating and $5400 target. Sandler O’Neill maintained SEI Investments Co. (NASDAQ:SEIC) on Thursday, February 1 with “Buy” rating. Oppenheimer maintained the stock with “Buy” rating in Monday, July 10 report. The company was maintained on Friday, November 17 by Mizuho. Mizuho maintained the shares of SEIC in report on Friday, April 27 with “Buy” rating. The firm earned “Buy” rating on Thursday, October 26 by Mizuho. The stock has “Hold” rating by Keefe Bruyette & Woods on Friday, November 10. The stock of SEI Investments Co. (NASDAQ:SEIC) earned “Buy” rating by Mizuho on Monday, February 26. The stock of SEI Investments Co. (NASDAQ:SEIC) has “Hold” rating given on Tuesday, September 1 by Zacks.

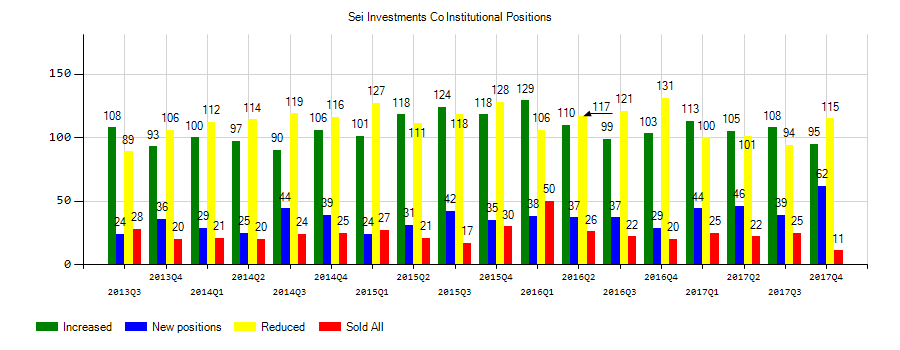

Investors sentiment decreased to 1.07 in Q3 2018. Its down 0.15, from 1.22 in 2018Q2. It fall, as 30 investors sold SEIC shares while 112 reduced holdings. 49 funds opened positions while 103 raised stakes. 105.46 million shares or 0.21% less from 105.68 million shares in 2018Q2 were reported. Price T Rowe Assocs Md accumulated 69,389 shares. Valley National Advisers Inc holds 0.04% in SEI Investments Co. (NASDAQ:SEIC) or 1,700 shares. Schwab Charles Inv Mngmt Inc has invested 0.02% in SEI Investments Co. (NASDAQ:SEIC). Voya Invest Mngmt Lc holds 1.49M shares or 0.19% of its portfolio. Pnc Fincl Svcs Gp owns 88,299 shares. Piedmont Advisors invested 0.02% in SEI Investments Co. (NASDAQ:SEIC). Tci Wealth Advisors, a Arizona-based fund reported 94 shares. Blackrock has 0.04% invested in SEI Investments Co. (NASDAQ:SEIC). Westpac, a Australia-based fund reported 10,940 shares. Frontier Management holds 0.03% in SEI Investments Co. (NASDAQ:SEIC) or 6,763 shares. United Kingdom-based Gulf Savings Bank (Uk) Limited has invested 0.03% in SEI Investments Co. (NASDAQ:SEIC). Numerixs Inc owns 0.07% invested in SEI Investments Co. (NASDAQ:SEIC) for 6,318 shares. Bnp Paribas Arbitrage Sa stated it has 58,752 shares or 0% of all its holdings. South State invested in 0.04% or 6,208 shares. Sumitomo Mitsui Inc has invested 0.03% of its portfolio in SEI Investments Co. (NASDAQ:SEIC).

Since September 12, 2018, it had 0 insider purchases, and 7 selling transactions for $27.09 million activity. On Wednesday, December 19 the insider WITHROW WAYNE sold $237,358. Ujobai Joseph P also sold $940,800 worth of SEI Investments Co. (NASDAQ:SEIC) shares. The insider MCGONIGLE DENNIS sold $942,450.

Goodnow Investment Group Llc, which manages about $697.23 million and $686.49 million US Long portfolio, decreased its stake in Discovery Inc (NASDAQ:DISCK) by 107,720 shares to 160,235 shares, valued at $4.74 million in 2018Q3, according to the filing. It also reduced its holding in Aircastle Ltd (NYSE:AYR) by 91,100 shares in the quarter, leaving it with 769,635 shares, and cut its stake in Etsy Inc.

More notable recent SEI Investments Co. (NASDAQ:SEIC) news were published by: Nasdaq.com which released: “After-Hours Earnings Report for July 19, 2018 : MSFT, ISRG, COF, CTAS, SWKS, ETFC, CE, SEIC, PBCT, WAL, ASB, SKX – Nasdaq” on July 19, 2018, also Nasdaq.com with their article: “SEI Investments (SEIC) Earnings Expected to Grow: Should You Buy? – Nasdaq” published on January 23, 2019, Nasdaq.com published: “SEI Investments is Now Oversold (SEIC) – Nasdaq” on July 20, 2018. More interesting news about SEI Investments Co. (NASDAQ:SEIC) were released by: Nasdaq.com and their article: “5 Reasons to Buy SEI Investments (SEIC) Stock Right Now – Nasdaq” published on August 10, 2017 as well as Nasdaq.com‘s news article titled: “Relative Strength Alert For SEI Investments – Nasdaq” with publication date: December 17, 2018.

Investors sentiment increased to 1.46 in 2018 Q3. Its up 0.21, from 1.25 in 2018Q2. It improved, as 51 investors sold MRVL shares while 83 reduced holdings. 65 funds opened positions while 130 raised stakes. 603.15 million shares or 17.61% more from 512.84 million shares in 2018Q2 were reported. Raymond James Advsr Inc stated it has 11,293 shares. Bnp Paribas Asset Mgmt Hldgs owns 12,578 shares. Proshare Limited owns 59,630 shares or 0.01% of their US portfolio. Price T Rowe Inc Md invested in 0.15% or 52.10 million shares. Lord Abbett Llc reported 0.07% stake. Shaker Invs Oh stated it has 0.36% in Marvell Technology Group Ltd. (NASDAQ:MRVL). Dimensional Fund L P, a Texas-based fund reported 4.59 million shares. Utah Retirement holds 0.04% in Marvell Technology Group Ltd. (NASDAQ:MRVL) or 101,516 shares. Montag A invested in 0.09% or 52,408 shares. Yhb Advsrs holds 0.05% or 18,020 shares in its portfolio. Massachusetts Ser Co Ma has invested 0.04% in Marvell Technology Group Ltd. (NASDAQ:MRVL). Suntrust Banks Incorporated holds 0% or 17,084 shares in its portfolio. Us Financial Bank De owns 468,117 shares. Plante Moran Financial Advisors Ltd Liability Co holds 165 shares. The Missouri-based Enterprise Financial Services Corp has invested 0.25% in Marvell Technology Group Ltd. (NASDAQ:MRVL).

More notable recent Marvell Technology Group Ltd. (NASDAQ:MRVL) news were published by: Nasdaq.com which released: “Marvell Technology (MRVL) Dips More Than Broader Markets: What You Should Know – Nasdaq” on January 28, 2019, also Nasdaq.com with their article: “Marvell (MRVL) Q3 Earnings & Revenues Outpace Estimates – Nasdaq” published on December 05, 2018, Nasdaq.com published: “Technology Sector Update for 10/16/2018: ADBE, MRVL, PLUG, MSFT, AAPL, IBM, CSCO, GOOG – Nasdaq” on October 16, 2018. More interesting news about Marvell Technology Group Ltd. (NASDAQ:MRVL) were released by: Nasdaq.com and their article: “Weekly Market Preview: Five Stocks To Watch For the Coming Week (HPE, MRVL, LULU, DOCU, AVGO) – Nasdaq” published on December 02, 2018 as well as Nasdaq.com‘s news article titled: “Marvell (MRVL) Q4 Earnings & Revenues Beat Estimates, Up Y/Y – Nasdaq” with publication date: March 09, 2018.

Among 40 analysts covering Marvell Technology Group (NASDAQ:MRVL), 30 have Buy rating, 1 Sell and 9 Hold. Therefore 75% are positive. Marvell Technology Group had 141 analyst reports since August 5, 2015 according to SRatingsIntel. Morgan Stanley maintained Marvell Technology Group Ltd. (NASDAQ:MRVL) rating on Wednesday, December 13. Morgan Stanley has “Equal-Weight” rating and $22 target. On Wednesday, October 10 the stock rating was maintained by FBR Capital with “Buy”. B. Riley & Co maintained it with “Buy” rating and $23.0 target in Monday, August 21 report. The firm earned “Overweight” rating on Tuesday, October 23 by Barclays Capital. On Friday, November 30 the stock rating was maintained by Barclays Capital with “Overweight”. The stock of Marvell Technology Group Ltd. (NASDAQ:MRVL) earned “Buy” rating by M Partners on Tuesday, May 29. The firm earned “Outperform” rating on Wednesday, October 12 by Credit Suisse. Nomura maintained Marvell Technology Group Ltd. (NASDAQ:MRVL) rating on Friday, September 25. Nomura has “Buy” rating and $14 target. B. Riley & Co downgraded the shares of MRVL in report on Tuesday, October 27 to “Sell” rating. The rating was maintained by Cowen & Co on Friday, September 11 with “Outperform”.

Analysts await Marvell Technology Group Ltd. (NASDAQ:MRVL) to report earnings on March, 14. They expect $0.23 earnings per share, down 17.86% or $0.05 from last year’s $0.28 per share. MRVL’s profit will be $151.21 million for 20.01 P/E if the $0.23 EPS becomes a reality. After $0.25 actual earnings per share reported by Marvell Technology Group Ltd. for the previous quarter, Wall Street now forecasts -8.00% negative EPS growth.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.